Last updated by BM on April 25, 2022

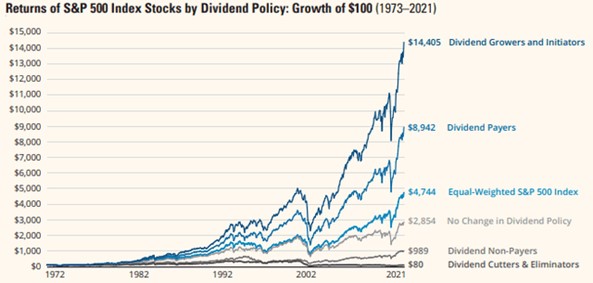

“The difference between what we do and what the others do is quite simple. It has profound implications, though. It’s all in the cash flow and patience needed to wait for it.” Tom Connolly

We recently finished our business plan for the new MP Wealth-Builder Model Portfolio (CDN). As part of the introduction, we referenced a paper written by Jim Garland in 2013 titled ‘Memo to the Darcy Family: To Thine Own Self Be True’.

The paper has a lot of good information. I was very impressed by the long-term objectives of The Jeffrey Company (an endowment fund) that have virtually been unchanged since 1974. I wanted to share them with you because I think they align well with our approach as dividend growth investors.

- To provide over the long term a stable dividend payout in inflation-adjusted dollars;

- To provide through long-term principal appreciation the expanding capital base required to achieve Objective #1 in the face of inflation and capital gains taxes;

- To avoid risks which in the aggregate might reasonably impair the ability to achieve Objective #1; and

- In determining dividend policy, the Board shall attempt to increase dividends at rates that would theoretically under normal market conditions permit the underlying assets of the Company to grow at similar rates over the long term, thereby presumably providing generally comparable benefits to present and future recipients.

Notice that more than anything else, the dividends the fund provides year after year matter most.

Performance of ‘The List’

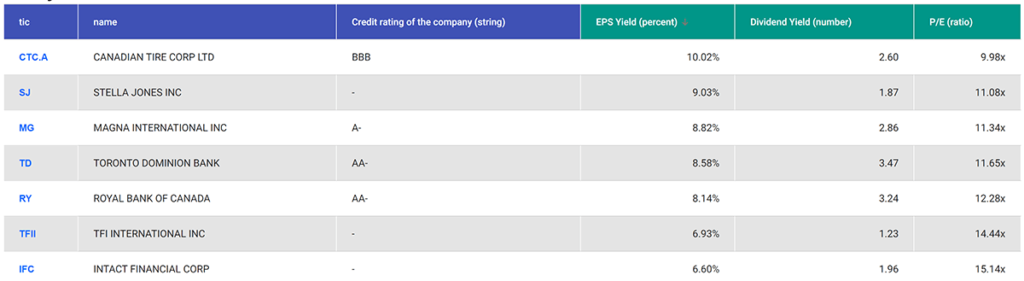

‘The List’ was down a bit again last week with a 1.5% YTD price return (capital). Dividend growth of ‘The List’ is 9.2% YTD, demonstrating the rise in income over last year.

The best performers last week on ‘The List’ were TFI International (TFII-N) up 2.3%; Magna International (MGA-N) up 1.2%; and Loblaws (L-T) up .9%.

Stantec Inc. (STN-T) was the worst performer last week, down -5.7%.

Recent News

A couple of news items from Magna International (MGA-N) last week.

LG Magna e-Powertrain, a joint venture (JV) between LG Electronics (LG) and Magna International Inc. (Magna), celebrated the groundbreaking of its new plant in Ramos Arizpe, Mexico. Scheduled for completion in 2023, the new facility will produce inverters, motors, and on-board chargers to support General Motors’ electric vehicle (EV) production. The 260,000 square foot plant will be LG Magna e-Powertrain’s first production base in North America and is expected to create around 400 new jobs.

Magna is expanding its ADAS and electrification footprint with the opening of a new plant in Kechnec, Slovakia. The brownfield facility will support two European automakers and new global entrant. Covering an area of approximately 22,000 square meters, the facility is expected to begin operations in the fourth quarter of this year with plans to hire 100 employees initially in time for start of production.

