MP Market Review – October 27, 2023

Last updated by BM on October 30, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was down with a YTD price return of -5.0% (capital). Dividend growth was up and is now at +8.8% YTD, highlighting growth in income over the past year.

- Last week, two dividend increases from companies on ‘The List’.

- Last week, five earnings reports from companies on ‘The List’.

- Five companies on ‘The List’ are due to report earnings this week.

- If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service, which grants you access to the MP Wealth-Builder Model Portfolio (CDN) and exclusive subscriber-only content. Learn More

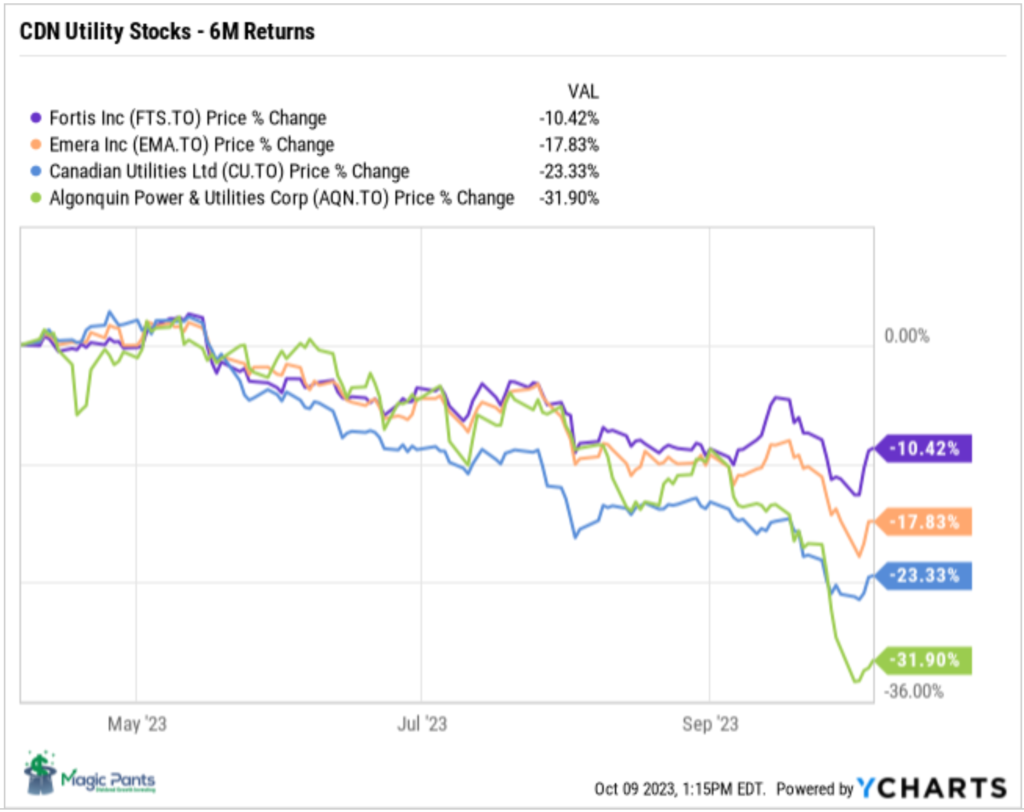

Identifying companies whose dividend growth aligns closely with price growth can considerably enhance the predictability of future returns. Dividend growth investors know that the dividend drives the price in a predictable way, not the other way around. Fortis Inc. (FTS-T) is another company on ‘The List’ that aligns very closely with this dividend growth vs price growth pattern we like to see.

Introduction

“You have a pair of pants. In the left pocket, you have $100. You take $1 out of the left pocket and put it in the right pocket. You now have $101. There is no diminution of dollars in your left pocket. That is one magic pair of pants.”

This ‘magic pants’ analogy was from a Seeking Alpha article on dividend investing I read about a decade ago and was one of the catalysts for me to take a closer look at this type of investing and see if it truly was magical.

After conducting additional research, I have shifted towards utilizing a dividend growth investing (DGI) strategy as my primary investment approach. While I maintain portfolios consisting of high-quality dividend growers from both the United States and Canada, I have opted to concentrate on Canadian (CDN) dividend growth companies in this blog. This is due to several reasons, including a smaller pool of DGI companies to track, a lack of coverage for the DGI strategy by the North American investment media, and a tendency for those who do cover DGI to narrowly focus on only a handful of sectors (Energy and Financials).

