Posted by BM on September 13, 2021

“While dividend investing is a timeless strategy, investors should consider several key attributes combined with today’s market dynamics.”

If you get a chance this week read the article published by nuveen, a global investment management firm.

– Available at: https://documents.nuveen.com/Documents/nuveen/Default.aspx?uniqueId=5d8a964c-cbcf-4a07-b181-eb6ace0eb3b4

The article reiterates a lot of the same attributes the dividend growth investors know and love. What caught my eye though was some of the other advantages that are specific to the market we are in today.

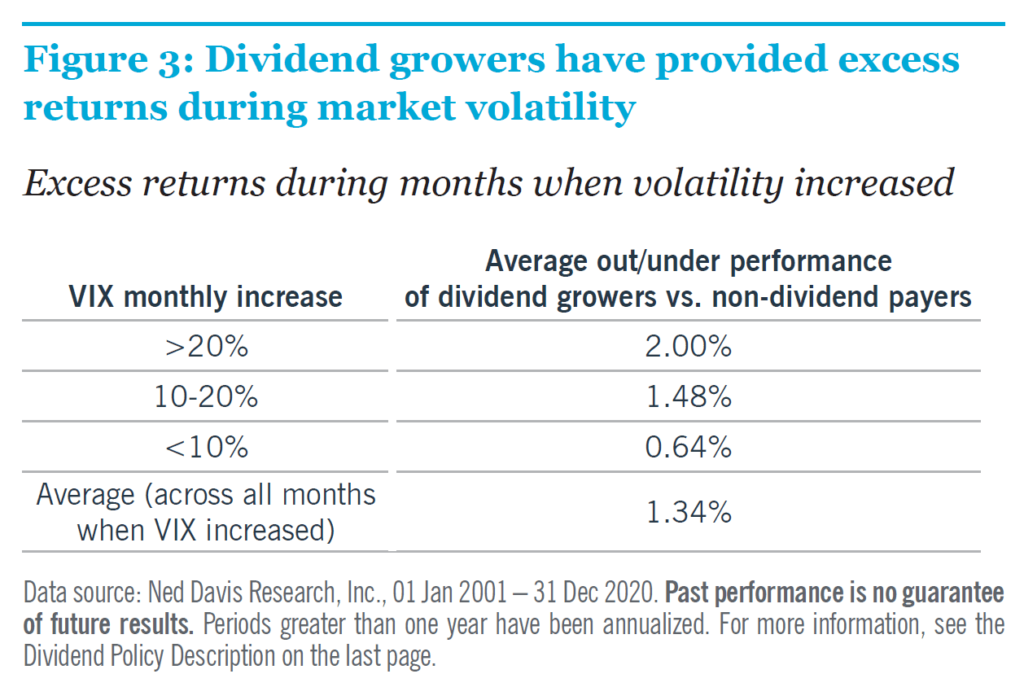

The first attribute that stood out for me was the research behind dividend growth companies and market volatility.

Comforting to know that during periods of market volatility, dividend growth stocks had provided excess returns. In today’s overvalued market of non-dividend payers, the probability that there will be an increase in volatility is on the rise.

