MP Market Review – December 6, 2024

Last updated by BM on December 10, 2024

Summary

This is a weekly installment of our MP Market Review series, which provides insights and updates on Canadian dividend growth companies we monitor on ‘The List’. To read all our newsletters and premium content be sure to check us out on magicpants.substack.com.

- This week, we look at the predictability of dividend growth for companies on ‘the List’.

- Last week, dividend growth of ‘The List’ was up and has increased by +9.2% YTD (income).

- Last week, the price of ‘The List’ was up with a return of +15.0% YTD (capital).

- Last week, there were two dividend announcements from companies on ‘The List’.

- Last week, there were three off-cycle earnings reports from companies on ‘The List’.

- This week, one company on ‘The List’ is due to report earnings.

DGI Clipboard

“The beauty of dividends is their predictability, even when the stock market isn’t.”

— Lowell Miller

Predictable Dividend Growth: The Cornerstone of Wealth Building

Intro

Last week, we highlighted the resilience of dividend stocks with long dividend growth streaks. Remarkably, none of the 24 Canadian companies with 10+ years of consecutive dividend growth heading into the Global Financial Crisis of 2008/2009 cut their dividends. This resilience offers peace of mind to income-focused investors, providing a reliable income stream no matter what challenges the future holds.

Another key aspect of quality dividend growth stocks is the dependability of their dividend increases. Once a company enters our universe of quality dividend growers, management typically prioritizes consistent dividend growth. It’s common to find these commitments clearly articulated in their dividend policies and growth strategies, often featured prominently in quarterly earnings reports.

For instance, here are a few examples from Q4 2023 earnings reports (from a year ago) of companies we track on ‘The List’. These examples underscore how management teams take their dividend-growth commitments seriously and make them a core element of their investor value proposition.

“Last year Fortis was proud to celebrate 50 consecutive years of increases in dividends paid to shareholders,” said Mr. Hutchens. “We remain focused on extending this track record as we execute our$25 billion five-year capital plan in support of our annual dividend growth guidance of 4-6% through 2028.“

– Fortis Inc.

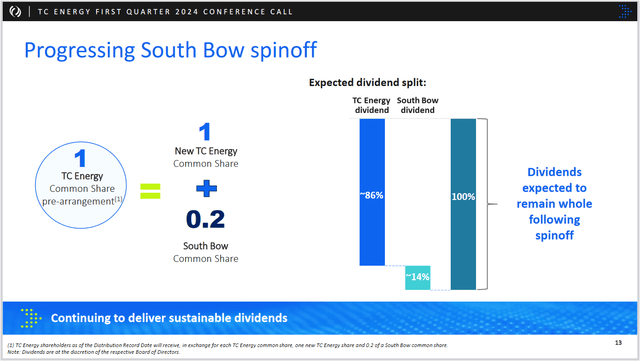

“We will continue to develop quality projects within our secured capital program, with approximately $7.0 billion of assets expected to be placed in service in 2024. Our commitment to limiting annual net capital expenditures to $6.0 to $7.0 billion, with a bias to the lower end beyond 2024, will not waver. We believe that adhering to our net capital expenditure limit beyond 2024 will allow TC Energy to continue delivering an attractive and sustainable dividend growth rate of three to five percent.”

-TC Energy

“This quarterly dividend reflects an increase of 7.1 per cent from the $0.3511 per share dividend declared one year earlier and consistent with our multi-year dividend growth program.”