While ‘The List’ is not a portfolio in itself, it serves as an excellent initial reference for individuals seeking to diversify their investments and attain higher returns in the Canadian stock market. Through our blog, we provide weekly updates on ‘The List’ and offer valuable perspectives and real-life examples of the dividend growth investing strategy in practice. This helps readers gain a deeper understanding of how to implement and benefit from this investment approach.

DGI Clipboard

“Dividend growth investing is a long-term strategy that takes the fear out of bear markets. It’s about the income, not the fluctuations.”

– Charles Schwab

Accelerate Your Wealth-Building in Bear Markets!

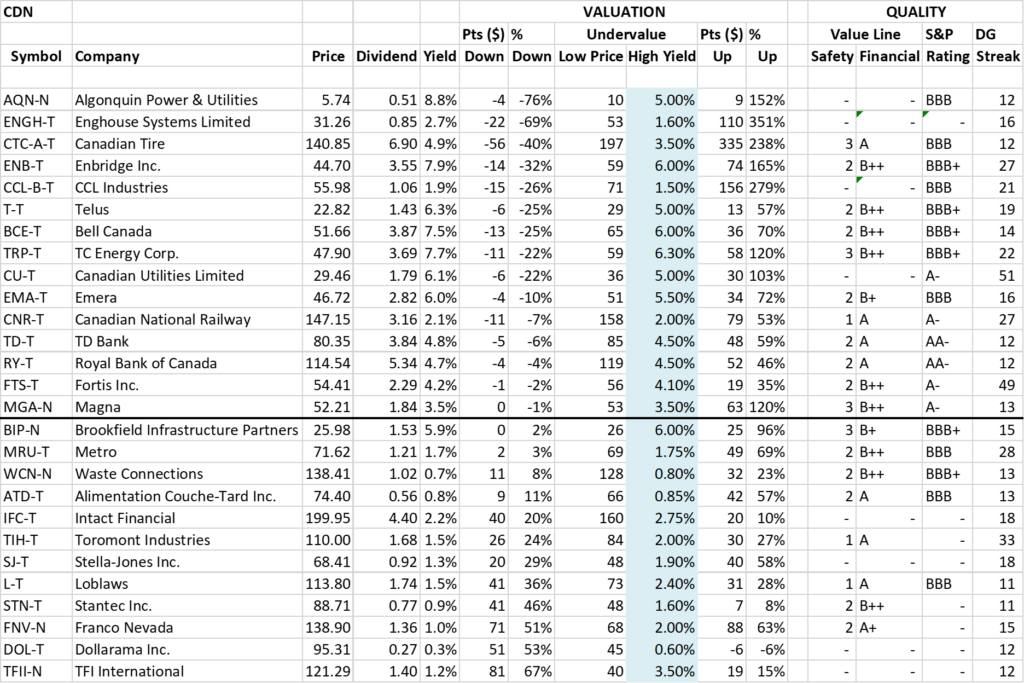

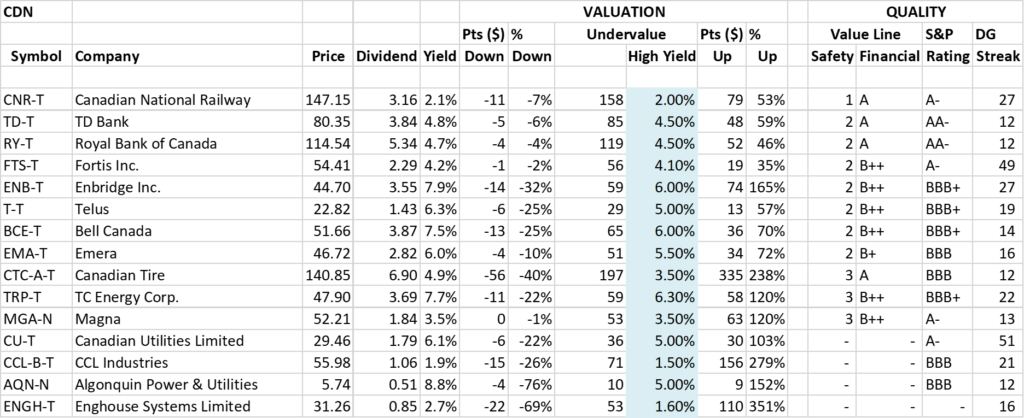

Many stocks, especially those offering increasing dividends, have experienced declines due to fear and uncertainty, leading to attractive discounts and higher dividend yields. In our opinion, individuals seeking to enhance their passive income through dividends should seize the opportunity presented by this bear market to expedite their wealth-building.

