MP Market Review – September 23, 2022

Last updated by BM on September 26, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

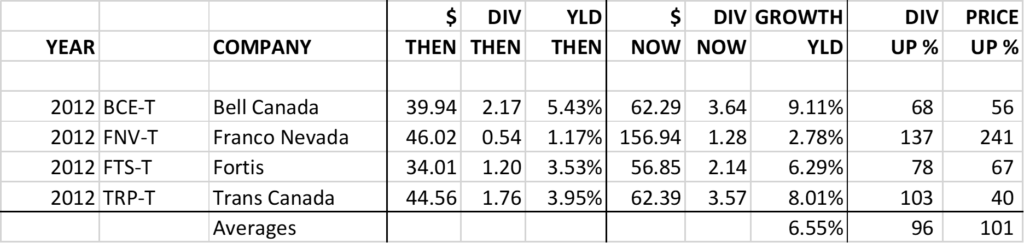

- Last week, ‘The List’ was down sharply with a minus -6.0% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, there were no earnings reports from companies on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“Fortunes are made by buying right and holding on.”

– Tom Phelps

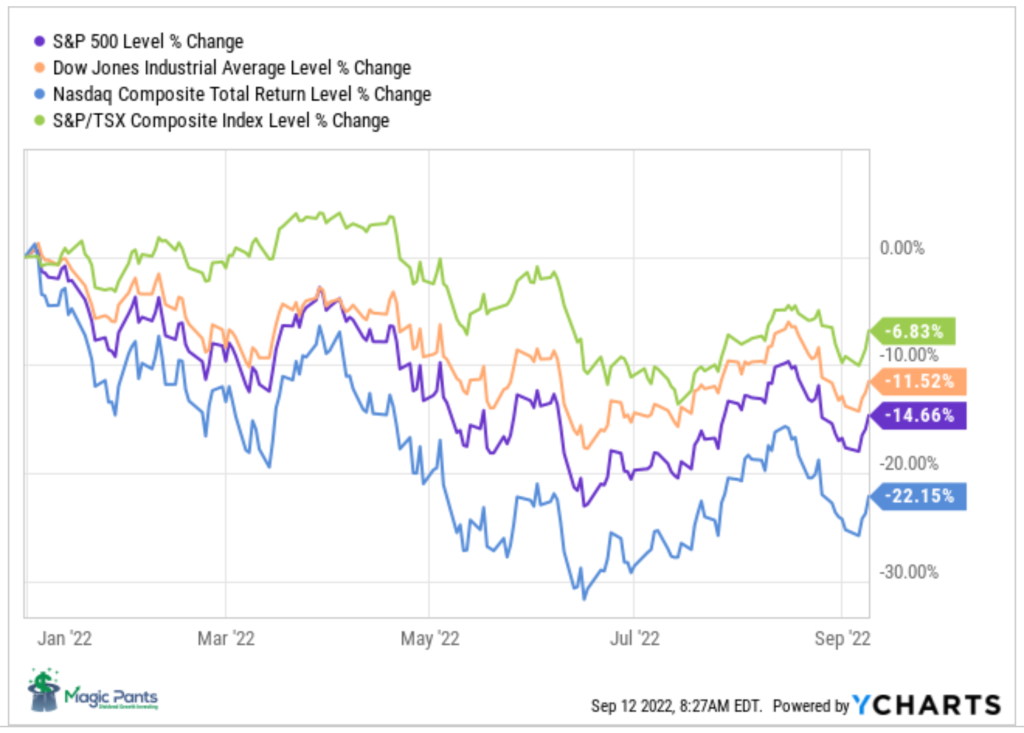

Last week in the markets was difficult to watch as many of the indexes plummeted further as the reality of an upcoming recession has finally sunk in. The TSX Composite Index finally went below -10% for the first time this year.

Although it is difficult to look for optimism, we need to remember that as dividend growth investors we do things a bit differently. We see volatile markets as opportunities to either prune or add to our positions. In the case of a downward trending market, we look to buy more income when our quality companies go on sale.

