MP Market Review – February 24, 2023

Last updated by BM on February 27, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ exhibited a YTD price return of +4.6% (capital), while its dividend growth increased to +6.2% YTD, highlighting growth in income over the past year.

- Last week, there were two dividend increases from companies on ‘The List’.

- Last week, there were four earnings reports from companies on ‘The List’.

- Three companies on ‘The List’ are due to report earnings this week.

- If you’re interested in creating your own income portfolio, consider subscribing to our premium service, which grants you access to the MP Wealth-Builder Model Portfolio (CDN) and exclusive subscriber-only content. Learn More

Introduction

“You have a pair of pants. In the left pocket, you have a $100. You take $1 out of the left pocket and put in the right pocket. You now have a $101. There is no diminution of dollars in your left pocket. That is one magic pair of pants.”

This ‘magic pants’ analogy was from a Seeking Alpha article on dividend investing I read about a decade ago and was one of the catalysts for me to take a closer look at this type of investing and see if it truly was magical.

After conducting additional research, I have shifted towards utilizing a dividend growth investing (DGI) strategy as my primary investment approach. While I maintain portfolios consisting of high-quality dividend growers from both the United States and Canada, I have opted to concentrate on Canadian (CDN) dividend growth companies in this blog. This is due to several reasons, including a smaller pool of DGI companies to track, a lack of coverage for the DGI strategy by Canadian investment media, and a tendency for those who do cover DGI to narrowly focus on only a handful of sectors (Energy and Financials).

While ‘The List’ is not a portfolio in itself, it serves as an excellent initial reference for individuals seeking to diversify their investments and attain higher returns in the Canadian stock market. Through our blog, we provide weekly updates on ‘The List’ and offer valuable perspectives and real-life examples of the dividend growth investing strategy in practice. This helps readers gain a deeper understanding of how to implement and benefit from this investment approach.

DGI Thoughts

Plenty of predictions in the financial media on the probability of the markets going up, down or sideways last week. Did you know that as dividend growth investors we still get paid regardless of the outcome?

“Persistent high inflation rates will change everything. Dividend growth stocks are the best inflation hedge I know of.”

– Financial Sense, Seeking Alpha Contributor

This quote was from an article in Seeking Alpha that I read on the weekend. The author demonstrates why persistent inflation could disrupt the retirement planning communities’ rules.

“The first rule is the ‘age rule’ which defines how much of a person’s portfolio should be allocated between stocks and bonds. You take the number 100 minus your current age and that defines what you should allocate to stocks. For example, if you are age 65 when you retire, subtracting 65 from 100 equals 35%, the number you should invest in equities with the remaining 65% is invested in bonds and cash. At age 80, your equity portfolio would decline to 20%.

The second rule is on the withdrawal or spend down of your assets, which is 4% per year according to retirement planning advocates. Assuming a $1,000,000 portfolio, you would withdraw $40,000 a year which would last 25 years of your retirement.”

The author notes that both rules have major flaws with their reasoning, especially in a persistently high inflation environment. Purchasing power will be eaten away by inflation and prolonged bear markets can devastate retirement portfolios.

