MP Market Review – June 23, 2023

Last updated by BM on June 26, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was down with a YTD price return of +2.2% (capital). Dividend growth remained the same and is now at +8.4% YTD, highlighting growth in income over the past year.

- Last week, no dividend increases from companies on ‘The List’.

- Last week, no earnings reports from companies on ‘The List’.

- One company on ‘The List’ is due to report earnings this week.

- If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service, which grants you access to the MP Wealth-Builder Model Portfolio (CDN) and exclusive subscriber-only content. Learn More

Introduction

“You have a pair of pants. In the left pocket, you have $100. You take $1 out of the left pocket and put it in the right pocket. You now have $101. There is no diminution of dollars in your left pocket. That is one magic pair of pants.”

This ‘magic pants’ analogy was from a Seeking Alpha article on dividend investing I read about a decade ago and was one of the catalysts for me to take a closer look at this type of investing and see if it truly was magical.

After conducting additional research, I have shifted towards utilizing a dividend growth investing (DGI) strategy as my primary investment approach. While I maintain portfolios consisting of high-quality dividend growers from both the United States and Canada, I have opted to concentrate on Canadian (CDN) dividend growth companies in this blog. This is due to several reasons, including a smaller pool of DGI companies to track, a lack of coverage for the DGI strategy by the North American investment media, and a tendency for those who do cover DGI to narrowly focus on only a handful of sectors (Energy and Financials).

While ‘The List’ is not a portfolio in itself, it serves as an excellent initial reference for individuals seeking to diversify their investments and attain higher returns in the Canadian stock market. Through our blog, we provide weekly updates on ‘The List’ and offer valuable perspectives and real-life examples of the dividend growth investing strategy in practice. This helps readers gain a deeper understanding of how to implement and benefit from this investment approach.

DGI Thoughts

“What’s an investment, anyhow, but a body of capital that produces income. The income maybe current income, or it may be prospective income, but is is the magnitude of the income, current or prospective, that determines the value of the capital which produces it. “

– Arnold Bernhard, page 21, The Evaluation of Common Stocks, 1959

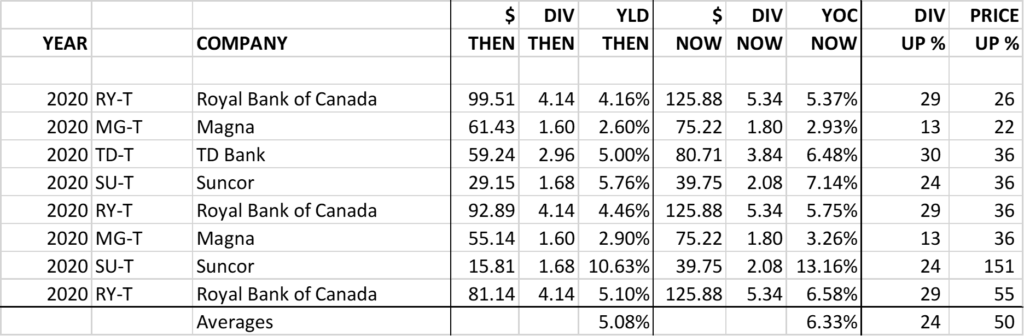

When markets are falling or going sideways, I have always taken comfort in looking at the income my investments produce. Unlike most growth-only investors, we do not have to wait on our excellent dividend growers to go up in value to generate income to pay our bills or have fun with.

The link below is a table with each stock in ‘The List’ sorted by total dividends paid over the last ten years.

The average is a little over 45% of your initial investment ($4,539) being returned to you in the form of dividends over the last decade. Starting yield (YLD ’13) has a big impact on dividends paid in the first ten years but some of our low yield high growth stocks are gaining fast. It will be interesting to publish this report in another ten years’ time to see how the order has changed.

If you have not yet joined as a subscriber of the blog to receive DGI Alerts on the activity and content related to our model portfolio, it’s not too late. Click Here.

Recent News

Is there a new bull market on the horizon? (Globe & Mail)

https://www.theglobeandmail.com/investing/article-new-bull-market/

According to the author, the rise in Artificial Intelligence companies recently and renewed strength in the real estate sector have some thinking a new bull market is just around the corner.