Upon closer examination of ‘The List,’ it becomes evident that the average dividend yield has risen from 3.2% at the beginning of the year to 3.7% now. A higher initial yield enables us to acquire more income from our investment, allowing us to reach our income goals more rapidly.

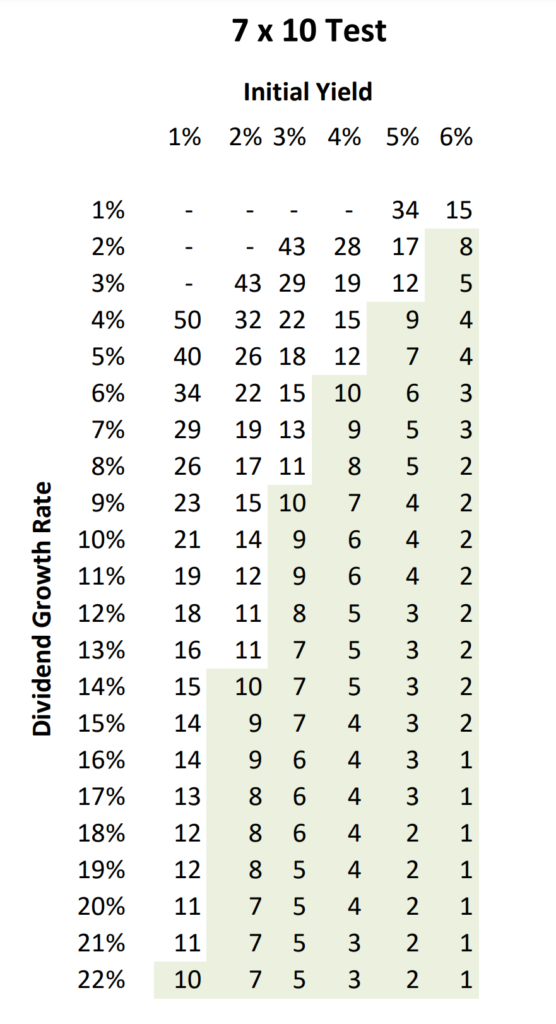

Last week, we discussed the significance of compounding income and how to measure it. We emphasized our preference for a 7% growth yield after ten years as our benchmark. Let’s explore the impact of the starting yield on achieving this goal.

For instance, a stock with an initial yield of 3% and an annualized dividend growth of 9% will take ten years to attain a growth yield of 7%. However, if we increase our starting yield to 4% while maintaining the same 9% dividend growth rate, we will only need seven years to reach our desired 7% growth yield.

Growth Yield is calculated by dividing the current annualized dividend by the original cost basis of the stock.

The starting yield can make a significant difference. Reducing the investment horizon from ten to seven years accelerates our wealth-building process.

If you have not yet joined as a paid subscriber of the blog to receive DGI Alerts on the activity and content related to our model portfolio, it’s not too late. Click Here.

Recent News

The (really) long-term benefits of dividend reinvestment (Globe & Mail)

DGI Truth #4: Dividend re-investment will supercharge your returns

Amazing results from the purchase of 1000 shares in Royal Bank 40 years ago! In this case, the buy and hold strategy netted an annualized return of 8.7%. Reinvest dividends and your annualized return jumps to over 13.0%. Dividend re-investment accelerates your wealth-building.

Analysts remain bullish on Brookfield Infrastructure Partners. But there’s a catch (Globe & Mail)

“With the business continuing to perform well, we are of the view investors are being presented with an outstanding buying opportunity here,” Frederic Bastien, an analyst at Raymond James, said in a Oct. 17 note.

