MP Market Review – January 27, 2023

Last updated by BM on January 30, 2023

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was down slightly with a +3.8% YTD price return (capital). Dividend growth of ‘The List’ increased to +4.4% YTD, demonstrating the rise in income over the last year.

- Last week, there were two dividend increases from companies on ‘The List’.

- Last week, there were two earnings reports from companies on ‘The List’.

- Two companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“Investing is where you find a few great companies and then sit on your ass.”

– Charlie Munger

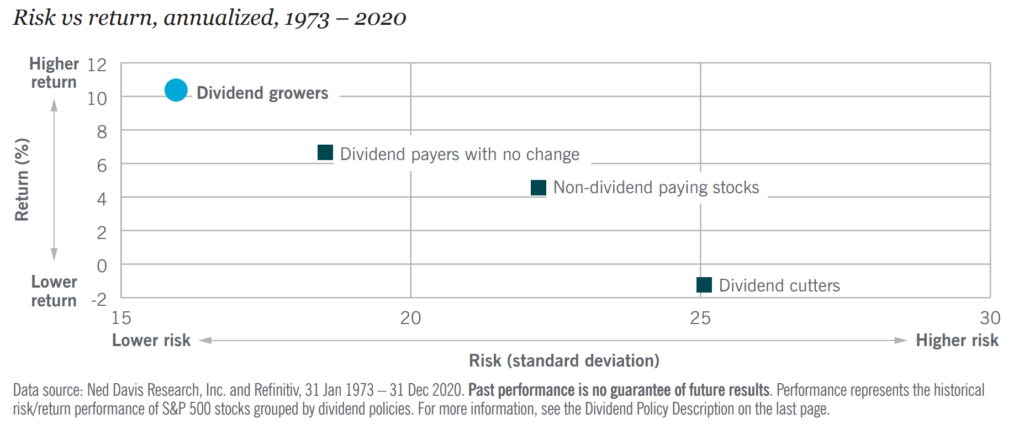

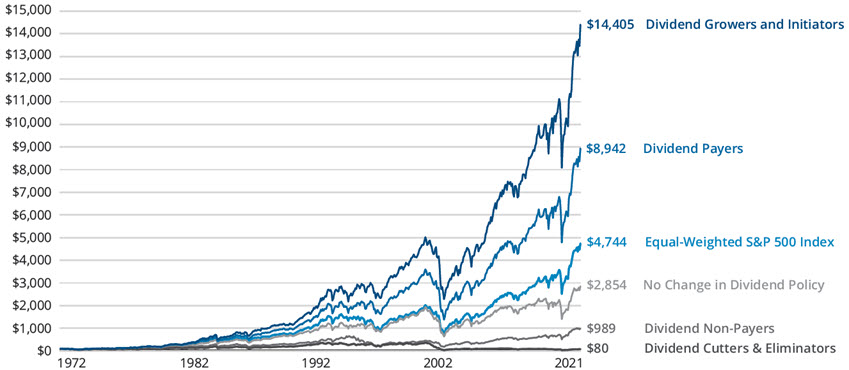

Noticing that two great companies (MRU-T) and (CNR-T) increased their dividends last week, we couldn’t help but wonder what our list of quality dividend growers would look like if one of our criteria were twenty years of dividend growth instead of ten. The list would be smaller, but we wondered what their dividend growth metrics would look like. Here is what we found:

10YR_CAGR-The List-01-01-2023 – 20+ YR of DG

Remember that the data in this chart displays returns derived from purchases made on January 1, 2013, regardless of valuation. By being a bit more active and following our process of only buying when companies are sensibly priced, we strive to do even better than this passive approach.

In summary, many metrics are similar, which tells you a few of things:

First, from a total return perspective, owning twenty-seven dividend growth stocks isn’t much different from owning eight non-cyclical, quality dividend growers, across a few sectors. In fact, you would probably be just as well off owning a basket of ten to fifteen quality companies from ‘The List’ as opposed to the entire list of dividend growth stocks we follow. It certainly would be a lot easier to monitor a smaller portfolio.

Secondly, these companies once had dividend growth streaks of ten years and comprised a very small list of dividend growth stocks in Canada. Seeing them extend their streaks for an additional ten years and beyond tells you how safe investing in companies with an established dividend growth policy can become.

Finally, the returns from companies with dividend streaks longer than twenty years appear to be even more predictable using our Growth Yield metric. Both the Historical Growth Yield and Estimated Growth Yield are almost identical. Historically, building a dividend growth portfolio with a >7% Estimated Growth Yield has been among the best predictors of market-beating returns.