-Telus

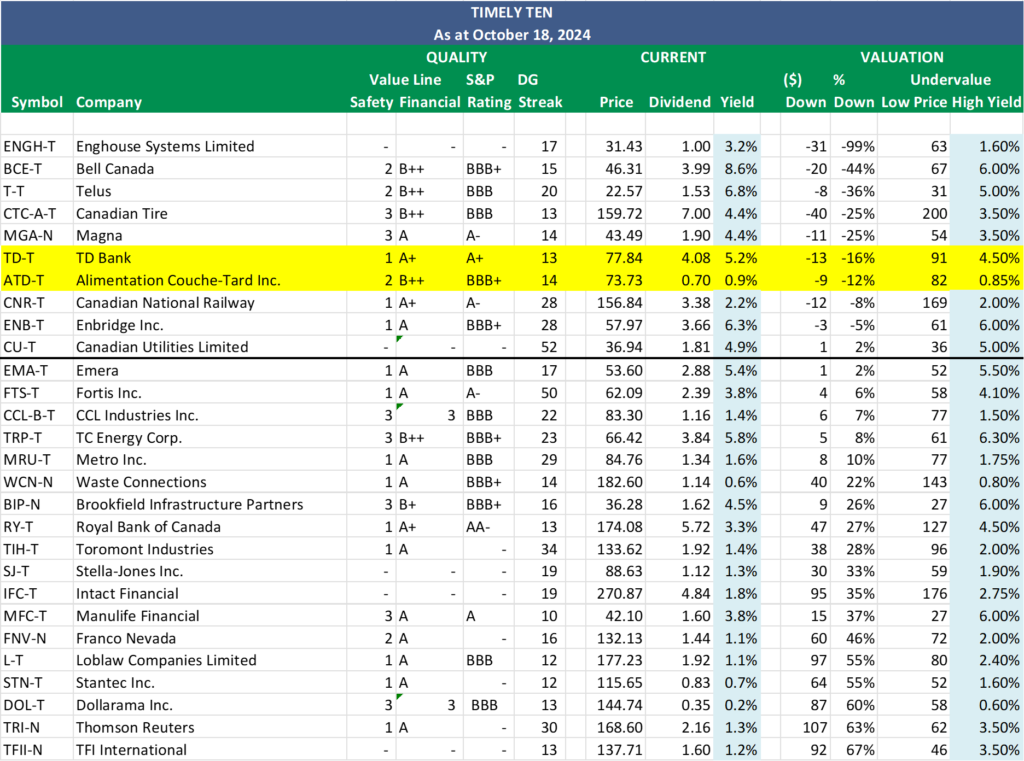

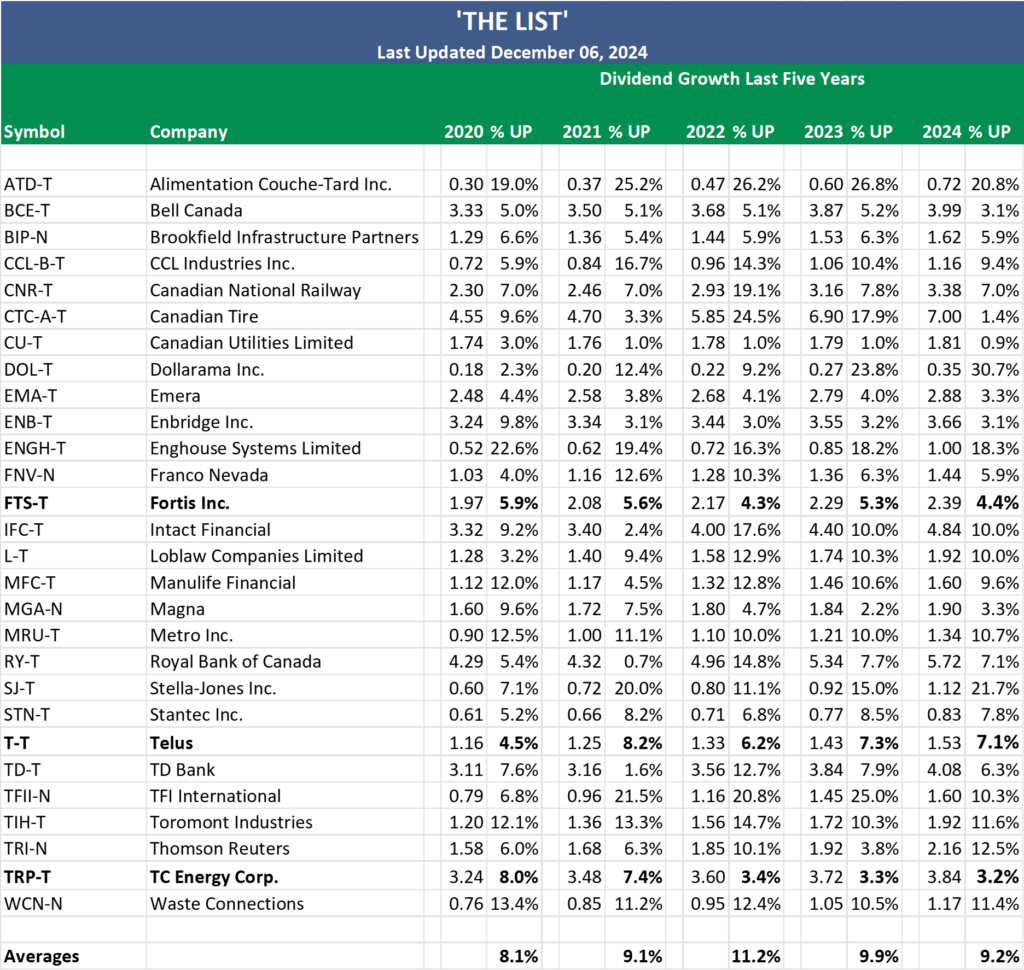

Let’s examine how these companies performed in 2024. The table below showcases the five-year dividend growth history for the companies