Yield on Cost: Getting the Respect it Deserves

Posted by BM on August 27, 2021

“We believe yield on cost (the indicated dividend divided by the per share purchase price) may be a more accurate measure of the long-term value of a dividend.”

-Standard and Poors Outlook, September 8, 2004

Yield on Cost (YOC) is a much-maligned term because it is not really the yield that the stock is trading at today. Many investors believe the only yield that really matters is the yield today.

Our two mentors use a different term for YOC. Tom Connolly calls it Greater Dividend Return and Chuck Carnevale calls it Growth Yield. Both agree that it clearly singles out the growing cash flow of our quality dividend growers and is therefore useful as a metric. Imagine beating the index from dividends alone after less than a decade of holding a good dividend grower.

“Some people who do not ‘believe’ in YOC argue that what happened ten or 15 years ago is not always a good indicator of the future. That’s true. I’m not saying that YOC is a good indicator of the future. However, if the dividend has grown since purchase, YOC is a good indicator the company is doing well. If a company has a ‘culture’ of increasing its dividend the pattern could easily continue. If folks are not using YOC to measure because it is rooted in the past, how do they measure their returns? Do they not use a past-connected number also? Growing yield is the essence of what the dividend growth strategy is about. Growing yield drives returns. If the yield does not grow, essentially, you have a bond.”

-Tom Connolly

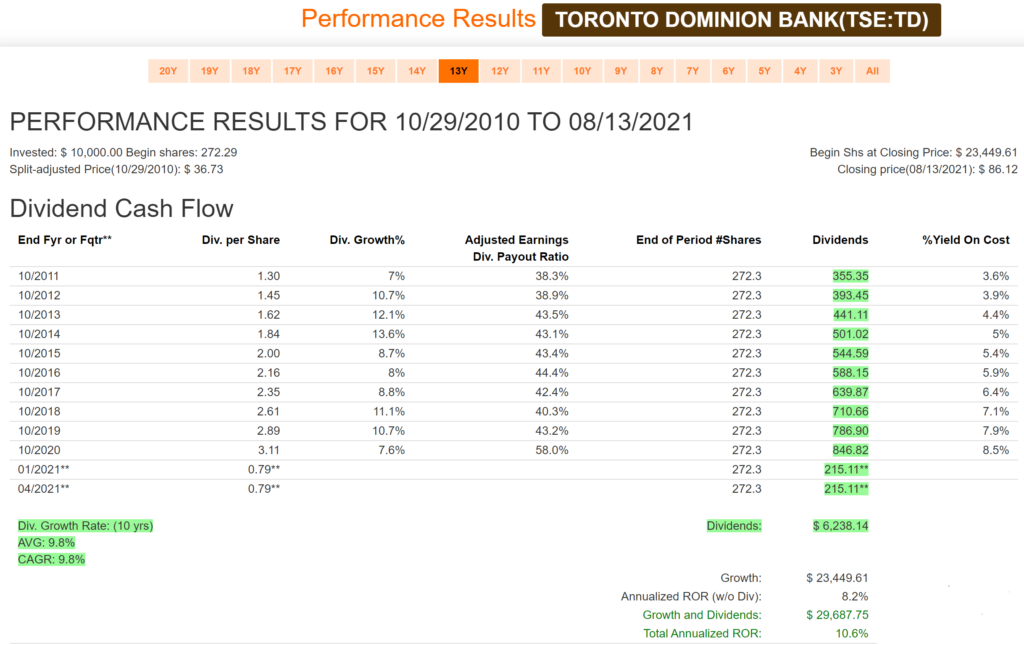

Whenever we analyze decade long returns of our quality dividend growers, we usually show a column for Yield on Cost (YOC). We use historical dividend growth rates to help estimate, based on a starting yield today, what return we can realistically expect to receive in the future from dividends alone. This is important for retirees who require a certain income in their retirement.

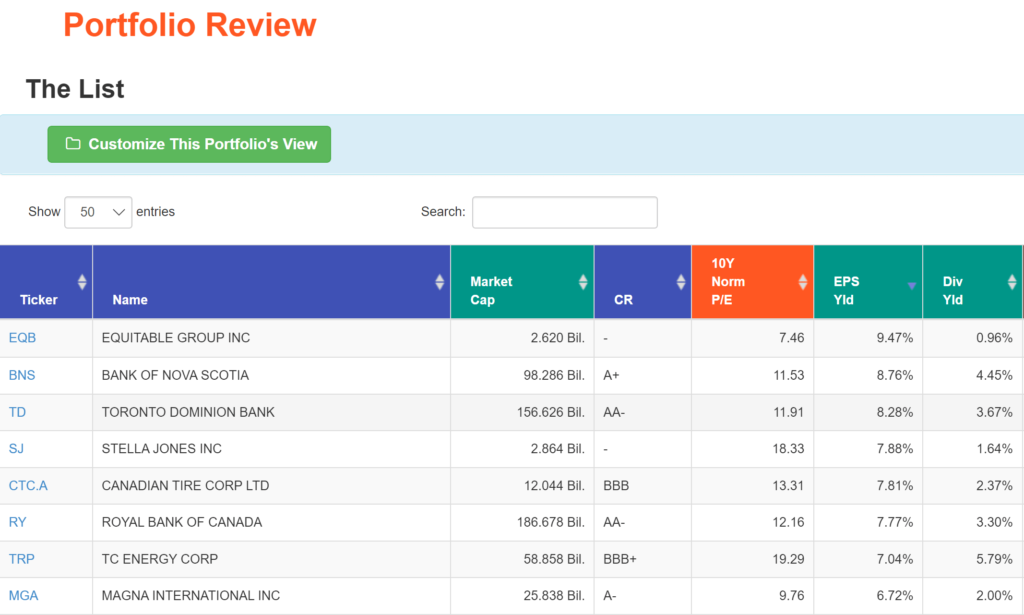

‘The List’ YOCs below (over the last decade) tell you a lot about the historical dividend growth of the underlying companies. 10YR_YOC-The List-01-01-2021

If you look closely at the data in the file you will find six companies that now return more than 10% on dividends alone. If you combine capital appreciation and dividends, you end up with a total return of ~15.5% annually over the past decade. I wonder what their fifteen- and twenty-year Greater Dividend Returns/Growth Yields will look like?

In addition to good total returns over time, one of the biggest benefits of the YOC metric is that by focusing on dividend growth returns alone an investor can navigate the short-term price volatility often found in the stock market and focus on building a sound income producing plan for their retirement.