When a stock falls this far this fast we usually put the brakes on and try to figure out why. It will be interesting to hear what management has to say in their upcoming Q3 earnings report.

The List (2023)

Last updated by BM on October 27, 2023

The Magic Pants List contains 27 Canadian dividend growth stocks. ‘The List’ contains Canadian companies that have raised their dividend yearly for at least the last ten years and have a market cap of over a billion dollars. Below is each stock’s symbol, name, current yield, current price, price return year-to-date, current dividend, dividend growth year-to-date and current dividend growth streak. Companies on ‘The List’ are added or subtracted once a year, on January 1. After that, ‘The List’ is set for the next twelve months. Prices and dividends are updated weekly.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 10.1% | $5.03 | -25.3% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $72.86 | 21.2% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 7.6% | $50.83 | -15.6% | $3.87 | 5.2% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $21.39 | -31.7% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 2.0% | $53.89 | -7.2% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 2.2% | $145.05 | -10.9% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 5.1% | $136.08 | -7.2% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 6.2% | $29.05 | -21.4% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $94.15 | 17.9% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 6.1% | $45.93 | -12.7% | $2.82 | 5.0% | 16 |

| ENB-T | Enbridge Inc. | 8.1% | $43.57 | -18.3% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 2.7% | $31.86 | -10.8% | $0.85 | 18.2% | 16 |

| FNV-N | Franco Nevada | 1.0% | $137.47 | -0.5% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis Inc. | 4.2% | $54.99 | -0.6% | $2.29 | 5.3% | 49 |

| IFC-T | Intact Financial | 2.3% | $189.34 | -3.3% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.6% | $110.61 | -8.1% | $1.74 | 13.2% | 11 |

| MGA-N | Magna | 3.9% | $47.65 | -17.2% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.8% | $68.74 | -8.9% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 4.9% | $108.47 | -15.3% | $5.34 | 7.7% | 12 |

| SJ-T | Stella-Jones Inc. | 1.3% | $71.67 | 44.6% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 0.9% | $83.16 | 27.3% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 5.0% | $76.16 | -13.1% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.3% | $107.53 | 7.4% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.6% | $102.71 | 5.1% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 7.9% | $46.95 | -11.9% | $3.69 | 3.4% | 22 |

| T-T | Telus Corp. | 6.5% | $22.01 | -16.4% | $1.43 | 7.4% | 19 |

| WCN-N | Waste Connections | 0.8% | $128.04 | -2.8% | $1.05 | 10.5% | 13 |

| Averages | 3.7% | -5.0% | 8.8% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

Note: When the dividend and share price currency match, the calculation is straightforward. But it’s not so simple when the dividend is declared in one currency, and the share price is quoted in another. Dividing the former by the latter would produce a meaningless result because it’s a case of apples and oranges. To calculate the yield properly, you must express the dividend and share price in the same currency.

Performance of ‘The List’

Feel free to click on this link, ‘The List’ for a sortable version from our website.

Last week, ‘The List’ was down with a YTD price return of -5.0% (capital). Dividend growth was up and is now at +8.8% YTD, highlighting growth in income over the past year.

The best performers last week on ‘The List’ were Emera (EMA-T), up +3.68%; Fortis Inc. (FTS-T), up +2.71%; and TC Energy Corp. (TRP-T), up +0.95%.

TFI International (TFII-N) was the worst performer last week, down -9.30%.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

“As a dividend increase is a positive sign of a company’s financial strength, the safest purchase, after research, is a stock with a recent dividend increase.”

– Tom Connolly (the founder of dividendgrowth.ca)

Two companies on ‘The List’ announced a dividend increase last week.

TFI International (TFII-N)) on Monday said it increased its 2024 quarterly dividend from $0.35 to $0.40 per share, payable January 13, 2024, to shareholders of record on December 29, 2023.

This represents a dividend increase of +14.0%, marking the 13th straight year of dividend growth for this quality transportation and logistics company.

Waste Connections (WCN-N) on Wednesday said it increased its 2023 quarterly dividend from $0.255 to $0.285 per share, payable November 28, 2023, to shareholders of record on November 8, 2023.

