MP Market Review – December 29, 2023

Last updated by BM on January 1, 2024

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was up with a 2023 price return of +5.8% (capital). Dividends increased by +8.7% in 2023, highlighting the growth in the dividend (income).

- Last week, there were no dividend announcements from companies on ‘The List’.

- Last week, there were no earnings reports from companies on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

The List (2023)

The Magic Pants List includes 27 Canadian dividend growth stocks. Each has raised their dividend annually for the last ten years (or longer) and has a market cap of over a billion dollars. Based on these criteria, companies on ‘The List’ are added or removed annually, on January 1. Prices and dividends are updated weekly.

While ‘The List’ does not function as a portfolio on its own, it serves as an excellent initial reference for individuals looking to diversify their investments and achieve higher returns in the Canadian stock market. Through our newsletter, readers gain a deeper understanding of how to implement and benefit from our Canadian dividend growth investing strategy.

If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service. Subscribers gain access to buy/sell alerts and exclusive content available only to subscribers.

Performance of ‘The List’

Last week, ‘The List’ was up with a 2023 price return of +5.8% (capital). Dividends increased by +8.7% in 2023, highlighting the dividend (income) growth over the last calendar year.

The best performers last week on ‘The List’ were TFI International (TFII-N), up +2.77%; Metro (MRU-T), up +1.96%; and Stantec Inc. (STN-T), up +1.82%.

TC Energy Corp. (TRP-T) was the worst performer last week, down -2.36%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 8.0% | $6.32 | -6.1% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $76.76 | 27.6% | $0.60 | 26.8% | 13 |

| BCE-T | Bell Canada | 7.4% | $52.17 | -13.4% | $3.87 | 5.2% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $31.49 | 0.5% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.8% | $59.59 | 2.7% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 1.9% | $166.55 | 2.3% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.9% | $140.72 | -4.0% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 5.6% | $31.89 | -13.7% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $95.49 | 19.6% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 5.5% | $50.30 | -4.4% | $2.79 | 4.0% | 16 |

| ENB-T | Enbridge Inc. | 7.4% | $47.70 | -10.6% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 2.4% | $35.10 | -1.7% | $0.85 | 18.2% | 16 |

| FNV-N | Franco Nevada | 1.2% | $110.81 | -19.8% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis Inc. | 4.2% | $54.51 | -1.5% | $2.29 | 5.3% | 49 |

| IFC-T | Intact Financial | 2.2% | $203.86 | 4.1% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.4% | $128.28 | 6.6% | $1.74 | 10.3% | 11 |

| MGA-N | Magna | 3.1% | $59.08 | 2.7% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.8% | $68.59 | -9.1% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 4.0% | $134.00 | 4.7% | $5.34 | 7.7% | 12 |

| SJ-T | Stella-Jones Inc. | 1.2% | $77.12 | 55.5% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 0.7% | $106.38 | 62.8% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.5% | $85.62 | -2.3% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.1% | $135.98 | 35.8% | $1.45 | 25.0% | 12 |

| TIH-T | Toromont Industries | 1.5% | $116.10 | 18.8% | $1.72 | 10.3% | 33 |

| TRP-T | TC Energy Corp. | 7.2% | $51.76 | -2.9% | $3.72 | 3.3% | 22 |

| T-T | Telus Corp. | 6.1% | $23.58 | -10.4% | $1.43 | 7.3% | 19 |

| WCN-N | Waste Connections | 0.7% | $149.27 | 13.3% | $1.05 | 10.5% | 13 |

| Averages | 3.4% | 5.8% | 8.7% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

