Last updated by BM on November 14, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was up slightly with a minus -3.0% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.3% YTD, demonstrating the rise in income over the last year.

- Last week, there was one dividend increase from a company on ‘The List’.

- Last week, nine companies on ‘The List’ reported their Q3 earnings.

- Two companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“Try not to worry about short-term price volatility. Volatility just means ‘they’ don’t know what’s going to happen. We don’t know either, but what we do is predictable. Highly predictable. It’s in our data.”

– Tom Connolly

Double-digit gains last week from four companies on ‘The List’ and one double-digit loss. Add Magna International’s (MGA-N) return of +10.79% to our summary of best performers last week, and you would think that we are finally coming out of the bear market that has dogged us for most of the year. That is until Algonquin Power & Utilities (AQN-N) reported their third-quarter earnings and Q4 2022 guidance, and the stock ended down -15.9% on the week. Also of note, five of the nine companies who reported last week missed Analyst estimates on their Q3 earnings reports. Scroll to the bottom of ‘The List’ menu item to see our ‘Q3 2022 Earnings Calendar’. Unfortunately, nothing has changed from a macro standpoint in the economy, yet investors rush into the market in droves every time there is a hint of good news.

Having a process protects our hard-earned capital. Knowing when to add to a position in these volatile markets is important. As a subscriber of the blog, you will have noticed that we do not always add to a position at the absolute market bottom. As ‘incremental’ buyers (more than one trade) at sensible prices, we increase our probability of a successful outcome.

The actual good news in the market is that the dividend income of ‘The List’ in 2022 is once again higher than inflation and continues to grow (+10.3% YTD), with a handful of companies already announcing increases for 2023. As dividend growth investors, we know that the growing dividend will eventually drive the price higher, so we wait patiently to add to our quality companies. As my mentor, Tom Connolly, states above..” what we do is highly predictable.”

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

Last week, ‘The List’ was up slightly with a minus -3.0% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.3% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were TFI International (TFII-N), up +12.86%; Stella-Jones Inc. (SJ-T), up +11.78%; and Franco Nevada (FNV-N), up +11.58%.

Algonquin Power & Utilities (AQN-N) was the worst performer last week, down -15.91%.

Recent News

Algonquin Power shares plunge nearly 20% as utility lowers guidance, analysts slash price targets (Globe & Mail)

Not all was well in this season’s earnings reports, and one of the utilities we follow on ‘The List’ reported lower-than-expected earnings and was forced to lower guidance for the rest of the year. The reason was challenging macroeconomic conditions (higher interest rates and inflation).

This should not have surprised most investors as (AQN-N) is highly leveraged, and any hint of bad news will send their stock price spiralling downward. The next shoe to drop could be the company’s dividend record. At a minimum, dividend growth will be slowing.

Algonquin Power & Utilities has been a favourite of many dividend ETF’s and model portfolios due to its higher-than-average starting yield. Fortunately, (AQN-N) never passed the ‘quality’ test for us, so we stayed away.

Trudeau government’s tax on corporate share buybacks will likely hurt Canada’s economy (Glove & Mail)

“No tax is ever costless to the economy. Owing mainly to reduced productivity, the cost of a tax on share buybacks will likely exceed the modest revenues the tax will raise.”

In another attempt by governments to legislate that large corporations pay their ‘fair share’ of taxes, Canada may end up doing the opposite, as the author points out.

On the positive side, this could also mean that companies use their cash flow to raise dividends even more if they don’t want to pay the tax on buybacks. We have always preferred dividends to share buybacks as we don’t believe buybacks create long-term wealth for shareholders.

We probably will never know how much of this is good policy over good politics as our memories are short-term, and the result of this new tax could take years to play out.

Two companies on ‘The List’ are due to report earnings this week.

Metro (MRU-T) will release its fourth-quarter 2022 results on Wednesday, November 16, 2022, before markets open.

Loblaws (L-T) will release its third-quarter 2022 results on Wednesday, November 16, 2022, before markets open.

Dividend Increases

One company on ‘The List’ announced a dividend increase last week.

Canadian Tire (CTC-A-T) on Thursday said it increased its 2023 quarterly dividend from $1.625 to $1.725 per share, payable March 1, 2023, to shareholders of record on January 31, 2023.

This represents a dividend increase of +6%, marking the 13th straight year of dividend growth for this quality retailer.

