Last updated by BM on October 09, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was down with a YTD price return of -0.9% (capital). Dividend growth remained the same at +8.5% YTD, highlighting growth in income over the past year.

- Last week, no dividend increases from companies on ‘The List’.

- Last week, no earnings reports from companies on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

- If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service, which grants you access to the MP Wealth-Builder Model Portfolio (CDN) and exclusive subscriber-only content. Learn More

Identifying companies whose dividend growth aligns closely with price growth can considerably enhance the predictability of future returns. Dividend growth investors know that the dividend drives the price in a predictable way, not the other way around. Fortis Inc. (FTS-T) is another company on ‘The List’ that aligns very closely with this dividend growth vs price growth pattern we like to see.

Introduction

“You have a pair of pants. In the left pocket, you have $100. You take $1 out of the left pocket and put it in the right pocket. You now have $101. There is no diminution of dollars in your left pocket. That is one magic pair of pants.”

This ‘magic pants’ analogy was from a Seeking Alpha article on dividend investing I read about a decade ago and was one of the catalysts for me to take a closer look at this type of investing and see if it truly was magical.

After conducting additional research, I have shifted towards utilizing a dividend growth investing (DGI) strategy as my primary investment approach. While I maintain portfolios consisting of high-quality dividend growers from both the United States and Canada, I have opted to concentrate on Canadian (CDN) dividend growth companies in this blog. This is due to several reasons, including a smaller pool of DGI companies to track, a lack of coverage for the DGI strategy by the North American investment media, and a tendency for those who do cover DGI to narrowly focus on only a handful of sectors (Energy and Financials).

While ‘The List’ is not a portfolio in itself, it serves as an excellent initial reference for individuals seeking to diversify their investments and attain higher returns in the Canadian stock market. Through our blog, we provide weekly updates on ‘The List’ and offer valuable perspectives and real-life examples of the dividend growth investing strategy in practice. This helps readers gain a deeper understanding of how to implement and benefit from this investment approach.

DGI Thoughts

“Stock returns always add up to the sum of the current dividend yield, plus dividends/earnings per share growth, plus or minus any change in the valuation”.

– Charles Ellis

‘Higher for longer’

Rising interest rates can have a detrimental impact on stocks for two primary reasons. Firstly, interest expenses play a crucial role in a company’s income statement. If the cost of borrowing money increases, companies tend to borrow less and face higher expenses when refinancing existing debt. Secondly, higher yields present more attractive alternatives for investors’ capital, creating stronger competition for their investments.

With recent data still indicating an overheated economy (inflation accelerating), Central Banks may find themselves with no choice but to raise interest rates further or, at the very least, maintain their current trajectory.

