MP Market Review – November 25, 2022

Last updated by BM on November 28, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was up again with a minus -1.4% YTD price return (capital). Dividend growth of ‘The List’ continues to grow and is now at +10.6% YTD, demonstrating the rise in income over the last year.

- Last week, there was one dividend increase from a company on ‘The List’.

- Last week, there was one earnings report from a company on ‘The List’.

- Two companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“As income investors, our primary concern is not the price of a stock on a given day. We are not sellers, we are always net buyers of stocks. So we want to constantly question whether changing conditions will put our dividends at risk. The good news is that the pressures of this selloff are valuation driven, not driven by the fundamentals. Fundamentally, the companies we are invested in likely have higher earnings this quarter than last quarter. Earnings are climbing, it’s the market’s valuation of those earnings that is declining.”

– Rida Morwa, Seeking Alpha Contributor

Changing conditions have certainly put Algonquin Power & Utilities (AQN-N) dividend at risk. Algonquin’s earnings are not climbing, they are dropping, and higher interest rates have certainly affected their ability to service their floating rate debt. With a cash flow deficit looming and a payout ratio set to exceed 100%, (AQN-N) will likely need to cut its dividend to fund its capital program.

We have never owned (AQN-N) in our portfolios because they did not score high enough on our quality indicators. Most dividend growth ETFs and model portfolios did, however own Algonquin Power & Utilities because they don’t put the same emphasis on quality as we do. They are more interested in yield than quality.

We have updated our post, ‘Finding Quality Dividend Growth Stocks’, from 2021. From time to time, we will update some of our learning material to reflect new research. Keep these indicators nearby whenever you are thinking about entering a position in a dividend growth stock.

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

Last week, ‘The List’ was up slightly with a minus -1.4% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.6% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were Loblaws (L-T), up +6.14%; Franco Nevada (FNV-N), up +4.08%; and Dollarama Inc. (DOL-T), up +3.93%.

Alimentation Couche-Tard Inc. (ATD-T) was the worst performer last week, down -1.36%.

Recent News

Couche-Tard shares have had a good year. Here’s why investors shouldn’t shy away from a winner (Globe & Mail)

The author details why Alimentation Couche-Tard Inc. is a good company to own in all markets. Although the valuation could be better, the article makes a good argument for getting in now, as this dividend grower rarely goes on sale. Nice dividend raise last week of 27.3% is a good sign that he may be right.

See the earnings report below for more insight on (ATD-T).

Why I’m buying more of these two dividend-growing utilities (Globe & Mail)

It seems that owning lower-quality dividend growth companies in the model ‘Yield Hog Dividend Growth Portfolio’ has finally caught up to Mr. Heinzl. He decided to sell his Algonquin Power & Utilities holdings and reinvest in higher-quality utilities after Algonquin reported less-than-stellar earnings and a revised outlook in its recent third quarter.

“If there is one lesson Algonquin taught us, however, it’s that even companies with a history of raising their dividends can stumble.”

Mr. Heinzl is right about dividend growers stumbling from time to time. Assessing the quality of our good dividend growers is the first step in our process. We don’t move forward unless several quality indicators are present.

Two companies on ‘The List’ are due to report earnings this week.

Royal Bank of Canada (RY-T) will release its fourth-quarter 2022 results on Wednesday, November 30, 2022, before markets open.

TD Bank (TD-T) will release its fourth-quarter 2022 results on Thursday, December 1, before markets open.

Dividend Increases

One company on ‘The List’ announced a dividend increase last week.

Alimentation Couche-Tard Inc. (ATD-T) on Wednesday said it increased its 2023 quarterly dividend from $0.11 to $0.14 per share, payable December 15, 2022, to shareholders of record on December 1, 2022.

This represents a dividend increase of +27.3%, marking the 13th straight year of dividend growth for this global convenience-store operator.

Earnings Releases

Alimentation Couche-Tard Inc. (ATD-T) follows an off-cycle reporting schedule. On Wednesday, November 23, 2022, before markets opened, they reported their Q2 Fiscal 2023 earnings.

“We are pleased to report strong results this quarter, especially in the face of the continued challenges of high inflation, energy and fuel prices across the global economy. We had good performance in convenience with favorable same store sales, particularly in our U.S. market, which had strong growth in food, and positive promotional activity. We also continued to generate robust fuel margins across all of our platforms. As always, we remain committed to delivering consistent value both inside our stores and on our forecourts to help make our customers’ lives a little easier every day.”

– President and Chief Executive Officer, Brian Hannasch

Highlights:

- Net earnings were $810.4 million, or $0.79 per diluted share for the second quarter of fiscal 2023 compared with $694.8 million, or $0.65 per diluted share for the second quarter of fiscal 2022. Adjusted net earnings1 were approximately $838.0 million compared with $693.0 million for the second quarter of fiscal 2022. Adjusted diluted net earnings per share1 were $0.82, representing an increase of 26.2% from $0.65 for the corresponding quarter of last year.

- Total merchandise and service revenues of $4.1 billion, an increase of 2.3%. Same-store merchandise revenues2 increased by 5.6% in the United States, by 2.9% in Europe and other regions1, and decreased by 1.5% in Canada.

- Merchandise and service gross margin1 increased by 0.2% in the United States to 34.0%, by 0.9% in Canada to 33.2% and decreased by 0.1% in Europe and other regions to 38.3%.

- Same-store road transportation fuel volumes decreased by 1.9% in the United States, by 6.3% in Europe and other regions, and by 6.5% in Canada.

- Road transportation fuel gross margin1 of 49.16¢ per gallon in the United States, an increase of 12.77¢ per gallon, US 9.76¢ per liter in Europe and other regions, a decrease of US 0.81¢ per liter driven by the impact of currency translation, and CA 12.55¢ per liter in Canada, an increase of CA 1.52¢ per liter. Fuel margins remained healthy throughout the network due to favorable market conditions and the continued work on the optimization of the supply chain.

- The Corporation completed the acquisition of 218 sites within the Wilsons network, consisting of 79 company-owned and operated convenience retail and fuel locations, 2 company-owned and dealer-operated locations, 137 dealer-owned and operated locations, and a fuel terminal in Atlantic Canada. According to the Corporation’s agreement with the competition bureau, a portion of this network will be divested.

- During the second quarter and first half-year of fiscal 2023, the Corporation repurchased shares for amounts of $205.2 million and $683.2 million, respectively. Subsequent to the end of the quarter, shares were repurchased for an amount of $396.2 million.

