Last updated by BM on April 11, 2022

“To the extent you know that your investments will be held for the very long term, you have automatically self-insured against the uncertainty of short-term market price fluctuations.” P.76 of Winning the Loser’s Game, Charles Ellis

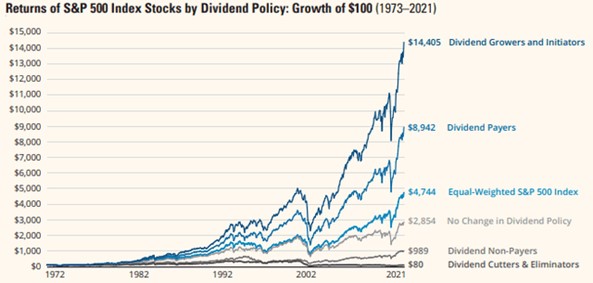

Excellent chart from Hartford Funds. Notice the outperformance between ‘Dividend Growers and Initiators’ and ‘Dividend Payers’. Not all dividend paying stocks are the same.

Investing can be difficult in the short-term. Knowing that our dividend growth strategy will pay off over time, as dividend growth aligns with price growth, helps us ignore the short-term price fluctuations of other philosophies. Plus, we can always rely on our inflation protecting dividend growth to provide us with the income we need while we wait.

Performance of ‘The List’

‘The List’ was up last week with a 4.0% YTD price return (capital). Dividend growth of ‘The List’ is 9.2% YTD, demonstrating the rise in income over last year.

Note: We are now reporting price and dividends for TFI International in US dollars and have replaced the Symbol with -N instead of -T for the Canadian price and dividend.

The best performers last week on ‘The List’ were Loblaws (L-T) up 6.2%; Bell Canada (BCE-T) up 4.3%; and Waste Connections (WCN-T) up 3.7%.

TFI International (TFII-T) was the worst performer last week, down -17.3%.

Recent News

CCL Industries (CCL-B-T) announced another acquisition this past week. That’s nineteen since January 1, 2020!

Geoffrey T. Martin, President and Chief Executive Officer of CCL Industries Inc., commented, “We are very excited to expand our highly successful operations in Brazil and welcome the Adelbras team to CCL. The new business will be headed by Luis Jocionis, Group Vice President CCL Industries South America.”

CCL Industries is another one of our good dividend growers (over 20 years) that has come under pressure recently. After record results reported last quarter, the stock has retreated. Our job as investors is to determine if the underlying fundamentals are changing or is it simply a case where the ‘speculative return’, we spoke of last week, is causing the concern.

Up next on the news front was the long anticipated federal budget released on Thursday. As expected, the Liberal/NDP government announced higher taxation and more spending initiatives. The one announcement we paid the closest attention to was the Bank Profit Surtax. Targeting Canada’s banks and life insurers with an additional tax is not something dividend investors applauded leading up to the budget but based on the market reaction (both sectors up Friday), it looks like the banks and insurers have a plan too. Much like we saw from Dollarama last week, who are combatting the cost of high inflation by raising their prices, the banks and insurers will likely recoup their losses by increasing their fees. Politicians seem to be stuck in this continuous loop of raising taxes on the wealthiest for optics sake, only to hurt the one’s they are trying to help.

There are no companies on ‘The List’ due to report earnings this week. Next up is Metro (MRU-T) on April 21.

Dividend Increases

There were no companies on ‘The List’ that announced a dividend increase last week.

Earnings Releases

There were no companies on ‘The List’ that reported their earnings last week.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’ please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Rather, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on April 8, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 4.3% | $15.86 | 10.5% | $0.68 | 2.3% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $57.42 | 10.2% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.0% | $73.22 | 11.1% | $3.68 | 5.1% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.2% | $67.11 | 9.9% | $2.16 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.7% | $57.14 | -15.7% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.9% | $156.38 | 1.0% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 2.7% | $189.58 | 3.5% | $5.20 | 10.6% | 11 |

| CU-T | Canadian Utilities Limited | 4.5% | $39.34 | 7.5% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $73.75 | 16.3% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.1% | $64.53 | 3.1% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 5.9% | $58.71 | 18.5% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 1.8% | $39.38 | -14.1% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 0.8% | $166.36 | 22.2% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.3% | $64.59 | 6.8% | $2.14 | 4.4% | 48 |

| IFC-T | Intact Financial | 2.1% | $186.79 | 14.1% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.2% | $117.74 | 14.6% | $1.46 | 6.6% | 10 |

| MGA-N | Magna | 2.9% | $61.27 | -24.9% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.5% | $72.80 | 8.6% | $1.10 | 10.0% | 27 |

| RY-T | Royal Bank of Canada | 3.5% | $136.66 | -0.1% | $4.80 | 11.1% | 11 |

| SJ-T | Stella-Jones Inc. | 2.1% | $37.63 | -7.5% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $62.14 | -11.5% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 3.7% | $96.73 | -2.6% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.3% | $82.57 | -25.4% | $1.08 | 11.3% | 11 |

| TIH-T | Toromont Industries | 1.3% | $119.45 | 5.1% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 4.8% | $73.78 | 23.5% | $3.57 | 4.4% | 21 |

| T-T | Telus | 3.8% | $34.42 | 15.7% | $1.31 | 4.4% | 18 |

| WCN-N | Waste Connections | 0.6% | $144.89 | 8.1% | $0.92 | 8.9% | 12 |

| Averages | 2.6% | 4.0% | 9.2% | 18 |