For more info on Growth Yield, see one of our Top Posts; Using Growth Yield (YOC) To Build Powerful DGI Portfolios.

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

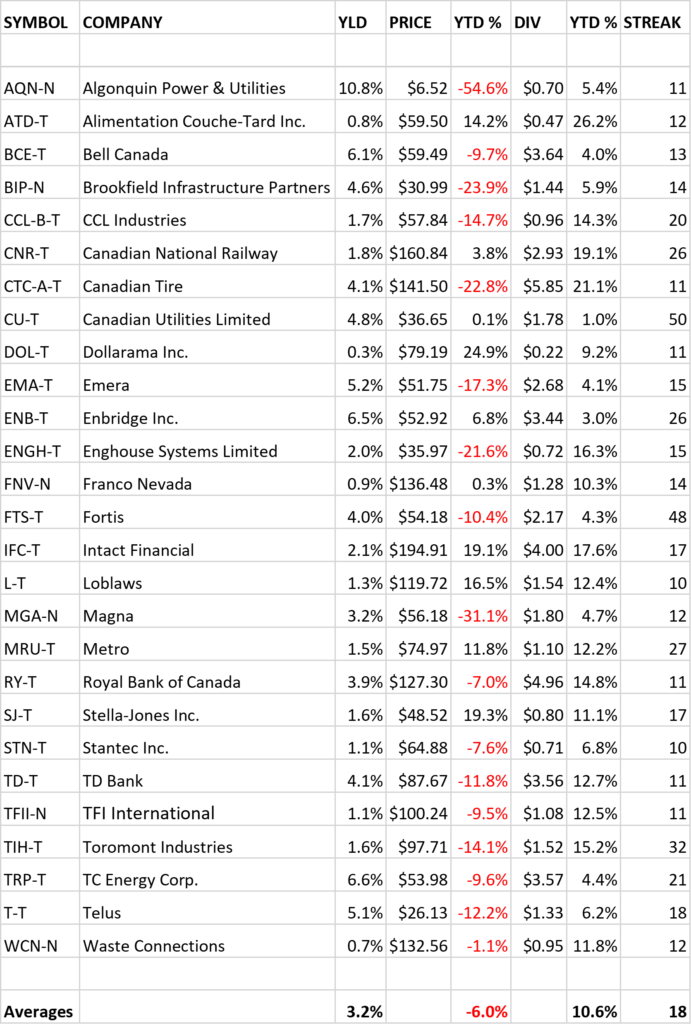

Last week, ‘The List’ was down slightly with a +3.8% YTD price return (capital). Dividend growth of ‘The List’ increased to +4.4% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were Canadian Tire (CTC-A-T), up +4.02%; Toromont Industries (TIH-T), up +3.73%; and TD Bank (TD-T), up +2.51%.

Canadian National Railway (CNR-T) was the worst performer last week, down -4.55%.

