MP Market Review – May 26, 2023

Last updated by BM on May 29, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was down with a YTD price return of +4.8% (capital). Dividend growth remained the same and is now at +8.4% YTD, highlighting growth in income over the past year.

- Last week, one dividend increase from companies on ‘The List’.

- Last week, two earnings reports from companies on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

- If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service, which grants you access to the MP Wealth-Builder Model Portfolio (CDN) and exclusive subscriber-only content. Learn More

Introduction

“You have a pair of pants. In the left pocket, you have $100. You take $1 out of the left pocket and put it in the right pocket. You now have $101. There is no diminution of dollars in your left pocket. That is one magic pair of pants.”

This ‘magic pants’ analogy was from a Seeking Alpha article on dividend investing I read about a decade ago and was one of the catalysts for me to take a closer look at this type of investing and see if it truly was magical.

After conducting additional research, I have shifted towards utilizing a dividend growth investing (DGI) strategy as my primary investment approach. While I maintain portfolios consisting of high-quality dividend growers from both the United States and Canada, I have opted to concentrate on Canadian (CDN) dividend growth companies in this blog. This is due to several reasons, including a smaller pool of DGI companies to track, a lack of coverage for the DGI strategy by the North American investment media, and a tendency for those who do cover DGI to narrowly focus on only a handful of sectors (Energy and Financials).

While ‘The List’ is not a portfolio in itself, it serves as an excellent initial reference for individuals seeking to diversify their investments and attain higher returns in the Canadian stock market. Through our blog, we provide weekly updates on ‘The List’ and offer valuable perspectives and real-life examples of the dividend growth investing strategy in practice. This helps readers gain a deeper understanding of how to implement and benefit from this investment approach.

DGI Thoughts

“The idea of excessive diversification is madness. Wide diversification, which necessarily includes investments in mediocre businesses, only guarantees ordinary returns.”

– Charlie Munger

“Diversification does not guarantee against loss, only against losing everything all at once”

– Peter L. Bernstein’s Against the Gods: The Remarkable Story of Risk

Over the weekend, we read another article on diversifying your portfolio.

Diversifying your portfolio – how much is too much? (Globe & Mail)

The author comments on what a lot of people do, which is over-diversify (diworsification). Depending on your wealth advisor, the recommendations can cover a wide range of options which they believe manage your “risk” efficiently. After all, who can predict what the stock market will do?

Modern Portfolio Theory/Efficient Market Hypothesis is what most wealth managers believe in today, which requires a lot of companies in your portfolio to help manage “risk”. It’s important to note that this approach doesn’t eliminate “risk”; instead, it only ensures “ordinary returns”.

For years, proponents of dividend growth investing have taken advantage of this theory, advocating for a focused portfolio comprised of select high-quality stocks that offer consistent dividend growth. Instead of emphasizing diversification, they view “risk” as the price they pay for their quality dividend growers.

The returns in the stock market are not haphazard; we understand that dividend growth plays a pivotal role in driving price appreciation. Surprisingly, many wealth managers disregard dividends entirely and fail to recognize their significant impact on stock prices.

For those new to do-it-yourself investing, you have a choice to make.

If you have not yet joined as a subscriber of the blog to receive DGI Alerts on the activity and content related to our model portfolio, it’s not too late. Click Here.

Recent News

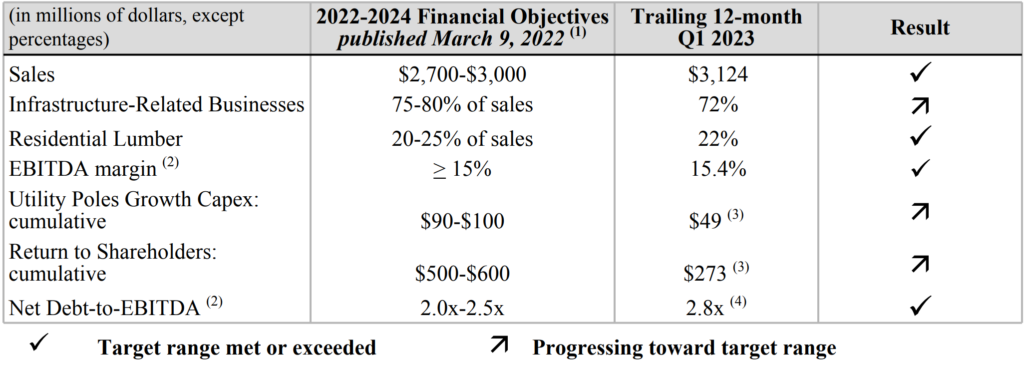

Stella-Jones updates its financial objectives (Stella-Jones Investor Presentation)

