Earnings Releases

Last week, nine companies on ‘The List’ reported their Q3 2022 earnings. Let’s get started with one of our ‘Core’ category companies, Franco-Nevada.

Franco Nevada (FNV-N) released its third-quarter 2022 results on Monday, November 7, 2022, before markets opened.

“Our diversified portfolio performed well in the quarter with declines in precious metal prices partially offset by strong oil and gas prices.”

– Chief Executive Officer, Paul Brink

Highlights:

- Earned record GEOs, revenue, net income, Adjusted Net Income and Adjusted EBITDA YTD in 2022

- No debt and $2.0 billion in available capital as at September 30, 2022

- Generated $232.3 million in operating cash flow for the quarter

Portfolio Additions

- Financing Package with Argonaut Gold on the Magino Gold Project: On October 27, 2022, we acquired a 2% NSR on Argonaut Gold Inc.’s (“Argonaut”) construction-stage Magino gold project located in Ontario, Canada, for a purchase price of $52.5 million. We also completed a private placement with Argonaut of $10.0 million (C$13.6 million). Argonaut reported that the construction of the project is approximately 70% complete as at September 30, 2022, with first gold pour expected in April 2023.

- Financing Package with Westhaven Gold Corp. on Spences Bridge Gold Belt Claims: On October 6, 2022, we acquired a 2% NSR on all of Westhaven Gold Corp’s (“Westhaven”) claims across the Spences Bridge Gold Belt in Southern British Columbia, Canada, for $6.0 million and an existing 2.5% NSR from Westhaven on adjoining properties currently owned by Talisker Resources Ltd. for a purchase price of $0.75 million. In addition, we also subscribed for $0.73 million (C$1.0 million) of Westhaven’s common shares.

- Financing Package with G Mining Ventures on the Tocantinzinho Gold Project: As previously announced on July 18, 2022, we acquired, through our wholly-owned subsidiary, Franco-Nevada (Barbados) Corporation (“FNBC”), a gold stream with reference to production from the Tocantinzinho project, owned by G Mining Ventures Corp. (“G Mining Ventures”) and located in Pará State, Brazil (the Stream”). FNBC will provide a deposit of $250 million. Additionally, through one of our wholly-owned subsidiaries, we agreed to provide G Mining Ventures with a $75.0 million secured term loan (the “Term Loan”). We also subscribed for $27.5 million (C$35.8 million) of G Mining Ventures’ common shares.

Outlook:

“Franco-Nevada has record GEOs, revenue, net income, Adjusted Net Income and Adjusted EBITDA for the three quarters through September 30, 2022 and is on-track to meet full year guidance.

– Chief Executive Officer, Paul Brink

See the full Earnings Release here

Intact Financial (IFC-T) released its third-quarter 2022 results on Tuesday, November 8, 2022, after markets closed.

“We achieved solid operating performance across the platform despite active weather and ongoing cost pressures. Our people are working hard to get customers back on track after the devastation caused by recent hurricanes. At the same time, our balance sheet remains resilient in the context of volatile capital market conditions which we continue to monitor closely. Finally, we continued to make progress on the integration of RSA, with synergies tracking towards our recently increased target of a $350 million run-rate in 2024.”

– Chief Executive Officer, Charles Brindamour

Highlights:

- Net operating income per share decreased 6% to $2.70, reflecting a slight increase in operating combined ratio, offset in part by higher investment and distribution income

- Operating DPW grew 2% as continued solid growth in specialty lines was partially offset by profitability actions, including strategic exits

- Operating combined ratio was robust at 92.6%, with very strong results in commercial lines and Canada personal auto performing as expected

- EPS increased 26% to $2.02 with solid operating and non-operating performance, while last year’s results were impacted by an impairment charge on an investment

- OROE and ROE were strong at 15.0% and 19.1%, respectively, reflecting continued strong performance

- BVPS was stable year-over-year, as strong earnings were offset by significant mark-to-market losses on investments

Outlook:

- Over the next twelve months, we expect firm-to-hard insurance market conditions to continue in most lines of business, driven by inflation and climate change.

- In Canada, we expect firm market conditions to continue in personal property. Personal auto premium growth is expected to be in the midsingle-digit range over the next 12 months, to reflect inflation and evolving driving patterns.

- In commercial and specialty lines across all geographies, hard market conditions are expected to continue.

- In the UK&I, we expect the personal property market to firm as it reacts to inflationary pressures and adapts to reform measures. Personal motor has begun to firm and we anticipate this to increase over time.

