‘The List’ – Portfolio Review (January 2022)

Posted by BM on January 31, 2022

Each month we walk through our valuation process using a stock on ‘The List’ that meets our minimum screen of 6.5% EPS Yld. This month is a little different as we have already reported on companies, in previous reviews, that meet this criterion and there are no new companies to add. There is however one company on ‘The List’ that is valued differently and has recently come into what we would call a ‘sensible price’ range based on its own unique historical valuation pattern. That stock is Franco Nevada Corporation (FNV-T).

Valuation is the second step in our three-step process. Buying when our quality stocks are sensibly priced will help ensure our future investment returns meet our expectations. We rely heavily on the fundamental analyzer software tool (FASTgraphs) to help us understand the fundamentals of the stocks we invest in and then read the company’s website for investor presentations and recent earnings reports to learn more.

Intro:

Franco-Nevada Corp is a precious-metals-focused royalty and investment company. The company owns a diversified portfolio of precious metals and royalty streams, which is actively managed to generate the bulk of its revenue from gold, silver, and platinum. The company does not operate mines, develop projects, or conduct exploration. Franco-Nevada’s short-term financial performance is linked to the price of commodities and the amount of production from its portfolio of producing assets. Its long-term performance is affected by the availability of exploration and development capital. The company holds a portfolio of assets, diversified by commodity, revenue type, and stage of a project, primarily located in the United States, Canada, and Australia.

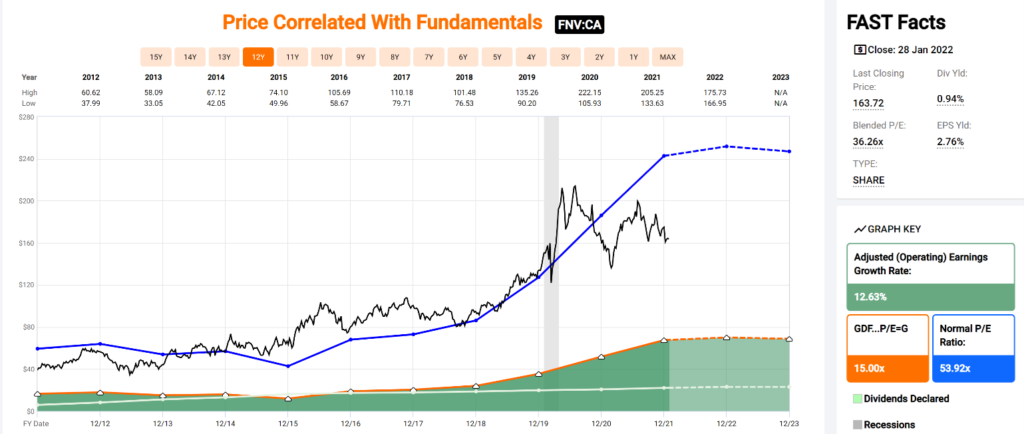

Historical Graph:

Comments:

Franco Nevada Corp. is another of our good dividend growers that trades within a narrow valuation corridor. As you can see from the Blue Line on the graph (Normal P/E) and the Black Line (Price), there is typically very little variance. Investment opportunities typically occur when the Black Line falls below the Blue Line (53.9 PE) with this quality dividend grower. The fundamentals show a company whose earnings have grown steadily over the last ten years at an annualized rate of ~12.63%.