“Following a record year in 2022, coupled with our outstanding start to 2023, we are excited to share updated financial objectives that reflect Stella-Jones’ performance and growth potential,” said Eric Vachon, President and Chief Executive Officer of Stella-Jones. “In light of our favourable position to meet or exceed our original financial targets, we are raising our 2025 sales target to almost 20% above 2022 sales and the 2023–2025 EBITDA margin goal to 16%, primarily driven by the accelerating demand for our higher margin utility poles business.”

When companies increase their outlook by 20% it always gets our attention. Stella Jones is one of those ‘under the radar’ types of dividend growth stocks that we follow on ‘The List’. We had an opportunity last year to establish a position for our model portfolio but missed out. With our focus on accumulating ‘Core’ category stocks in our first year, we may have let a good ‘Non-Core’ company get away (for now).

Stella-Jones (SJ-T) has an established track record of generating consistent and strong cashflows which provides flexibility to deliver significant value to shareholders. With a dividend increase earlier this year, their dividend streak is now at 19 years and counting.

‘Slow and steady’ wins the race for Canadian banks, Veritas report argues (Globe & Mail)

“In their report, entitled “The Tortoise and the Hare,” they argue that “slow and steady” wins the race in Canadian banking. They conclude that the banks that generated the best risk-adjusted returns over the past decade were the “tortoises” that focused on Canadian banking rather than the “hares” that raced out to pursue international diversification.”

Their logic is based upon the safety of the Canadian banking system compared to international banks.

“Since 1840, Canada has not experienced a bank crisis,” it notes. Over the same period, the United States has suffered 12 major banking crises. Meanwhile, Latin America has ricocheted among “bouts of political uncertainty, financial crisis, bank failures and currency devaluation.”

To receive breaking news about companies on ‘The List’ follow us on Twitter @MagicPants_DGI.

The List (2023)

Last updated by BM on May 26, 2023

The Magic Pants List contains 27 Canadian dividend growth stocks. ‘The List’ contains Canadian companies that have raised their dividend yearly for at least the last ten years and have a market cap of over a billion dollars. Below is each stock’s symbol, name, current yield, current price, price return year-to-date, current dividend, dividend growth year-to-date and current dividend growth streak. Companies on ‘The List’ are added or subtracted once a year, on January 1. After that, ‘The List’ is set for the next twelve months. Prices and dividends are updated weekly.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 6.1% | $8.30 | 23.3% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $67.39 | 12.1% | $0.56 | 19.1% | 13 |

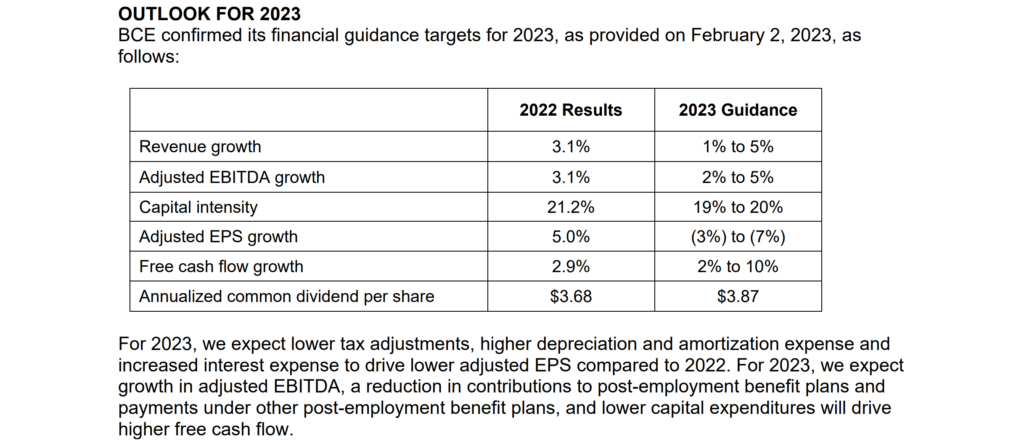

| BCE-T | Bell Canada | 6.2% | $61.87 | 2.7% | $3.82 | 5.0% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $36.28 | 5.2% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.6% | $65.61 | 13.0% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 2.0% | $155.16 | -4.7% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.1% | $168.90 | 15.2% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 4.9% | $36.32 | -1.7% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $83.74 | 4.9% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 4.9% | $56.38 | 7.1% | $2.76 | 3.0% | 16 |