DGI Clipboard

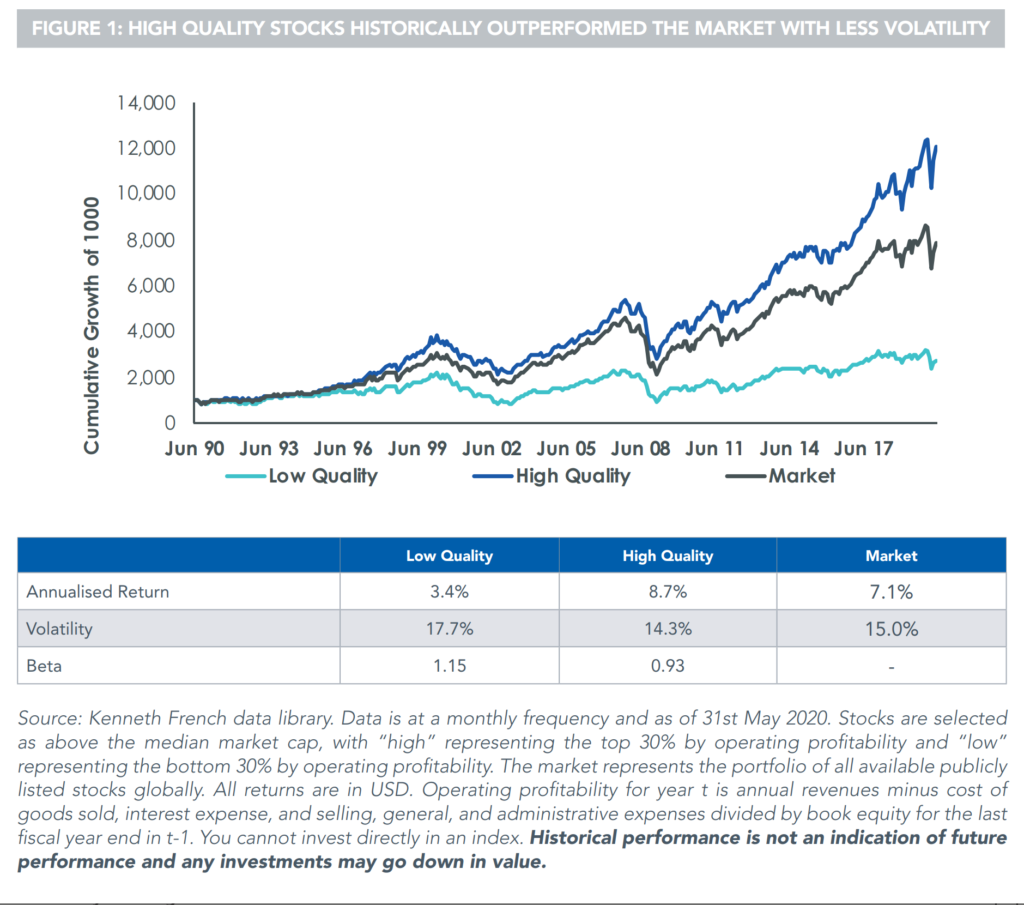

“If you look for companies that can raise their dividends year after year without milking operations, you will automatically be lead to high quality stocks.”

– Edmund Faltermayer, Fortune magazine, October 1990

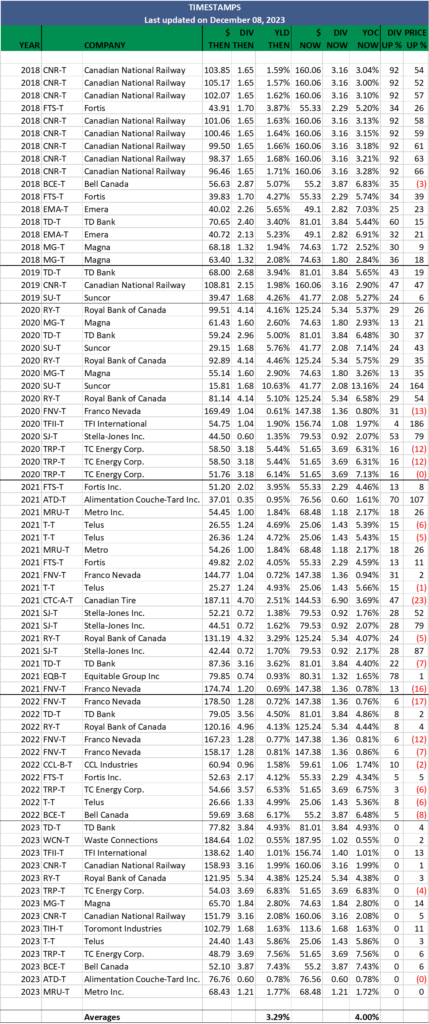

Our watchlist of the top Canadian dividend growth stocks for 2024

The year 2023 is now in the past. Last week, I presented the criteria for constructing our watchlist:

- Dividend growth streak: 10 years or more.

- Market cap: Minimum one billion dollars.

- Diversification: Limit of five companies per sector, preferably two per industry.

- Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

While ‘The List’ does not function as a portfolio on its own, it serves as an excellent initial reference for individuals looking to diversify their investments and achieve higher returns in the Canadian stock market. Through our newsletter, readers gain a deeper understanding of how to implement and benefit from our Canadian dividend growth investing strategy.