– Chief Executive Officer, Charles Brindamour

See the full Earnings Release here

TC Energy (TRP-T) released its third-quarter 2022 results on Wednesday, November 9, 2022, before markets opened.

“Demand for our services across our North American portfolio remains high and we continue to see strong utilization, availability, and overall asset performance. Comparable EBITDA was 10 per cent higher and segmented earnings 16 per cent higher relative to third quarter 2021. As a result, we have increased our 2022 comparable EBITDA outlook which is now expected to be approximately four per cent higher than 2021.”

– Chief Executive Officer, Francois Poirier

Highlights:

- Revised 2022 comparable EBITDA outlook to be higher than 2021, with an expected year-over-year growth rate of approximately four per cent. 2022 comparable earnings per common share1 are expected to be consistent with 2021

- Third quarter 2022 results were underpinned by solid utilization, safe operations and availability across our assets during peak demand. The continued need for energy security has placed renewed focus on the long-term role we believe our infrastructure will play in responsibly fulfilling North America’s growing energy demand:

- Louisiana XPress was phased into service during the quarter and has increased our market share from 25 to approximately 30 per cent of volumes destined for export from third-party U.S. LNG facilities

- Total NGTL System deliveries averaged 12.4 Bcf/d, up four per cent compared to third quarter 2021

- S. Natural Gas Pipelines flows averaged 25.8 Bcf/d, up six per cent compared to third quarter 2021

- Bruce Power provided emission-less power with approximately 95 per cent availability during third quarter 2022

- The Keystone Pipeline System safely reached a record month in September, delivering approximately 640,000 Bbl/d as we commercialized an incremental 10,000 Bbl/d of contracts from the 2019 Open Season

- Third quarter 2022 financial results:

- Net income attributable to common shares of $0.8 billion or $0.84 per common share compared to net income of $0.8 billion or $0.80 per common share in 2021. Comparable earnings1 of $1.1 billion or $1.07 per common share compared to $1.0 billion or $0.99 per common share in 2021

- Segmented earnings of $1.8 billion compared to segmented earnings of $1.5 billion in 2021 and comparable EBITDA of $2.5 billion compared to $2.2 billion in 2021

- Net cash provided by operations of $1.7 billion was consistent with 2021 results and comparable funds generated from operations1 was $1.6 billion, consistent with 2021 results

- Declared a quarterly dividend of $0.90 per common share for the quarter ending December 31, 2022

- Dividend Reinvestment Plan (DRP) participation rate amongst common shareholders was approximately 38 per cent resulting in $342 million reinvested in common equity from the dividends declared July 27, 2022, subsequently paid on October 31, 2022

- Continued to execute on our $34 billion secured capital program, with $2.6 billion invested in third quarter 2022 • Placed the Louisiana XPress, Elwood Power and Wisconsin Access projects into commercial service adding approximately 1 Bcf/d of U.S. natural gas capacity

- Sanctioned the US$0.4 billion Gillis Access project, a 1.5 Bcf/d header system that will connect growing supply from the Haynesville basin to Louisiana markets including the rapidly expanding Louisiana LNG export market. The project has an anticipated in-service date of 2024

- Sanctioned the $0.6 billion Valhalla North and Berland River (VNBR) project in November 2022 that will use non-emitting electric compression to connect migrating supply to key demand markets on our NGTL System with expected in-service in 2026

- Executed definitive agreements in July 2022 with LNG Canada that addressed and resolved disputes over certain incurred and anticipated costs of the Coastal GasLink pipeline project

- Established a strategic alliance with the Comisión Federal de Electricidad (CFE) in August 2022 for the completion and development of natural gas infrastructure in central and southeast Mexico

- Placed the north section of the Villa de Reyes pipeline (VdR North) and the east section of the Tula pipeline (Tula East) into commercial service during the third quarter of 2022

- Reached a final investment decision to proceed and build the US$4.5 billion Southeast Gateway pipeline, a 1.3 Bcf/d, 715 km offshore natural gas pipeline to serve the southeast region of Mexico with an expected in-service date by mid-2025

- Issued common equity for gross proceeds of approximately $1.8 billion in August 2022 to fund costs associated with the construction of the Southeast Gateway pipeline.

Outlook:

- 2022 comparable EBITDA is expected to be higher than 2021 and 2022 comparable earnings per common share outlook is expected to be consistent with 2021. We continue to monitor the impact of changes in energy markets, our construction projects and regulatory proceedings as well as COVID-19 for any potential effect on our 2022 comparable EBITDA and comparable earnings per share.