featured on ‘The List,’ highlighting their commitment to rewarding shareholders.

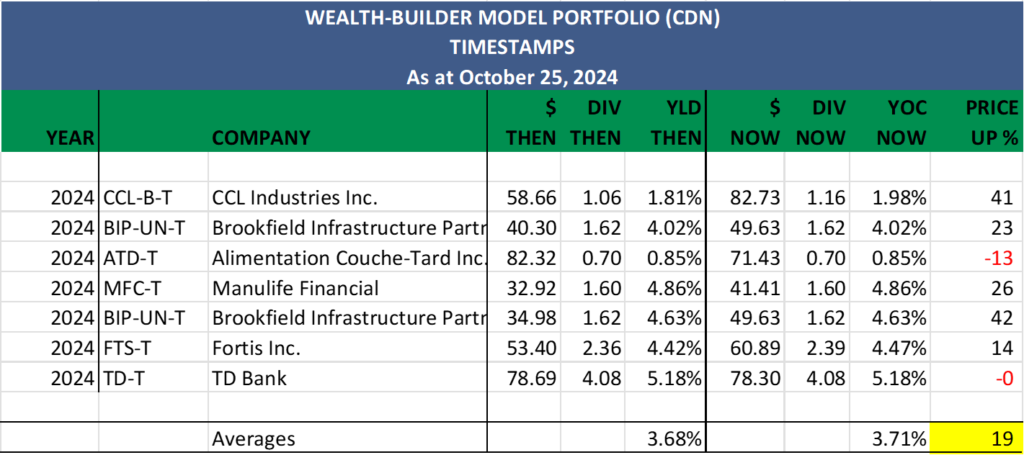

As communicated, Fortis increased its 2024 dividend by 4.4%, Telus by 7.1%, and TC Energy by 3.2%.