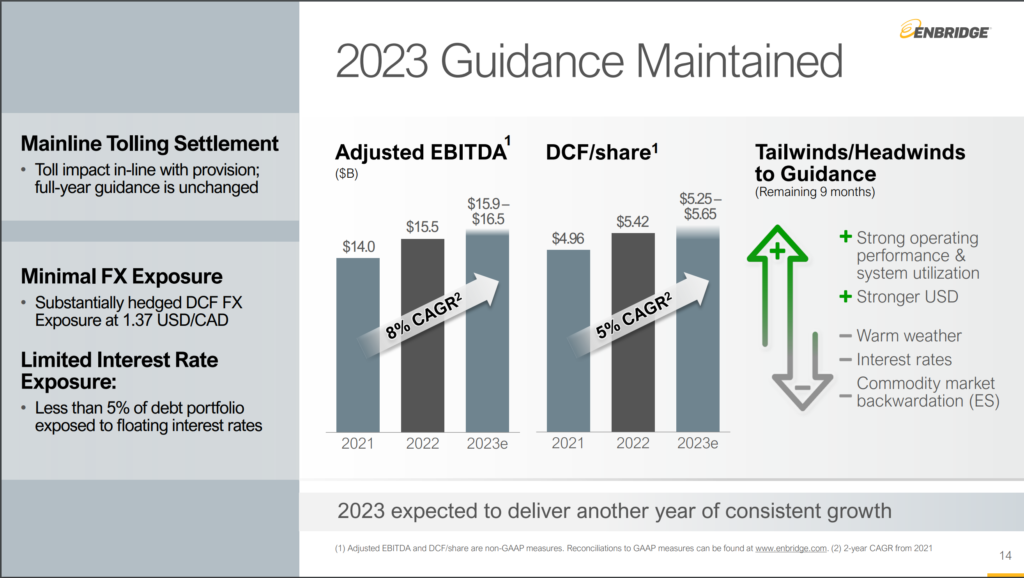

| ENB-T | Enbridge Inc. | 7.3% | $48.85 | -8.4% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 2.2% | $38.42 | 7.6% | $0.85 | 18.2% | 16 |

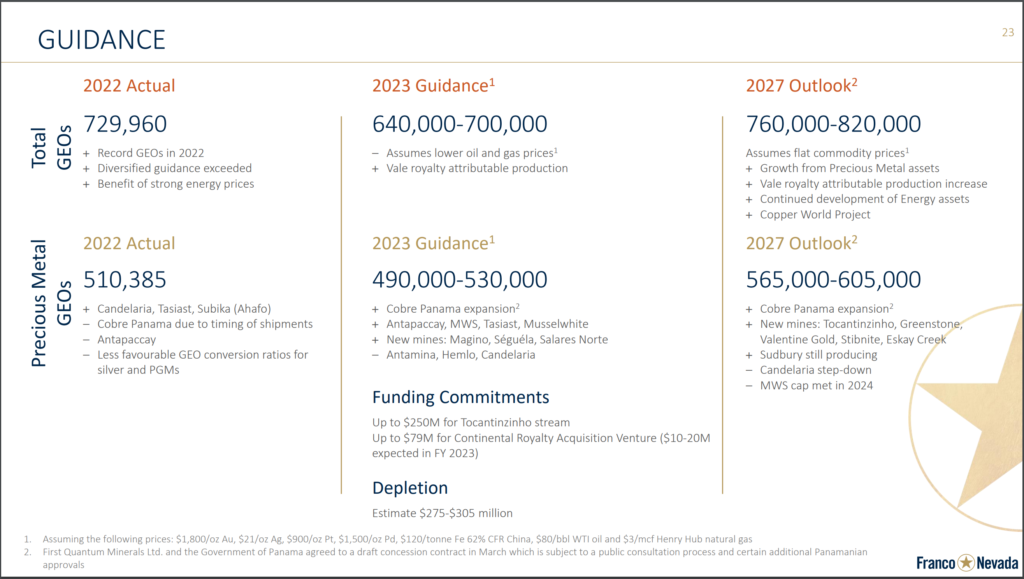

| FNV-N | Franco Nevada | 0.9% | $145.72 | 5.5% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis | 3.9% | $57.46 | 3.8% | $2.26 | 4.1% | 49 |

