Selling Dividend Growth Stocks

Posted by BM on March 21, 2021

Trees don’t grow to the sky or do they? In my USD portfolio in 2019 last year I sold 1/3 of my position in Microsoft and Visa and more recently in Apple because all three looked to be overvalued. My logic was that the stocks would ‘correct’, and I would be able to buy back in at a lower price. This got me thinking about what a dividend growth investor should do when stocks in their portfolio’s appear overvalued.

In my annual update from 2019 I wrote about my criteria for selling:

“When we make an investment, we take a patient, long term investment horizon and expect to hold the stock for decades, keeping portfolio turnover low. Generally speaking, we will only sell a stock if the safety of the dividend payment has come into question, the company’s long-term earnings power appears to have become impaired, the stock’s valuation reaches seemingly excessive levels, or we find a more attractive idea.”

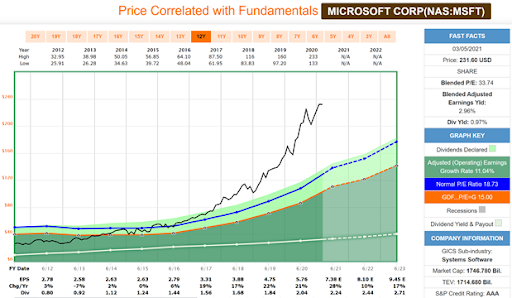

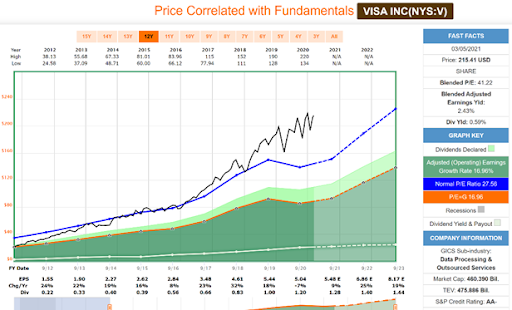

With the three stocks listed above I chose to sell based on what my process told me was ‘historic’ over valuation. Interpreting the graphs: The ‘black’ line is price; the ‘blue’ line is P/E and the ‘orange’ line is a historical fair valuation metric of 15 P/E.

Apple is trading at a P/E that is 107% higher than its ten-year average.

Microsoft is trading at a P/E that is 80% higher than its ten-year average.

and Visa is trading at a P/E that is 50% higher than its ten-year average.

Source: FASTgraphs

Warren Buffet probably would have disagreed with my decision to sell.

“Truly good businesses are exceptionally hard to find. Selling any you are lucky enough to own makes no sense at all.” Warren Buffet Annual Letter 2018

I understand with what Buffet is saying about how hard it is to find good businesses. I believe that all three are wonderful companies that are set up for continued growth going forward, but I felt it was time to take advantage of the capital gains being offered to me, and to do some de-risking in my portfolio. Sorry Warren!

Although I left a little money on the table in 2020 by selling some too early, I was still able to participate in the success of these wonderful companies by retaining 2/3 of my original positions in all three stocks. I will most likely trim again as valuations continue to make me uncomfortable and undervalued opportunities in other stocks I follow are revealed.

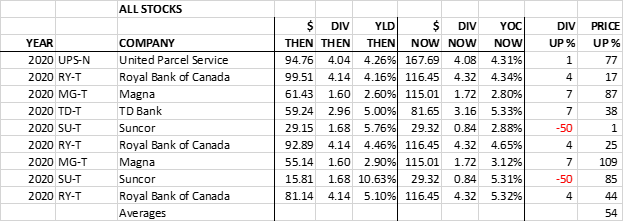

When to sell is a personal choice for dividend growth investors and one you should take seriously especially if the dividend is still growing. As it turns out I was fortunate to be able to quickly deploy this extra cash generated when COVID hit and was able to reinvest in sensibly priced companies. This has already turned out to be a prudent choice regardless of how these three companies perform going forward.

Trimming your positions due to overvaluations is a good problem to have but, better yet, is redeploying that capital in quality, sensibly priced, DGI stocks that can increase your current income and provide a margin of safety to your portfolio moving forward.

“A company’s valuation level, at time of purchase, significantly influences subsequent returns. As, “risk is more often in the price you pay than in the stock itself”. C.Browne’s Little Book of Value Investing.