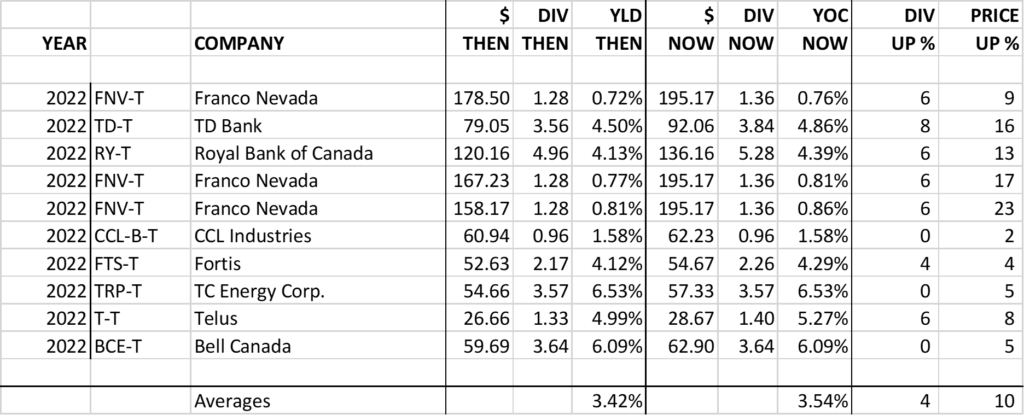

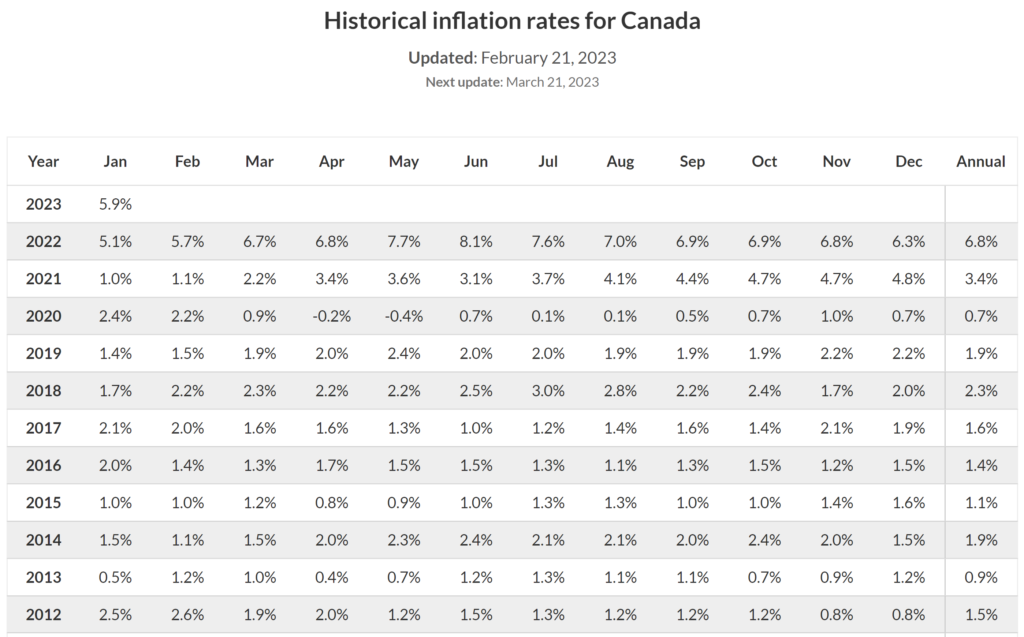

The two charts below show the historical inflation rates for Canada and the annual dividend growth rates of ‘The List’ we follow. Inflation hasn’t been much of a problem for investors in other strategies until recently, but it certainly will wreak havoc on purchasing power if it becomes persistent. The same holds true for a prolonged bear market for those who withdraw capital to live off in their retirement. Their portfolios will get smaller and smaller.

Alternatively, a dividend growth strategy means we don’t need to sell stocks in a bear market to pay our bills. We have dividends. On top of that, our dividends grow so we don’t lose purchasing power either.

Source: rateinflation.com

Compare this inflation rate data to the dividend growth rates of the stocks on ‘The List’ over the same period:

Source: Magic Pants Dividend Growth Investing

When compared to historical inflation rates, an average annual 10% growth rate of our dividends means our purchasing power is increasing not decreasing. If there is a better inflation hedge than dividend growth, we haven’t found it yet.

Recent News

How to beat the pros, Part 2: Simplify by focusing on stocks of high quality

Recall the first rule in our process. We define quality much the same as this author except we throw in “…a lengthy record of consistent dividend growth” for good measure.

The author defines winners as quality companies that have the “durability of the company’s competitive advantage, predictability/understandability of the business model, and longevity/stability of the industry/market.” Sound familiar?

We like the author’s message here, only deal with high-quality companies. They have the highest probability of delivering higher returns over the long term.

Even as markets tumble, the dividend hikes keep coming (Globe & Mail)

Not sure what to do with all the uncertainty in the markets?