This represents a dividend increase of +11.8%, marking the 14th straight year of dividend growth for this quality solid waste and recycling services company.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter, we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

Earnings growth and dividend growth tend to go hand in hand, so this information can tell us a lot about the future dividend growth of our quality companies. Monitoring our dividend growers periodically is part of the process, and reading the quarterly earnings releases is a good place to start.

Five earnings reports from companies on ‘The List’ this week

Toromont Industries (TIH-T) will release its third-quarter fiscal 2023 results on Monday, October 30, 2023, after markets close.

Bell Canada (BCE-T) will release its third-quarter fiscal 2023 results on Thursday, November 2, 2023, before markets open.

Telus (T-T) will release its third-quarter fiscal 2023 results on Friday, November 3, 2023, before markets open.

Enbridge Inc. (ENB-T) will release its third-quarter fiscal 2023 results on Friday, November 3, 2023, before markets open.

Magna (MGA-N) will release its third-quarter fiscal 2023 results on Friday, November 3, 2023, before markets open.

Last week, five earnings reports from companies on ‘The List’.

TFI International (TFII-N) released its third-quarter fiscal 2023 results on Monday, October 23, 2023, after markets closed.

“We executed well during this stretch of weaker demand as our team was able to quickly adapt to changing market conditions while further streamlining operations. As a result, we were able to post solid results including close to $280 million of net cash from operating activities. Looking ahead, we’re well positioned to capitalize on the eventual pick-up in demand given our efficient platform, our team’s focus on profitability and cash flow, and our solid financial foundation, which further benefitted from our post-quarter, half billion dollar private placement. It’s this foundation that allows us to strategically allocate capital including eleven acquisitions this year, along with our share repurchases and our Board’s recently approved dividend increase.”

– Alain Bedard, President and Chief Executive Officer

Highlights:

- Third quarter operating income of $200.6 million compares to $318.4 million the same quarter last year, reflecting reduced freight volumes and non-recurring costs, including the prior year divestiture of CFI and the related gain, $5.6 million and $75.7 million, respectively, $5.5 million of IT systems and related transition expenses in U.S. LTL, a $4.7 million expense for the MTM of director share units, and $2.9 million unfavorable currency translation impact1 relative to the same period last year.

- Third quarter net income of $133.3 million compared to $245.2 million in Q3 2022, while adjusted net income1 of $136.0 million compared to $181.2 million as a result of the items described above.

- Third quarter diluted earnings per share (diluted “EPS”) of $1.54 compared to $2.72 in Q3 2022, while adjusted diluted EPS1 of $1.57 compared to $2.01.

- Third quarter net cash from operating activities of $278.7 million compares to $337.8 million in Q3 2022 and free cash flow1 of $198.3 million compares to $292.1 million in Q3 2022.

- The Board of Directors approved a $0.40 quarterly dividend, an increase of 14%.

Outlook:

We are reaffirming our 2023 EPS guidance provided in July of a range of $6 to $6.50. We’re also maintaining our full-year free cash flow outlook at $700 million to $800 million, including CapEx of $200 million to $225 million. In addition, we have already exceeded a combined total of $500 million this year of capital deployed in M&A and share repurchase given our very strong financial position.

Source: (TFII-N) Q3-2023 Quarterly Review

Canadian National Railway (CNR-T) released its third-quarter fiscal 2023 results on Tuesday, October 24, 2023, after markets closed.

“Our ‘Make the Plan, Run the Plan, Sell the Plan’ approach continued to perform well, delivering strong customer service despite weak consumer demand as well as external challenges. As volumes continue to improve, we are well positioned to deliver incremental operating leverage. We remain confident in our ability to accelerate sustainable, profitable growth in 2024 through 2026.”

– Tracy Robinson, President and Chief Executive Officer

Highlights:

- Revenues of C$3,987 million for the third quarter of 2023, a decrease of C$526 million, or 12%, and C$12,357 million for the first nine months of 2023, a decrease of C$208 million, or 2%.

- Operating income of C$1,517 million for the third quarter of 2023, a decrease of C$415 million, or 21% and C$4,779 million for the first nine months of 2023, a decrease of C$149 million, or 3%.