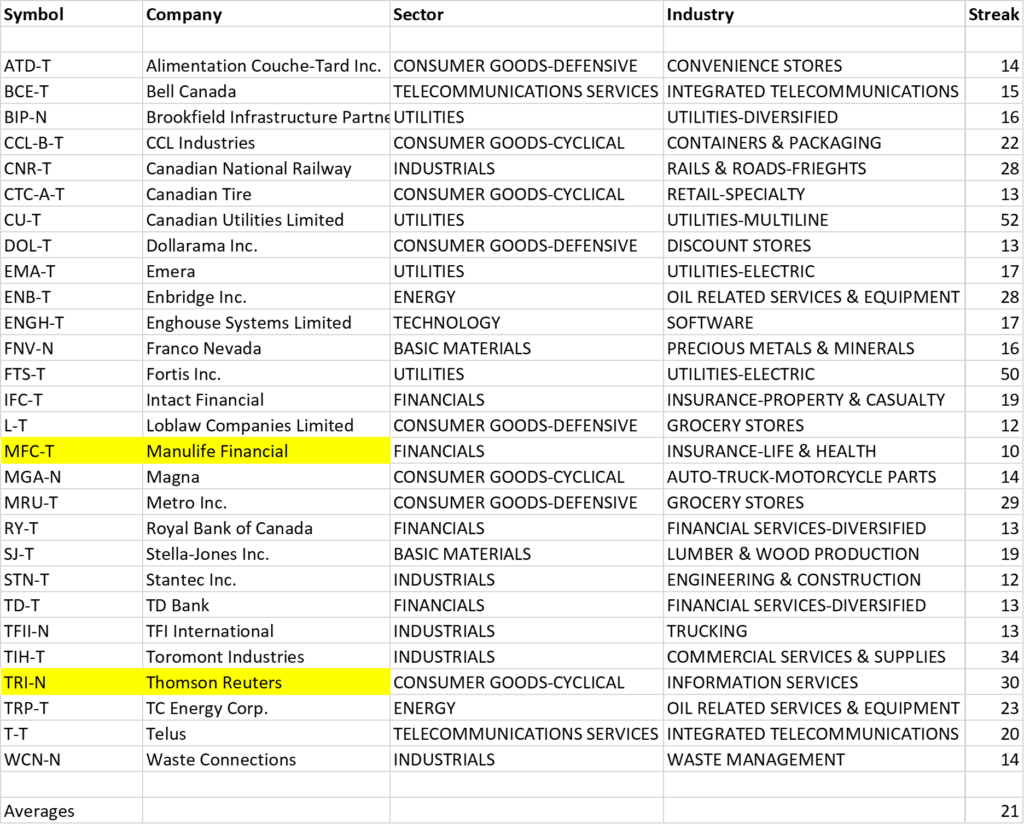

Here is ‘The List’ for 2024:

We have removed Algonquin Power & Utilities (AQN-N) from ‘The List’ as it reduced its dividend in 2023 and no longer qualifies. In its place, we have added two new companies: Manulife Financial (MFC-T) and Thomson Reuters (TRI-N) for 2024.

Manulife Financial recently met our minimum criteria of 10 consecutive years of dividend growth, transforming itself from a high-yield, slow-growth life insurance company to one with a high-growth global wealth and asset management business. Manulife boasts a ten-year dividend growth streak, starting with a yield of 5.0% and a 10-year annualized dividend growth rate of approximately 10%. Over the past decade, it has proven to be an above-average income generator, with a historical growth yield (yield on cost) of 7% on a purchase made ten years ago. Holding onto strong dividend growers for the long term can indeed surpass average historical market returns with dividends alone.

Thomson Reuters was previously on ‘The List’ but exhibited more characteristics of a ‘growth-only’ stock due to its sluggish dividend growth. However, the company has recently accelerated its dividend growth rate at a double-digit pace, prompting us to reinstate it on ‘The List.’ We are also optimistic about the company’s significant investments in artificial intelligence in its product offerings and acquisitions. Thomson Reuters holds a thirty-year dividend growth streak, starting with a yield of 1.3%, and a 5-year annualized dividend growth rate of approximately 5.3%. It has delivered above-average total returns (15.7% CAGR) over the past decade, challenging the notion that market-beating returns are impossible with a dividend growth investing strategy.

Under our set criteria, companies on ‘The List’ are reviewed annually on January 1, leading to additions or removals. Weekly updates ensure that prices and dividends remain current. ‘The List’ for 2024 comprises 28 companies strategically diversified across nine sectors within the Canadian economy.

If you have not yet joined as a paid subscriber of the blog to receive DGI Alerts on the activity and content related to our model portfolio, it’s not too late. Click Here.

Recent News

After a long period of low rates, the time has come for older investors to be even more prudent (Globe & Mail)

This former portfolio manager with four decades of experience had this familiar advice for older investors:

“In order to protect their nest eggs when there is less time to bounce back from losses, older investors should decrease their equity exposure and increase the income portion, particularly in their bond weightings.”