- Sustained healthy financial situation as demonstrated by a leverage ratio1 of 1.20 : 1, and a return on capital employed1 of 16.4%, both driven by strong earnings.

- 3% increase of the quarterly dividend, from CA 11.0¢ per share, bringing it to CA 14.0¢ per share.

Outlook:

“We are proud of the recent significant milestones that we have achieved especially in innovation and mobility. Over 1,000 units have been deployed so far in the roll out of our easy-to-use, smart checkout technology. We passed one million pay-by-plate fuel transactions on Circle K forecourts in Europe and launched the first-ever public EV-chargers for trucks in Scandinavia. We have also piloted our new loyalty program in the U.S. and new tiered concept in Europe. We are pleased with the early results of those pilots and are preparing for an expansion in the upcoming quarters,” concluded Brian Hannasch..

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on November 25, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 9.2% | $7.68 | -46.5% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $60.88 | 16.9% | $0.47 | 26.2% | 12 |

| BCE-T | Bell Canada | 5.7% | $64.15 | -2.7% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.8% | $37.76 | -7.3% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.5% | $64.07 | -5.5% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.7% | $169.17 | 9.2% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.9% | $150.08 | -18.1% | $5.85 | 21.1% | 11 |

| CU-T | Canadian Utilities Limited | 4.8% | $36.84 | 0.6% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $80.75 | 27.3% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 5.1% | $52.73 | -15.8% | $2.68 | 4.1% | 15 |

| ENB-T | Enbridge Inc. | 6.1% | $55.94 | 12.9% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.4% | $30.18 | -34.2% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 0.9% | $144.45 | 6.1% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 4.0% | $54.09 | -10.6% | $2.17 | 4.3% | 48 |

| IFC-T | Intact Financial | 2.0% | $197.71 | 20.8% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.3% | $117.75 | 14.6% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 2.9% | $61.64 | -24.5% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.4% | $77.26 | 15.2% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 3.7% | $134.81 | -1.5% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 1.7% | $47.31 | 16.3% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.0% | $67.81 | -3.4% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 3.9% | $91.02 | -8.4% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.0% | $106.19 | -4.1% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.5% | $102.34 | -10.0% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.4% | $65.97 | 10.4% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.6% | $29.04 | -2.4% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $142.17 | 6.0% | $0.95 | 11.8% | 12 |

| Averages | 3.0% | -1.4% | 10.6% | 18 |

MP Market Review – November 18, 2022

Last updated by BM on November 21, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was down slightly with a minus -3.3% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.3% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, two companies on ‘The List’ reported their earnings.

- No companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

Williams shared many of Graham’s views when it came to drawing a distinction between investing and speculating. Williams defined an investor as “a buyer interested in dividends, or coupons and principal,” and a speculator as “a buyer interested in the resale price” alone.

– John Burr Williams, The Theory of Investment Value

As dividend growth investors, we like to tell the story of the two farmers, the chicken farmer and the egg farmer. Given what we are seeing in markets now, we thought it was a good time to tell the story again.

“Imagine two farms and two farmers. One farmer raises chickens and sells them to grocery stores. We’ll call him a chicken farmer. The other farmer keeps hens in a henhouse and feeds the eggs to his rather large family. The second one is an egg farmer.

The first person, the chicken farmer, is vitally interested in the market value of chickens. The second one, the egg farmer, is vitally interested in the number of eggs that his hens can lay, and in the health of the hens, but he doesn’t care at all about the market value of his hens.

For the chicken farmer, risk means the probability of a decline in the price of chickens. On the other hand, the egg farmer could care less about market values. His risks are foxes, and viruses, and other such threats to the well-being of his hens.”

– Jim Garland,, Memo to the Darcy Family: To Thine Own Self Be True

The ‘chicken farmers’ make up most of the investing world and are still chasing the latest narrative or big idea after losing a substantial amount of their wealth during the volatile markets of 2022. Many have either panicked and sold their high-flying ETFs and funds because they needed the income to live off or have not yet realized any losses and have re-entered on every bear market bounce to lower their cost base, only to see their lower prices go even lower. For the latter group, you are not alone. Maybe it’s time to take a page out of the ‘egg farmers’ playbook.

The ‘egg farmers’ above are fine as the dividends (eggs) from their chickens continue to grow in both up and down markets.

Our advice to someone who has been in your shoes, stop being a ‘speculator’ and look at dividend growth investing for a portion of your net worth. You won’t be disappointed. A growing dividend and a growing price (eventually) are a powerful combination.

Armed with a strategy that pays us in both up and down markets, we take a patient approach to investing and wait for a sensible price on our good dividend growers. Buying more income at a lower price is our key to wealth-building in today’s chicken-farming world.

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

Last week, ‘The List’ was down slightly with a minus -3.3% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.3% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were Metro (MRU-T), up +6.34%; CCL Industries (CCL-B-T), up +5.75%; and Waste Connections (WCN-N), up +2.90%.

Algonquin Power & Utilities (AQN-N) was the worst performer last week, down -17.53%.

Recent News

Falling Q4 profit forecasts another negative for U.S. stocks (Globe & Mail)

“For the Fed to achieve their inflation targets, they’re going to have to push the economy into a recession,” which means 2023 profit estimates “have to come down a lot more,” he said.”

According to the article, persistent inflation means that rates are going to continue to rise, and the economy will therefore continue to slow. This has been our view all along.

Fortunately, good bargains on our dividend growers are still to come.

Boring stocks work better than you think (Globe & Mail)

“A highly volatile asset should be less attractive than a more stable one, everything else being equal. But volatility’s allure makes perfect sense psychologically. What do people want? Huge returns. When do they want them? Now.”

Canadian Railways, Telcos, Utilities, Grocers, Banks and Financials (think of ‘The List’) have put up impressive returns for years, according to the author. His laggards have been technology, precious metal miners, and exploration and production companies in the energy space.

“If there is a lesson here, it is that boring works better than you may think. You may never have the thrill of watching your investments soar overnight. Then again, you are far less likely them to see them abruptly wither. Over the long haul, the race goes to the mundane, not the magic beans.”

No companies on ‘The List’ are due to report earnings this week.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

Last week, two companies on ‘The List’, reported earnings. Grocers got their chance to report last week and they did not disappoint.