Earnings Releases

Last week, nine companies on ‘The List’ reported their Q3 2022 earnings. Let’s get started with one of our ‘Core’ category companies, Franco-Nevada.

Franco Nevada (FNV-N) released its third-quarter 2022 results on Monday, November 7, 2022, before markets opened.

“Our diversified portfolio performed well in the quarter with declines in precious metal prices partially offset by strong oil and gas prices.”

– Chief Executive Officer, Paul Brink

Highlights:

- Earned record GEOs, revenue, net income, Adjusted Net Income and Adjusted EBITDA YTD in 2022

- No debt and $2.0 billion in available capital as at September 30, 2022

- Generated $232.3 million in operating cash flow for the quarter

Portfolio Additions

- Financing Package with Argonaut Gold on the Magino Gold Project: On October 27, 2022, we acquired a 2% NSR on Argonaut Gold Inc.’s (“Argonaut”) construction-stage Magino gold project located in Ontario, Canada, for a purchase price of $52.5 million. We also completed a private placement with Argonaut of $10.0 million (C$13.6 million). Argonaut reported that the construction of the project is approximately 70% complete as at September 30, 2022, with first gold pour expected in April 2023.

- Financing Package with Westhaven Gold Corp. on Spences Bridge Gold Belt Claims: On October 6, 2022, we acquired a 2% NSR on all of Westhaven Gold Corp’s (“Westhaven”) claims across the Spences Bridge Gold Belt in Southern British Columbia, Canada, for $6.0 million and an existing 2.5% NSR from Westhaven on adjoining properties currently owned by Talisker Resources Ltd. for a purchase price of $0.75 million. In addition, we also subscribed for $0.73 million (C$1.0 million) of Westhaven’s common shares.

- Financing Package with G Mining Ventures on the Tocantinzinho Gold Project: As previously announced on July 18, 2022, we acquired, through our wholly-owned subsidiary, Franco-Nevada (Barbados) Corporation (“FNBC”), a gold stream with reference to production from the Tocantinzinho project, owned by G Mining Ventures Corp. (“G Mining Ventures”) and located in Pará State, Brazil (the Stream”). FNBC will provide a deposit of $250 million. Additionally, through one of our wholly-owned subsidiaries, we agreed to provide G Mining Ventures with a $75.0 million secured term loan (the “Term Loan”). We also subscribed for $27.5 million (C$35.8 million) of G Mining Ventures’ common shares.

Outlook:

“Franco-Nevada has record GEOs, revenue, net income, Adjusted Net Income and Adjusted EBITDA for the three quarters through September 30, 2022 and is on-track to meet full year guidance.

– Chief Executive Officer, Paul Brink

See the full Earnings Release here

Intact Financial (IFC-T) released its third-quarter 2022 results on Tuesday, November 8, 2022, after markets closed.

“We achieved solid operating performance across the platform despite active weather and ongoing cost pressures. Our people are working hard to get customers back on track after the devastation caused by recent hurricanes. At the same time, our balance sheet remains resilient in the context of volatile capital market conditions which we continue to monitor closely. Finally, we continued to make progress on the integration of RSA, with synergies tracking towards our recently increased target of a $350 million run-rate in 2024.”

– Chief Executive Officer, Charles Brindamour

Highlights:

- Net operating income per share decreased 6% to $2.70, reflecting a slight increase in operating combined ratio, offset in part by higher investment and distribution income

- Operating DPW grew 2% as continued solid growth in specialty lines was partially offset by profitability actions, including strategic exits

- Operating combined ratio was robust at 92.6%, with very strong results in commercial lines and Canada personal auto performing as expected

- EPS increased 26% to $2.02 with solid operating and non-operating performance, while last year’s results were impacted by an impairment charge on an investment

- OROE and ROE were strong at 15.0% and 19.1%, respectively, reflecting continued strong performance

- BVPS was stable year-over-year, as strong earnings were offset by significant mark-to-market losses on investments

Outlook:

- Over the next twelve months, we expect firm-to-hard insurance market conditions to continue in most lines of business, driven by inflation and climate change.

- In Canada, we expect firm market conditions to continue in personal property. Personal auto premium growth is expected to be in the midsingle-digit range over the next 12 months, to reflect inflation and evolving driving patterns.

- In commercial and specialty lines across all geographies, hard market conditions are expected to continue.