Wrap Up

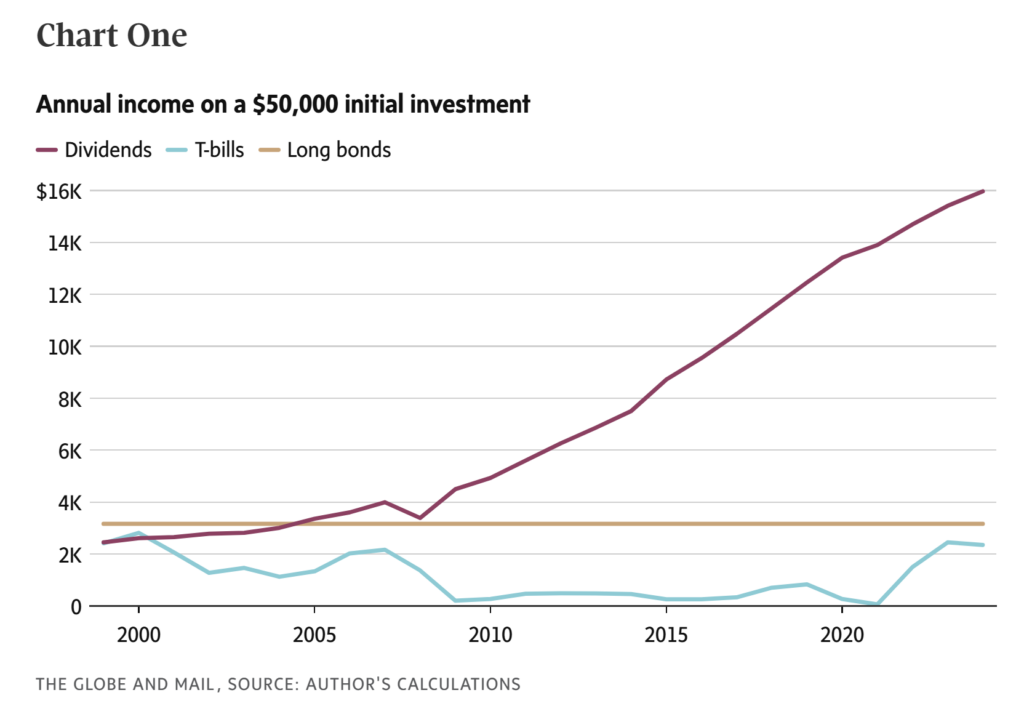

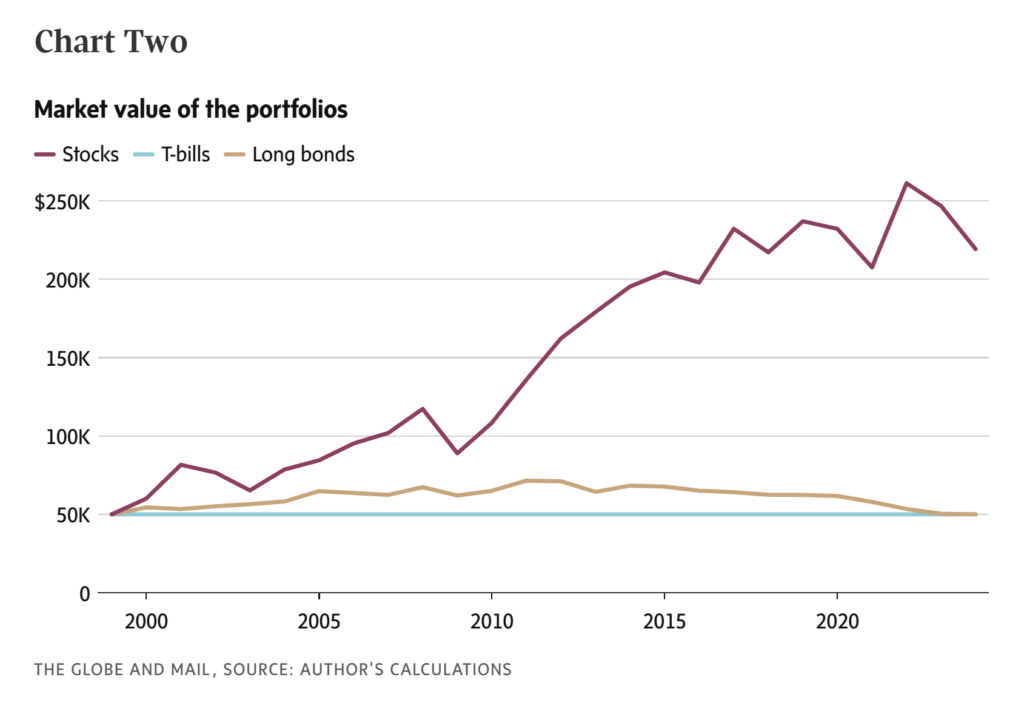

Predictable growth is the cornerstone of our strategy, offering peace of mind and long-term financial stability. It eliminates the need to ‘panic sell’ stocks during market turbulence, as our income remains reliable and steadily growing. By consistently outpacing inflation, this income ensures that we not only preserve but enhance our purchasing power over time.