Metro (MRU-T) follows an off-cycle reporting schedule. This means its fiscal year ends at the end of September. On Wednesday, November 16, 2022, before markets opened, Metro released its fourth-quarter 2022 results.

“Our 2022 fiscal year ended with a solid performance in the fourth quarter as our teams worked tirelessly to offer products at affordable and competitive prices in the current high inflation environment, which we know is difficult for many consumers. Our diversified business model allowed us to maintain stable gross margins while delivering good value to our customers, as reflected in overall tonnage growth and market share gains in the quarter. We are confident that our dedicated teams, multiple banners, strong private label offering, effective weekly promotions and loyalty programs position us well to continue to meet the needs of our customers as we navigate in this period of turbulence.

– President and Chief Executive Officer, Eric La Fleche

Highlights:

- Sales of $4,432.6 million, up 8.3%

- Food same-store sales up 8.0%

- Pharmacy same-store sales up 7.4%

- Net earnings of $168.7 million, down 13.0% and adjusted net earnings of $219.4 million, up 9.4%

- Fully diluted net earnings per share of $0.70, down 11.4%, and adjusted fully diluted net earnings per share of $0.92, up 13.6%

- Non-cash impairment of a loyalty program totaling $60.0 million

Outlook:

“As we begin our new fiscal year, we continue to face market uncertainties, labour shortages and elevated levels of cost inflation and it is difficult to predict how this macroeconomic environment will evolve. We remain steadfast in our focus to deliver value to our customers through our robust merchandising programs, our strong private label offer and working with our supply chain partners. We have also decided to exit the UGI purchasing group effective March 11, 2023. This decision will have no significant impact on our financial results.”

– President and Chief Executive Officer, Eric La Fleche

See the full Earnings Release here

Loblaws (L-T) released its third-quarter 2022 results on Wednesday, November 16, 2022, before markets opened.

“In a difficult economic environment, Loblaw is putting the strength of its unique assets to work for Canadians, offering record loyalty rewards, unmatched private-label brands, the best discount stores, and an inflation-fighting price freeze,” said Galen G. Weston, Chairman and President, Loblaw Companies Limited. “Customer expectations for value have never been higher, and we are working hard to meet them.”

– Chairman and President, Galen G. Weston

Highlights:

- Revenue was $17,388 million, an increase of $1,338 million, or 8.3%.

- Retail segment sales were $17,130 million, an increase of $1,299 million, or 8.2%.

- Food Retail (Loblaw) same-stores sales increased by 6.9%.

- Drug Retail (Shoppers Drug Mart) same-store sales increased by 7.7%.

- E-commerce sales increased by 3%.

- Operating income was $991 million, an increase of $128 million, or 14.8%.

- Adjusted EBITDA was $1,846 million, an increase of $172 million, or 10.3%.

- Retail segment adjusted gross profit percentage was 30.8%, an increase of 10 basis points.

- Net earnings available to common shareholders of the Company were $556 million, an increase of $125 million or 29.0%. Diluted net earnings per common share were $1.69, an increase of $0.42, or 33.1%.

- Adjusted net earnings available to common shareholders of the Company were $663 million, an increase of $123 million, or 22.8%.

- Adjusted diluted net earnings per common share were $2.01, an increase of $0.42 or 26.4%.

- Repurchased for cancellation, 3.4 million common shares at a cost of $403 million and invested $432 million in capital expenditures. Retail segment free cash flow was $543 million.

Outlook:

Loblaw will continue to execute on retail excellence in its core grocery and pharmacy businesses while advancing its growth initiatives in 2022. In the third year of the pandemic, the Company’s businesses remain well placed to service the everyday needs of Canadians. However, the Company cannot predict the precise impacts of COVID-19, the related industry volatility and inflationary environment on its 2022 financial results.

On a full year basis, the Company continues to expect:

- its Retail business to grow earnings faster than sales;

- to invest approximately $1.4 billion in capital expenditures, net of proceeds from property disposals, reflecting incremental store and distribution network investments; and

- to return capital to shareholders by allocating a significant portion of free cash flow to share repurchases.

Based on its year to date operating and financial performance and momentum exiting the third quarter, the Company expects full year adjusted net earnings per common share growth in the high teens.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on November 18, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 9.2% | $7.67 | -46.6% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.7% | $61.72 | 18.5% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.7% | $63.37 | -3.9% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.9% | $37.15 | -8.8% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.5% | $62.37 | -8.0% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.8% | $166.49 | 7.5% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 4.0% | $147.86 | -19.3% | $5.85 | 21.1% | 11 |

| CU-T | Canadian Utilities Limited | 5.0% | $35.85 | -2.1% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $77.70 | 22.5% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 5.2% | $51.32 | -18.0% | $2.68 | 4.1% | 15 |

| ENB-T | Enbridge Inc. | 6.4% | $53.97 | 8.9% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.4% | $29.21 | -36.3% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 0.9% | $138.79 | 2.0% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 4.1% | $53.43 | -11.7% | $2.17 | 4.3% | 48 |

| IFC-T | Intact Financial | 2.1% | $194.26 | 18.7% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.4% | $110.94 | 8.0% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 2.9% | $62.00 | -24.0% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.4% | $76.67 | 14.4% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 3.7% | $132.70 | -3.0% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 1.7% | $46.62 | 14.6% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $66.48 | -5.3% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.0% | $89.42 | -10.0% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.0% | $104.80 | -5.4% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.5% | $99.98 | -12.1% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.6% | $64.00 | 7.1% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.6% | $29.17 | -2.0% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $140.20 | 4.6% | $0.95 | 11.8% | 12 |

| Averages | 3.1% | -3.3% | 10.3% | 18 |

MP Market Review – November 11, 2022

Last updated by BM on November 14, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was up slightly with a minus -3.0% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.3% YTD, demonstrating the rise in income over the last year.

- Last week, there was one dividend increase from a company on ‘The List’.

- Last week, nine companies on ‘The List’ reported their Q3 earnings.

- Two companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“Try not to worry about short-term price volatility. Volatility just means ‘they’ don’t know what’s going to happen. We don’t know either, but what we do is predictable. Highly predictable. It’s in our data.”

