MP Market Review – December 24, 2021

Posted by BM on December 27, 2021

The Canadian stock market continued its strong performance this past week keeping pace with its peers to the south. With the new year in sight, stay tuned for our year-end summaries of companies on ‘The List’ and whether there will be any changes to ‘The List’ for 2022.

Our new list will be published in the first week of 2022.

Performance of ‘The List’

The best performers this week on ‘The List’ were Alimentation Couche-Tard (ATD-T) up 9.1% on the back of another acquisition; Enghouse Systems Limited (ENGH-T) up 8.1% after it was obviously in oversold territory following last week’s earnings news; and TFI International (TFII-T) up 3.4% as it continues to soar in 2021.

Canadian National Railway (CNR-T) was the worst performer, down -4.5% after the setback in their CEO search.

‘The List’ as a whole was up 2% this past week with a 19.0% YTD price return gain (capital) and an average of 8.2% dividend increase (income) in 2021.

Dividend Increases

There were no dividend increases announced from companies on ‘The List’ this past week.

Earnings Releases

There were no earnings releases announced from companies on ‘The List’ this past week.

Recent News

ALIMENTATION COUCHE-TARD ANNOUNCES THE ACQUISITION OF 19 SITES AND 2 NON-OPERATING PROPERTIES FROM PIC QUIK

Alimentation Couche-Tard (ATD-T) announced an agreement with Pic Quik under which Couche-Tard has acquired 19 convenience stores and 2 non-operating properties across the state of New Mexico. The assets are owned and operated by Pic Quik, a successful Company originally founded in 1958. The acquisition closed on December 17, 2021.

“We are very pleased to welcome the Pic Quik locations and team to our Circle K family in New Mexico,” said Alex Miller, Couche-Tard’s Executive Vice President, Operations, North America, and Global Commercial Optimization. “With this acquisition, we will be able to build on our strong network in the state and grow our mission of making our customers’ lives a little easier every day.

ATD-T has been in acquisition mode lately after acquiring 17 sites last week from Slidell Oil Company.

CCL INDUSTRIES ACQUIRES BRAZIL’S FOREVER BLUE FOR C$19.1 MILLION

CCL Industries (CCL-B-T) on Monday said it agreed to acquire Brazil-based Forever Blue Investimentos e Participacoes for C$19.1 million

The company said the company “is a leader in labels and tags for the retail and apparel industry strategically located at the heart of Brazil’s textile industry” with 2021 sales forecast to be C$17.6 million.

This too is CCL-B-T’s second acquisition in as many weeks.

JIM VENA WITHDRAWS AS CANDIDATE FOR CANADIAN NATIONAL CEO ROLE

Canadian National Railway (CNR-T) said on Monday Jim Vena, who was backed by a group of investors to lead the country’s largest railway operator, had pulled out of the running to serve as its new chief.

The former Union Pacific executive was pitched for the top job by TCI Fund Management, which is Canadian National’s second-largest shareholder with a 5% stake.

“Vena looked to us like an ideal candidate considering his contribution to Union Pacific’s solid OR (operating ratio) progress since implementing PSR (precision scheduled railroading) in 2018,” Morningstar analyst Matthew Young said.

“There’s a good chance he would have helped reinvigorate CN’s operating strategy, and we suspect shareholders would have welcomed his leadership.”

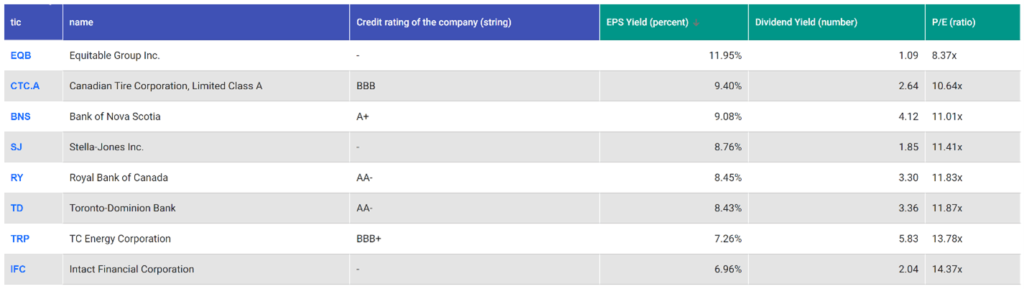

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’ please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Rather, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’, only a starting point for our analysis and discussion.