- In the UK&I, we expect the personal property market to firm as it reacts to inflationary pressures and adapts to reform measures. Personal motor has begun to firm and we anticipate this to increase over time.

– Chief Executive Officer, Charles Brindamour

See the full Earnings Release here

TC Energy (TRP-T) released its third-quarter 2022 results on Wednesday, November 9, 2022, before markets opened.

“Demand for our services across our North American portfolio remains high and we continue to see strong utilization, availability, and overall asset performance. Comparable EBITDA was 10 per cent higher and segmented earnings 16 per cent higher relative to third quarter 2021. As a result, we have increased our 2022 comparable EBITDA outlook which is now expected to be approximately four per cent higher than 2021.”

– Chief Executive Officer, Francois Poirier

Highlights:

- Revised 2022 comparable EBITDA outlook to be higher than 2021, with an expected year-over-year growth rate of approximately four per cent. 2022 comparable earnings per common share1 are expected to be consistent with 2021

- Third quarter 2022 results were underpinned by solid utilization, safe operations and availability across our assets during peak demand. The continued need for energy security has placed renewed focus on the long-term role we believe our infrastructure will play in responsibly fulfilling North America’s growing energy demand:

- Louisiana XPress was phased into service during the quarter and has increased our market share from 25 to approximately 30 per cent of volumes destined for export from third-party U.S. LNG facilities

- Total NGTL System deliveries averaged 12.4 Bcf/d, up four per cent compared to third quarter 2021

- S. Natural Gas Pipelines flows averaged 25.8 Bcf/d, up six per cent compared to third quarter 2021

- Bruce Power provided emission-less power with approximately 95 per cent availability during third quarter 2022

- The Keystone Pipeline System safely reached a record month in September, delivering approximately 640,000 Bbl/d as we commercialized an incremental 10,000 Bbl/d of contracts from the 2019 Open Season

- Third quarter 2022 financial results:

- Net income attributable to common shares of $0.8 billion or $0.84 per common share compared to net income of $0.8 billion or $0.80 per common share in 2021. Comparable earnings1 of $1.1 billion or $1.07 per common share compared to $1.0 billion or $0.99 per common share in 2021

- Segmented earnings of $1.8 billion compared to segmented earnings of $1.5 billion in 2021 and comparable EBITDA of $2.5 billion compared to $2.2 billion in 2021

- Net cash provided by operations of $1.7 billion was consistent with 2021 results and comparable funds generated from operations1 was $1.6 billion, consistent with 2021 results

- Declared a quarterly dividend of $0.90 per common share for the quarter ending December 31, 2022

- Dividend Reinvestment Plan (DRP) participation rate amongst common shareholders was approximately 38 per cent resulting in $342 million reinvested in common equity from the dividends declared July 27, 2022, subsequently paid on October 31, 2022

- Continued to execute on our $34 billion secured capital program, with $2.6 billion invested in third quarter 2022 • Placed the Louisiana XPress, Elwood Power and Wisconsin Access projects into commercial service adding approximately 1 Bcf/d of U.S. natural gas capacity

- Sanctioned the US$0.4 billion Gillis Access project, a 1.5 Bcf/d header system that will connect growing supply from the Haynesville basin to Louisiana markets including the rapidly expanding Louisiana LNG export market. The project has an anticipated in-service date of 2024

- Sanctioned the $0.6 billion Valhalla North and Berland River (VNBR) project in November 2022 that will use non-emitting electric compression to connect migrating supply to key demand markets on our NGTL System with expected in-service in 2026

- Executed definitive agreements in July 2022 with LNG Canada that addressed and resolved disputes over certain incurred and anticipated costs of the Coastal GasLink pipeline project

- Established a strategic alliance with the Comisión Federal de Electricidad (CFE) in August 2022 for the completion and development of natural gas infrastructure in central and southeast Mexico

- Placed the north section of the Villa de Reyes pipeline (VdR North) and the east section of the Tula pipeline (Tula East) into commercial service during the third quarter of 2022

- Reached a final investment decision to proceed and build the US$4.5 billion Southeast Gateway pipeline, a 1.3 Bcf/d, 715 km offshore natural gas pipeline to serve the southeast region of Mexico with an expected in-service date by mid-2025

- Issued common equity for gross proceeds of approximately $1.8 billion in August 2022 to fund costs associated with the construction of the Southeast Gateway pipeline.

