Last updated by BM on November 27, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was down slightly with a YTD price return of +2.5% (capital). Dividends have increased by +8.8% YTD, highlighting the growth in the dividend (income).

- Last week, no dividend announcements from companies on ‘The List’.

- Last week, no earnings reports from companies on ‘The List’.

- Three companies on ‘The List’ are due to report earnings this week.

The List (2023)

The Magic Pants List includes 27 Canadian dividend growth stocks. Each have raised their dividend annually for the last ten years (or longer) and have a market cap of over a billion dollars. Based on these criteria, companies on ‘The List’ are added or removed annually, on January 1. Prices and dividends are updated weekly.

While ‘The List’ does not function as a portfolio on its own, it serves as an excellent initial reference for individuals looking to diversify their investments and achieve higher returns in the Canadian stock market. Through our newsletter, readers gain a deeper understanding of how to implement and benefit from our Canadian dividend growth investing strategy.

If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service. Subscribers gain access to buy/sell alerts and exclusive content available only to subscribers.

Performance of ‘The List’

Last week, ‘The List’ was down slightly with a YTD price return of +2.5% (capital). Dividends have increased by +8.8% YTD, highlighting the growth in the dividend (income).

The best performers last week on ‘The List’ were TFI International (TFII-N), up +3.76%; Enghouse Systems Limited (ENGH-T), up +2.53%; and Intact Financial (IFC-T), up +1.48%.

Canadian Tire (CTC-A-T) was the worst performer last week, down -5.86%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 8.4% | $6.03 | -10.4% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.7% | $79.20 | 31.7% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 7.2% | $53.76 | -10.7% | $3.87 | 5.2% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $27.19 | -13.2% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.8% | $57.80 | -0.4% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 2.0% | $157.24 | -3.5% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.9% | $139.60 | -4.8% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 5.8% | $30.72 | -16.8% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $98.25 | 23.0% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 5.8% | $48.20 | -8.4% | $2.82 | 5.0% | 16 |

| ENB-T | Enbridge Inc. | 7.6% | $46.57 | -12.7% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 2.5% | $34.44 | -3.6% | $0.85 | 18.2% | 16 |

| FNV-N | Franco Nevada | 1.2% | $117.56 | -14.9% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis Inc. | 4.1% | $55.73 | 0.7% | $2.29 | 5.3% | 49 |

| IFC-T | Intact Financial | 2.1% | $212.14 | 8.4% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.4% | $121.67 | 1.1% | $1.74 | 13.2% | 11 |

| MGA-N | Magna | 3.4% | $54.75 | -4.8% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.7% | $69.74 | -7.6% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 4.5% | $118.96 | -7.1% | $5.34 | 7.7% | 12 |

| SJ-T | Stella-Jones Inc. | 1.2% | $79.46 | 60.3% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 0.8% | $95.55 | 46.3% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.6% | $83.35 | -4.9% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.2% | $117.39 | 17.2% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.5% | $112.93 | 15.6% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 7.3% | $50.60 | -5.1% | $3.69 | 3.4% | 22 |

| T-T | Telus Corp. | 5.9% | $24.06 | -8.6% | $1.43 | 7.4% | 19 |

| WCN-N | Waste Connections | 0.8% | $133.31 | 1.2% | $1.05 | 10.5% | 13 |

| Averages | 3.4% | 2.5% | 8.8% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