| IFC-T | Intact Financial | 2.2% | $202.59 | 3.5% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.4% | $120.85 | 0.4% | $1.74 | 10.3% | 11 |

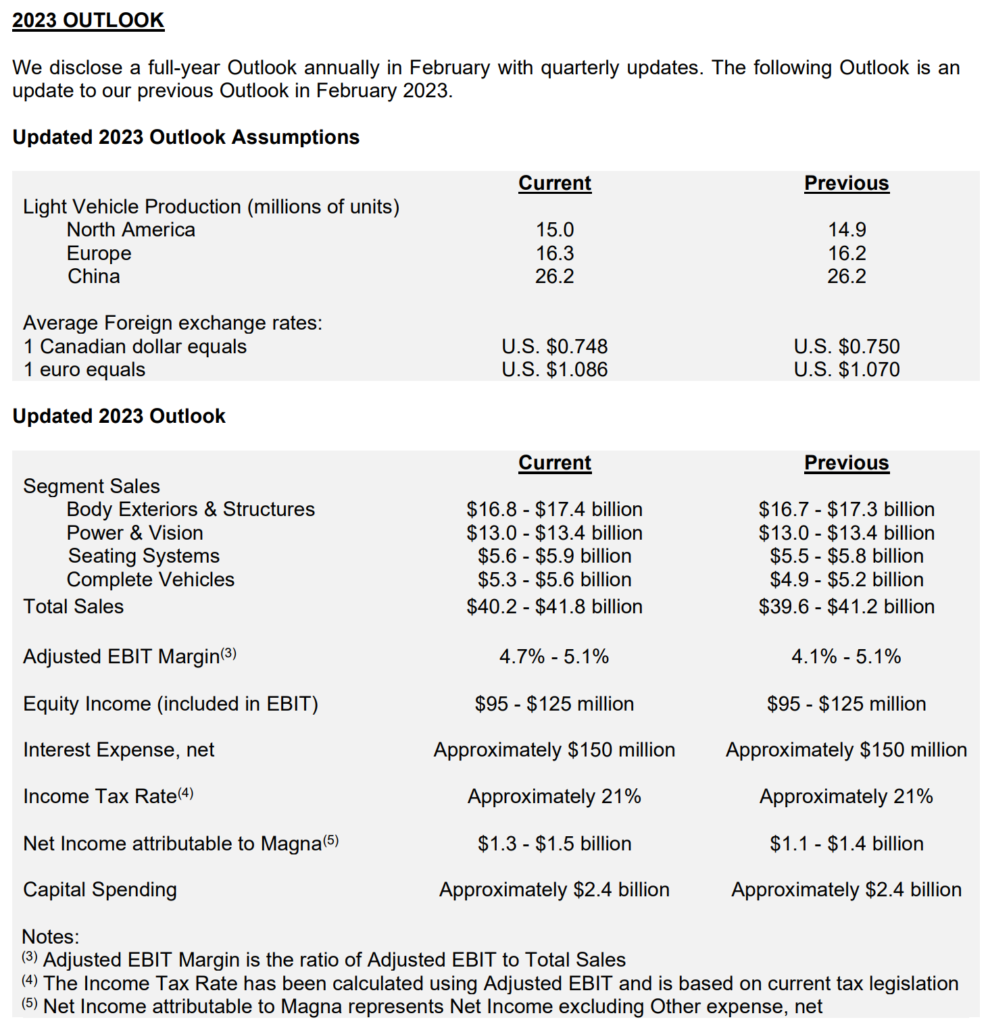

| MGA-N | Magna | 3.6% | $51.55 | -10.4% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.6% | $73.51 | -2.6% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 4.3% | $123.08 | -3.9% | $5.34 | 7.7% | 12 |