Outlook:

- 2022 comparable EBITDA is expected to be higher than 2021 and 2022 comparable earnings per common share outlook is expected to be consistent with 2021. We continue to monitor the impact of changes in energy markets, our construction projects and regulatory proceedings as well as COVID-19 for any potential effect on our 2022 comparable EBITDA and comparable earnings per share.

- Our total capital expenditures for 2022 are now expected to be approximately $9.5 billion. The increase from the amount outlined in the 2021 Annual Report is primarily due to 2022 installments of approximately $1.3 billion for partner equity contributions to the Coastal GasLink Pipeline Limited Partnership (Coastal GasLink LP) in accordance with revised agreements with Coastal GasLink LP. In addition, approximately US$0.7 billion in capital expenditures are expected in 2022 related to the construction of the Southeast Gateway pipeline subsequent to the final investment decision (FID) reached with the CFE in August 2022. Refer to the Recent developments section for additional information on Coastal GasLink and the Southeast Gateway pipeline. Finally, higher project costs are expected for the NGTL System reflecting inflationary pressures on labour and materials, additional regulatory conditions and other factors. We continue to monitor developments on construction projects, focus on cost mitigation strategies and assess market conditions as well as the impact of COVID-19 for further changes to our overall 2022 capital program.

See the full Earnings Release here

Stella-Jones Inc. (SJ-T) released its third-quarter 2022 results on Wednesday, November 9, 2022, before markets opened.

“Stella-Jones delivered strong results this quarter, reflecting the robust growth of our infrastructure-related product sales and the normalization of residential lumber sales,” said Éric Vachon, President and CEO of Stella-Jones. “Our performance demonstrates Stella-Jones’ ability to capitalize on growing utility poles demand, amplified by increased infrastructure spend and broadband network expansion programs. It also highlights the stability of our railway ties business and unique value proposition we deliver to our residential lumber customers. It is this resilience, in the face of inflationary pressures and supply chain constraints, that reaffirms the power of our business model and extensive network.”

–President and Chief Executive Officer, Scott Éric Vachon

Highlights:

- Sales increased 24% to $842 million, driven by all product categories

- EBITDA rose by $50 million to $119 million, a margin of 14.1%

- Net income reached $65 million or $1.07 per share

- Completed acquisition of wood utility pole manufacturing business of Texas Electric Cooperatives, Inc.

- Returned $180 million to shareholders in the first nine months of 2022

- Announced a Normal Course Issuer Bid for 2022-2023

Outlook:

Stella-Jones’ sales are primarily to critical infrastructure-related businesses. While all product categories can be impacted by short-term fluctuations, the business is mostly based on replacement and maintenance driven requirements, which are rooted in our customers’ long-term planning. Corresponding to this longer-term horizon and to better reflect the expected sales run-rate for residential lumber and reduce the impact of commodity price volatility, in March 2022, the Company provided its financial objectives for 2022 to 2024. Below are key highlights of the 2022-2024 financial objectives with a more comprehensive version, including management assumptions, available in the Company’s MD&A. Management remains confident in the achievement of its three-year strategic guidance.

Key Highlights:

Compound annual sales growth rate in the mid-single digit range from 2019 pre-pandemic levels to 2024;

- EBITDA margin of approximately 15% for the 2022-2024 period;

- Capital investment of $90 to $100 million to support the growing demand of its infrastructure-related customer base, in addition to the $50 to $60 million of annual capital expenditures;

- Residential lumber sales expected to stabilize between 20-25% of total sales while infrastructure-related businesses expected to grow to 75-80% of total sales by 2024;

- Anticipated returns to shareholders between $500 and $600 million during the three-year period;

- Leverage ratio of 2.0x-2.5x between 2022-2024, but may temporarily exceed range to pursue acquisitions.

See the full Earnings Release here

CCL Industries (CCL-B-T) released its third-quarter 2022 results on Wednesday, November 9, 2022, after markets closed.

“In the context of extraordinary inflationary pressures in the developed world, including highly volatile energy markets, plus Covid restrictions in China, I am pleased to report strong third quarter results with a record $0.95 adjusted basic earnings per class B share.”