“Stocks have been stumbling through February, as worries about the economy, interest rates and corporate earnings weigh on equity markets. But for dividend investors, it’s been a banner month.”

This is one of the great things about dividend growth stocks, no matter which direction the market moves, your income continues to grow. Don’t forget about inflation protection too. The income generated from ‘The List’ has already surpassed the inflation rate with more dividend raises last week.

The List (2023)

Last updated by BM on February 24, 2023

The Magic Pants List contains 27 Canadian dividend growth stocks. ‘The List’ contains Canadian companies that have raised their dividend yearly for at least the last ten years and have a market cap of over a billion dollars. Provided below is each stock’s symbol, name, current yield, current price, price return year-to-date, current dividend, dividend growth year-to-date and current dividend growth streak. Companies on ‘The List’ are added or subtracted once a year, on January 1. After that, ‘The List’ is set for the next twelve months. Prices and dividends are updated weekly.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 6.5% | $7.83 | 16.3% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $64.29 | 6.9% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 6.3% | $60.46 | 0.4% | $3.82 | 5.0% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $32.95 | 5.2% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.6% | $65.04 | 12.0% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 2.0% | $156.76 | -3.8% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.1% | $169.49 | 15.6% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 4.9% | $36.31 | -1.7% | $1.78 | 0.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $79.36 | -0.6% | $0.22 | 2.3% | 12 |

| EMA-T | Emera | 5.1% | $54.64 | 3.8% | $2.76 | 3.0% | 16 |

| ENB-T | Enbridge Inc. | 6.9% | $51.46 | -3.5% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 1.8% | $42.03 | 17.7% | $0.74 | 3.5% | 16 |

| FNV-N | Franco Nevada | 1.1% | $125.27 | -9.3% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis | 4.1% | $54.80 | -1.0% | $2.26 | 4.1% | 49 |

| IFC-T | Intact Financial | 2.2% | $198.06 | 1.2% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.4% | $119.63 | -0.6% | $1.62 | 5.2% | 11 |

| MGA-N | Magna | 3.4% | $53.80 | -6.5% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.7% | $71.42 | -5.4% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 3.8% | $137.22 | 7.2% | $5.28 | 6.5% | 12 |

| SJ-T | Stella-Jones Inc. | 1.7% | $47.55 | -4.1% | $0.80 | 0.0% | 18 |

| STN-T | Stantec Inc. | 1.0% | $79.25 | 21.3% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.2% | $91.11 | 3.9% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.1% | $122.35 | 22.2% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.5% | $113.38 | 16.0% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 6.6% | $56.22 | 5.5% | $3.69 | 3.4% | 22 |

| T-T | Telus | 5.2% | $27.17 | 3.2% | $1.40 | 5.4% | 19 |

| WCN-N | Waste Connections | 0.8% | $134.13 | 1.8% | $1.02 | 7.9% | 13 |

| Averages | 3.1% | 4.6% | 6.2% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

Note: When the currency of the dividend and share price match, the calculation is straightforward. But it’s not so simple when the dividend is declared in one currency and the share price is quoted in another. Dividing the former by the latter would produce a meaningless result because it’s a case of apples and oranges. To calculate the yield properly, you would need to express the dividend and share price in the same currency.

Performance of ‘The List’

Feel free to click on this link, ‘The List’ for a sortable version from our website.

Last week, ‘The List’ exhibited a YTD price return of +4.6% (capital), while its dividend growth increased to +6.2% YTD, highlighting growth in income over the past year.

The best performers last week on ‘The List’ were Stantec Inc. (STN-T), up +10.22%; CCL Industries (CCL-B-T), up +5.53%; and Toromont Industries (TIH-T), up +0.78%.

Franco Nevada (FNV-N) was the worst performer last week, down -5.42%.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

“As a dividend increase is a positive sign of a company’s financial strength, the safest purchase, after research, is a stock with a recent dividend increase.”

– Tom Connolly (the founder of dividendgrowth.ca)

Last week, there were two dividend increases from companies on ‘The List’.

CCL Industries (CCL-B-T) on Thursday, February 23, 2023, said it increased its 2023 quarterly dividend from $0.24 to $0.265 per share, payable March 31, 2023, to shareholders of record on March 17, 2023.