The List (2021)

Last updated by BM on December 24, 2021

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 4.7% | $14.32 | -11.9% | $0.67 | 10.2% | 10 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.7% | $52.45 | 20.2% | $0.37 | 25.2% | 11 |

| BCE-T | Bell Canada | 5.3% | $65.65 | 19.4% | $3.46 | 5.1% | 12 |

| BIP-N | Brookfield Infrastructure Partners | 3.5% | $58.75 | 18.7% | $2.04 | 2.5% | 13 |

| BNS-T | Bank of Nova Scotia | 4.0% | $89.76 | 32.5% | $3.60 | 0.0% | 10 |

| CCL-B-T | CCL Industries | 1.3% | $66.62 | 14.9% | $0.84 | 16.7% | 19 |

| CNR-T | Canadian National Railway | 1.6% | $156.66 | 11.9% | $2.46 | 7.0% | 25 |

| CTC-A-T | Canadian Tire | 2.6% | $180.89 | 8.7% | $4.70 | 3.3% | 10 |

| CU-T | Canadian Utilities Limited | 4.8% | $36.32 | 17.4% | $1.76 | 1.1% | 49 |

| DOL-T | Dollarama Inc. | 0.3% | $63.10 | 20.8% | $0.20 | 12.4% | 10 |

| EMA-T | Emera | 4.1% | $62.30 | 16.1% | $2.58 | 3.8% | 14 |

| ENB-T | Enbridge Inc. | 6.9% | $48.75 | 19.3% | $3.34 | 3.1% | 25 |

| ENGH-T | Enghouse Systems Limited | 1.3% | $48.64 | -21.7% | $0.64 | 24.3% | 14 |