Recent News

Monetary Policy Report Press Conference Opening Statement

https://www.bankofcanada.ca/2023/01/opening-statement-2023-01-25/

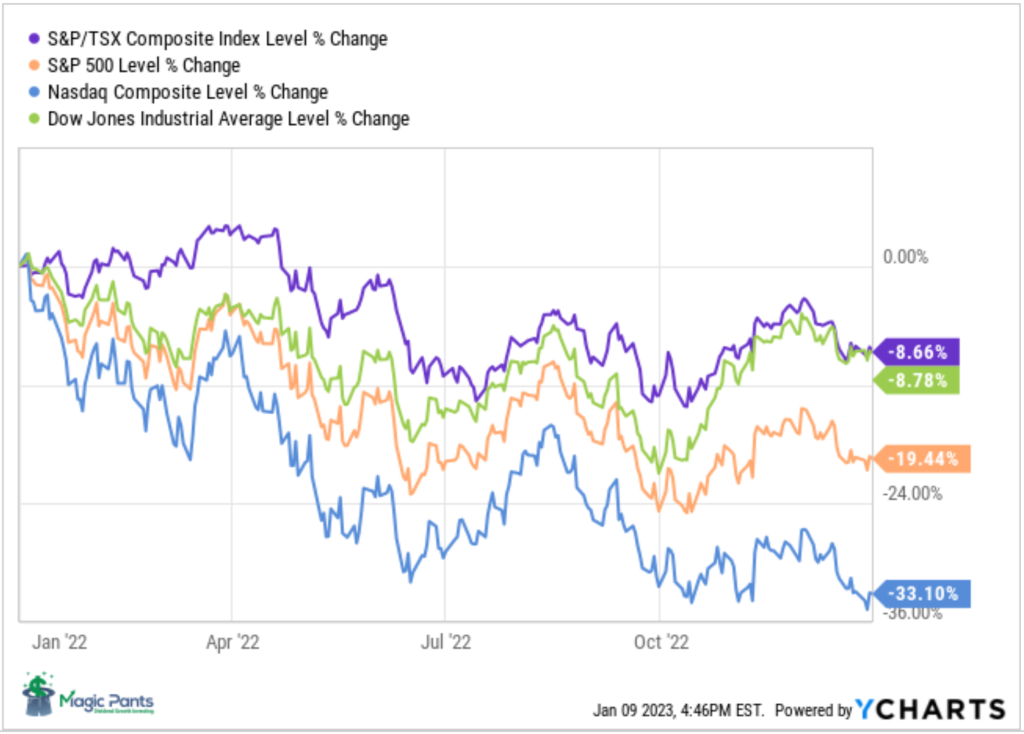

The Canadian government announced a 25 basis point hike last week, bringing their policy interest rate to 4.50%. They then said that they are now taking a wait-and-see approach before signalling any further hikes. Some see this as a sign that the Bank of Canada may soon pivot and start reductions as early as September. No one really knows. After all, inflation was supposed to be ‘transitory’ back in 2021, according to our central banks. As investors, we want to know how this current information affects the earnings of our quality dividend growers.

A little further down the article we get our answer in the economic outlook section.

“Putting this together, we expect growth in Canada to stall through the middle of this year before picking up later in the year. We project that, on an annual average basis, growth in Canada’s gross domestic product will slow from about 3½% in 2022 to about 1% in 2023 and 2% in 2024.”

With the economy slowing, historical valuation metrics should come back in line for our quality dividend growers allowing us to purchase them at sensible prices.

(CNR-T) alluded to the economy slowing last week in their outlook for 2023.

Climate-minded electrical companies look to improve their weakest link: the wooden utility pole (Globe & Mail)

https://www.theglobeandmail.com/canada/article-climate-change-electricity-utility-poles/

“Many major utilities predict that climate change will take a mounting toll on their infrastructure. Their preparations are whipping up a bonanza in the utility pole business.”

When we saw the headline, we immediately thought of Stella Jones (SJ-T), one of the companies on ‘The List’ and a quality dividend grower of eighteen years. The company is highlighted in this article as they are North America’s largest provider of wooden utility poles. Although Stella Jones addresses some of the pitfalls of traditional wooden poles, it is worth keeping an eye on the trend to find alternatives to this approach. In the short term, the cost looks prohibitive to new technologies but is still worth monitoring.

Dividend Increases

Last week, there were two dividend increases from companies on ‘The List’.

Metro (MRU-T) on Tuesday, January 24, 2023, said it increased its 2023 quarterly dividend from $0.275 to $0.3025 per share, payable March 06, 2023, to shareholders of record on February 08, 2023.

This represents a dividend increase of +10.0%, marking the 29th straight year of dividend growth for this quality grocer.

Canadian National Railway (CNR-T) on Tuesday, January 24, 2023, said it increased its 2023 quarterly dividend from $0.7325 to $0.79 per share, payable March 31, 2023, to shareholders of record on March 10, 2023.

This represents a dividend increase of +7.85%, marking the 28th straight year of dividend growth for this quality railroad.

Earnings Releases

Two companies on ‘The List’ are due to report earnings this week.

Brookfield Infrastructure Partners (BIP-N) will release its fourth-quarter 2022 results on Thursday, February 2, 2023, before markets open.

Bell Canada (BCE-T) will release its fourth-quarter 2022 results on Thursday, February 2, 2023, before markets open.

Last week, two companies on ‘The List’, reported their earnings.

Metro (MRU-T) released its first-quarter 2023 results on Tuesday, January 24, 2023, before markets opened.

“We delivered solid results in the first quarter, gaining market share in a very competitive environment. As inflationary pressures persist, our teams did an excellent job to offer the best value possible to customers in our stores, pharmacies and online and I thank them for their hard work. We will continue to execute on our business plans to deliver a strong value proposition to our customers, invest in our retail network and infrastructure, and support our communities. As the Company proudly celebrates its 75th anniversary, we look forward to continued growth and success for all stakeholders.”