– Chief Executive Officer, Geoffrey T. Martin

Highlights:

- Per Class B share: $0.95 adjusted basic earnings up 11.8%; $0.93 basic earnings up 9.4%; currency translation negative $0.01 per share

- Sales increased 11.4% on 8.8% organic growth, 4.9% acquisition growth partially offset by 2.3% negative currency translation

- CCL, Avery, Checkpoint and Innovia posted organic sales growth of 13.2%, 0.8%, 5.0% and 1.5%, respectively

- Operating income improved 11.6%, excluding negative currency translation of 1.4%, with a 14.9% operating margin

Outlook:

“Our fourth quarter outlook is somewhat clouded by the impact of inflation; although the summer speculative European energy hikes subsided and many other commodities moved off highs by some distance, potential for event driven volatility remains. The demand picture is stable but less certain, with ongoing strength in some businesses now offset by slower conditions in others. The economic forecast for 2023 suggests a deterioration of some note over 2022 conditions, but as always, we focus on making progress in both good and challenging times. At today’s Canadian dollar exchange rates, currency translation would be a modest headwind, if sustained, for the fourth quarter of 2022; as weaker European and Asia Pacific currencies more than offset stronger ones in the U.S. and Latin America.”

– Chief Executive Officer, Geoffrey T. Martin

See the full Earnings Release here

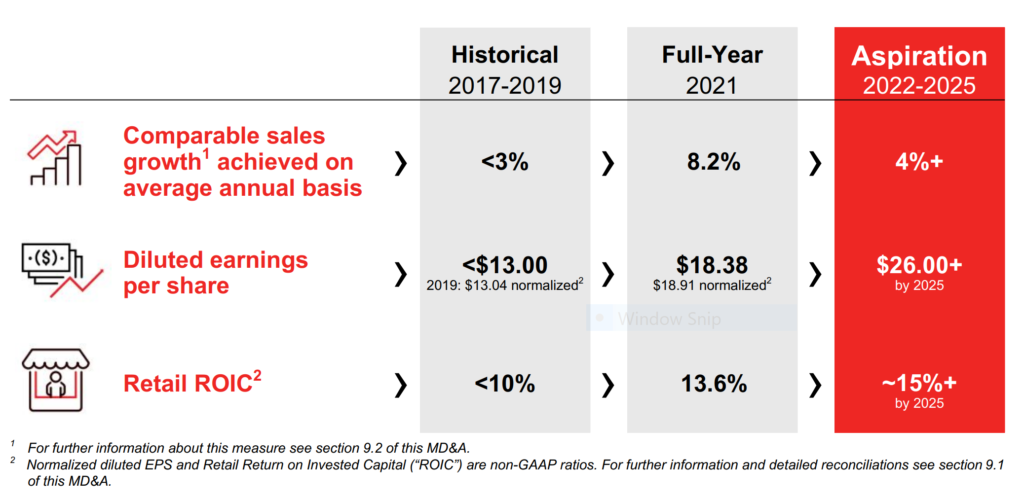

Canadian Tire (CTC-A-T) released its third-quarter 2022 results on Thursday, November 10, 2022, before markets opened.

“In the third quarter, we effectively engaged our loyalty customers, resulting in increased spending per Triangle Member, with total loyalty sales outpacing non-member sales – a trend we expect to continue,” said Greg Hicks, President and CEO, Canadian Tire Corporation. “We remain committed to the strategic growth investments we laid out as part of our Better Connected strategy, and in the near-term, we will face into changing customer demand and a dynamic economic environment with the confidence that our multi-category assortment is well-positioned to meet our customer needs.”

“Throughout its long history, Canadian Tire Corporation has consistently demonstrated the underlying strength and resilience of its business and its ability to deliver steady growth and returns to its shareholders,” said Hicks.

– President and Chief Executive Officer, Greg Hicks

Highlights:

- Revenue increased 8.1% to $4,228.8 million; Revenue (excluding Petroleum) increased 6.0% over the same period last year, with the Retail and Financial Services segments both contributing to growth; on a year-to-date basis, Revenue was up 11.8%, and Revenue (excluding Petroleum) increased 7.8%

- Consolidated IBT was $298.6 million, down 19.3% compared to the third quarter of 2021, and $314.5 million, down 19.1%, on a normalized basis

- Normalized diluted EPS was $3.34, compared to $4.20 in the prior year. Q3 2022 Diluted EPS was $3.14 per share, compared to $3.97 in the prior year.