- Operating ratio, defined as operating expenses as a percentage of revenues, of 62.0% for the third quarter of 2023, an increase of 4.8-points and 61.3% for the first nine months of 2023, an increase 0.5-points or an increase of 0.7- points on an adjusted basis.

- Diluted earnings per share (EPS) of C$1.69 for the third quarter of 2023, a decrease of 21% and C$5.27 for the first nine months of 2023, a decrease of 1% or a decrease of 2% on an adjusted basis.

- Free cash flow was C$581 million for the third quarter of 2023, a decrease of C$775 million, or 57% and C$2,274 million for the first nine months of 2023, a decrease of C$650 million, or 22%.

Outlook:

CN continues to expect flat to slightly negative year-over-year growth in adjusted diluted EPS in 2023. CN reiterates its longer-term financial perspective and continues to target compounded annual diluted EPS growth in the range of 10%-15% over the 2024-2026 period driven by growing volumes more than the economy, pricing above rail inflation and incrementally improving efficiency, all of which assumes a supportive economy.

Source: (CNR-T) Q2-2023 Quarterly Review

Waste Connections (WCN-N) released its third-quarter fiscal 2023 results on Wednesday, October 25, 2023, after markets closed.

“We are extremely pleased by the durability of our financial and operating results in the quarter, with momentum for continued outsized margin expansion. Solid operational execution enabled us to deliver adjusted EBITDA(b) margin of 32.5% in the third quarter, as expected, up 140 basis points sequentially and up 120 basis points year over year, in spite of over $15 million in unforeseen headwinds. During the quarter, we overcame elevated levels of risk-related expenses and other lagging effects of higher employee turnover in prior periods, as well as site-specific incremental operating expenses at one of our landfills in California. The expected Q4 and ongoing expanding impacts from that evolving landfill situation are currently being evaluated, along with a recent shorter-term development at a landfill in Texas, and as such weren’t anticipated in the full year outlook we provided in August. We expect to get more clarity going forward but currently estimate the range of outcomes in Q4 to include impacts of up to $20 million to revenue, adjusted EBITDA and adjusted free cash flow.”

– Ronald J. Mittelstaedt, President and Chief Executive Officer

Highlights:

- Revenue of $2.065 billion, up 9.8% year over year

- Net income of $229.0 million, and adjusted EBITDA of $671.2 million, up 14.1% year over year

- Adjusted EBITDA margin of 32.5% of revenue, up 120 basis points year over year and up 140 basis points sequentially from Q2 – Net income of $0.89 per share, and adjusted net income of $1.17 per share

- Year to date net cash provided by operating activities of $1.571 billion and adjusted free cash flow of $969.3 million

- Acquisition activity expected to continue through year-end, with an estimated rollover contribution in 2024 of almost 2% from approximately $250 million in annualized revenues signed or closed to date in 2023

Outlook:

We remain encouraged by the pace of improvement in employee retention, which, along with our differentiated strategy and execution, should provide for above average underlying margin expansion in solid waste collection, transfer and disposal in 2024. On that basis, we should be positioned for high single-digit adjusted EBITDA growth in 2024 on expected mid to high single-digit revenue growth, including approximately $150 million of revenue carryover from acquisitions signed or closed year to date, with upside potential from additional acquisition activity and any further improvement in commodity related activity

Source: (WCN-N) Q3-2023 Quarterly Review

Canadian Utilities Limited (CU-T) released its third-quarter fiscal 2023 results on Thursday, October 26, 2023, before markets opened.

“As you know, we concluded a successful second cycle performance based regulation in our Alberta distribution utilities in 2022. 2023 is a single cost of service rebasing year and in 2024 we will start the third cycle of performance based regulation with final rebased rates.

Performance-based regulation facilitates affordability, which is important to the long term sustainability of the business, as the savings and efficiencies generated in the second PBR cycle are returned to customers through the rebasing process. As expected the impact of our Alberta distribution utilities rebasing resulted in lower year-over-year earnings in the third quarter. On its own, this rebasing contributed to a year-over-year decline in earnings of approximately $70 [ph] million. This is a significant impact to 2023 earnings.”

– Brian Shkrobot, Executive Vice President and Chief Financial Officer

Highlights:

- Canadian Utilities Limited (Canadian Utilities or the Company) today announced third quarter 2023 adjusted earnings of $87 million ($0.32 per share), $33 million ($0.13 per share) lower compared to $120 million ($0.45 per share) in the third quarter of 2022.

