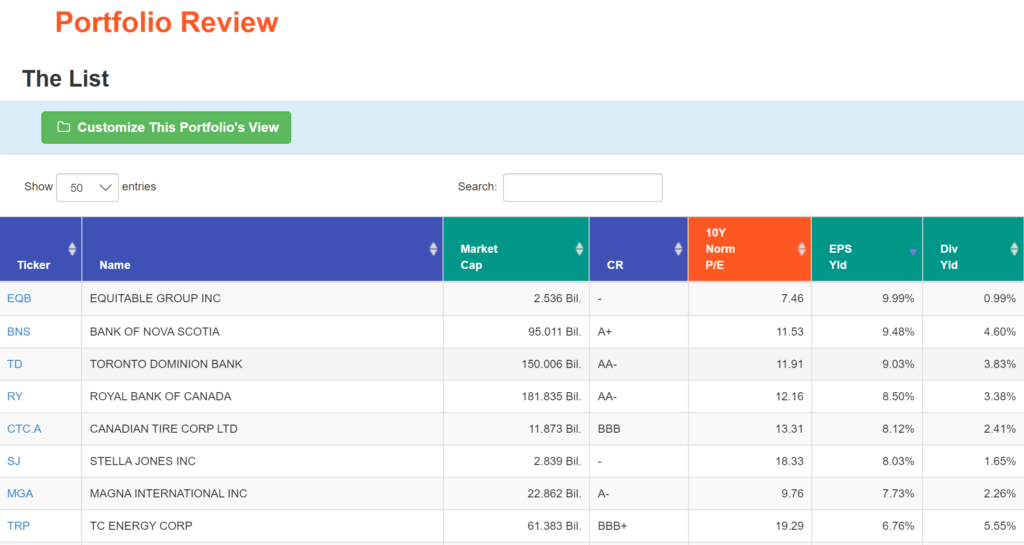

‘The List’ – Portfolio Review (September 2021)

Posted by BM on September 17, 2021

Each month I will walk through our valuation process using a stock on ‘The List’ that meets our minimum screen of 6.5% EPS Yld. This month it is Canadian Tire Corp. (CTC-A-T).

Valuation is the second step in our three-step process. Buying when our quality stocks are sensibly priced will help ensure our future investment returns meet our expectations. We rely heavily on the fundamental analyzer software tool (FASTgraphs) to help us understand the fundamentals of the stocks we invest in and then read the company’s website for investor presentations and recent earnings reports to learn more.

Intro:

Canadian Tire Corp. operates a network of 1,741 retail and gas outlets in Canada under the Canadian Tire, FGL Sports, Mark’s, and Petroleum banners. The stores offer living, fixing, automobile, sports, seasonal, gardening, and apparel products. The Retail segment (92% of 2020 revenues) is supported by the Financial Services division, which provides credit cards, retail deposits, and insurance products. It has three segments: Retail, CT REIT, and Financial Services.

CTC stores offer everything from automotive tools, apparel, and hardware to sporting goods and home essentials. The company has the advantage of being a one-stop shop for many Canadians. Through its diversified offerings, the company targets several customer segments at once.