Magna (MGA-N) has been one of the worst performers on ‘The List’ in 2022. As we mentioned in an earlier post, we think most of the decline was due to its stretched valuation coming into the year. We will learn more in their earnings release this week.

An article published in the Globe and Mail Friday caught our attention.

The TSX just had its worst day of the year – and investors may not like what’s coming next

The article supports our earlier posts in that the author believes the aggressive interest rate hikes will slow the economy to a point that a recession is inevitable. Being patient and looking for opportunities when the market overreacts is critical at this stage for dividend growth investors. In the short term we enjoy the cash flow from our quality dividend growers.

There are four companies on ‘The List’ due to report earnings this week.

Canadian National Railway (CNR-T) will release its first quarter 2022 results on Tuesday April 26, 2002, after markets close.

Canadian Utilities (CU-T) will release its first quarter 2022 results on Wednesday April 27, 2002, after markets close.

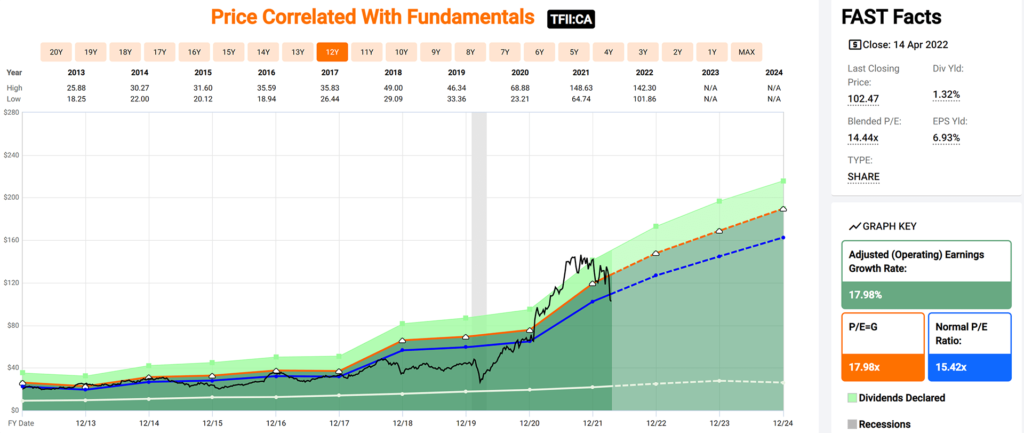

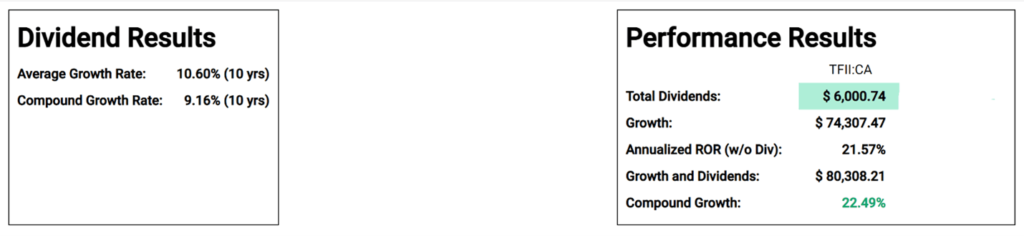

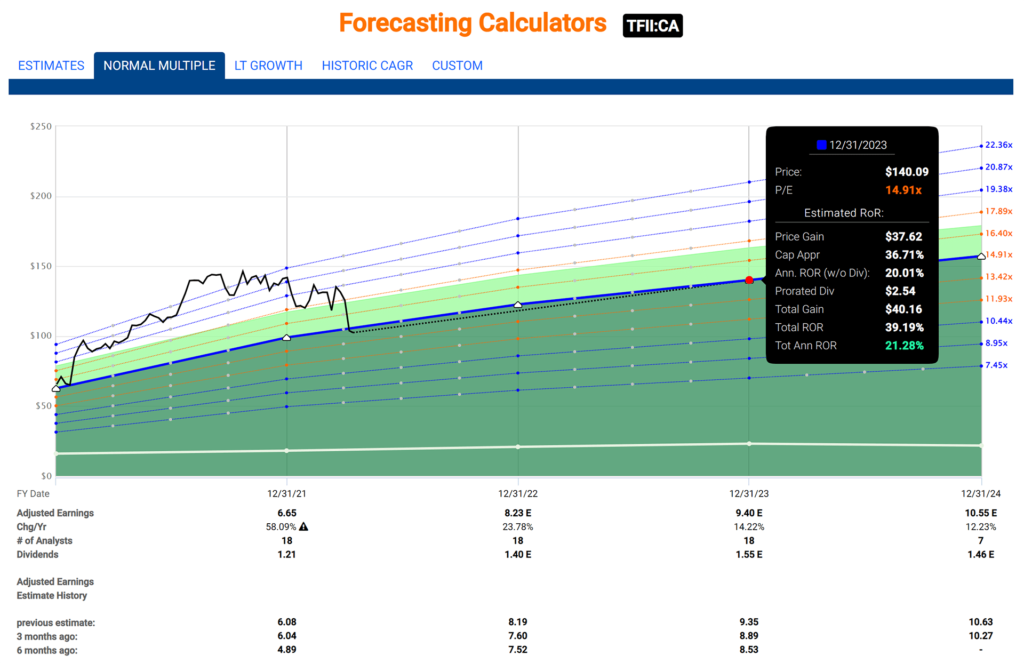

TFI International (TFII-N) will release its first quarter 2022 results on Thursday April 28, 2002, after markets close.

Magna International (MGA-N) will release its first quarter 2022 results on Friday April 29, 2002, before markets open.

Dividend Increases

There were no companies on ‘The List’ that announced a dividend increase last week.

Earnings Releases

Metro Inc. reported their Q2 Fiscal 2022 earnings last week.

Metro (MRU-T)

“We are pleased with our results in the second quarter, achieved in a challenging operating environment marked by the Omicron variant and labour shortages throughout the supply chain. Our industry continues to experience higher than normal inflationary pressures and our teams remain focused on providing quality products at competitive prices to our customers. We reached another