– Chief Executive Officer, Eric La Fleche

Highlights:

- Sales of $4,670.9 million, up 8.2%

- Food same-store sales up 7.5%

- Pharmacy same-store sales up 7.7%

- Net earnings of $231.1 million, up 11.3%, and adjusted net earnings of $237.6 million, up 10.9%

- Fully diluted net earnings per share of $0.97, up 14.1%, and adjusted fully diluted net earnings per share of $1.00, up 13.6%

- Declared dividend of $0.3025 per share, up 10.0% versus last year

Outlook:

“As we begin our second quarter, market challenges and inflationary pressures persist, and our focus remains on delivering value to our customers while executing on our strategic priorities. In a very competitive market environment, we are well-positioned to meet our customers’ high expectations and continue to create long-term value for our shareholders.”

– Chief Executive Officer, Eric La Fleche

See the full Earnings Release here

Canadian National Railway (CNR-T) released its fourth-quarter 2022 results on Tuesday, January 24, 2023, after markets closed.

“I am very proud of the work accomplished by our team in the fourth quarter and throughout the year. Our approach to scheduled railroading improved our service to our customers, drove operational efficiency, and built the resiliency that enabled a rapid recovery during the extreme winter conditions late in the quarter. As we look to 2023, we believe our back to-basics strategy and disciplined operating model will continue to deliver despite the softening economy.”

– Tracy Robinson, President and Chief Executive Officer, CN

Highlights:

Fourth-quarter 2022 compared to fourth-quarter 2021

- Revenues of C$4,542 million, an increase of C$789 million or 21%.

- Operating income of C$1,912 million, an increase of 22%, or an increase of 21% on an adjusted basis.

- Diluted EPS of C$2.10, an increase of 24%, or an increase of 23% on an adjusted basis.

- Operating ratio, defined as operating expenses as a percentage of revenues, of 57.9%, an improvement of 0.4 points, or remained flat on an adjusted basis

Outlook:

CN expects to deliver EPS growth in the low single-digit range due to a softer economic outlook.

See the full Earnings Release here

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not intended to be a portfolio others replicate. Rather, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor reflects the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolios. It is only a starting point for our analysis and discussion of dividend growth investing concepts.

The List (2023)

Last updated by BM on January 27, 2023

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 6.9% | $7.30 | 8.5% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $59.67 | -0.8% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 5.9% | $62.32 | 3.5% | $3.68 | 1.1% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $32.95 | 5.2% | $1.44 | 0.0% | 15 |

| CCL-B-T | CCL Industries | 1.5% | $62.17 | 7.1% | $0.96 | 0.0% | 21 |

| CNR-T | Canadian National Railway | 2.0% | $157.51 | -3.3% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.3% | $161.89 | 10.4% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 4.8% | $37.13 | 0.5% | $1.78 | 0.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $80.25 | 0.5% | $0.22 | 2.3% | 12 |

| EMA-T | Emera | 5.1% | $53.62 | 1.9% | $2.76 | 3.0% | 16 |

| ENB-T | Enbridge Inc. | 6.5% | $54.40 | 2.0% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 1.9% | $39.31 | 10.1% | $0.74 | 3.5% | 16 |

| FNV-N | Franco Nevada | 0.9% | $146.87 | 6.3% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis | 4.1% | $54.74 | -1.1% | $2.26 | 4.1% | 49 |

| IFC-T | Intact Financial | 2.1% | $193.15 | -1.3% | $4.00 | 0.0% | 18 |

| L-T | Loblaws | 1.3% | $120.99 | 0.5% | $1.62 | 5.2% | 11 |

| MGA-N | Magna | 2.8% | $63.89 | 11.1% | $1.80 | 0.0% | 13 |

| MRU-T | Metro | 1.7% | $73.04 | -3.2% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 3.9% | $134.65 | 5.2% | $5.28 | 6.5% | 12 |

| SJ-T | Stella-Jones Inc. | 1.7% | $47.47 | -4.3% | $0.80 | 0.0% | 18 |

| STN-T | Stantec Inc. | 1.0% | $68.71 | 5.2% | $0.72 | 2.1% | 11 |

| TD-T | TD Bank | 4.2% | $91.42 | 4.3% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.3% | $109.14 | 9.0% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.5% | $106.93 | 9.4% | $1.56 | 2.6% | 33 |

| TRP-T | TC Energy Corp. | 6.2% | $57.70 | 8.3% | $3.60 | 0.8% | 22 |

| T-T | Telus | 4.9% | $28.40 | 7.9% | $1.40 | 5.4% | 19 |

| WCN-N | Waste Connections | 0.8% | $131.28 | -0.3% | $1.02 | 7.9% | 13 |

| Averages | 3.1% | 3.8% | 4.4% | 19 |