This represents a dividend increase of +10.4%, marking the 22nd straight year of dividend growth for this quality manufacturer of packaging and packaging-related products.

Stantec Inc. (STN-T) on Thursday, February 23, 2023, said it increased its 2023 quarterly dividend from $0.18 to $0.195 per share, payable April 17, 2023, to shareholders of record on March 31, 2023.

This represents a dividend increase of +8.3%, marking the 12th straight year of dividend growth for this quality global engineering, architecture, and environmental consulting company.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season. Q4 2022 is just about over and we are now seeing the beginning of the next earnings season with a couple of banks reporting this week.

The updated earnings calendar can be found here.

Earnings growth and dividend growth tend to go hand in hand, so this information can tell us a lot about the future dividend growth of our quality companies. Monitoring our dividend growers periodically is part of the process, and reading the quarterly earnings releases is a good place to start.

Three companies on ‘The List’ are due to report earnings this week.

Royal Bank of Canada (RY-T) will release its first-quarter 2023 results on Wednesday, March 1, 2023, before markets open.

TD Bank (TD-T) will release its first-quarter 2023 results on Thursday, March 2, 2023, before markets open.

Canadian Utilities Limited (CU-T) will release its fourth-quarter 2022 results on Thursday, March 2, 2023, before markets open.

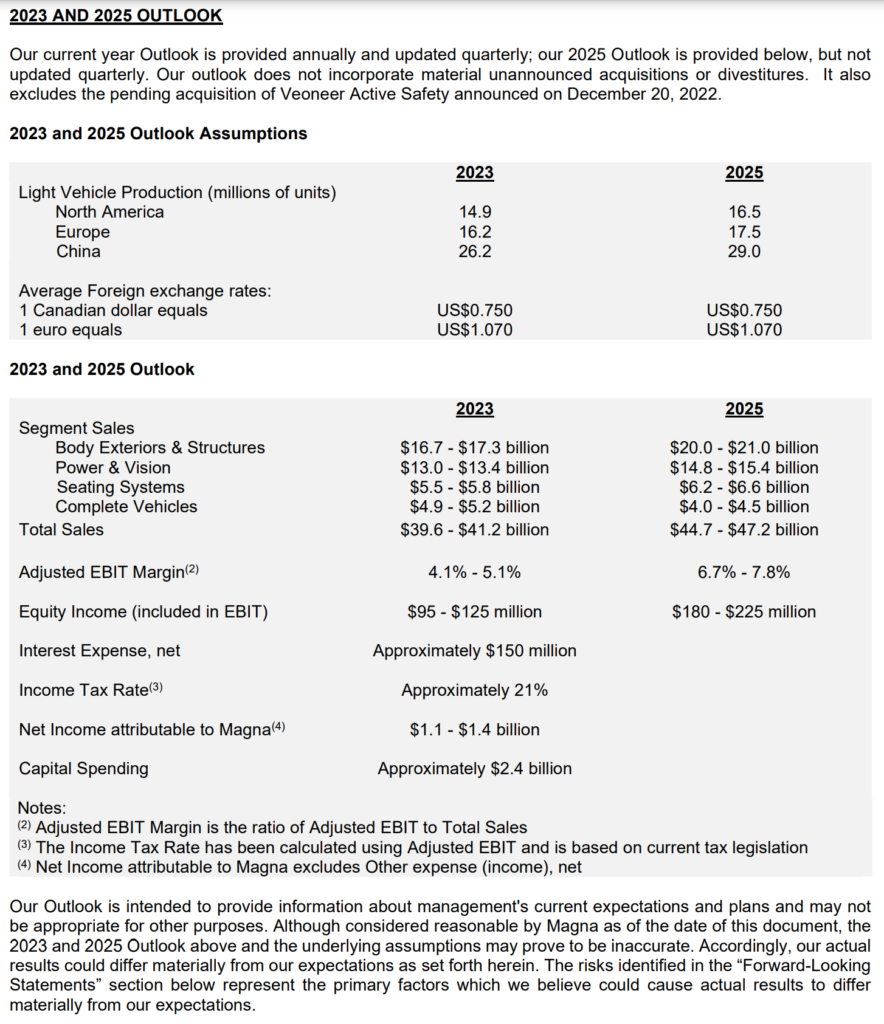

Last week, four companies on ‘The List’, reported their earnings.