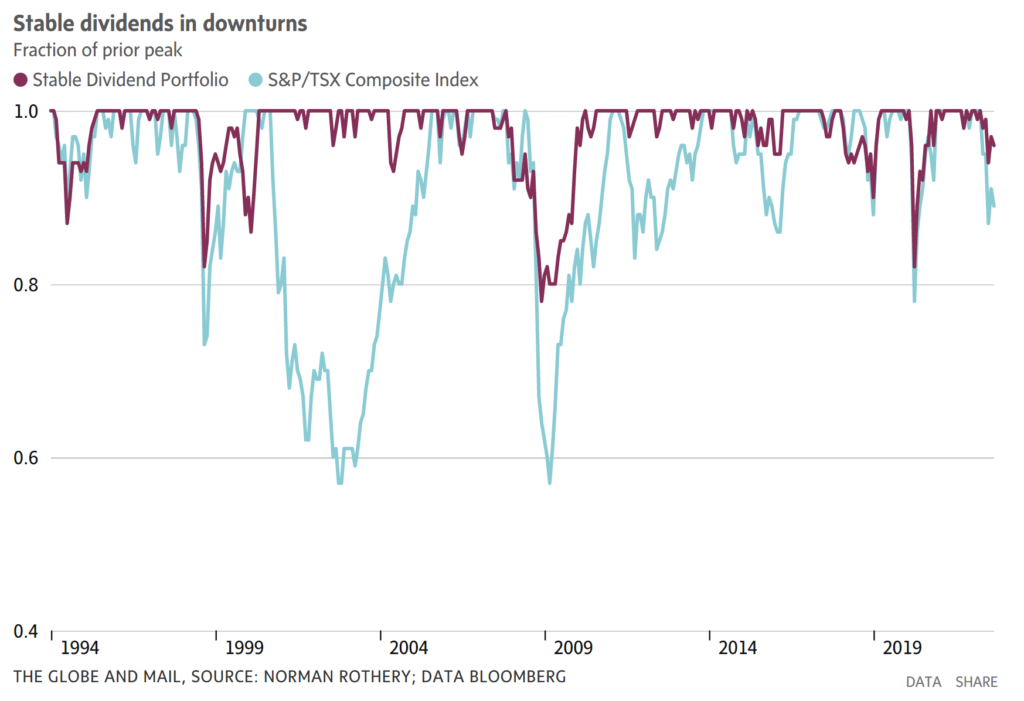

In the ‘Recent News’ section of this week’s review, there is a good article on dividend investing in uncertain times. Although our historical returns are similar, we are much less active than the ‘Stable Dividend portfolio’ strategy. It is interesting to note that many of our companies on ‘The List’ have found their way into Mr. Rothery’s portfolio currently.

One of the charts we like in the article is the chart that displays the volatility of the ‘Stable Dividend Portfolio’ versus the index.

This data seems to support our own experience with ‘The List’ as our YTD capital returns are down much less than the decline in the TSX Composite index.

Saying you are down only half as much as the index is not that comforting to most retirees, but it at least means that the climb back up will be shorter. Our growing yields seem to act as a floor for declining prices. In addition, we still have our growing dividend income to cover our expenses and have fun with, until things turn around.

In the case of our model portfolio, we believe our patience will pay off very soon and we can enjoy even more of our newfound income when we start or add to our positions at ‘sensible prices’.

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

Last week, ‘The List’ was down sharply with a minus -6.0% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were all negative. Dollarama Inc. (DOL-T), down -0.30%; Emera (EMA-T), down -0.92%; and CCL Industries (CCL-B-T), down -1.05%.

Magna (MGA-N) was the worst performer last week, down -8,68%.