- Our total capital expenditures for 2022 are now expected to be approximately $9.5 billion. The increase from the amount outlined in the 2021 Annual Report is primarily due to 2022 installments of approximately $1.3 billion for partner equity contributions to the Coastal GasLink Pipeline Limited Partnership (Coastal GasLink LP) in accordance with revised agreements with Coastal GasLink LP. In addition, approximately US$0.7 billion in capital expenditures are expected in 2022 related to the construction of the Southeast Gateway pipeline subsequent to the final investment decision (FID) reached with the CFE in August 2022. Refer to the Recent developments section for additional information on Coastal GasLink and the Southeast Gateway pipeline. Finally, higher project costs are expected for the NGTL System reflecting inflationary pressures on labour and materials, additional regulatory conditions and other factors. We continue to monitor developments on construction projects, focus on cost mitigation strategies and assess market conditions as well as the impact of COVID-19 for further changes to our overall 2022 capital program.

See the full Earnings Release here

Stella-Jones Inc. (SJ-T) released its third-quarter 2022 results on Wednesday, November 9, 2022, before markets opened.

“Stella-Jones delivered strong results this quarter, reflecting the robust growth of our infrastructure-related product sales and the normalization of residential lumber sales,” said Éric Vachon, President and CEO of Stella-Jones. “Our performance demonstrates Stella-Jones’ ability to capitalize on growing utility poles demand, amplified by increased infrastructure spend and broadband network expansion programs. It also highlights the stability of our railway ties business and unique value proposition we deliver to our residential lumber customers. It is this resilience, in the face of inflationary pressures and supply chain constraints, that reaffirms the power of our business model and extensive network.”

–President and Chief Executive Officer, Scott Éric Vachon

Highlights:

- Sales increased 24% to $842 million, driven by all product categories

- EBITDA rose by $50 million to $119 million, a margin of 14.1%

- Net income reached $65 million or $1.07 per share

- Completed acquisition of wood utility pole manufacturing business of Texas Electric Cooperatives, Inc.

- Returned $180 million to shareholders in the first nine months of 2022

- Announced a Normal Course Issuer Bid for 2022-2023

Outlook:

Stella-Jones’ sales are primarily to critical infrastructure-related businesses. While all product categories can be impacted by short-term fluctuations, the business is mostly based on replacement and maintenance driven requirements, which are rooted in our customers’ long-term planning. Corresponding to this longer-term horizon and to better reflect the expected sales run-rate for residential lumber and reduce the impact of commodity price volatility, in March 2022, the Company provided its financial objectives for 2022 to 2024. Below are key highlights of the 2022-2024 financial objectives with a more comprehensive version, including management assumptions, available in the Company’s MD&A. Management remains confident in the achievement of its three-year strategic guidance.

Key Highlights:

Compound annual sales growth rate in the mid-single digit range from 2019 pre-pandemic levels to 2024;

- EBITDA margin of approximately 15% for the 2022-2024 period;

- Capital investment of $90 to $100 million to support the growing demand of its infrastructure-related customer base, in addition to the $50 to $60 million of annual capital expenditures;

- Residential lumber sales expected to stabilize between 20-25% of total sales while infrastructure-related businesses expected to grow to 75-80% of total sales by 2024;

- Anticipated returns to shareholders between $500 and $600 million during the three-year period;

- Leverage ratio of 2.0x-2.5x between 2022-2024, but may temporarily exceed range to pursue acquisitions.

See the full Earnings Release here

CCL Industries (CCL-B-T) released its third-quarter 2022 results on Wednesday, November 9, 2022, after markets closed.

“In the context of extraordinary inflationary pressures in the developed world, including highly volatile energy markets, plus Covid restrictions in China, I am pleased to report strong third quarter results with a record $0.95 adjusted basic earnings per class B share.”