Stantec (STN-T) released its fourth-quarter 2022 results on Wednesday, February 22, 2023, after markets closed.

“For the second consecutive year, we achieved record financial results, and I am extremely pleased that we outperformed our revenue and earnings guidance for 2022 on the strength of our outstanding fourth quarter performance.” said Gord Johnston, President and CEO. “I am also very proud that Stantec has again been ranked as one of the most sustainable companies in the world. These remarkable achievements are attributed to the dedication and passion of our employees. With the Cardno integration behind us, we expect our strong financial momentum to continue throughout 2023 and the years ahead.”

– President and Chief Executive Officer, Gord Johnston

Highlights:

- Net revenue of $4.5 billion in 2022, an increase of 22.6% over 2021

- Adjusted diluted EPS1 of $3.13, an increase of 29.3% over 2021

- Backlog of $5.9 billion, up 14.9% since December 31, 2021

- Ranked #7 of the most sustainable corporations in the world by Corporate Knights, first among peers

Outlook:

“Stantec is well positioned for another year of solid growth,” said Mr. Johnston. “Significant backlog and strong tailwinds of public and private investment, along with Stantec’s focus on project execution and operational efficiencies, support Stantec’s confidence for delivering on our strategic plan and 2023 targets.”

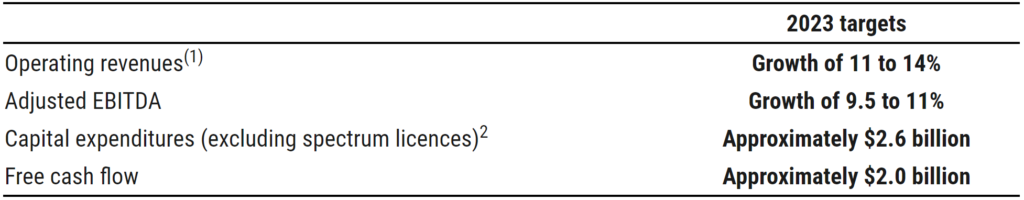

For 2023, Stantec has established the following targets and expectations.

Source: (STN-T) Q4-2022 Earnings Presentation

CCL Industries (CCL-B-T) released its fourth-quarter 2022 results on Wednesday, February 22, 2023, after markets closed.

“2022 was our third consecutive year of delivering record results despite difficult economic conditions including historic inflationary pressures, global supply chain disruptions, pandemic-related restrictions and geopolitical events disrupting commodity and energy markets. Our teams worked with resolve, dedication and passion delivering for customers and shareholders. 2022 was another year of strong free cash flow, largely reinvested in our businesses, positioning the Company for continued long term success.”

– Geoffrey T. Martin, President and Chief Executive Officer

Highlights:

Fourth Quarter Highlights

- Per Class B share: $0.83 adjusted basic earnings up 2.5%; $0.82 basic earnings up 2.5%; currency translation positive $0.03

- Sales increased 6.6% on 4.9% acquisition growth and 2.3% positive currency translation partially offset by 0.6% organic decline

- Operating income increased 1.1%, with a 13.3% operating margin down 70 bps

2022 Highlights

- Per Class B share: $3.57 adjusted basic earnings up 5.9%; $3.50 basic earnings up 5.1%; currency translation negative $0.02

- Sales increased 11.3% on 7.3% organic growth and 4.8% acquisition growth partially offset by 0.8% negative currency translation

- Operating income increased 4.8%, with a 14.6% operating margin down 90 bps

- Annual dividend increased 10.4% effective March 17, 2023

Outlook:

- Core CCL business units’ orders picture still solid

- CCL Design: outlook similar to Q4

- CCL Secure volume expected to improve

- Avery direct to consumer strength remains, augmented by recent acquisitions, horticultural peak season in Q1

- Checkpoint: apparel destocking expected to continue for some months, MAS outlook stable with easier comps

- Innovia volume subject to label materials industry demand recovery, inflationary pressures and inventory cost squeeze both stabilizing

- Modest FX tailwind

Source: (CCL-B-T) Q4-2022 Earnings Release

Loblaws (L-T) released its fourth-quarter 2022 results on Thursday, February 23, 2023, before markets opened.