milestone this quarter with the successful start up of our fully automated frozen distribution center in Toronto. Finally, I am proud to say that for the second time in three years, the Jean Coutu banner has been designated by consumers as the most admired company in Quebec in the latest Leger Reputation survey. This is a reflection of the strength of the brand, the trust of consumers, and the quality of services provided by the pharmacist owners”, declared Eric La Flèche, President and Chief Executive Officer.

Highlights:

- Sales of $4,274.2 million, up 1.9%

- Food same-store sales up 0.8%, and up 11.5% for the first 8 weeks of the second quarter versus 2020 (pre-COVID period)

- Pharmacy same-store sales up 9.4%, and up 11.0% for the first 8 weeks of the second quarter versus 2020 (pre-COVID period)

- Net earnings of $198.1 million, up 5.3% and adjusted net earnings(1) of $204.7 million, up 5.1%

- Fully diluted net earnings per share of $0.82, up 9.3%, and adjusted fully diluted net earnings per share of $0.84, up 7.7%

- $8 million of gift cards paid to front-line employees, the same amount as in the second quarter last year

Outlook:

“At the start of the third quarter, most government measures to curb the pandemic had been lifted, but the ancillary impacts on our industry are ongoing. We continue to face higher than normal inflationary pressures and labour shortages which, if prolonged, could put pressure on margins. In the short term, we expect food sales to remain relatively stable versus last year while we expect continued growth in our pharmacy business although somewhat moderated versus the first half of the year. The labour conflict with our full-time distribution center employees in Toronto, which started on April 2, 2022, was resolved seven days later with the ratification of a new four-and-a-half-year collective agreement. Our third quarter results will be impacted by the direct costs of the strike and the impact of the new labour agreement, estimated at about $10 million pre-tax.”

See full Earnings Release here