– Chief Executive Officer, Geoffrey T. Martin

Highlights:

- Per Class B share: $0.95 adjusted basic earnings up 11.8%; $0.93 basic earnings up 9.4%; currency translation negative $0.01 per share

- Sales increased 11.4% on 8.8% organic growth, 4.9% acquisition growth partially offset by 2.3% negative currency translation

- CCL, Avery, Checkpoint and Innovia posted organic sales growth of 13.2%, 0.8%, 5.0% and 1.5%, respectively

- Operating income improved 11.6%, excluding negative currency translation of 1.4%, with a 14.9% operating margin

Outlook:

“Our fourth quarter outlook is somewhat clouded by the impact of inflation; although the summer speculative European energy hikes subsided and many other commodities moved off highs by some distance, potential for event driven volatility remains. The demand picture is stable but less certain, with ongoing strength in some businesses now offset by slower conditions in others. The economic forecast for 2023 suggests a deterioration of some note over 2022 conditions, but as always, we focus on making progress in both good and challenging times. At today’s Canadian dollar exchange rates, currency translation would be a modest headwind, if sustained, for the fourth quarter of 2022; as weaker European and Asia Pacific currencies more than offset stronger ones in the U.S. and Latin America.”

– Chief Executive Officer, Geoffrey T. Martin

See the full Earnings Release here

Canadian Tire (CTC-A-T) released its third-quarter 2022 results on Thursday, November 10, 2022, before markets opened.

“In the third quarter, we effectively engaged our loyalty customers, resulting in increased spending per Triangle Member, with total loyalty sales outpacing non-member sales – a trend we expect to continue,” said Greg Hicks, President and CEO, Canadian Tire Corporation. “We remain committed to the strategic growth investments we laid out as part of our Better Connected strategy, and in the near-term, we will face into changing customer demand and a dynamic economic environment with the confidence that our multi-category assortment is well-positioned to meet our customer needs.”

“Throughout its long history, Canadian Tire Corporation has consistently demonstrated the underlying strength and resilience of its business and its ability to deliver steady growth and returns to its shareholders,” said Hicks.

– President and Chief Executive Officer, Greg Hicks

Highlights:

- Revenue increased 8.1% to $4,228.8 million; Revenue (excluding Petroleum) increased 6.0% over the same period last year, with the Retail and Financial Services segments both contributing to growth; on a year-to-date basis, Revenue was up 11.8%, and Revenue (excluding Petroleum) increased 7.8%

- Consolidated IBT was $298.6 million, down 19.3% compared to the third quarter of 2021, and $314.5 million, down 19.1%, on a normalized basis

- Normalized diluted EPS was $3.34, compared to $4.20 in the prior year. Q3 2022 Diluted EPS was $3.14 per share, compared to $3.97 in the prior year.

- Retail Return on Invested Capital (ROIC) calculated on a trailing twelve-month basis, was 12.5% at the end of the third quarter, compared to 13.2% at the end of the third quarter of 2021, as Average Retail Invested Capital increased over the prior period

- Refer to the Company’s Q3 2022 Management Discussion and Analysis (MD&A) section 4.1.1 for information on normalizing items and for additional details on events that have impacted the Company in the quarter

Outlook:

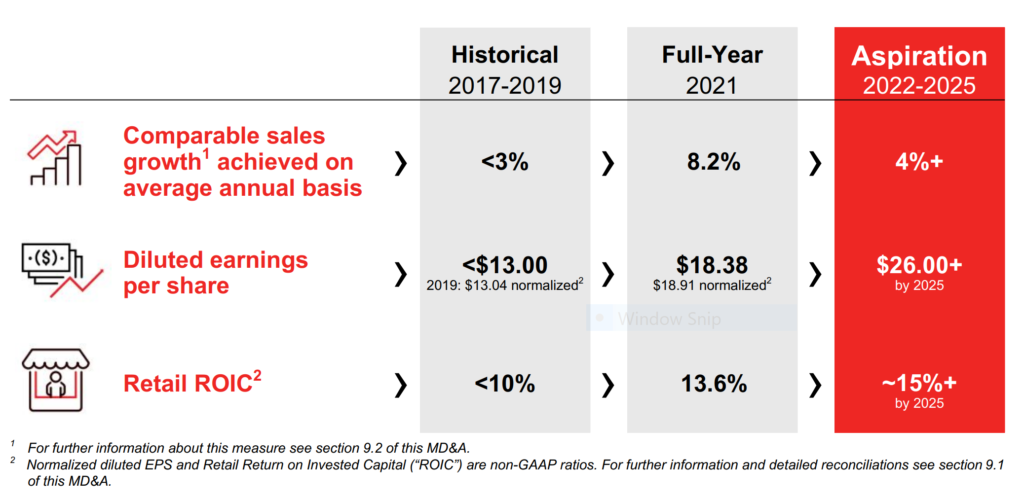

In conjunction with the announcement of its strategic plan, CTC also established the following financial aspirations for fiscal years 2022 to 2025.