“Loblaw used its assets to provide value to customers in a period of continued inflation,” said Galen G. Weston, Chairman and President, Loblaw Companies Limited. “Consumers responded favourably to those efforts and continued to benefit from our extensive private label offering, leading loyalty program and targeted promotions.”

– Galen G. Weston, Chairman and President

Highlights:

2022 FOURTH QUARTER HIGHLIGHTS

- Revenue was $14,007 million, an increase of $1,250 million, or 9.8%.

- Retail segment sales were $13,694 million, an increase of $1,208 million, or 9.7%.

- Food Retail (Loblaw) same-stores sales increased by 8.4%.

- Drug Retail (Shoppers Drug Mart) same-store sales increased by 8.7%, with front store same-store sales growth of 11.5% and pharmacy same-store sales growth of 5.4%.

- E-commerce sales increased by 8.3%.

- Operating income was $871 million, an increase of $166 million, or 23.5%.

- Adjusted EBITDA was $1,493 million, an increase of $169 million, or 12.8%.

- Retail segment adjusted gross profit percentage was 30.6%, a decrease of 30 basis points.

- Retail segment selling, general and administrative expenses (“SG&A”) as a percentage of sales was 20.2%, a favourable decrease of 70 basis points.

- Net earnings available to common shareholders of the Company were $529 million, a decrease of $215 million or 28.9%. Diluted net earnings per common share were $1.62, a decrease of $0.58, or 26.4%. The decrease was primarily driven by a prior year gain related to a favourable Court ruling.

- Adjusted net earnings available to common shareholders of the Company were $575 million, an increase of $60 million, or 11.7%.

- Adjusted diluted net earnings per common share were $1.76, an increase of $0.24 or 15.8%.

- Repurchased for cancellation 0.8 million common shares at a cost of $100 million and invested $599 million in capital expenditures, net of proceeds from property disposals. Retail segment free cash flow was $408 million.

2022 SELECT ANNUAL HIGHLIGHTS

- Revenue was $56,504 million, an increase of $3,334 million, or 6.3%.

- Food Retail same-store sales increased by 4.7% and Drug Retail same-store sales increased by 6.9%.

- E-commerce sales were approximately $3 billion, a decrease of 3.8%, lapping elevated online sales due to lockdowns last year.

- Net earnings available to common shareholders of the Company were $1,909 million, an increase of $46 million or 2.5%. Diluted net earnings per common share were $5.75, an increase of $0.30, or 5.5%.

- Adjusted net earnings available to common shareholders of the Company were $2,263 million, an increase of $352 million, or 18.4%.

- Adjusted diluted net earnings per common share were $6.82, an increase of $1.23, or 22.0%.

- Repurchased for cancellation, 10.9 million common shares at a cost of $1,258 million and invested $1,407 million in capital expenditures, net of proceeds from property disposals. Retail segment free cash flow was $2,005 million.

Outlook:

Loblaw will continue to execute on retail excellence while advancing its growth initiatives in 2023. The Company’s businesses remain well placed to service the everyday needs of Canadians. However, the Company cannot predict the precise impacts of global economic uncertainties, including the inflationary environment, on its 2023 financial results.

For the full-year 2023, Loblaw expects:

- its Retail business to grow earnings faster than sales;

- Adjusted net EPS growth in the low double digits;

- to increase investments in our store network and distribution centres by investing a net amount of $1.6 billion in capital expenditures; and

- to return capital to shareholders by allocating a significant portion of free cash flow to share repurchases.

