Last updated by BM on January 16, 2023

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was up sharply with a positive +3.8% YTD price return (capital). Dividend growth took a step back with the dividend cut announced by (AQN-N). ‘The List’ is at +3.5% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’, but there was a dividend cut.

- Last week, there were no earnings reports from companies on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“Having a framework that objectively improves the probability of being directionally accurate is more important than having the most intellectually compelling narrative. Some of the smartest people out there are just as likely to be dead wrong, no matter how compelling their narratives sound. Investing success is a game of having a probabilistic advantage that enables returns to compound over time.”

– Josh Steiner, Hedgeye

One of the reasons we publish ‘The List’ is so that we can ‘coach’ others on how to select and monitor dividend growth stocks for their portfolios. Its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List,’ nor a portfolio that reflects the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolios. It is only a starting point for our analysis and discussion of dividend growth investing concepts.

Last week one of the companies on ‘The List’, Algonquin Power & Utilities (AQN-N) announced a 40% dividend cut. Although dividend cuts are rare for dividend growth companies, they do happen.

As part of our process audit, we will take a few paragraphs to review the signs leading up to the dividend cut by (AQN) to see if we need to change anything or if an investor following our process could have seen this one coming. A good process means you review your decisions when they fall outside your expectations.

Here is an excerpt from the article we published on our blog titled ‘Our Dividend Growth Investing Process’.

“By standing on the shoulders of giants, those great investors who came before us, we have come up with a process that is simple to understand with only three basic rules:

- Quality; only buy large-cap companies that have a long dividend growth streak and good financial safety metrics in an industry that is stable and growing.

- Valuation; look to buy a company that is sensibly priced or undervalued by looking at a company’s track record. Undervaluation introduces a margin of safety. You are in essence tilting the odds in your favor that future price movements will be upwards.

- Monitor; keep an eye on your dividend growers; especially the current yield; fluctuations in yields send signals. The consistency of a firm’s dividend growth is the best measure of management’s confidence in the long-term growth outlook for a company.”

“We will also review our outcomes regardless of if they were good or bad. Having a good process means you go back and review your decisions when they fall outside your expectations. We can then make tweaks based on our findings and enhance our process. Only then will we know if we were good or just lucky.”

This week we see the importance of Rule # 3. By monitoring our quality dividend growers, we can see signs of possible dividend cuts and mitigate the damage they can do to our portfolios.

In the case of Algonquin Power & Utilities (AQN-N), the fluctuation in yield and slowing dividend growth in 2022 were definitely ‘red flags’. While many investors would have been attracted to a higher yield, we see yield fluctuations as a warning sign. This, combined with a lower dividend growth rate announcement in July 2022, should have alerted the dividend growth investor to do a deeper dive into company fundamentals. In doing so, the dividend growth investor would have seen that the company had issues servicing its debt due to higher interest rates. This was noticeable when looking at the dividend payout ratio, which climbed to over 100%. Paying out more than you take in eventually leads to financial trouble. A high payout ratio often precedes a dividend cut.

Fortunately, we have never owned a position in (AQN-N) in any of our Wealth-Builder Portfolios, but if we did, it is reassuring to know that our process would have signalled us to do more research and then it would have been up to us to take action and decide what to do next.

Here is an excerpt from an article on the blog dated March 2021 that may help when you have this type of decision to make. Selling Dividend Growth Stocks

“When we make an investment, we take a patient, long-term investment horizon and expect to hold the stock for decades, keeping portfolio turnover low. Generally speaking, we will only sell a stock if the safety of the dividend payment has come into question, the company’s long-term earnings power appears to have become impaired, the stock’s valuation reaches seemingly excessive levels, or we find a more attractive idea.”

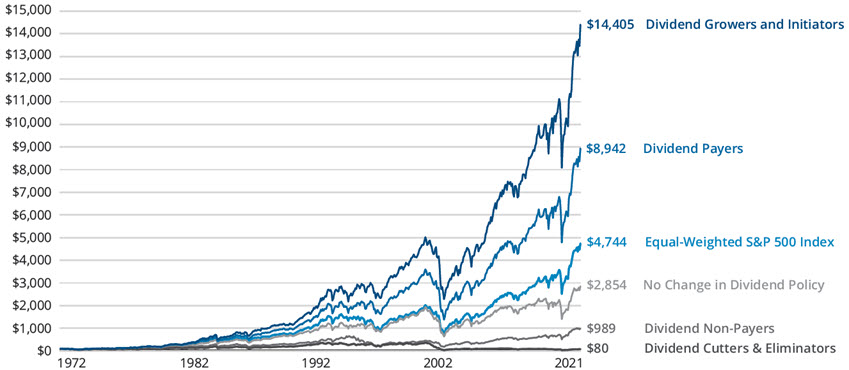

As dividend growth investors, a dividend cut means the wealth-building stops, so, we know what to do. Deep-value investors may need more of a push. Research shows us that the probability of a successful outcome is greatly reduced after the dividend is cut or eliminated.