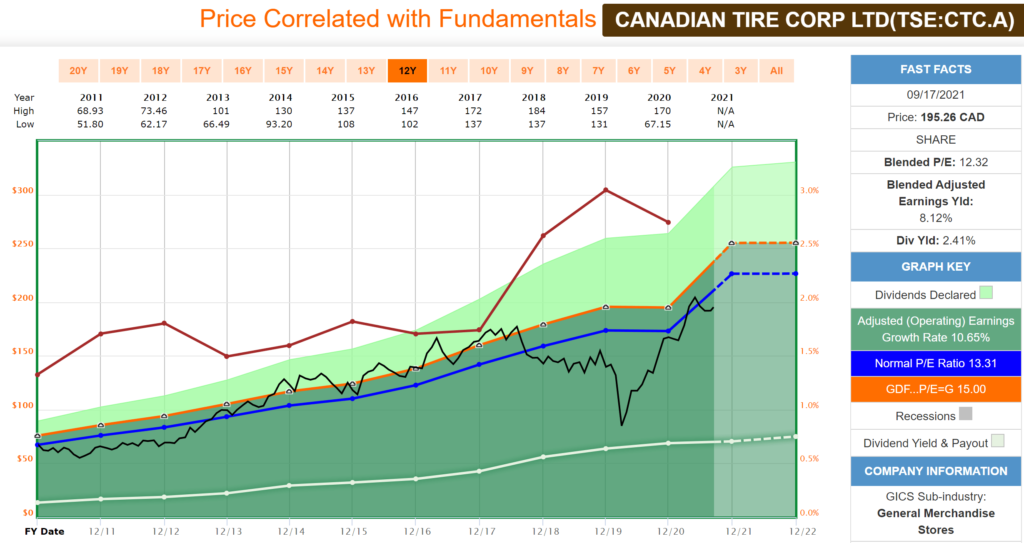

Historical Graph:

Comments:

Canadian Tire is another of our good dividend growers that trades within a narrow valuation corridor. As you can see from the Blue Line on the graph (Average P/E) and the Black Line (Price), there is typically very little variance (except for the large dip in 2020 due to COVID). Investment opportunities occur when the Black Line falls below the Blue Line with this quality dividend grower. With a lower-than-average P/E, a relatively low payout ratio (White Line), higher than average yield (Red Line) and near-term double-digit growth, this company’s fundamentals look quite appealing at first glance.

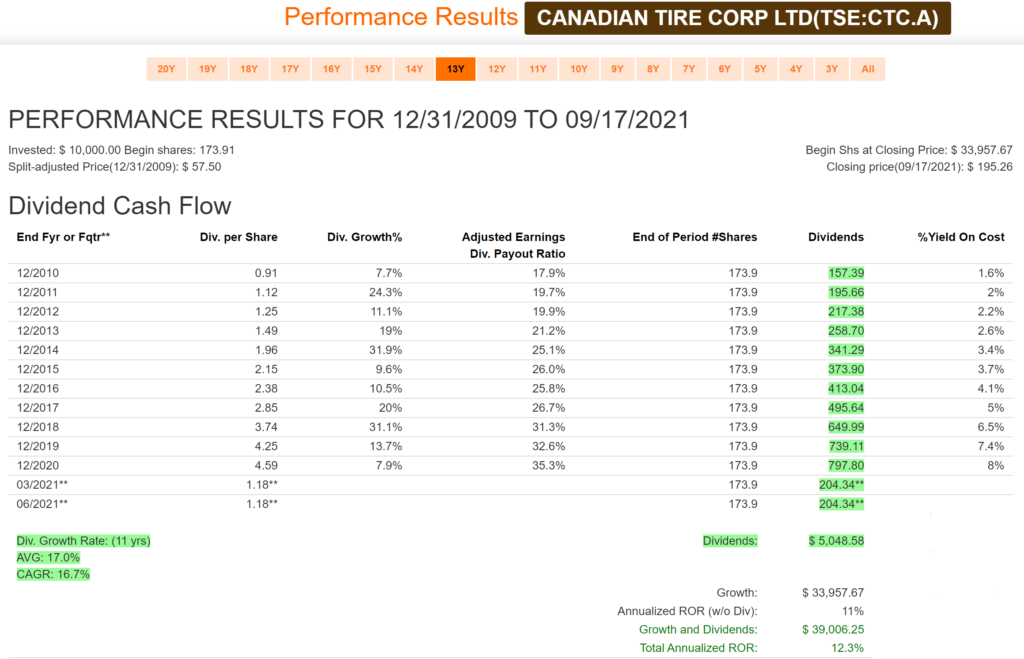

Performance Graph:

Comments:

Canadian Tire has an excellent dividend growth rate (16.7%/year) over the last decade. An above average starting yield with a good dividend growth rate means it doesn’t take long for your income to compound and grow. With a starting yield of only 1.6% ten years ago, you would now be receiving a return of 8% on your original investment from the income alone.

Note: Dividend growth in 2021 to date is only 3.3%. A slowing dividend growth rate can mean that management isn’t as optimistic on future growth and wants to be cautious before raising the dividend too much. We will be paying close attention to this metric going forward with CTC.A.