– Tom Connolly

Double-digit gains last week from four companies on ‘The List’ and one double-digit loss. Add Magna International’s (MGA-N) return of +10.79% to our summary of best performers last week, and you would think that we are finally coming out of the bear market that has dogged us for most of the year. That is until Algonquin Power & Utilities (AQN-N) reported their third-quarter earnings and Q4 2022 guidance, and the stock ended down -15.9% on the week. Also of note, five of the nine companies who reported last week missed Analyst estimates on their Q3 earnings reports. Scroll to the bottom of ‘The List’ menu item to see our ‘Q3 2022 Earnings Calendar’. Unfortunately, nothing has changed from a macro standpoint in the economy, yet investors rush into the market in droves every time there is a hint of good news.

Having a process protects our hard-earned capital. Knowing when to add to a position in these volatile markets is important. As a subscriber of the blog, you will have noticed that we do not always add to a position at the absolute market bottom. As ‘incremental’ buyers (more than one trade) at sensible prices, we increase our probability of a successful outcome.

The actual good news in the market is that the dividend income of ‘The List’ in 2022 is once again higher than inflation and continues to grow (+10.3% YTD), with a handful of companies already announcing increases for 2023. As dividend growth investors, we know that the growing dividend will eventually drive the price higher, so we wait patiently to add to our quality companies. As my mentor, Tom Connolly, states above..” what we do is highly predictable.”

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

Last week, ‘The List’ was up slightly with a minus -3.0% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.3% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were TFI International (TFII-N), up +12.86%; Stella-Jones Inc. (SJ-T), up +11.78%; and Franco Nevada (FNV-N), up +11.58%.

Algonquin Power & Utilities (AQN-N) was the worst performer last week, down -15.91%.

Recent News

Algonquin Power shares plunge nearly 20% as utility lowers guidance, analysts slash price targets (Globe & Mail)

Not all was well in this season’s earnings reports, and one of the utilities we follow on ‘The List’ reported lower-than-expected earnings and was forced to lower guidance for the rest of the year. The reason was challenging macroeconomic conditions (higher interest rates and inflation).

This should not have surprised most investors as (AQN-N) is highly leveraged, and any hint of bad news will send their stock price spiralling downward. The next shoe to drop could be the company’s dividend record. At a minimum, dividend growth will be slowing.

Algonquin Power & Utilities has been a favourite of many dividend ETF’s and model portfolios due to its higher-than-average starting yield. Fortunately, (AQN-N) never passed the ‘quality’ test for us, so we stayed away.

Trudeau government’s tax on corporate share buybacks will likely hurt Canada’s economy (Glove & Mail)

“No tax is ever costless to the economy. Owing mainly to reduced productivity, the cost of a tax on share buybacks will likely exceed the modest revenues the tax will raise.”

In another attempt by governments to legislate that large corporations pay their ‘fair share’ of taxes, Canada may end up doing the opposite, as the author points out.

On the positive side, this could also mean that companies use their cash flow to raise dividends even more if they don’t want to pay the tax on buybacks. We have always preferred dividends to share buybacks as we don’t believe buybacks create long-term wealth for shareholders.

We probably will never know how much of this is good policy over good politics as our memories are short-term, and the result of this new tax could take years to play out.

Two companies on ‘The List’ are due to report earnings this week.

Metro (MRU-T) will release its fourth-quarter 2022 results on Wednesday, November 16, 2022, before markets open.

Loblaws (L-T) will release its third-quarter 2022 results on Wednesday, November 16, 2022, before markets open.

Dividend Increases

One company on ‘The List’ announced a dividend increase last week.

Canadian Tire (CTC-A-T) on Thursday said it increased its 2023 quarterly dividend from $1.625 to $1.725 per share, payable March 1, 2023, to shareholders of record on January 31, 2023.

This represents a dividend increase of +6%, marking the 13th straight year of dividend growth for this quality retailer.

Earnings Releases

Last week, nine companies on ‘The List’ reported their Q3 2022 earnings. Let’s get started with one of our ‘Core’ category companies, Franco-Nevada.

Franco Nevada (FNV-N) released its third-quarter 2022 results on Monday, November 7, 2022, before markets opened.

“Our diversified portfolio performed well in the quarter with declines in precious metal prices partially offset by strong oil and gas prices.”

– Chief Executive Officer, Paul Brink

Highlights:

- Earned record GEOs, revenue, net income, Adjusted Net Income and Adjusted EBITDA YTD in 2022

- No debt and $2.0 billion in available capital as at September 30, 2022

- Generated $232.3 million in operating cash flow for the quarter

Portfolio Additions

- Financing Package with Argonaut Gold on the Magino Gold Project: On October 27, 2022, we acquired a 2% NSR on Argonaut Gold Inc.’s (“Argonaut”) construction-stage Magino gold project located in Ontario, Canada, for a purchase price of $52.5 million. We also completed a private placement with Argonaut of $10.0 million (C$13.6 million). Argonaut reported that the construction of the project is approximately 70% complete as at September 30, 2022, with first gold pour expected in April 2023.

- Financing Package with Westhaven Gold Corp. on Spences Bridge Gold Belt Claims: On October 6, 2022, we acquired a 2% NSR on all of Westhaven Gold Corp’s (“Westhaven”) claims across the Spences Bridge Gold Belt in Southern British Columbia, Canada, for $6.0 million and an existing 2.5% NSR from Westhaven on adjoining properties currently owned by Talisker Resources Ltd. for a purchase price of $0.75 million. In addition, we also subscribed for $0.73 million (C$1.0 million) of Westhaven’s common shares.

- Financing Package with G Mining Ventures on the Tocantinzinho Gold Project: As previously announced on July 18, 2022, we acquired, through our wholly-owned subsidiary, Franco-Nevada (Barbados) Corporation (“FNBC”), a gold stream with reference to production from the Tocantinzinho project, owned by G Mining Ventures Corp. (“G Mining Ventures”) and located in Pará State, Brazil (the Stream”). FNBC will provide a deposit of $250 million. Additionally, through one of our wholly-owned subsidiaries, we agreed to provide G Mining Ventures with a $75.0 million secured term loan (the “Term Loan”). We also subscribed for $27.5 million (C$35.8 million) of G Mining Ventures’ common shares.

Outlook:

“Franco-Nevada has record GEOs, revenue, net income, Adjusted Net Income and Adjusted EBITDA for the three quarters through September 30, 2022 and is on-track to meet full year guidance.

– Chief Executive Officer, Paul Brink

See the full Earnings Release here

Intact Financial (IFC-T) released its third-quarter 2022 results on Tuesday, November 8, 2022, after markets closed.

