FASTgraphs as a Valuation Tool – Part 3

Posted by BM on May 28, 2021

Reviewing historical information is a good way to see how a stock has performed over time but critics of this approach in valuation will often accuse you of looking backward. They have a point, so FASTgraphs has added an ‘Estimates’ tab to its arsenal. Before I buy, sell or hold a stock I want some expectation of what the return in the future might look like. We simply do not buy a stock and hope for a return. With FASTgraphs we have five ways to view the future thanks to the Analysts who follow the stock. I will use the ‘Normal Multiple’ approach.

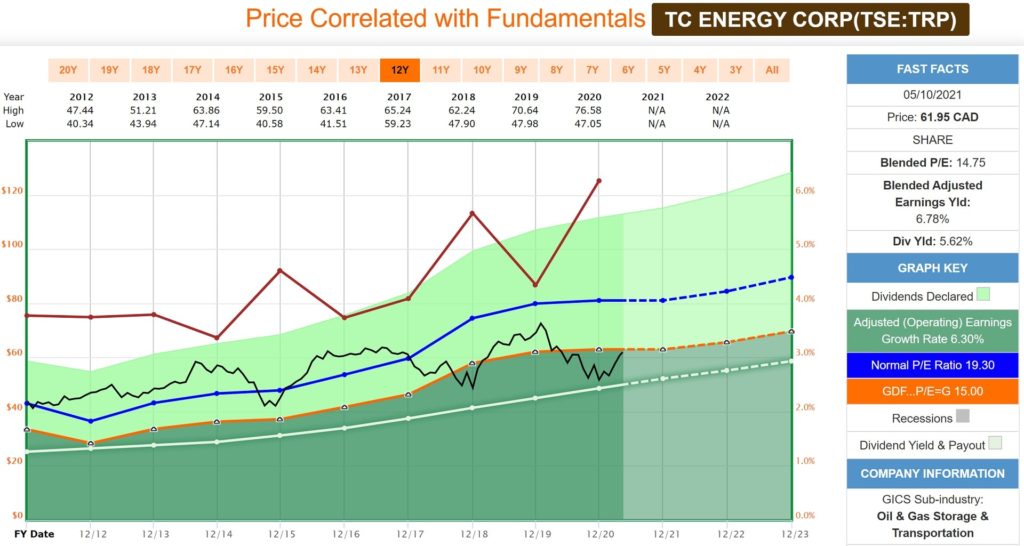

TRP has traded at a ‘Normal Multiple’ over the past five years of 16.84 (P/E). We will use that multiple combined with the Analyst’s (19 of them) estimated earnings and dividend growth to arrive at a reasonable expectation of return. We are also only going to use the information out to the end of 2022 as after that the number of Analysts providing estimates drops off quickly.

The ‘Black Line’ is the price line and shows the stock price going back to the beginning of 2020 until now. The dotted black line represents a projection of the stock price at the end of 2022. The box on the right side of the graph shows the data that helps you decide. The data shows you the projected stock price ($73.80) and how much of your return is made up from capital appreciation and the dividend paid. Over the next year and a half Analysts predict you will make ~17% total annualized rate of return (ROR) on a purchase at today’s price. This projection assumes that the Analysts are correct in their earnings estimates and that the stock trades at its normal multiple at the end of 2022. We can always do projections both assuming a higher P/E and a lower P/E than the norm to see a range of results. We call this our valuation corridor.

Another nice feature of the FASTgraphs tool is it’s ‘Analyst Scorecard’ feature. What you are trying to determine here, is how accurate have Analysts been with their past projections.

If you scroll across the ‘2-yr Forward’ row you will see the past predictions of Analysts and right below the ‘Actual’ earnings numbers. Over the last five years, the Analysts have underestimated Actual earnings every time. Their summarized historical record can be found in the ‘Summary’ tab on this Analyst Scorecard view. Actual earnings have either hit or beat Analysts two-year projections 83% of the time over the last twelve years (assuming a 20% margin of error). Their record recently has been much better. This should give you a comfort feeling when it comes to trusting the Analysts who cover TRP as they have recently been conservative in their projections tending to underestimate as opposed to overestimate earnings (Difference % row).

Forecasting is not an exact science but with a little research you can set reasonable expectations of what the future may look like.

This ends our three-part series on the FASTgraphs tool. Although we do not use FASTgraphs exclusively to make our investment decisions it certainly helps you feel comfortable when you do decide on an action (buy, sell, hold).