Recent News

How the Stable Dividend portfolio fares in uncertain times (Globe & Mail)

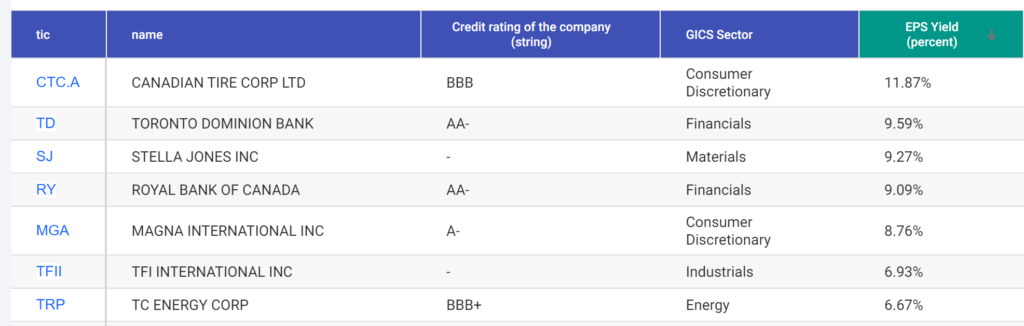

“That brings me to the Stable Dividend portfolio. It picks 20 stocks from the dividend-paying portfolio that were the least volatile over the preceding 260 days. That is, their prices varied the least compared to other dividend stocks in recent months. The hope is that they’ll continue to offer a relatively smooth ride in the future.”

The strategy puts an equal amount of money in each of the 20 stocks and is rebalanced monthly. The portfolio has had an average 14.5% annual return over the last twenty years. If you chose to rebalance the portfolio only once a year, the return is still very good (13.6% annualized return).

Although the criteria are different from ours (recent volatility vs growing dividends) it is interesting to notice that about 50% of the stocks on ‘The List’ and on the ‘Stable Dividend’ portfolio are currently the same.

We like our more passive approach better as our capital grows at about the same rate, our income continues to compound and we pay fewer taxes along the way.

The terrifying – and highly profitable – journey of a bank stock (Globe & Mail)

“The purpose of this exercise is to demonstrate that, when you own an excellent company, you are much better off holding the shares through thick and thin than trying to trade your way through the market’s gyrations. I don’t know anyone who can do that reliably, but I know plenty of people who try.”

In this article, the author walks you through the ride of the share price of Canada’s largest bank over the last twenty years. Although there have been a few recessions, and dividend freezes (no cuts) the capital return easily beats the index.

“Royal Bank’s total return over that time, including dividends, was 12.45 per cent on an annualized basis. To put that into dollars, your initial $10,000 investment would have grown to $104,618 – a gain of 946 per cent – before tax.”

Imagine your returns if you had pruned a little at the top and bought a little back after each dividend freeze. I wonder how much our income would have grown during the same time period?

No companies on ‘The List’ are due to report earnings this week.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

Last week, there were no earnings reports from companies on ‘The List’.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on September 23, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 5.6% | $12.49 | -13.0% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $54.53 | 4.7% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.9% | $61.45 | -6.8% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.6% | $39.61 | -2.7% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.5% | $65.11 | -4.0% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.9% | $150.97 | -2.5% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.9% | $149.92 | -18.2% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.5% | $39.45 | 7.8% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $76.52 | 20.7% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.4% | $60.48 | -3.4% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.7% | $51.64 | 4.2% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.5% | $28.53 | -37.8% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 1.1% | $114.13 | -16.1% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.8% | $56.19 | -7.1% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.0% | $197.32 | 20.5% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.4% | $111.98 | 9.0% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 3.6% | $50.11 | -38.6% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.6% | $69.84 | 4.2% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 4.0% | $123.40 | -9.8% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 2.1% | $37.85 | -7.0% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.2% | $59.42 | -15.3% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.2% | $84.37 | -15.1% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.2% | $91.00 | -17.8% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.6% | $95.56 | -15.9% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 6.0% | $59.21 | -0.9% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.7% | $28.38 | -4.6% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $139.72 | 4.2% | $0.92 | 8.9% | 12 |

| Averages | 3.0% | -6.0% | 10.2% | 18 |