- Retail Return on Invested Capital (ROIC) calculated on a trailing twelve-month basis, was 12.5% at the end of the third quarter, compared to 13.2% at the end of the third quarter of 2021, as Average Retail Invested Capital increased over the prior period

- Refer to the Company’s Q3 2022 Management Discussion and Analysis (MD&A) section 4.1.1 for information on normalizing items and for additional details on events that have impacted the Company in the quarter

Outlook:

In conjunction with the announcement of its strategic plan, CTC also established the following financial aspirations for fiscal years 2022 to 2025.

See the full Earnings Release here

Stantec (STN-T) released its third-quarter 2022 results on Thursday, November 10, 2022, after markets closed.

“Our performance in the quarter demonstrates the ongoing strong execution of our strategic plan, while our record backlog reflects the resiliency of our business despite broader economic headwinds,” said Gord Johnston, President and CEO. “As we look ahead to the remainder of the year and into 2023, we continue to see numerous growth opportunities that we are well positioned to capture, bolstering our confidence in our ability to deliver on our strategic plan.”

– President and Chief Executive Officer, Gord Johnston

Highlights:

- Net revenue of $1.2 billion, up 24.3% over Q3 2021

- Adjusted diluted EPS1 of $0.86, up 19.4% over Q3 2021

- Backlog of $6.2 billion, up 20.2% since December 31, 2021

Outlook:

Stantec reaffirms full year 2022 guidance for adjusted diluted EPS growth of 22% to 26% and net revenue growth of 18% to 22%, both compared to 2021, and for adjusted EBITDA margin in the range of 15.3% to 16.3%. Stantec further anticipates delivering adjusted return on invested capital of greater than 10.0% for 2022, compared to earlier guidance of greater than 10.5%. This is largely due to the disruption to cash flows arising from the integration of Cardno, which has resulted in higher than anticipated average debt outstanding for the year. Stantec anticipates cash flows and debt levels normalizing by the end of this year as the financial integration work winds up.

See the full Earnings Release here

Algonquin Power & Utilities (AQN-N) released its third-quarter 2022 results on Friday, November 11, 2022, before markets opened.

“It was a challenging third quarter. Despite year-over-year growth in Adjusted EBITDA, our results for the quarter came in below our expectations and were negatively impacted by increasing interest rates and the timing of tax incentives related to certain renewable energy projects. Our underlying businesses remain strong; however, we are not immune to the macroeconomic environment. Our team is focused on identifying and implementing the necessary adjustments while executing on our three pillars of Growth, Operational Excellence and Sustainability to drive shareholder value over the long-term.”

– President and Chief Executive Officer, Arun Banskota

Highlights:

- Adjusted EBITDA of $276.1 million, an increase of 10% compared to the third quarter of 2021.

- Adjusted Net Earnings of $73.5 million, a decrease of 25% compared to the third quarter of 2021. Adjusted Net Earnings was negatively impacted year-over-year by higher interest expense of $23.3 million as a result of borrowings to support growth and higher interest rates. The Company also had lower year-over-year recognition of investment tax credits and production tax credits of $17.1 million, which included revised estimates associated with renewable projects that are now expected to be placed in service in 2023.

- Adjusted Net Earnings per common share of $0.11, a decrease of 27% compared to the third quarter of 2021.

Outlook:

- Updated 2022 Adjusted Net Earnings Per Common Share Estimate – In light of challenging macroeconomic conditions (including higher interest rates and inflation), delays in the construction and completion of certain of the Company’s renewable energy projects, and anticipated delays in connection with certain rate decisions, among other factors, the Company is updating its previously-disclosed Adjusted Net Earnings per common share estimate for the 2022 fiscal year from a range of $0.72-$0.77 to a range of $0.66-$0.69. This revised estimate is based on, and should be read in conjunction with, the assumptions set out under “Outlook – Updated 2022 Adjusted Net Earnings Per Common Share Estimate” and “Caution Concerning Forward-Looking Statements and Forward-Looking Information” in AQN’s Management Discussion & Analysis for the three and nine months ended September 30, 2022 (the “Interim MD&A”), which will be available on SEDAR, EDGAR and the Company’s web site. Please also refer to “Caution Regarding Forward-Looking Information” and “Non-GAAP Measures” below.

- Update on Longer-Term Targets – Given the challenging macroeconomic environment, which is expected to continue into 2023, the Company is evaluating its longer-term targets and financial expectations. The Company intends to provide further details at its upcoming Investor and Analyst Day, expected to be held in early 2023.