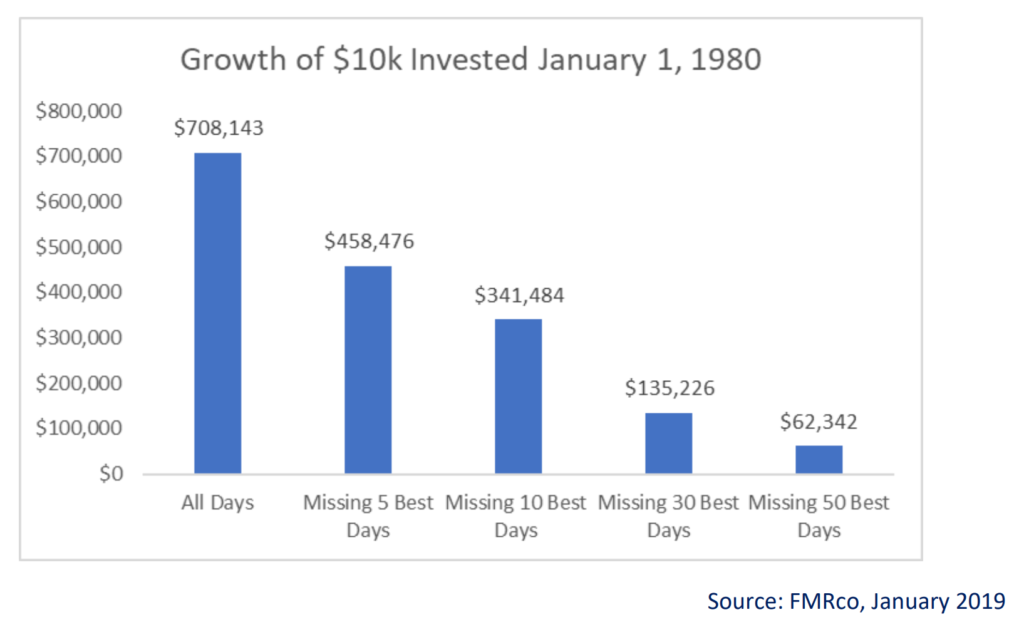

Bull or Bear markets don’t really affect how we execute our process except for the fact that we acquire good dividend growers at lower valuations during market downturns. Being in the market is more important to us than trying to time it.

A gameplan for savers and conservative investors who think interest rates will go higher (Globe & Mail)

The author recommends looking at High-Interest Savings Accounts (HISAs). Rates are around 5% right now.

We prefer to invest in dividend growth companies that offer similar yields to HISAs yet grow their yields every year. Interest income is also taxed at a higher rate than our dividend income which takes the shine off these investments as well. Not a bad idea to use HISAs to earn a little extra in the short term while you wait to deploy some of your cash in good dividend growers but as a long-term investment we think there are better alternatives.

To receive breaking news about companies on ‘The List’ follow us on Twitter @MagicPants_DGI.

The List (2023)

Last updated by BM on June 23, 2023

The Magic Pants List contains 27 Canadian dividend growth stocks. ‘The List’ contains Canadian companies that have raised their dividend yearly for at least the last ten years and have a market cap of over a billion dollars. Below is each stock’s symbol, name, current yield, current price, price return year-to-date, current dividend, dividend growth year-to-date and current dividend growth streak. Companies on ‘The List’ are added or subtracted once a year, on January 1. After that, ‘The List’ is set for the next twelve months. Prices and dividends are updated weekly.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 6.3% | $8.05 | 19.6% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $63.48 | 5.6% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 6.5% | $58.82 | -2.3% | $3.82 | 5.0% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $35.06 | 5.2% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.7% | $61.89 | 6.6% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 2.0% | $155.32 | -4.6% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.0% | $170.53 | 16.3% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 5.2% | $34.35 | -7.0% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $86.36 | 8.1% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 5.2% | $53.38 | 1.4% | $2.76 | 3.0% | 16 |

| ENB-T | Enbridge Inc. | 7.4% | $47.74 | -10.5% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 2.7% | $31.41 | -12.0% | $0.85 | 18.2% | 16 |