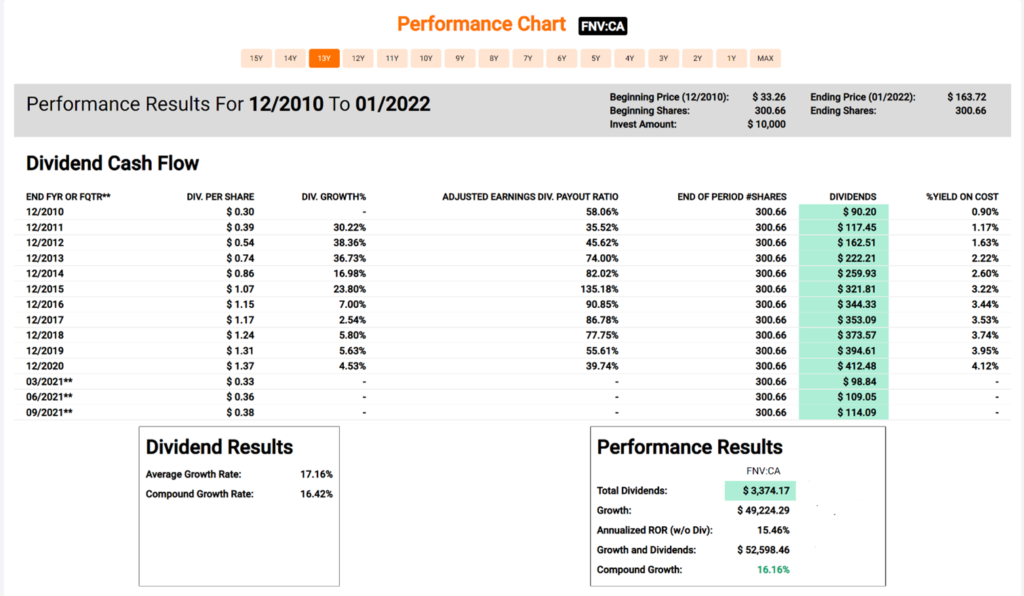

Performance Graph:

Comments:

Franco Nevada Corp. has an annualized dividend growth rate of 16.42% over the last decade but growth has slowed over the last five years. The company also has an annualized Total Return of 16.16% over that time. FNV-T recently announced another dividend increase of 6.7% for 2022 which is more in line with the recent past.

Estimated Earnings:

Comments:

Using the “Normal Multiple’ estimating tool from FASTgraphs, we see a blended P/E average over the last five years of 63.66. Based on Analysts’ forecasts two years out, you can expect an annualized return of 35.75% should FNV-T trade at its five-year average blended P/E.

Blended P/E is based upon a weighted average of the most recent actual value and the closest forecast value.

Another thing I like about Franco Nevada Corp.’s earnings is that they are being revised upwards from both six months and three months ago for both 2022 and 2023. Analysts seem bullish on FNV-T in the short term.

Analyst Scorecard:

Comments:

Analyst estimates over the years are fairly accurate based on one and two-year earnings projections. Analysts’ projections have hit or beat 75% of the time on one-year estimates and 71% on two-year estimates.

Recent Earnings Report-Q3 2021:

Franco-Nevada Reports Strong Q3 Results; 2021 Energy Guidance Increased

Highlights

“Franco-Nevada delivered a strong third quarter, setting the stage for a record year in 2021. Our diversified portfolio continues to serve us well with strong contributions during the quarter from precious metals, energy and iron ore,” stated Paul Brink, President & CEO. “Higher energy prices have led us to increase our 2021 Energy guidance for the second time this year. Margins have moved higher this year due to the inflation-protected nature of our business model. Franco-Nevada is debt-free and is growing its cash balances.”

Strong Financial Position

- No debt and $1.6 billion in available capital as of September 30, 2021

- Generated $206.9 million in operating cash flow for the quarter

- Quarterly dividend of $0.30/share

Sector-Leading ESG

- Ranked #1 gold company by Sustainalytics, AA by MSCI and Prime by ISS ESG

- Committed to the World Gold Council’s “Responsible Gold Mining Principles”

- Partnering with our operators on community and ESG initiatives

- Goal of 40% diverse representation at the Board and top leadership levels

Diverse, Long-Life Portfolio

- Most diverse royalty and streaming portfolio by asset, operator, and country

- Core assets outperforming since time of acquisition

- Growth in long-life reserves

Growth and Optionality

- Acquisitions, mine expansions and new mines driving growth

- 1-million-ounce increase in Measured and Indicated Mineral Resources at Detour Lake

- Long-term options in gold, copper and nickel

- Noront consolidation likely to accelerate development of Ring of Fire properties

Summary:

Franco Nevada Corp. is one of only two companies in our ‘Double-Double Club’ and has been a stellar performer from a total return perspective for many years now. Although Franco Nevada is weighted heavily in the gold sector, it has been much more stable than the price of gold has been. Those of us who follow macro investing believe that gold may have its day again soon and FNV-T is an excellent way to benefit. The current yield is low at ~1% but growth is acceptable and if you believe that gold is a currency you want exposure to, then you will want to look closely at adding FNV-T to your dividend growth portfolio.

Franco Nevada Corp. appears to be sensibly priced based on historical metrics. It is well below its blended P/E at this point. Both its forecasted earnings growth and dividend growth appear to be trending along recent historical norms. Throw in a recent dividend increase (14 years and counting) and there is a lot to like about FNV-T.