| SJ-T | Stella-Jones Inc. | 1.5% | $60.08 | 21.2% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 1.0% | $79.03 | 21.0% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.9% | $78.26 | -10.7% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.3% | $108.71 | 8.6% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.6% | $107.15 | 9.7% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 6.8% | $54.11 | 1.5% | $3.69 | 3.4% | 22 |

| T-T | Telus | 5.4% | $26.34 | 0.1% | $1.43 | 7.3% | 19 |

| WCN-N | Waste Connections | 0.7% | $138.45 | 5.1% | $1.02 | 7.4% | 13 |

| Averages | 3.2% | 4.8% | 8.4% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

Note: When the dividend and share price currency match, the calculation is straightforward. But it’s not so simple when the dividend is declared in one currency, and the share price is quoted in another. Dividing the former by the latter would produce a meaningless result because it’s a case of apples and oranges. To calculate the yield properly, you must express the dividend and share price in the same currency.

Performance of ‘The List’

Feel free to click on this link, ‘The List’ for a sortable version from our website.

Last week, ‘The List’ was down with a YTD price return of +4.8% (capital). Dividend growth remained the same and is now at +8.4% YTD, highlighting growth in income over the past year.

The best performers last week on ‘The List’ were Enghouse Systems Limited (ENGH-T), up +2.56%; Alimentation Couche-Tard Inc. (ATD-T), up +2.09%; and TFI International (TFII-N), down -0.28%.

CCL Industries (CCL-B-T) was the worst performer last week, down -7.17%.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

“As a dividend increase is a positive sign of a company’s financial strength, the safest purchase, after research, is a stock with a recent dividend increase.”

– Tom Connolly (the founder of dividendgrowth.ca)

Last week, one dividend increase from companies on ‘The List’.

Royal Bank (RY-T) on Thursday said it increased its 2023 quarterly dividend for the second time this year, from $1.32 to $1.35 per share, payable August 24, 2023, to shareholders of record on July 26, 2023.

This represents a dividend increase of +2.27%, marking the 13th straight year of dividend growth for this quality financial institution.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

Earnings growth and dividend growth tend to go hand in hand, so this information can tell us a lot about the future dividend growth of our quality companies. Monitoring our dividend growers periodically is part of the process, and reading the quarterly earnings releases is a good place to start.

No earnings reports from companies on ‘The List’ this week

Last week, two earnings reports from companies on ‘The List’.

Canada’s big Banks reported their fiscal Q2 earnings last week kicking off the next earnings season.

Royal Bank of Canada (RY-T) released its second-quarter fiscal 2023 results on Thursday, May 25, 2023, before markets opened.

“As our second quarter results demonstrate, RBC will never compromise on doing right by our clients and delivering sustainable, long-term value to them, our communities and shareholders. Our focused growth strategy, prudent risk and capital management, and diversified business mix exemplify our strength and stability amidst a complex macro environment. As we continue to realize the benefits of our strategic investments in technology and our incredible talent, we are confident in our ability to slow expense growth and drive greater efficiencies while supporting our clients’ needs.”

– Dave McKay, RBC President and Chief Executive Officer

Highlights:

- Adjusted net income and adjusted EPS of $3.8 billion and $2.65 were down 13% and 11% from the prior year, respectively.

- Results this quarter reflected higher provisions for credit losses, with a PCL on loans ratio of 30 bps, mainly attributable to provisions taken on performing loans in the current quarter, largely driven by unfavourable changes in our credit quality and macroeconomic outlook, as compared to releases in the prior year which reflected reduced uncertainty from the COVID-19 pandemic. The current quarter also reflected higher provisions on impaired loans.

- Pre-provision, pre-tax earnings of $5 billion were up $54 million or 1% from a year ago, mainly reflecting higher net interest income driven by higher interest rates and strong loan growth in Canadian Banking and Wealth Management. Higher Corporate & Investment Banking revenue in Capital Markets also contributed to the increase. These factors were partially offset by higher expenses, mainly due to higher staff-related costs, including from headcount growth, as well as stock-based compensation. Higher professional fees (including technology investments) and higher discretionary costs to support strong client-driven growth also contributed to higher expenses.