| FNV-N | Franco Nevada | 1.0% | $139.15 | 0.7% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis | 4.1% | $55.43 | 0.2% | $2.26 | 4.1% | 49 |

| IFC-T | Intact Financial | 2.2% | $195.74 | 0.0% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.5% | $116.39 | -3.3% | $1.74 | 10.3% | 11 |

| MGA-N | Magna | 3.5% | $52.03 | -9.5% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.7% | $71.91 | -4.7% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 4.4% | $122.32 | -4.5% | $5.34 | 7.7% | 12 |

| SJ-T | Stella-Jones Inc. | 1.4% | $64.37 | 29.8% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 0.9% | $82.86 | 26.8% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.9% | $78.00 | -11.0% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.3% | $105.65 | 5.5% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.6% | $104.30 | 6.7% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 7.1% | $51.81 | -2.8% | $3.69 | 3.4% | 22 |

| T-T | Telus | 5.6% | $25.35 | -3.7% | $1.43 | 7.3% | 19 |

| WCN-N | Waste Connections | 0.7% | $136.10 | 3.3% | $1.02 | 7.4% | 13 |

| Averages | 3.3% | 2.2% | 8.4% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

Note: When the dividend and share price currency match, the calculation is straightforward. But it’s not so simple when the dividend is declared in one currency, and the share price is quoted in another. Dividing the former by the latter would produce a meaningless result because it’s a case of apples and oranges. To calculate the yield properly, you must express the dividend and share price in the same currency.

Performance of ‘The List’

Feel free to click on this link, ‘The List’ for a sortable version from our website.

Last week, ‘The List’ was down with a YTD price return of +2.2% (capital). Dividend growth remained the same and is now at +8.4% YTD, highlighting growth in income over the past year.

The best performers last week on ‘The List’ were Metro (MRU-T), up +1.08%; Loblaws (L-T), up +1.02%; and CCL Industries (CCL-B-T), up +0.15%.

Magna (MGA-T) was the worst performer last week, down -8.7%.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

“As a dividend increase is a positive sign of a company’s financial strength, the safest purchase, after research, is a stock with a recent dividend increase.”

– Tom Connolly (the founder of dividendgrowth.ca)

Last week, no dividend increases from companies on ‘The List’.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

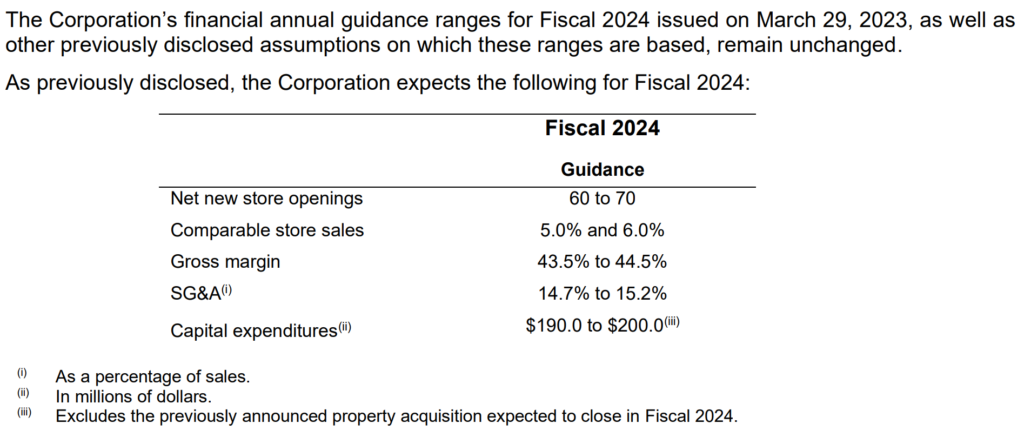

Earnings growth and dividend growth tend to go hand in hand, so this information can tell us a lot about the future dividend growth of our quality companies. Monitoring our dividend growers periodically is part of the process, and reading the quarterly earnings releases is a good place to start.

One earnings report from companies on ‘The List’ this week

Alimentation Couche-Tard Inc. (ATD-T) will release its fourth-quarter fiscal 2023 results on Tuesday, June 27, 2023, after markets close.

Last week, No earnings reports from companies on ‘The List’.