“We achieved solid operating performance across the platform despite active weather and ongoing cost pressures. Our people are working hard to get customers back on track after the devastation caused by recent hurricanes. At the same time, our balance sheet remains resilient in the context of volatile capital market conditions which we continue to monitor closely. Finally, we continued to make progress on the integration of RSA, with synergies tracking towards our recently increased target of a $350 million run-rate in 2024.”

– Chief Executive Officer, Charles Brindamour

Highlights:

- Net operating income per share decreased 6% to $2.70, reflecting a slight increase in operating combined ratio, offset in part by higher investment and distribution income

- Operating DPW grew 2% as continued solid growth in specialty lines was partially offset by profitability actions, including strategic exits

- Operating combined ratio was robust at 92.6%, with very strong results in commercial lines and Canada personal auto performing as expected

- EPS increased 26% to $2.02 with solid operating and non-operating performance, while last year’s results were impacted by an impairment charge on an investment

- OROE and ROE were strong at 15.0% and 19.1%, respectively, reflecting continued strong performance

- BVPS was stable year-over-year, as strong earnings were offset by significant mark-to-market losses on investments

Outlook:

- Over the next twelve months, we expect firm-to-hard insurance market conditions to continue in most lines of business, driven by inflation and climate change.

- In Canada, we expect firm market conditions to continue in personal property. Personal auto premium growth is expected to be in the midsingle-digit range over the next 12 months, to reflect inflation and evolving driving patterns.

- In commercial and specialty lines across all geographies, hard market conditions are expected to continue.

- In the UK&I, we expect the personal property market to firm as it reacts to inflationary pressures and adapts to reform measures. Personal motor has begun to firm and we anticipate this to increase over time.

– Chief Executive Officer, Charles Brindamour

See the full Earnings Release here

TC Energy (TRP-T) released its third-quarter 2022 results on Wednesday, November 9, 2022, before markets opened.

“Demand for our services across our North American portfolio remains high and we continue to see strong utilization, availability, and overall asset performance. Comparable EBITDA was 10 per cent higher and segmented earnings 16 per cent higher relative to third quarter 2021. As a result, we have increased our 2022 comparable EBITDA outlook which is now expected to be approximately four per cent higher than 2021.”

– Chief Executive Officer, Francois Poirier

Highlights:

- Revised 2022 comparable EBITDA outlook to be higher than 2021, with an expected year-over-year growth rate of approximately four per cent. 2022 comparable earnings per common share1 are expected to be consistent with 2021

- Third quarter 2022 results were underpinned by solid utilization, safe operations and availability across our assets during peak demand. The continued need for energy security has placed renewed focus on the long-term role we believe our infrastructure will play in responsibly fulfilling North America’s growing energy demand:

- Louisiana XPress was phased into service during the quarter and has increased our market share from 25 to approximately 30 per cent of volumes destined for export from third-party U.S. LNG facilities

- Total NGTL System deliveries averaged 12.4 Bcf/d, up four per cent compared to third quarter 2021

- S. Natural Gas Pipelines flows averaged 25.8 Bcf/d, up six per cent compared to third quarter 2021

- Bruce Power provided emission-less power with approximately 95 per cent availability during third quarter 2022

- The Keystone Pipeline System safely reached a record month in September, delivering approximately 640,000 Bbl/d as we commercialized an incremental 10,000 Bbl/d of contracts from the 2019 Open Season

- Third quarter 2022 financial results:

- Net income attributable to common shares of $0.8 billion or $0.84 per common share compared to net income of $0.8 billion or $0.80 per common share in 2021. Comparable earnings1 of $1.1 billion or $1.07 per common share compared to $1.0 billion or $0.99 per common share in 2021

- Segmented earnings of $1.8 billion compared to segmented earnings of $1.5 billion in 2021 and comparable EBITDA of $2.5 billion compared to $2.2 billion in 2021

- Net cash provided by operations of $1.7 billion was consistent with 2021 results and comparable funds generated from operations1 was $1.6 billion, consistent with 2021 results

- Declared a quarterly dividend of $0.90 per common share for the quarter ending December 31, 2022

- Dividend Reinvestment Plan (DRP) participation rate amongst common shareholders was approximately 38 per cent resulting in $342 million reinvested in common equity from the dividends declared July 27, 2022, subsequently paid on October 31, 2022

- Continued to execute on our $34 billion secured capital program, with $2.6 billion invested in third quarter 2022 • Placed the Louisiana XPress, Elwood Power and Wisconsin Access projects into commercial service adding approximately 1 Bcf/d of U.S. natural gas capacity

- Sanctioned the US$0.4 billion Gillis Access project, a 1.5 Bcf/d header system that will connect growing supply from the Haynesville basin to Louisiana markets including the rapidly expanding Louisiana LNG export market. The project has an anticipated in-service date of 2024

- Sanctioned the $0.6 billion Valhalla North and Berland River (VNBR) project in November 2022 that will use non-emitting electric compression to connect migrating supply to key demand markets on our NGTL System with expected in-service in 2026

- Executed definitive agreements in July 2022 with LNG Canada that addressed and resolved disputes over certain incurred and anticipated costs of the Coastal GasLink pipeline project

- Established a strategic alliance with the Comisión Federal de Electricidad (CFE) in August 2022 for the completion and development of natural gas infrastructure in central and southeast Mexico

- Placed the north section of the Villa de Reyes pipeline (VdR North) and the east section of the Tula pipeline (Tula East) into commercial service during the third quarter of 2022

- Reached a final investment decision to proceed and build the US$4.5 billion Southeast Gateway pipeline, a 1.3 Bcf/d, 715 km offshore natural gas pipeline to serve the southeast region of Mexico with an expected in-service date by mid-2025

- Issued common equity for gross proceeds of approximately $1.8 billion in August 2022 to fund costs associated with the construction of the Southeast Gateway pipeline.

Outlook:

- 2022 comparable EBITDA is expected to be higher than 2021 and 2022 comparable earnings per common share outlook is expected to be consistent with 2021. We continue to monitor the impact of changes in energy markets, our construction projects and regulatory proceedings as well as COVID-19 for any potential effect on our 2022 comparable EBITDA and comparable earnings per share.