DGI Clipboard

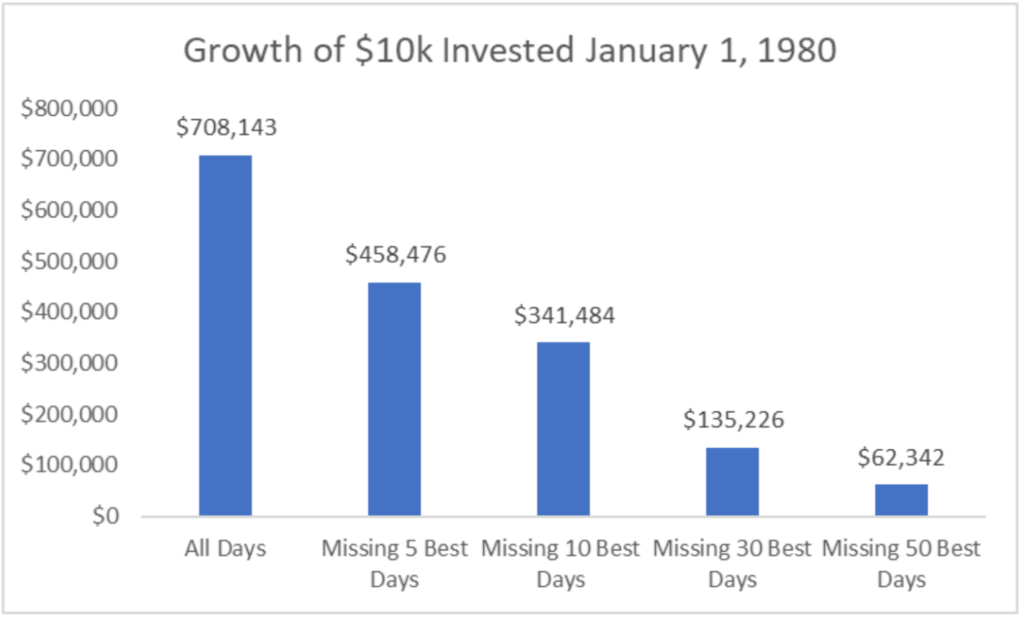

“Time in the market is more important than timing the market.”

Market Timing

Source: FMRco, January 2019

We likely all know someone who entered an investment right before it surged and exited just before a decline. However, finding individuals claiming consistent success in this practice is exceptionally challenging, if not impossible.

As the image above depicts, attempting to time the market is statistically unfavorable. On the contrary, an investor employing a buy-and-hold strategy, even with the most unfortunate timing in history, would still surpass the average investor by a substantial margin.

Consider a hypothetical investor who invested $50,000 in the S&P 500 at the market peak just before each of the four worst bear markets in the last 50 years:

Investment 1: $50,000 in December 1972 (before a 48% crash)

Investment 2: $50,000 in August 1987 (before a 34% crash)

Investment 3: $50,000 in December 1999 (before a 49% crash)

Investment 4: $50,000 in October 2007 (before a 52% crash)

Despite the dismal timing of these purchases, the investor refrained from panic selling and automatically reinvested dividends. By May 2019, their initial $200,000 investment had grown to $3,894,503. A commendable nest egg, considering the unfavorable timing of the investments.

Source: https://www.moneycrashers.com/reasons-shouldnt-time-market/

We tend to get similar results with our dividend growth investing strategy. Below is a chart we do each year with the companies on ‘The List’ to help us stay disciplined when it comes to market timing. Regardless of valuation or current market trends, purchasing an equal amount of every company on ‘The List’ on January 1, 2013, would have produced annualized returns of 12.4%.

If you have not yet joined as a paid subscriber of the blog to receive DGI Alerts on the activity and content related to our model portfolio, it’s not too late. Click Here.

Recent News

Cobre Panama Additional Operations Update and Revised Franco Nevada Guidance

We continue to monitor the developments in a story that is impacting one of the companies on ‘The List.’

Franco-Nevada (FNV-N) holds a substantial royalty stream with First Quantum, the owner of the Cobre Panama mine. The recent uncertainty surrounding the constitutionality of the agreement between First Quantum and the government of Panama has exerted downward pressure on Franco-Nevada’s stock price.

In response to this, the company (FNV-T) has deemed the challenge to Law 406 significant enough to warrant a reissuing of guidance for this fiscal year. Currently, the Cobre Panama royalty stream constitutes approximately 21% of Franco-Nevada’s revenue. The stock is likely to face further declines if a swift resolution is not reached. Presently, the Supreme Court of Panama is in session, working towards resolving the issue.

On a positive note, Franco-Nevada and First Quantum have a crucial factor working in their favor. Cobre Panama, with its 4,000 employees, contributes around 5% to the national GDP. This economic impact may play a role in the resolution of the dispute. However, the stock’s fate hinges on the outcome of the Supreme Court deliberations.

BREAKING NEWS: Panama’s top court rules First Quantum’s mining contract is unconstitutional

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

No companies on ‘The List’ announced a dividend increase last week.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter, we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

Three earnings reports from companies on ‘The List’ this week

Alimentation Couche-Tard Inc. (ATD-T) will release its second-quarter fiscal 2024 results on Tuesday, November 28, 2023, after markets close.

Royal Bank of Canada (RY-T) will release its fourth-quarter and fiscal 2023 results on Thursday, November 30, 2023, before markets open.

TD Bank (TD-T) will release its fourth-quarter and fiscal 2023 results on Thursday, November 30, 2023, before markets open.

Last week, no earnings reports from companies on ‘The List’.