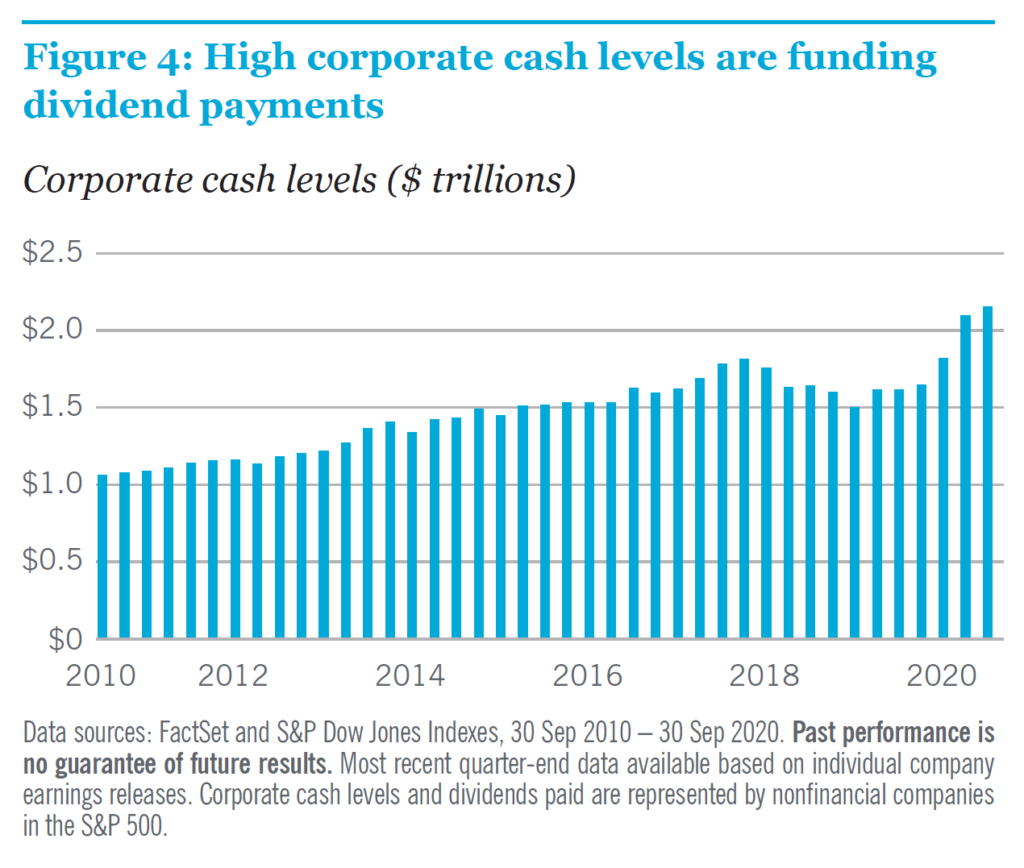

High levels of cash on corporate balance sheets in markets that are overvalued is good for dividend growth stocks.

According to this article, cash on corporate balance sheets are near their highest levels in two decades.

The good news for dividend growth investors is that corporate management teams are more likely to focus on raising dividends as opposed to stock buybacks given the price-to-earnings multiple expansions in 2019 and 2020 (the excitement factor). Buying overvalued stock would not be a good use of excess cash.

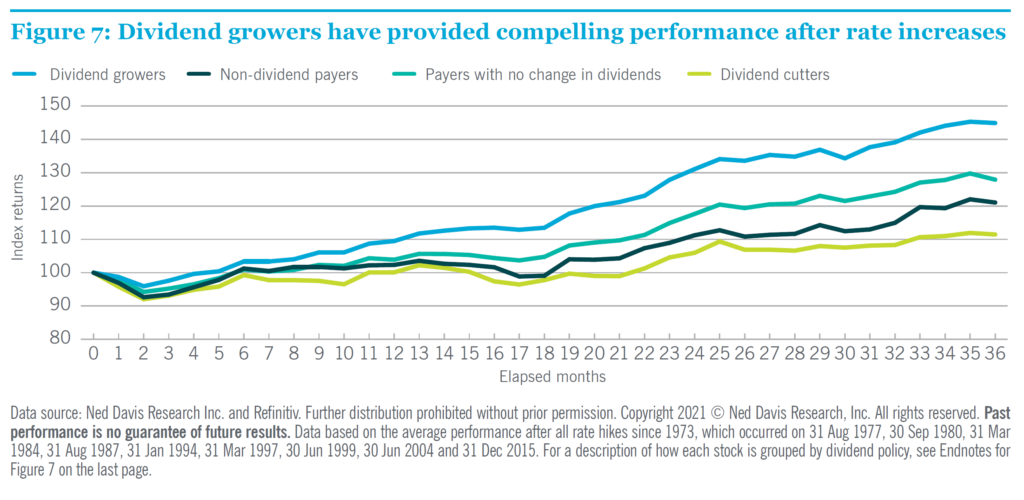

Dividend growers and initiators have outperformed after the Fed has increased interest rates.

Extraordinary levels of monetary and fiscal stimulus have boosted the economy, but inflation fears are on everyone’s mind. Although rates are currently near zero, a shift in policy with respect to interest rates may happen if inflation is more than transitory as the Fed will have us believe.

Today’s market dynamics are certainly cause for concern, but it helps to know that our dividend growers have attributes that will help mitigate the short term price return swings when market volatility eventually arrives.