- Our total capital expenditures for 2022 are now expected to be approximately $9.5 billion. The increase from the amount outlined in the 2021 Annual Report is primarily due to 2022 installments of approximately $1.3 billion for partner equity contributions to the Coastal GasLink Pipeline Limited Partnership (Coastal GasLink LP) in accordance with revised agreements with Coastal GasLink LP. In addition, approximately US$0.7 billion in capital expenditures are expected in 2022 related to the construction of the Southeast Gateway pipeline subsequent to the final investment decision (FID) reached with the CFE in August 2022. Refer to the Recent developments section for additional information on Coastal GasLink and the Southeast Gateway pipeline. Finally, higher project costs are expected for the NGTL System reflecting inflationary pressures on labour and materials, additional regulatory conditions and other factors. We continue to monitor developments on construction projects, focus on cost mitigation strategies and assess market conditions as well as the impact of COVID-19 for further changes to our overall 2022 capital program.

See the full Earnings Release here

Stella-Jones Inc. (SJ-T) released its third-quarter 2022 results on Wednesday, November 9, 2022, before markets opened.

“Stella-Jones delivered strong results this quarter, reflecting the robust growth of our infrastructure-related product sales and the normalization of residential lumber sales,” said Éric Vachon, President and CEO of Stella-Jones. “Our performance demonstrates Stella-Jones’ ability to capitalize on growing utility poles demand, amplified by increased infrastructure spend and broadband network expansion programs. It also highlights the stability of our railway ties business and unique value proposition we deliver to our residential lumber customers. It is this resilience, in the face of inflationary pressures and supply chain constraints, that reaffirms the power of our business model and extensive network.”

–President and Chief Executive Officer, Scott Éric Vachon

Highlights:

- Sales increased 24% to $842 million, driven by all product categories

- EBITDA rose by $50 million to $119 million, a margin of 14.1%

- Net income reached $65 million or $1.07 per share

- Completed acquisition of wood utility pole manufacturing business of Texas Electric Cooperatives, Inc.

- Returned $180 million to shareholders in the first nine months of 2022

- Announced a Normal Course Issuer Bid for 2022-2023

Outlook:

Stella-Jones’ sales are primarily to critical infrastructure-related businesses. While all product categories can be impacted by short-term fluctuations, the business is mostly based on replacement and maintenance driven requirements, which are rooted in our customers’ long-term planning. Corresponding to this longer-term horizon and to better reflect the expected sales run-rate for residential lumber and reduce the impact of commodity price volatility, in March 2022, the Company provided its financial objectives for 2022 to 2024. Below are key highlights of the 2022-2024 financial objectives with a more comprehensive version, including management assumptions, available in the Company’s MD&A. Management remains confident in the achievement of its three-year strategic guidance.

Key Highlights:

Compound annual sales growth rate in the mid-single digit range from 2019 pre-pandemic levels to 2024;

- EBITDA margin of approximately 15% for the 2022-2024 period;

- Capital investment of $90 to $100 million to support the growing demand of its infrastructure-related customer base, in addition to the $50 to $60 million of annual capital expenditures;

- Residential lumber sales expected to stabilize between 20-25% of total sales while infrastructure-related businesses expected to grow to 75-80% of total sales by 2024;

- Anticipated returns to shareholders between $500 and $600 million during the three-year period;

- Leverage ratio of 2.0x-2.5x between 2022-2024, but may temporarily exceed range to pursue acquisitions.

See the full Earnings Release here

CCL Industries (CCL-B-T) released its third-quarter 2022 results on Wednesday, November 9, 2022, after markets closed.

“In the context of extraordinary inflationary pressures in the developed world, including highly volatile energy markets, plus Covid restrictions in China, I am pleased to report strong third quarter results with a record $0.95 adjusted basic earnings per class B share.”

– Chief Executive Officer, Geoffrey T. Martin

Highlights:

- Per Class B share: $0.95 adjusted basic earnings up 11.8%; $0.93 basic earnings up 9.4%; currency translation negative $0.01 per share

- Sales increased 11.4% on 8.8% organic growth, 4.9% acquisition growth partially offset by 2.3% negative currency translation

- CCL, Avery, Checkpoint and Innovia posted organic sales growth of 13.2%, 0.8%, 5.0% and 1.5%, respectively

- Operating income improved 11.6%, excluding negative currency translation of 1.4%, with a 14.9% operating margin

Outlook:

“Our fourth quarter outlook is somewhat clouded by the impact of inflation; although the summer speculative European energy hikes subsided and many other commodities moved off highs by some distance, potential for event driven volatility remains. The demand picture is stable but less certain, with ongoing strength in some businesses now offset by slower conditions in others. The economic forecast for 2023 suggests a deterioration of some note over 2022 conditions, but as always, we focus on making progress in both good and challenging times. At today’s Canadian dollar exchange rates, currency translation would be a modest headwind, if sustained, for the fourth quarter of 2022; as weaker European and Asia Pacific currencies more than offset stronger ones in the U.S. and Latin America.”

– Chief Executive Officer, Geoffrey T. Martin

See the full Earnings Release here

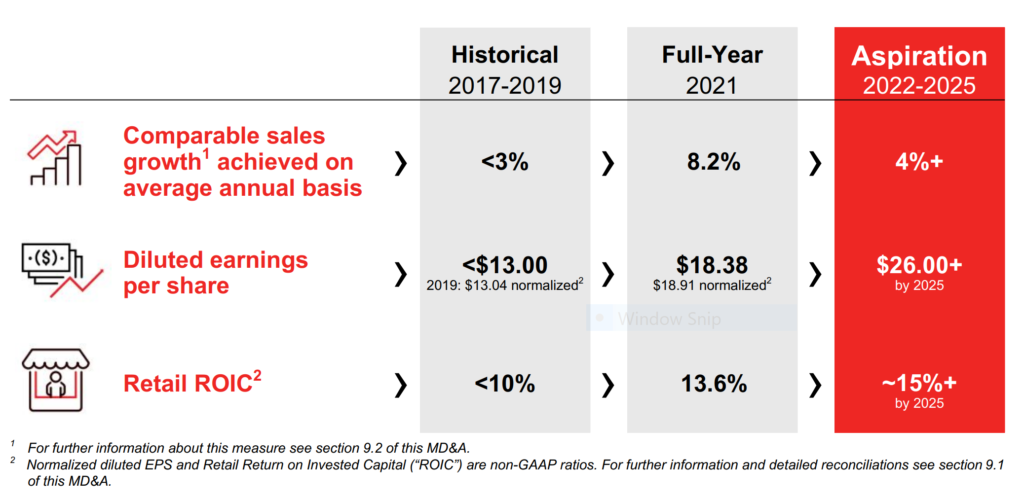

Canadian Tire (CTC-A-T) released its third-quarter 2022 results on Thursday, November 10, 2022, before markets opened.