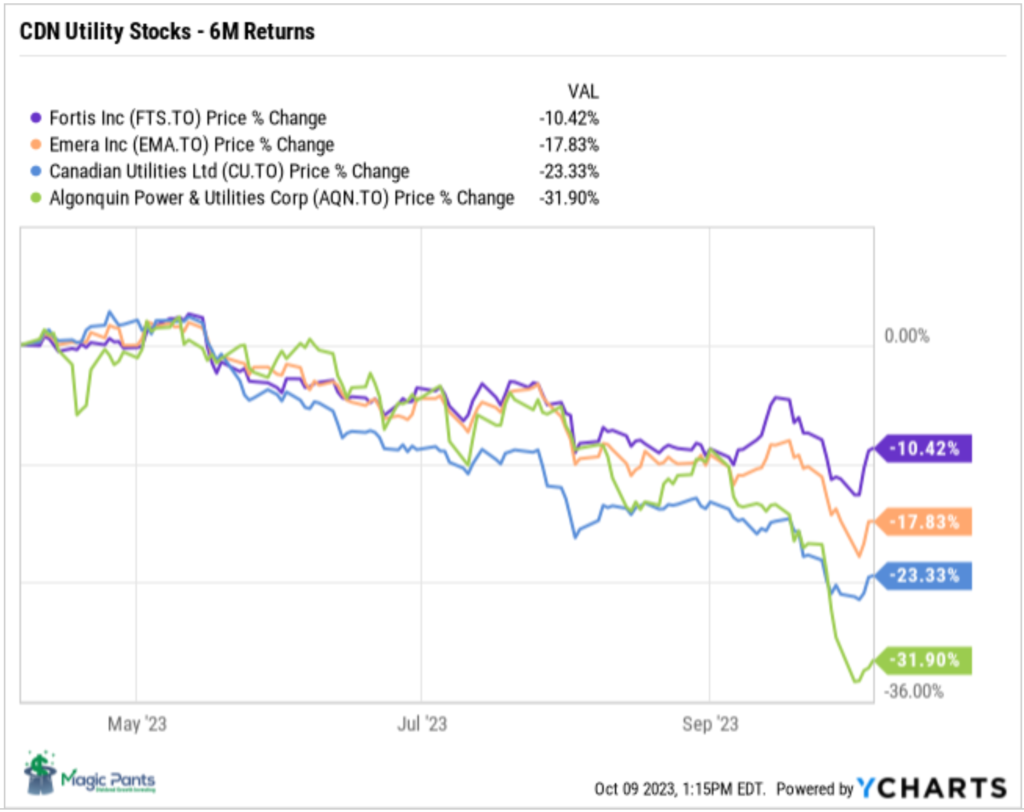

Let’s delve deeper into the implications of the increasingly prevalent “higher for longer” narrative within the investment media. Capital-intensive business models, such as pipelines, telecommunications companies (Telcos), Real Estate Investment Trusts (REITs), and utilities, could experience adverse effects if interest rates remain elevated for an extended period. Even the most defensively positioned sector among them, utilities, is not immune to these impacts.

Utility companies are often considered defensive stocks for several reasons:

- Steady Demand: Utility services, such as electricity, natural gas, water, and telecommunications, are necessities for both individuals and businesses. Regardless of economic conditions, people continue to use these services. This steady demand provides a reliable source of revenue for utility companies.

- Stable Cash Flows: Utility companies typically have a regulated business model. Regulatory bodies often set the rates these companies can charge for their services, which can provide a degree of predictability and stability to their cash flows. This regulation helps ensure that utility companies can cover their operating costs and debt obligations even during economic downturns.

- Income Generation: Many investors, especially those seeking income or dividends, are attracted to utility stocks because they tend to offer relatively high dividend yields. Utility companies often distribute a significant portion of their profits to shareholders in the form of dividends. This income can be especially appealing during periods of economic uncertainty when other investment options may offer lower yields or more risk.

- Low Price Elasticity: The demand for utility services is relatively price inelastic, meaning that changes in the price of these services do not significantly impact demand. People continue to use electricity, gas, and water even if prices increase moderately. This price inelasticity can help protect utility companies from severe revenue declines during economic downturns.

- Defensive Nature: Utility stocks are often considered “defensive” in the sense that they tend to be less sensitive to economic cycles. When the economy is performing poorly, investors may flock to defensive stocks like utilities as a way to preserve capital and maintain income.

- Hedging Against Market Volatility: Utility stocks can act as a hedge against market volatility. During periods of stock market turbulence, investors may seek refuge in assets that are less affected by market fluctuations. Utility stocks, with their stable cash flows and dividends, can provide a level of stability to a diversified investment portfolio.

- Regulated Monopolies: In many cases, utility companies operate as regulated monopolies in specific regions. This means they have limited competition, allowing them to maintain more consistent pricing power and profitability.

With characteristics like these, it’s no surprise that utility companies appear on ‘The List’ and have consistently delivered increasing income and capital appreciation to dividend growth investors for decades. Recent stock market data, however, paints a different picture of their defensive nature.

High interest rates, particularly the current narrative of “higher for longer” interest rates, have had a negative impact on utility companies, for the reasons explained earlier. To succeed, we must identify the highest quality utility companies and increase our holdings when they are oversold and trading at a discount to their fair value (sensible price). High interest rates are not sustainable over the long term and our good dividend growers will eventually rebound. In the short term there will still be yield and growth in a market sell-off.

If you have not yet joined as a paid subscriber of the blog to receive DGI Alerts on the activity and content related to our model portfolio, it’s not too late. Click Here.

Recent News

Dividend stocks may be sinking, but my cash flow keeps growing (Globe & Mail)

“For the first several years, the model portfolio chugged along nicely. Companies raised their dividends regularly, and their share prices moved steadily higher, too.”

DGI Truth #2: A rising dividend income stream will eventually lead to rising stock prices.

I have been following Mr. Heinzl’s articles for several years now and have commented on the reasons why his ‘Yield Hog Dividend Growth Portfolio’ has underperformed our portfolios in the past. While he includes some of our quality companies, he also incorporates REITs and ETFs for diversification. With rising interest rates, he is finally feeling the impact of his decision to include cyclical and lower-quality companies in his portfolio.

“But the benefits of rising dividends are more than financial. When your investment income is growing steadily, it’s easier to accept market volatility and sliding stock prices as normal parts of investing without panicking and doing something rash.”

Although the author seems to grasp many of our dividend growth investing principles, a greater emphasis on quality would have helped avoid many of his ‘surprises’ over the years.

A tough year for dividend stocks puts lots of big names on sale (Globe & Mail)

“But dividend stocks have a couple of advantages when it comes to inflation, Mr. Bushell said. The first is the potential for dividend increases. And the second is that many businesses can pass on some inflation through pricing power.”