A dependable income stream is fundamental to the success of our dividend growth strategy. As these companies increase payouts, their growing cash flows attract more investor interest, driving price appreciation and compounding our returns.

Become a PAID subscriber and start building your portfolio with confidence today. We do the work, and you stay in control!

DGI Scorecard

The List (2024)

The Magic Pants 2024 list includes 28 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on ‘The List’:

- Dividend growth streak: 10 years or more.

- Market cap: Minimum one billion dollars.

- Diversification: Limit of five companies per sector, preferably two per industry.

- Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies are added or removed from ‘The List’ annually on January 1. Prices and dividends are updated weekly.

‘The List’ is not a portfolio but a coaching tool that helps us think about ideas and risk manage our model portfolio. We own some but not all the companies on ‘The List’. In other words, we might want to buy these companies when valuation looks attractive.

Our newsletter provides readers with a comprehensive insight into the implementation and advantages of our Canadian dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

For those interested in something more, please upgrade to a paid subscriber; you get the enhanced weekly newsletter, access to premium content, full privileges on the new Substack website magicpants.substack.com and DGI alerts whenever we make stock transactions in our model portfolio.

Performance of ‘The List’

Last week, dividend growth of ‘The List’ stayed the same and has increased by +9.2% YTD (income). How much did your salary go up this year?

Last week, the average price return of ‘The List’ was up with a return of +15.0% YTD (capital).

Even though prices may fluctuate, the dependable growth in our income does not. Stay the course. You will be happy you did.

Last week’s best performers on ‘The List’ were Enghouse Systems Limited (ENGH-T), up +7.23%; Loblaw Companies Limited (L-T), up +5.51%; and Thomson Reuters (TRI-N), up +4.90%.

TD Bank (TD-T) was the worst performer last week, down -7.22%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $81.38 | 6.0% | $0.72 | 20.8% | 14 |

| BCE-T | Bell Canada | 10.5% | $37.94 | -30.0% | $3.99 | 3.1% | 15 |

| BIP-N | Brookfield Infrastructure Partners | 4.7% | $34.41 | 12.1% | $1.62 | 5.9% | 16 |

| CCL-B-T | CCL Industries Inc. | 1.5% | $77.00 | 33.1% | $1.16 | 9.4% | 22 |

| CNR-T | Canadian National Railway | 2.2% | $151.37 | -9.3% | $3.38 | 7.0% | 28 |

| CTC-A-T | Canadian Tire | 4.5% | $154.07 | 11.2% | $7.00 | 1.4% | 13 |

| CU-T | Canadian Utilities Limited | 5.0% | $36.49 | 13.6% | $1.81 | 0.9% | 52 |

| DOL-T | Dollarama Inc. | 0.2% | $142.04 | 49.5% | $0.35 | 30.7% | 13 |

| EMA-T | Emera | 5.2% | $55.88 | 10.0% | $2.88 | 3.3% | 17 |

| ENB-T | Enbridge Inc. | 6.0% | $61.05 | 26.1% | $3.66 | 3.1% | 28 |

| ENGH-T | Enghouse Systems Limited | 3.2% | $31.28 | -7.9% | $1.00 | 18.3% | 17 |