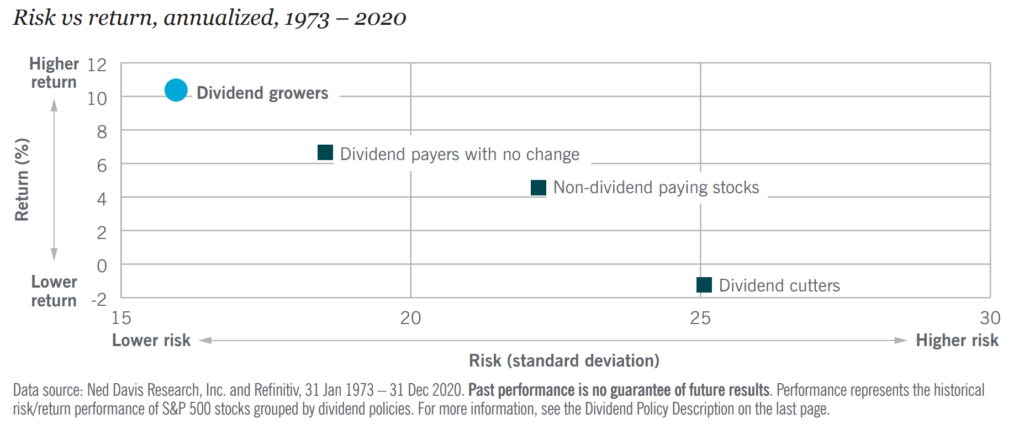

As you can see from the chart above, the probability of a ‘dividend cutter’ generating the type of future return we look for, at an acceptable risk, does not fit into our ‘probabilistic’ framework.

For those deep-value investors, we are not saying that Algonquin Power & Utilities will not go up in price from here. It simply does not meet our criteria as an investable dividend growth stock within our framework. We will keep an eye on (AQN-N) for the rest of the year to see how this ‘dividend cutter’ works out, but for now, we have plenty of higher probability ideas to invest our hard-earned capital in.

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

Last week, ‘The List’ was up sharply with a positive +3.8% YTD price return (capital). Dividend growth took a step back with the dividend cut announced by (AQN-N). ‘The List’ is at +3.5% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were Enghouse Systems Limited (ENGH-T), up +6.43%; TC Energy Corp. (TRP-T), up +5.66%; and Franco Nevada FNV-N), up +4.93%.

Algonquin Power & Utilities (AQN-N) was the worst performer last week, down -7.37%.

Recent News

Algonquin Power cuts dividend by 40 percent, shares slump (Globe & Mail)

“We have reached an inflection point, and as the market continues to evolve we are facing various challenges that are putting pressure on our growth rates and making our dividend payout unsustainable,” Mr. Banskota (CEO) said during a call with analysts.”

It finally happened. After months of speculation, management announced this week that the dividend will need to be cut.

Be wary of dividend-paying stocks with extremely high yields (Globe & Mail)

“It’s fairly easy to explain why stocks with giant yields might perform poorly. Just think about how a stock gets a high yield. In happy cases, yields are boosted by dividend growth. But extremely high yields often occur when a business falters and its share price falls dramatically. In such cases, the low price and high yield reflect the risk of an impending dividend cut – or worse.”

The author demonstrates how a portfolio of dividend-paying stocks with moderate yields has outperformed the TSX index over the last twenty-one years.

No charts for dividend growth as a strategy, though. That’s OK; we have done our own research.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

No companies on ‘The List’ are due to report earnings this week.

Last week, there were no earnings reports from companies on ‘The List’.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not intended to be a portfolio others replicate. Rather, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor reflects the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolios. It is only a starting point for our analysis and discussion of dividend growth investing concepts.

The List (2023)

Last updated by BM on January 13, 2023

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 7.6% | $6.66 | -1.0% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $62.98 | 4.7% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 5.9% | $62.48 | 3.7% | $3.68 | 1.1% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $32.95 | 5.2% | $1.44 | 0.0% | 15 |

| CCL-B-T | CCL Industries | 1.6% | $60.29 | 3.9% | $0.96 | 0.0% | 21 |

| CNR-T | Canadian National Railway | 1.8% | $165.64 | 1.7% | $2.93 | 0.0% | 27 |

| CTC-A-T | Canadian Tire | 4.4% | $156.43 | 6.7% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 4.7% | $37.84 | 2.4% | $1.78 | 0.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $81.79 | 2.4% | $0.22 | 2.3% | 12 |

| EMA-T | Emera | 5.1% | $53.94 | 2.5% | $2.76 | 3.0% | 16 |

| ENB-T | Enbridge Inc. | 6.3% | $55.92 | 4.9% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 1.9% | $39.39 | 10.3% | $0.74 | 3.5% | 16 |

| FNV-N | Franco Nevada | 0.9% | $146.69 | 6.2% | $1.28 | 0.0% | 15 |

| FTS-T | Fortis | 4.0% | $56.00 | 1.2% | $2.26 | 4.1% | 49 |

| IFC-T | Intact Financial | 2.0% | $199.38 | 1.8% | $4.00 | 0.0% | 18 |

| L-T | Loblaws | 1.4% | $115.82 | -3.7% | $1.62 | 5.2% | 11 |

| MGA-N | Magna | 2.8% | $64.07 | 11.4% | $1.80 | 0.0% | 13 |

| MRU-T | Metro | 1.5% | $74.06 | -1.9% | $1.10 | 0.0% | 28 |

| RY-T | Royal Bank of Canada | 3.9% | $134.28 | 4.9% | $5.28 | 6.5% | 12 |

| SJ-T | Stella-Jones Inc. | 1.7% | $47.85 | -3.5% | $0.80 | 0.0% | 18 |

| STN-T | Stantec Inc. | 1.0% | $69.22 | 6.0% | $0.72 | 2.1% | 11 |

| TD-T | TD Bank | 4.3% | $88.84 | 1.3% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.3% | $107.47 | 7.3% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.5% | $106.88 | 9.4% | $1.56 | 2.6% | 33 |

| TRP-T | TC Energy Corp. | 6.3% | $57.31 | 7.5% | $3.60 | 0.8% | 22 |

| T-T | Telus | 5.0% | $28.15 | 7.0% | $1.40 | 5.4% | 19 |

| WCN-N | Waste Connections | 0.8% | $130.59 | -0.9% | $1.02 | 7.9% | 13 |

| Averages | 3.1% | 3.8% | 3.5% | 19 |