“In the third quarter, we effectively engaged our loyalty customers, resulting in increased spending per Triangle Member, with total loyalty sales outpacing non-member sales – a trend we expect to continue,” said Greg Hicks, President and CEO, Canadian Tire Corporation. “We remain committed to the strategic growth investments we laid out as part of our Better Connected strategy, and in the near-term, we will face into changing customer demand and a dynamic economic environment with the confidence that our multi-category assortment is well-positioned to meet our customer needs.”

“Throughout its long history, Canadian Tire Corporation has consistently demonstrated the underlying strength and resilience of its business and its ability to deliver steady growth and returns to its shareholders,” said Hicks.

– President and Chief Executive Officer, Greg Hicks

Highlights:

- Revenue increased 8.1% to $4,228.8 million; Revenue (excluding Petroleum) increased 6.0% over the same period last year, with the Retail and Financial Services segments both contributing to growth; on a year-to-date basis, Revenue was up 11.8%, and Revenue (excluding Petroleum) increased 7.8%

- Consolidated IBT was $298.6 million, down 19.3% compared to the third quarter of 2021, and $314.5 million, down 19.1%, on a normalized basis

- Normalized diluted EPS was $3.34, compared to $4.20 in the prior year. Q3 2022 Diluted EPS was $3.14 per share, compared to $3.97 in the prior year.

- Retail Return on Invested Capital (ROIC) calculated on a trailing twelve-month basis, was 12.5% at the end of the third quarter, compared to 13.2% at the end of the third quarter of 2021, as Average Retail Invested Capital increased over the prior period

- Refer to the Company’s Q3 2022 Management Discussion and Analysis (MD&A) section 4.1.1 for information on normalizing items and for additional details on events that have impacted the Company in the quarter

Outlook:

In conjunction with the announcement of its strategic plan, CTC also established the following financial aspirations for fiscal years 2022 to 2025.

See the full Earnings Release here

Stantec (STN-T) released its third-quarter 2022 results on Thursday, November 10, 2022, after markets closed.

“Our performance in the quarter demonstrates the ongoing strong execution of our strategic plan, while our record backlog reflects the resiliency of our business despite broader economic headwinds,” said Gord Johnston, President and CEO. “As we look ahead to the remainder of the year and into 2023, we continue to see numerous growth opportunities that we are well positioned to capture, bolstering our confidence in our ability to deliver on our strategic plan.”

– President and Chief Executive Officer, Gord Johnston

Highlights:

- Net revenue of $1.2 billion, up 24.3% over Q3 2021

- Adjusted diluted EPS1 of $0.86, up 19.4% over Q3 2021

- Backlog of $6.2 billion, up 20.2% since December 31, 2021

Outlook:

Stantec reaffirms full year 2022 guidance for adjusted diluted EPS growth of 22% to 26% and net revenue growth of 18% to 22%, both compared to 2021, and for adjusted EBITDA margin in the range of 15.3% to 16.3%. Stantec further anticipates delivering adjusted return on invested capital of greater than 10.0% for 2022, compared to earlier guidance of greater than 10.5%. This is largely due to the disruption to cash flows arising from the integration of Cardno, which has resulted in higher than anticipated average debt outstanding for the year. Stantec anticipates cash flows and debt levels normalizing by the end of this year as the financial integration work winds up.

See the full Earnings Release here

Algonquin Power & Utilities (AQN-N) released its third-quarter 2022 results on Friday, November 11, 2022, before markets opened.

“It was a challenging third quarter. Despite year-over-year growth in Adjusted EBITDA, our results for the quarter came in below our expectations and were negatively impacted by increasing interest rates and the timing of tax incentives related to certain renewable energy projects. Our underlying businesses remain strong; however, we are not immune to the macroeconomic environment. Our team is focused on identifying and implementing the necessary adjustments while executing on our three pillars of Growth, Operational Excellence and Sustainability to drive shareholder value over the long-term.”

– President and Chief Executive Officer, Arun Banskota

Highlights:

- Adjusted EBITDA of $276.1 million, an increase of 10% compared to the third quarter of 2021.

- Adjusted Net Earnings of $73.5 million, a decrease of 25% compared to the third quarter of 2021. Adjusted Net Earnings was negatively impacted year-over-year by higher interest expense of $23.3 million as a result of borrowings to support growth and higher interest rates. The Company also had lower year-over-year recognition of investment tax credits and production tax credits of $17.1 million, which included revised estimates associated with renewable projects that are now expected to be placed in service in 2023.

- Adjusted Net Earnings per common share of $0.11, a decrease of 27% compared to the third quarter of 2021.

Outlook:

- Updated 2022 Adjusted Net Earnings Per Common Share Estimate – In light of challenging macroeconomic conditions (including higher interest rates and inflation), delays in the construction and completion of certain of the Company’s renewable energy projects, and anticipated delays in connection with certain rate decisions, among other factors, the Company is updating its previously-disclosed Adjusted Net Earnings per common share estimate for the 2022 fiscal year from a range of $0.72-$0.77 to a range of $0.66-$0.69. This revised estimate is based on, and should be read in conjunction with, the assumptions set out under “Outlook – Updated 2022 Adjusted Net Earnings Per Common Share Estimate” and “Caution Concerning Forward-Looking Statements and Forward-Looking Information” in AQN’s Management Discussion & Analysis for the three and nine months ended September 30, 2022 (the “Interim MD&A”), which will be available on SEDAR, EDGAR and the Company’s web site. Please also refer to “Caution Regarding Forward-Looking Information” and “Non-GAAP Measures” below.

- Update on Longer-Term Targets – Given the challenging macroeconomic environment, which is expected to continue into 2023, the Company is evaluating its longer-term targets and financial expectations. The Company intends to provide further details at its upcoming Investor and Analyst Day, expected to be held in early 2023.