- Our balance sheet strength coupled with a robust capital position, with a CET1 ratio of 13.7%, supported solid volume growth and $1.8 billion in common share dividends. We have a strong average LCR of 135%. We also continue to operate with a prudent ACL ratio, which included $173 million of provisions taken on performing loans in the current quarter.

Outlook:

Unemployment rates remain at historically low levels in Canada, the U.S., the Euro area and the U.K. However, the number of job openings in Canada and the U.S. has begun to slow and wage growth has shown signs of moderating. Inflation pressures have also eased across most advanced global economies. Household expenditure overall has been supported by resilient spending on services. However, the lagged impacts of central bank interest rate increases over the last year are expected to slow inflation and consumer demand further. The risk to financial markets resulting from raising interest rates aggressively has heightened after stresses emerged in the U.S. regional banking sector. Geopolitical uncertainty remains high with the ongoing war in Ukraine. With economic growth expected to slow, and mild recessions expected in the U.S. and Canada in the calendar year ahead, we expect most advanced economy central banks are currently at or approaching the end of their current cycle of rate increases.

Canada

Canadian GDP is expected to have risen 2.5% in the first calendar quarter of 2023, following no growth in the final calendar quarter of 2022. Consumer spending continued to rise in the first calendar quarter of 2023 but is expected to slow as the lagged impact of Bank of Canada (BoC) interest rate increases over the last calendar year gradually flow through to household borrowing costs. We continue to expect a mild recession with modest GDP declines over the second and third calendar quarters of 2023. Inflation pressures have continued to moderate after peaking in the summer of 2022. The year over-year rate of growth in the consumer price index (CPI) slowed to 4.4% in April 2023 from 6.3% in December 2022, partly reflecting easing global supply chain pressures and lower energy prices. Commodity prices have reversed initial increases following the start of the conflict between Russia and Ukraine in 2022. The breadth of price pressures has narrowed, with a smaller share of products and services impacted by abnormally high price growth. The unemployment rate was 5.0% in April 2023, holding for a fifth straight month at just above the multi-decade low rate of 4.9% in the summer of 2022. Labour shortages are still widespread but less intense according to the BoC’s 2023 Business Outlook Survey conducted for the first calendar quarter. The BoC announced a conditional pause in interest rate increases in January 2023. The overnight rate is expected to remain at the current 4.5% level through calendar 2023.

U.S.

U.S. GDP grew by 1.1% in the first calendar quarter of 2023 following a 2.6% increase in the final calendar quarter of 2022. While household spending has so far been resilient, Federal Reserve (Fed) interest rate increases over the last calendar year and in calendar 2023 continue to raise debt payments with a lag and reduce household purchasing power. We expect a mild recession with GDP declining over the second and third calendar quarters of 2023. The unemployment rate remains very low at 3.4% as of April 2023, however the number of job openings is declining as labour demand begins to slow. Year-over-year growth in the CPI slowed to 4.9% in April 2023 from 6.5% in December 2022, largely as a result of easing global supply chain disruptions and lower commodity prices. The breadth of inflation pressures has been narrowing across products but is still wide, and price growth for domestically produced services has been slower to ease. Inflation is expected to slow further as consumer demand declines, and concerns among monetary policy setters on the risks to financial markets from raising interest rates aggressively have increased after stresses emerged in the U.S. regional banking sector. We expect the Fed will pause interest rate increases after the last 25 basis point increase to the federal funds target range in May.

Europe

Euro area GDP in the first calendar quarter of 2023 grew modestly by 0.1% following no growth in the final calendar quarter of 2022. GDP growth is expected to remain slow over the remainder of the calendar year. Unemployment rates remain very low across countries in the Euro area but are expected to rise modestly through the rest of calendar 2023. Year-over-year consumer price growth has slowed, due largely to lower global commodity prices. Despite rising concerns surrounding financial sector stability, we anticipate the European Central Bank will raise the deposit rate to 3.75% by the end of calendar 2023. U.K. GDP increased by 0.1% in the first calendar quarter of 2023 following a 0.1% increase in the final calendar quarter of 2022. Recent inflation trends have been stronger than previously expected, with year-over-year growth in the CPI at 10.1% in March 2023. The Bank of England increased the Bank Rate to 4.5% in May 2023. We expect no further interest rate increases before the end of calendar 2023.