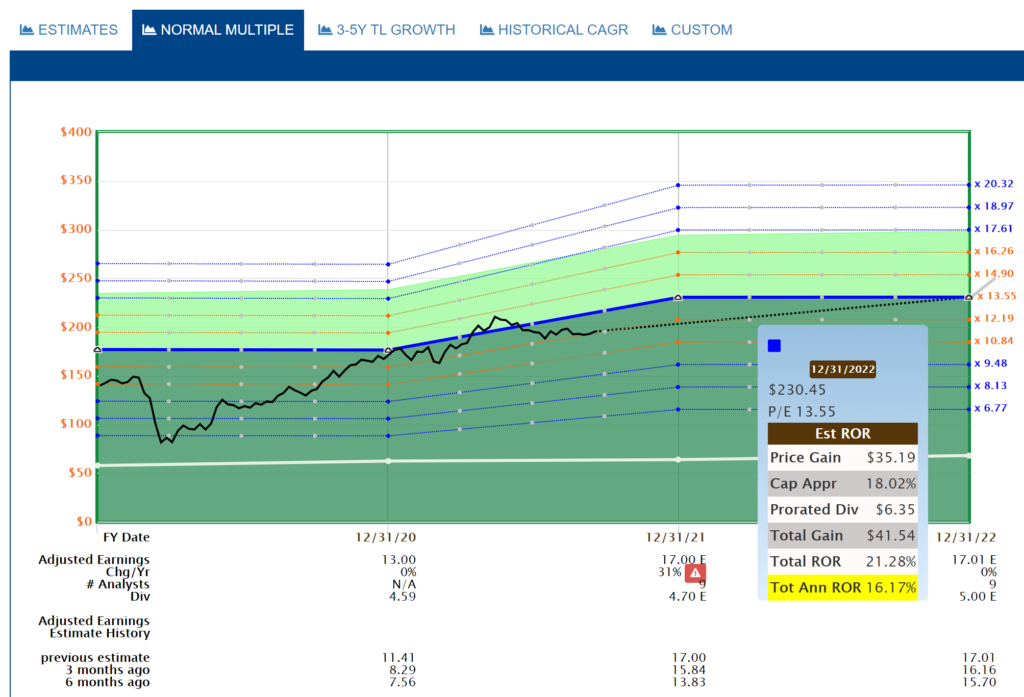

Estimated Earnings:

Comments:

There are nine analysts covering Canadian Tire in 2021/2022. Earnings in 2021 are expected to be up significantly over 2020 so this is a bit of an anomaly (Red Triangle). With most of the good news factored in already, analysts don’t see a lot of price appreciation beyond year end.

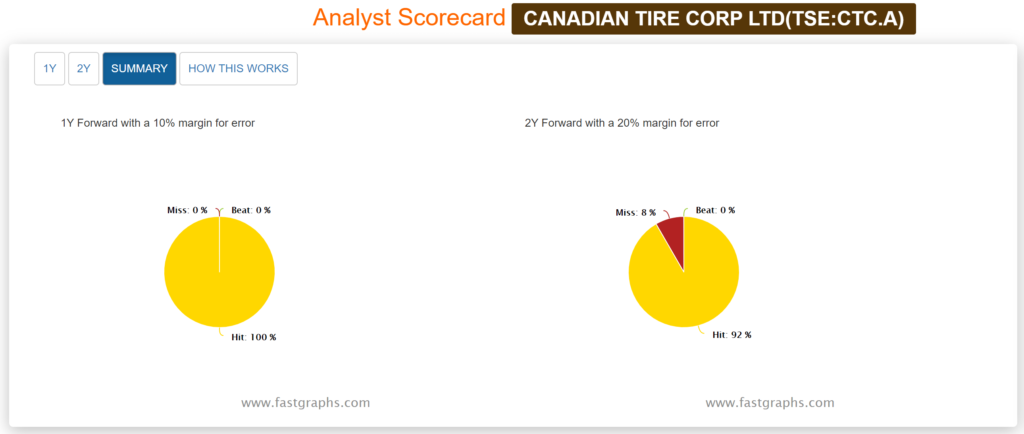

Analyst Scorecard:

Comments:

Analyst estimates over the years are quite accurate based on one and two-year earnings projections. Analysts projections have hit 100% of the time on one year estimates and 92% accuracy on two-year estimates.