Source: (L-T) Q4-2022 Earnings Release

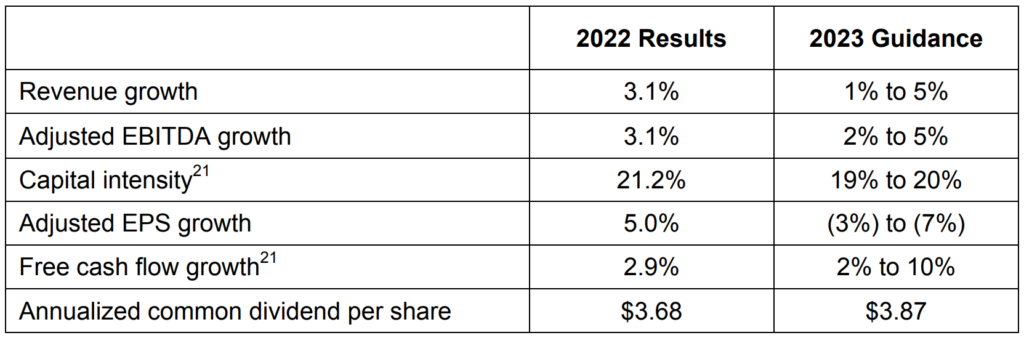

Emera Inc. (EMA-T) released its fourth-quarter 2022 results on Thursday, February 23, 2023, before markets opened.

“In 2022, we continued our track record of delivering for both our customers and shareholders. We successfully executed a $2.6 billion capital plan focused on delivering cleaner and more reliable energy for our customers, leading to strong earnings growth and supporting continued dividend increases for our shareholders” said Scott Balfour, President and CEO of Emera Inc. “In 2023, we will remain focused on leading a balanced energy transition at a pace that is as cost effective as possible for customers and supports system reliability.”

– Scott Balfour, President and Chief Executive Officer

Highlights:

Q4 2022 Financial Results

- Q4 2022 reported net income was $483 million, or $1.80 per common share, compared with net income of $324 million, or $1.24 per common share, in Q4 2021. Reported net income included a $307 million after-tax MTM gain, primarily at EES, compared to a $156 million gain in Q4 2021 and a $73 million non-cash impairment charge related to Grand Bahama Power Company (“GBPC”).

- Q4 2022 adjusted net income was $249 million, or $0.93 per common share, compared with $168 million, or $0.64 per common share, in Q4 2021. The increase was primarily due to the litigation award in Q4 2022; higher earnings contribution from Tampa Electric, EES and NMGC; and the impact of a weaker Canadian dollar (“CAD”). These were partially offset by lower earnings contribution from NSPI and increased corporate operating, maintenance and general expenses (“OM&G”) due to the timing of long-term compensation and related hedges and higher corporate interest expense.

Annual Financial Results

- 2022 reported net income was $945 million or $3.56 per common share, compared with a net income of $510 million or $1.98 per common share in 2021. 2022 reported net income included a $175 million after-tax MTM gain primarily at EES, compared to $213 million loss in 2021, a $73 million non-cash impairment charge related to GBPC and $7 million of NSP Maritime Link Inc. (“NSPML”) unrecoverable costs.

- 2022 adjusted net income was $850 million or $3.20 per common share, compared with $723 million or $2.81 per common share in 2021.

- Growth in 2022 adjusted net income was primarily due to higher earnings contributions from Tampa Electric, EES, and PGS; the litigation award in Q4 2022; and the impact of a weaker CAD. These were partially offset by increased corporate OM&G due to the timing of long-term compensation and related hedges, higher corporate interest expense, realized gains on corporate FX hedges in 2021, increased preferred stock dividends and lower earnings contribution from NSPI.

- The impact of the weakening CAD, partially offset by the unrealized losses on FX hedges increased reported net income by $42 million in Q4 2022 and $30 million for the year ended December 31, 2022, compared to the same periods in 2021. Weakening of the CAD increased adjusted net income by $14 million in Q4 2022 and $28 million for the year ended December 31, 2022, compared to the same periods in 2021. The impacts of the weakening CAD include the realized impacts of corporate FX hedges in the Other segment.

Outlook:

“In 2023, we will remain focused on leading a balanced energy transition at a pace that is as cost effective as possible for customers and supports system reliability,” said Scott Balfour, president and CEO of Emera.