| EQB-T | Equitable Group Inc | 1.1% | $69.35 | 32.0% | $0.74 | 0.0% | 10 |

| FNV-N | Franco Nevada | 0.9% | $135.49 | 2.8% | $1.16 | 12.6% | 13 |

| FTS-T | Fortis | 3.4% | $60.64 | 16.2% | $2.05 | 4.1% | 47 |

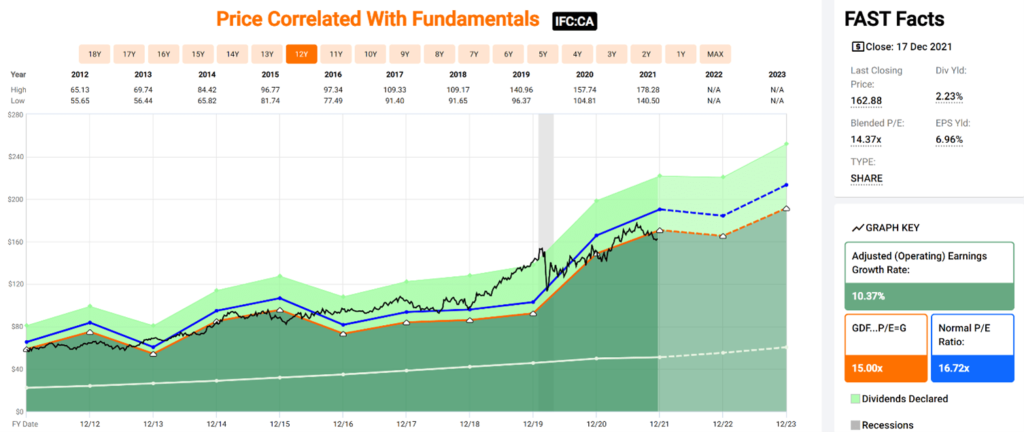

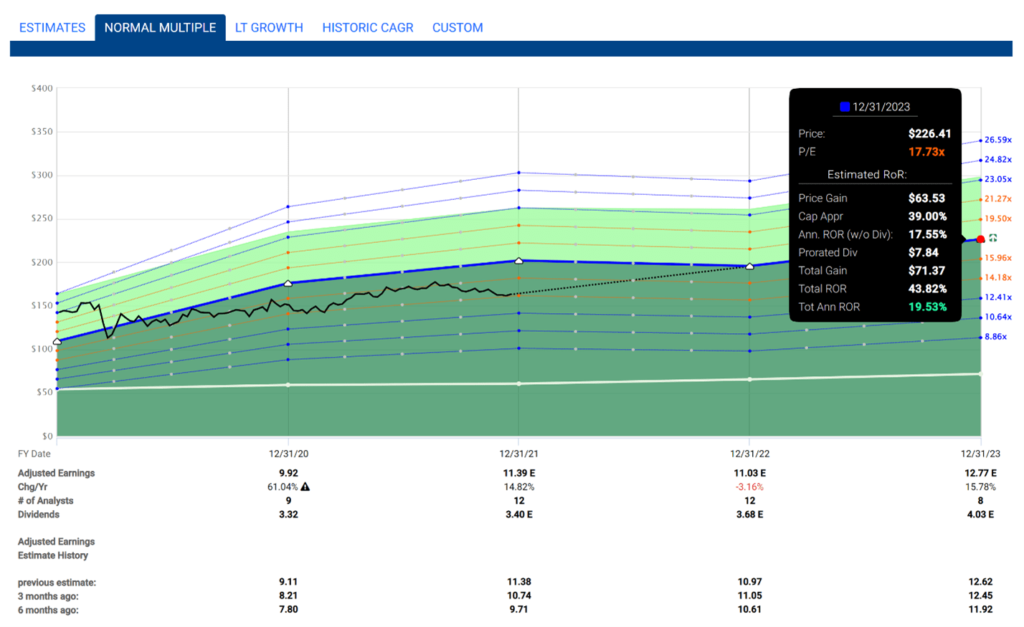

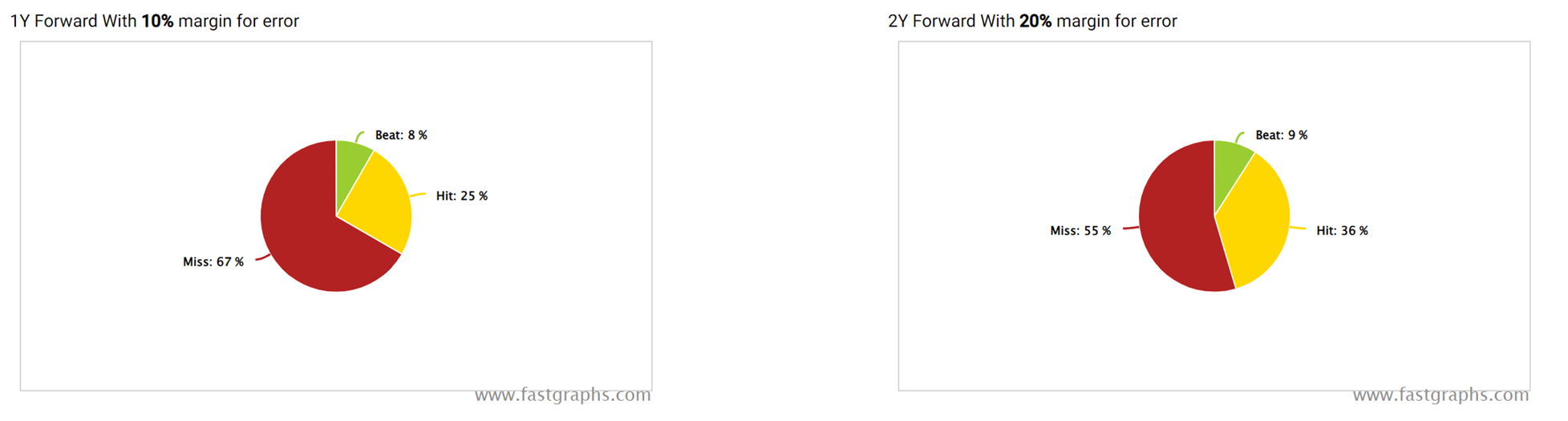

| IFC-T | Intact Financial | 2.1% | $163.48 | 9.2% | $3.40 | 2.4% | 16 |

| MGA-N | Magna | 2.2% | $79.50 | 14.0% | $1.72 | 7.5% | 11 |

| MRU-T | Metro | 1.5% | $67.52 | 17.2% | $1.00 | 13.6% | 26 |

| RY-T | Royal Bank of Canada | 3.2% | $133.99 | 28.0% | $4.32 | 0.7% | 10 |

| SJ-T | Stella-Jones Inc. | 1.8% | $39.79 | -14.4% | $0.72 | 20.0% | 16 |

| TD-T | TD Bank | 3.3% | $96.30 | 33.9% | $3.16 | 1.6% | 10 |

| TFII-T | TFI International | 0.8% | $141.10 | 115.9% | $1.16 | 8.4% | 10 |

| TIH-T | Toromont Industries | 1.2% | $113.29 | 28.0% | $1.36 | 9.7% | 31 |

| TRP-T | Trans Canada | 5.8% | $60.45 | 15.8% | $3.48 | 7.4% | 20 |

| T-T | Telus | 4.3% | $29.52 | 16.0% | $1.25 | 8.2% | 17 |

| WCN-N | Waste Connections | 0.6% | $132.19 | 30.6% | $0.85 | 11.2% | 11 |

| Averages | 2.7% | 19.0% | 8.2% | 17 |