See the full Earnings Release here

Emera Inc. (EMA-T) released its third-quarter 2022 results on Friday, November 11, 2022, before markets opened.

“In the face of the devastating storm impacts and extensive system outages resulting from Hurricanes Fiona and Ian, the restoration efforts of our teams in Nova Scotia and Tampa were remarkable,” said Scott Balfour, President and CEO of Emera Inc. “For the quarter, we continued to invest in meeting our customers needs for cleaner, reliable and cost-effective energy, and in so doing also delivered for our shareholders. Emera’s solid 5% growth in year-to-date earnings per share, and 12% growth in quarterly earnings per share year-over-year was principally driven by continued strong performance from our Florida utilities. Looking forward, continuing strong economic and customer growth in Florida is also supporting our updated $8-$9 billion capital plan and 7- 8% consolidated rate base growth over the 2023 – 2025 period, with approximately 75% of our capital plan expected to be invested in Tampa Electric and Peoples Gas.”

– President and Chief Executive Officer, Scott Balfour

Highlights:

- Quarterly adjusted EPS increased $0.08 or 12% to $0.76 compared to $0.68 in Q3 2021. Quarterly reported EPS increased $0.90 to $0.63 in Q3 2022 compared to a net loss per common share of $(0.27) in Q3 2021 due to lower mark-to-market (“MTM”) losses in 2022.

- Year-to-date, adjusted EPS increased $0.10 or 5% to $2.27 compared to $2.17 in Q3 2021. Year-to-date reported EPS increased by $1.02 to $1.75 from $0.73 in 2021 due to lower MTM losses in 2022.

- Adjusted EPS contributions from regulated utilities increased 11% for the quarter and 12% year-to-date primarily driven by the impact of favourable weather and new rates at Tampa Electric, as well as from customer growth at both Tampa Electric and People’s Gas (“PGS”). Higher marketing and trading margin increased adjusted EPS1 by $0.05 for the quarter due to higher natural gas prices and volatility, which created profitable opportunities for Emera Energy Services (“EES”). These increases were partially offset by higher corporate costs, and a higher share count.

- On track to deploy $2.7 billion of capital investment in 2022, principally focused on decarbonization and reliability investments across the portfolio.

Outlook:

The energy and services company said it was on track to deploy $2.7 billion of capital investment in 2022, principally focused on decarbonization and reliability investments across the portfolio.

“Emera’s solid 5% growth in year-to-date earnings per share, and 12% growth in quarterly earnings per share year-over-year was principally driven by continued strong performance from our Florida utilities,” Scott Balfour, President and CEO of Emera.

“Looking forward, continuing strong economic and customer growth in Florida is also supporting our updated $8-$9 billion capital plan and 7-8% consolidated rate base growth over the 2023-2025 period, with approximately 75% of our capital plan expected to be invested in Tampa Electric and Peoples Gas,” he said.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on November 11, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 7.6% | $9.30 | -35.2% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.7% | $62.90 | 20.7% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.8% | $62.53 | -5.1% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.8% | $37.95 | -6.8% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.6% | $58.98 | -13.0% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.8% | $161.97 | 4.6% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.7% | $156.79 | -14.4% | $5.85 | 21.1% | 11 |

| CU-T | Canadian Utilities Limited | 5.0% | $35.62 | -2.7% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $77.34 | 22.0% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 5.2% | $51.96 | -17.0% | $2.68 | 4.1% | 15 |

| ENB-T | Enbridge Inc. | 6.2% | $55.47 | 12.0% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.3% | $31.20 | -32.0% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 0.9% | $141.65 | 4.1% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 4.1% | $53.46 | -11.6% | $2.17 | 4.3% | 48 |

| IFC-T | Intact Financial | 2.1% | $193.74 | 18.3% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.4% | $109.78 | 6.9% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 2.9% | $62.74 | -23.1% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.5% | $72.10 | 7.5% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 3.8% | $131.68 | -3.8% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 1.7% | $46.41 | 14.1% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $65.72 | -6.4% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.0% | $88.44 | -11.0% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.0% | $103.94 | -6.1% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.5% | $102.45 | -9.9% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.6% | $64.02 | 7.2% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.6% | $29.02 | -2.5% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $136.25 | 1.6% | $0.95 | 11.8% | 12 |

| Averages | 3.0% | -3.0% | 10.3% | 18 |