- Announced a partnership agreement between the Chiniki and Goodstoney First Nations for the Deerfoot and Barlow Solar power projects, the largest solar installation in an urban centre in Western Canada. Under the terms of the agreement, the Chiniki and Goodstoney First Nations have become the majority

- Entered into a 12.5-year virtual power purchase agreement with Lafarge, an industry leader in sustainable building solutions, in September 2023. Under the terms of the agreement, Lafarge’s Exshaw cement plant will notionally purchase 100 per cent of the solar power generated from the 38.5-MW Empress solar project. wners with a 51 per cent ownership stake in the facilities.

- Received the Alberta Utilities Commission (AUC) decisions with respect to the parameters of the third generation of performance-based regulation (PBR3) and the future Generic Cost of Capital parameters, on October 4, 2023 and October 9, 2023, respectively. We will begin to operate under these new frameworks in 2024. The receipt of both of these critical regulatory decisions in advance of the respective operating years reinforces the strides we’ve seen in reducing regulatory lag.

- In October 2023, the South Australian Government announced an Early Contractor Involvement (ECI) agreement with ATCO Australia and our joint venture partner BOC Linde for the South Australian Hydrogen Jobs Plan project, a 250-MW Hydrogen production facility, a 200-MW Hydrogen-fuelled electricity generation facility and a Hydrogen storage facility. Activities under this agreement include developing a contract offer price, and negotiation of engineering, procurement, construction and O&M contracts for delivery and operations of the project. The ECI phase of the project is due for completion in the second quarter of 2024.

- Appointed John Ivulich to Chief Executive Officer & Country Chair of ATCO Australia, our regulated gas utility and non-regulated renewables, power, and clean fuels businesses in Australia, effective October 1, 2023.

- Incurred $330 million in capital expenditures in the third quarter of 2023, of which 88 per cent was invested in ATCO Energy Systems and 12 per cent mainly in ATCO EnPower.

Source: (CU-T) Q3-2023 Quarterly Review

Fortis Inc. (FTS-T) released its third-quarter fiscal 2023 results on Friday, October 27, 2023, before markets opened.

“The fundamentals of our North American regulated energy delivery businesses remain resilient despite volatility in the macroenvironment in which we operate. We have delivered strong results for the third quarter, driven by the continued execution of our annual capital plan and the completion of key regulatory proceedings in Arizona and British Columbia.”

– David Hutchens, President and Chief Executive Officer

Highlights:

- Third quarter net earnings of $394 million or $0.81 per common share, up from $326 million or $0.68 per common share in 2022

- Adjusted net earnings per common share of $0.84, up from $0.71 in the third quarter of 2022

- Released 2024-2028 capital plan of $25 billion, representing 6.3% average annualized rate base growth

- Capital expenditures of $3.0 billion through September; $4.3 billion annual capital plan on track

- Key regulatory decisions received in Western Canada and Arizona

Outlook:

Fortis continues to enhance shareholder value through the execution of its capital plan, the balance and strength of its diversified portfolio of regulated utility businesses, and growth opportunities within and proximate to its service territories. While energy price volatility, global supply chain constraints, increasing interest rates and inflation represent potential concerns, the Corporation does not expect these factors to have a material impact on its operations or financial results in 2023.

The Corporation’s $25 billion five-year capital plan is expected to increase midyear rate base from $36.8 billion in 2023 to $49.4 billion by 2028, translating into a five-year compound annual growth rate of 6.3%7 .

Beyond the five-year capital plan, additional opportunities to expand and extend growth include: further expansion of the electric transmission grid in the U.S. to facilitate the interconnection of cleaner energy, including infrastructure investments associated with the Inflation Reduction Act of 2022 and the MISO LRTP; climate adaptation and grid resiliency investments; renewable gas solutions and liquefied natural gas infrastructure in British Columbia; and the acceleration of cleaner energy infrastructure investments across our jurisdictions.

Fortis expects its long-term growth in rate base will drive earnings that support dividend growth guidance of 4-6% annually through 2028.

Source: (FTS-T) Q3-2023 Quarterly Review