Source: (RY-T) Q2-2023 Report to Shareholders

TD Bank (TD-T) released its second-quarter fiscal 2023 results on Thursday, May 25, 2023, before markets opened.

“TD’s retail businesses in both Canada and the United States continued to show strong revenue and earnings growth this quarter, with robust customer originations and loan volumes. Investments in differentiated wealth and insurance products and the close of the Cowen acquisition expanded our offerings and strengthened the competitive advantages of these businesses.”

– President and Chief Executive Officer, Bharat Masrani

Highlights:

SECOND QUARTER FINANCIAL HIGHLIGHTS, compared with the second quarter last year:

- Reported diluted earnings per share were $1.72, compared with $2.07.

- Adjusted diluted earnings per share were $1.94, compared with $2.02.

- Reported net income was $3,351 million, compared with $3,811 million.

- Adjusted net income was $3,752 million, compared with $3,714 million.

Outlook:

The global economy is forecast to slow in calendar 2023, but to a lesser degree than previously expected. A dramatic pull-back in energy prices has provided some economic relief in Europe and the sudden end of zero-COVID policies in China has provided an earlier lift to its economic prospects. While concerns about the global economy have eased, the risk of recession remains elevated. In North America, central banks have raised policy rates dramatically over the past year. The impact of this sizeable increase is expected to be the primary influence dampening economic growth in 2023 and into 2024. The recent U.S. bank failures have tightened credit conditions, which are likely to exert an increasing drag on economic activity in the months ahead although the full effects remain uncertain.

The U.S. economy expanded by 1.1% annualized in the first calendar quarter of 2023. Underlying domestic demand accelerated to 3.2%, due to a sharp rebound in consumer spending on motor vehicles and parts, but a sharp drawdown in inventories weighed on headline economic growth. A cooler economy was evident in softness in business investment, which expanded by only 0.7% and a continued downturn in housing activity which weighed on growth.

As of April, the job market was still tight with the unemployment rate at 3.4%, the lowest in over 50 years. However, there are signs that demand for workers is cooling, hiring trends are slowing, job openings have declined and claims for jobless benefits have been trending higher. Inflation has started to dissipate, but underlying services price pressures have been more persistent, and well above the U.S. Federal Reserve’s 2% target. TD Economics expects domestic spending to slow significantly over the second half of 2023, leading unemployment to rise gradually, and an eventual cooling in services inflation.

The Federal Reserve has signalled that after having raised interest rates by 500 basis points (bps) this tightening cycle, it is now in wait and see mode. TD Economics expects the federal funds rate will remain at its current range of 5.00-5.25% through the end of calendar 2023, before the Federal Reserve embarks on a series of interest rate cuts next year. If a further cooling in the labour market does not materialize, further interest rate increases in the coming months may be required. Given the steep rise in interest rates over the past year, the trend towards tighter U.S. credit conditions and the likelihood of rolling periods of financial stress related to the debt ceiling negotiations and/or other risk factors, the probability of a recession stateside remains elevated.

The Canadian economy is likely to have recorded a solid rate of expansion in the first calendar quarter of 2023, reflecting a rebound from the soft fourth calendar quarter of 2022. Despite the financial impact of rising interest costs on highly indebted households, consumer spending has remained resilient amid strong job market conditions, excess savings and increased government supports. Housing has turned in a mixed performance, as homebuilding activity has slowed while resale activity has shown signs of stabilization in recent months.

Canadian inflation has moderated, although the labour market remains quite strong with the unemployment rate at 5.0% in April 2023, near a cyclical low. TD Economics expects the aggregate spending of households and businesses to stagnate in the coming quarters, leading to weaker job market conditions and higher unemployment. Given the tepid growth backdrop and uncertainty surrounding the impact of past interest rate hikes on highly indebted Canadian households, the risk of recession also remains elevated in Canada.

The Bank of Canada left the overnight interest rate unchanged in April, at 4.50%. It signalled an intention to leave interest rates at their current level, provided the economy and inflation continue to slow in line with its outlook. The Canadian dollar is expected to hover around the 70-75 U.S. cent range in calendar 2023.

Source: (TD-T) Q2-2023 Report to Shareholders