DGI Truth #3: Dividend growth investors enjoy inflation-protected income.

Amidst the ongoing discussions regarding the potential for interest rates to remain ‘higher for longer,’ investors seeking greater yields may consider Guaranteed Investment Certificates (GICs) or High-Interest Savings Accounts as more secure options for their funds. However, what they often fail to recognize is that even within these seemingly risk-free investments, their cash remains susceptible to the erosive impact of inflation, resulting in a negative real rate of return. To put it simply, their purchasing power may dwindle over time, despite the appearance of security in their investments.

While we cannot completely shield our capital from price volatility in the short term, we can minimize the impact of inflation on our purchasing power through our income (rising dividends). Thus far, our dividend increases have consistently outpaced the rate of inflation.

The List (2023)

Last updated by BM on October 06, 2023

The Magic Pants List contains 27 Canadian dividend growth stocks. ‘The List’ contains Canadian companies that have raised their dividend yearly for at least the last ten years and have a market cap of over a billion dollars. Below is each stock’s symbol, name, current yield, current price, price return year-to-date, current dividend, dividend growth year-to-date and current dividend growth streak. Companies on ‘The List’ are added or subtracted once a year, on January 1. After that, ‘The List’ is set for the next twelve months. Prices and dividends are updated weekly.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 8.8% | $5.77 | -14.3% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $71.87 | 19.5% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 7.6% | $51.02 | -15.3% | $3.87 | 5.2% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $28.03 | 5.2% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.9% | $56.26 | -3.1% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 2.2% | $146.35 | -10.1% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.9% | $141.56 | -3.4% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 6.1% | $29.42 | -20.4% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $94.15 | 17.9% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 5.9% | $47.39 | -9.9% | $2.82 | 5.0% | 16 |

| ENB-T | Enbridge Inc. | 8.2% | $43.47 | -18.5% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 2.7% | $31.07 | -13.0% | $0.85 | 18.2% | 16 |

| FNV-N | Franco Nevada | 1.0% | $132.15 | -4.3% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis Inc. | 4.3% | $53.45 | -3.4% | $2.29 | 5.3% | 49 |

| IFC-T | Intact Financial | 2.2% | $199.09 | 1.7% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.5% | $116.46 | -3.2% | $1.74 | 10.3% | 11 |

| MGA-N | Magna | 3.4% | $54.18 | -5.8% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.7% | $71.51 | -5.3% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 4.6% | $114.90 | -10.3% | $5.34 | 7.7% | 12 |

| SJ-T | Stella-Jones Inc. | 1.4% | $64.66 | 30.4% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 0.9% | $89.88 | 37.6% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.8% | $79.80 | -9.0% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.1% | $124.78 | 24.6% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.5% | $110.49 | 13.1% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 8.1% | $45.73 | -14.2% | $3.69 | 3.4% | 22 |

| T-T | Telus Corp. | 6.3% | $22.55 | -14.3% | $1.43 | 7.4% | 19 |

| WCN-N | Waste Connections | 0.8% | $135.96 | 3.2% | $1.02 | 7.4% | 13 |

| Averages | 3.6% | -0.9% | 8.5% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

Note: When the dividend and share price currency match, the calculation is straightforward. But it’s not so simple when the dividend is declared in one currency, and the share price is quoted in another. Dividing the former by the latter would produce a meaningless result because it’s a case of apples and oranges. To calculate the yield properly, you must express the dividend and share price in the same currency.

Performance of ‘The List’

Feel free to click on this link, ‘The List’ for a sortable version from our website.

Last week, ‘The List’ was down with a YTD price return of -0.9% (capital). Dividend growth remained the same at +8.5% YTD, highlighting growth in income over the past year.

The best performers last week on ‘The List’ were Alimentation Couche-Tard Inc. (ATD-T), up +4.19%; Enghouse Systems Limited (ENGH-T), up +3.64%; and Fortis Inc. (FTS-T), up +3.61%.

Brookfield Infrastructure Partners (BIP-N) was the worst performer last week, down -4.66%.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

“As a dividend increase is a positive sign of a company’s financial strength, the safest purchase, after research, is a stock with a recent dividend increase.”

– Tom Connolly (the founder of dividendgrowth.ca)

Last week, no dividend increases from companies on ‘The List’.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

Earnings growth and dividend growth tend to go hand in hand, so this information can tell us a lot about the future dividend growth of our quality companies. Monitoring our dividend growers periodically is part of the process, and reading the quarterly earnings releases is a good place to start.

No earnings reports from companies on ‘The List’ this week

Last week, no companies on ‘The List’ reported earnings.