Recent Earnings Report-Q2 2021:

Record quarterly e-commerce sales at $856.7 million and $2.1 billion over the last 12 months

- eCommerce contributed to the growth in revenue, with CTR experiencing the largest quarter in its history for eCommerce sales, up 63.2% to more than $600 million

- 8 million orders were fulfilled, double last quarter and up 38% compared to the second quarter last year.

Consolidated comparable sales (excluding Petroleum) were up 3.2% vs last year, and up 15.1% vs 2019

- A longer period of restrictions compared to last year at CTR had particular impact in Ontario, which comprises 40% of the CTR store network, with stores closed for 70% of the quarter

- CTR comparable sales were down 2.0% overall, with gardening, seasonal recreation, camping and automotive categories all growing double digit in the quarter. Compared to 2019, comparable sales were up 18.3%, with growth in over 70% of categories

- Comparable store sales at SportChek were up 28.6%, and Mark’s up 43.2%, respectively, led by sales of athletic and industrial footwear and apparel. Compared to 2019, comparable sales were up 5.1% at SportChek and up slightly at Mark’s

- Owned Brands penetration was 38% across the banners, representing close to $1.6 billion of sales in the quarter, with growth coming from Raleigh, Canvas, Diamondback and Denver Hayes

Strengthening engagement with Triangle Rewards members driving solid contributions

- Members accounted for 57% of retail sales, and average member spend was up 3%

- 33% of members shopped at more than one retail banner

- Triangle Rewards members reached 10.4 million, with almost 600,000 new members joining the program in the quarter and strengthened engagement efforts to retain existing members

Our fourth consecutive quarter of strong retail segment earnings drove a significant increase in EPS and exceptional retail ROIC at 14.1%

- Retail segment normalized income before income taxes increased $275.3 million, reflecting:

- Retail revenue (excluding Petroleum) growth of 23.4%, fueled by revenue growth at all banners led by shipment growth at CTR

- Gross margin rate (excluding Petroleum) increased 425 bps, up across all banners led by CTR

- Operating leverage improved, with normalized SG&A expenses (excluding Petroleum) as a percentage of revenue improving by over 200 bps

- Financial Services income before income taxes grew by $74.3 million, or 145.7%, in the quarter, reflecting:

- Strong portfolio risk and customer metrics

- A year over year improvement in gross margin due mainly to a $31.2 million reduction in the allowance for loans receivable compared to an incremental allowance in the prior year

Summary:

According to Value Line:

“Canadian Tire will likely continue to enjoy strong e-commerce sales in the near term. The retailer had exceptional first-quarter online sales, rising more than 250% year over year. While the company was fully operating in March, many Canadian provinces mandated strict restrictions and limited in-person activities. Thus, online orders remained high as more people were shopping from home. We expect this positive momentum to continue in the coming months and keep Canadian Tire’s digital sales in solid shape.

Also, 1.4 million additional customers signed up on the mobile application, and another 400,000 new members joined the loyalty program, Triangle Rewards. We like that the company has been offering multiple options for customers to shop, such as buy online, pickup in store or curbside, and home delivery.

Probably grow double digits to about $15.80 before advancing 2%-3% in 2022. The retail business will likely remain healthy in the coming quarters thanks to a pickup in outdoor and lifestyle categories. Furthermore, the Financial Services business is expected to benefit from more customers signing up for credit cards and joining the rewards program. Loyalists are more likely to make repeated purchases and spend more than average customers per trip.

Canadian Tire seems to be well positioned for long-term growth.”

Like so many companies, comparables in the first couple of quarters in 2021 were easily higher due to COVID in the first half of 2020. Many companies are now cautious about expecting large year-over-year increases for Q3/Q4 2021.

Canadian Tire has been an excellent dividend growth stock over the past decade and appears sensibly priced today. A smaller than expected increase in their 2021 dividend and Q3/Q4 earnings estimates that are lower than their comparable in 2020 send signals. We will wait and see on this one.