| FNV-N | Franco Nevada | 1.2% | $120.65 | 9.6% | $1.44 | 5.9% | 16 |

| FTS-T | Fortis Inc. | 3.8% | $62.98 | 14.8% | $2.39 | 4.4% | 50 |

| IFC-T | Intact Financial | 1.8% | $274.23 | 34.9% | $4.84 | 10.0% | 19 |

| L-T | Loblaw Companies Limited | 1.0% | $191.71 | 49.1% | $1.92 | 10.0% | 12 |

| MFC-T | Manulife Financial | 3.5% | $45.81 | 58.6% | $1.60 | 9.6% | 10 |

| MGA-N | Magna | 4.2% | $45.29 | -18.4% | $1.90 | 3.3% | 14 |

| MRU-T | Metro Inc. | 1.4% | $93.20 | 36.0% | $1.34 | 10.7% | 29 |

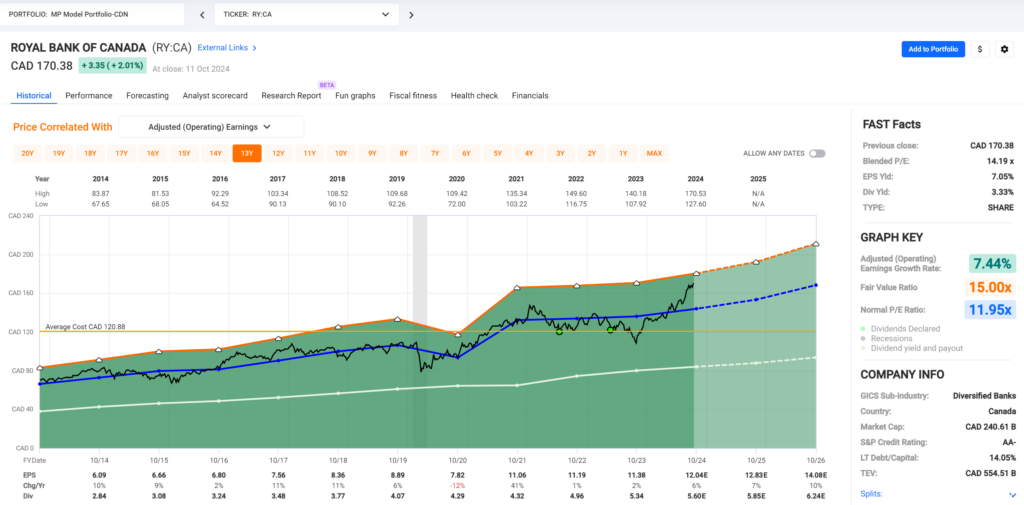

| RY-T | Royal Bank of Canada | 3.2% | $178.27 | 34.0% | $5.72 | 7.1% | 13 |

| SJ-T | Stella-Jones Inc. | 1.5% | $74.45 | -2.8% | $1.12 | 21.7% | 19 |

| STN-T | Stantec Inc. | 0.7% | $122.44 | 17.0% | $0.83 | 7.8% | 12 |

| T-T | Telus | 6.9% | $22.25 | -6.2% | $1.53 | 7.1% | 20 |

| TD-T | TD Bank | 5.6% | $73.51 | -13.2% | $4.08 | 6.3% | 13 |

| TFII-N | TFI International | 1.1% | $151.94 | 15.8% | $1.60 | 10.3% | 13 |

| TIH-T | Toromont Industries | 1.7% | $112.00 | -0.7% | $1.92 | 11.6% | 34 |

| TRI-N | Thomson Reuters | 1.3% | $170.56 | 19.0% | $2.16 | 12.5% | 30 |

| TRP-T | TC Energy Corp. | 5.6% | $68.29 | 30.5% | $3.84 | 3.2% | 23 |

| WCN-N | Waste Connections | 0.6% | $190.35 | 28.5% | $1.17 | 11.4% | 14 |

| Averages | 3.2% | 15.0% | 9.2% | 21 |

Note: Stocks ending in “-N” declare earnings and dividends in US dollars. To achieve currency consistency between dividends and share price for these stocks, we have shown dividends in US dollars and share price in US dollars (these stocks are listed on a US exchange). The dividends for their Canadian counterparts (-T) would be converted into CDN dollars and would fluctuate with the exchange rate.

PAID subscribers enjoy full access to our enhanced weekly newsletter, premium content, and easy-to-follow trade alerts so they can build DGI portfolios alongside ours. This service provides the resources to develop your DGI business plan confidently. We do the work; you stay in control!

It truly is the subscription that pays dividends!

The greatest investment you can make is in yourself. Are you ready to take that step?

For more articles and the full newsletter, check us out on magicpants.substack.com.