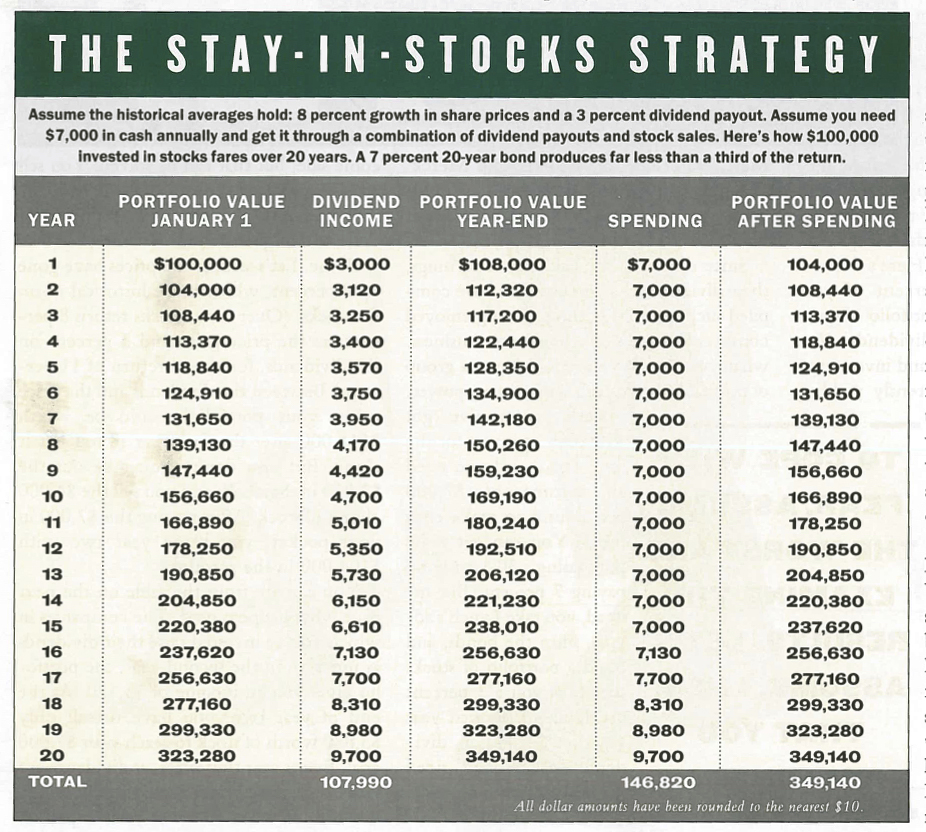

How often have we encountered the recommendation to shift our portfolios towards a 60/40 split between equities and bonds as retirement approaches? The reality is that over time, losses in bonds tend to surpass those in any stock market correction.

I think my mentor, Tom Connolly, said it best:

“If you are new to dividend growth investing and hold a few bonds, I’d keep them for a while…until the dividend income starts to grow…until you realize what’s going on. Once your growth yield (yield on cost) gets close to the yield on your bonds, you’ll know what to do.”

First Quantum Comments on Developments in Panama (Franco Nevada Corporation Royalty Stream)

In a surprise ruling on November 28, 2023, the Supreme Court of Panama has ruled that the agreement (Law 406) between the government and the mines owner, First Quantum Minerals, was unconstitutional and the agreement is void. As of now, there will be a transition process for the closure of the Cobre Panama mine.

Franco-Nevada management has stated that in the event of a prolonged dispute, the mine operators would likely opt for arbitration to settle the matter. This is precisely what transpired.

First Quantum Minerals has formally notified the government of its intent to commence arbitration to uphold its rights under international law as per the Canada-Panama Free Trade Agreement. Additionally, First Quantum has initiated arbitration proceedings before the International Court of Arbitration to safeguard its rights under the 2023 concession agreement, endorsed by the Government of Panama earlier this year. The arbitration agreement specifies Miami, Florida, as the venue for arbitration. Historically, international arbitrators have tended to rule in favor of mining companies in similar disputes.

Although the past month has been frustrating for investors, the current stock price of Franco-Nevada now reflects the complete write-off of the Cobre Panama royalty stream. We believe this reaction is overdone, and the decision will likely be reversed for several reasons.

Next year’s elections (May 2024) will significantly influence the resolution. The mine contributes approximately 5% to the country’s GDP and supports at least 40,000 jobs. The new government is unlikely to overlook this critical political and revenue source. Additionally, this is not the first occurrence of such a situation. In 2017, the agreement between the mine and its owner was declared unconstitutional, and the decision was subsequently reversed.

We will keep our subscribers informed of any new developments.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

No companies on ‘The List’ had dividend announcements last week.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter, we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

No earnings reports from companies on ‘The List’ this week

Last week, there were no earnings reports from companies on ‘The List’.