See the full Earnings Release here

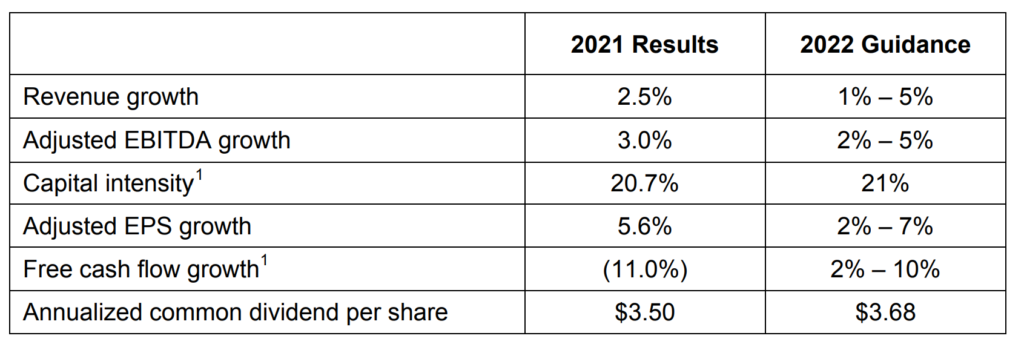

Emera Inc. (EMA-T) released its third-quarter 2022 results on Friday, November 11, 2022, before markets opened.

“In the face of the devastating storm impacts and extensive system outages resulting from Hurricanes Fiona and Ian, the restoration efforts of our teams in Nova Scotia and Tampa were remarkable,” said Scott Balfour, President and CEO of Emera Inc. “For the quarter, we continued to invest in meeting our customers needs for cleaner, reliable and cost-effective energy, and in so doing also delivered for our shareholders. Emera’s solid 5% growth in year-to-date earnings per share, and 12% growth in quarterly earnings per share year-over-year was principally driven by continued strong performance from our Florida utilities. Looking forward, continuing strong economic and customer growth in Florida is also supporting our updated $8-$9 billion capital plan and 7- 8% consolidated rate base growth over the 2023 – 2025 period, with approximately 75% of our capital plan expected to be invested in Tampa Electric and Peoples Gas.”

– President and Chief Executive Officer, Scott Balfour

Highlights:

- Quarterly adjusted EPS increased $0.08 or 12% to $0.76 compared to $0.68 in Q3 2021. Quarterly reported EPS increased $0.90 to $0.63 in Q3 2022 compared to a net loss per common share of $(0.27) in Q3 2021 due to lower mark-to-market (“MTM”) losses in 2022.

- Year-to-date, adjusted EPS increased $0.10 or 5% to $2.27 compared to $2.17 in Q3 2021. Year-to-date reported EPS increased by $1.02 to $1.75 from $0.73 in 2021 due to lower MTM losses in 2022.

- Adjusted EPS contributions from regulated utilities increased 11% for the quarter and 12% year-to-date primarily driven by the impact of favourable weather and new rates at Tampa Electric, as well as from customer growth at both Tampa Electric and People’s Gas (“PGS”). Higher marketing and trading margin increased adjusted EPS1 by $0.05 for the quarter due to higher natural gas prices and volatility, which created profitable opportunities for Emera Energy Services (“EES”). These increases were partially offset by higher corporate costs, and a higher share count.

- On track to deploy $2.7 billion of capital investment in 2022, principally focused on decarbonization and reliability investments across the portfolio.

Outlook:

The energy and services company said it was on track to deploy $2.7 billion of capital investment in 2022, principally focused on decarbonization and reliability investments across the portfolio.

“Emera’s solid 5% growth in year-to-date earnings per share, and 12% growth in quarterly earnings per share year-over-year was principally driven by continued strong performance from our Florida utilities,” Scott Balfour, President and CEO of Emera.

“Looking forward, continuing strong economic and customer growth in Florida is also supporting our updated $8-$9 billion capital plan and 7-8% consolidated rate base growth over the 2023-2025 period, with approximately 75% of our capital plan expected to be invested in Tampa Electric and Peoples Gas,” he said.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on November 11, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 7.6% | $9.30 | -35.2% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.7% | $62.90 | 20.7% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.8% | $62.53 | -5.1% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.8% | $37.95 | -6.8% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.6% | $58.98 | -13.0% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.8% | $161.97 | 4.6% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.7% | $156.79 | -14.4% | $5.85 | 21.1% | 11 |

| CU-T | Canadian Utilities Limited | 5.0% | $35.62 | -2.7% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $77.34 | 22.0% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 5.2% | $51.96 | -17.0% | $2.68 | 4.1% | 15 |

| ENB-T | Enbridge Inc. | 6.2% | $55.47 | 12.0% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.3% | $31.20 | -32.0% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 0.9% | $141.65 | 4.1% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 4.1% | $53.46 | -11.6% | $2.17 | 4.3% | 48 |

| IFC-T | Intact Financial | 2.1% | $193.74 | 18.3% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.4% | $109.78 | 6.9% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 2.9% | $62.74 | -23.1% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.5% | $72.10 | 7.5% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 3.8% | $131.68 | -3.8% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 1.7% | $46.41 | 14.1% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $65.72 | -6.4% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.0% | $88.44 | -11.0% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.0% | $103.94 | -6.1% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.5% | $102.45 | -9.9% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.6% | $64.02 | 7.2% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.6% | $29.02 | -2.5% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $136.25 | 1.6% | $0.95 | 11.8% | 12 |

| Averages | 3.0% | -3.0% | 10.3% | 18 |

We Just Bought CCL Industries Inc. for our MP Wealth-Builder Model Portfolio (CDN)

We Just Bought Fortis Inc. for our MP Wealth-Builder Model Portfolio (CDN)

MP Market Review – November 04, 2022

Last updated by BM on November 07, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was essentially flat with a minus -4.6% YTD price return (capital). Dividend growth of ‘The List’ increased to +10.4% YTD, demonstrating the rise in income over the last year.

- Last week, there were two dividend increases from companies on ‘The List’.

- Last week, there were seven earnings reports from companies on ‘The List’.

- Nine companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“It is very premature, in my view, to think about or be talking about pausing our rate hikes. We still have some ways to go. And incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected.”

– Jerome Powell, US Federal Reserve Chair

With that one statement, the markets came back to reality. What had been a one-week equities rally quickly ended during Mr. Powell’s post-announcement new conference.

Below is a summary of the Q3 earnings reports from some companies on ‘The List’ last week. Our good dividend growers seem to be doing well this year, but there are a few mentions of ‘uncertain times’ ahead and a slowing economy, which should make us wary of what lies ahead.

One of the best parts of having a blog is interacting with readers and subscribers to help us become better investors. We wanted to share one such conversation with you this week.

This week, we received an email from a reader who was ready to start putting his hard-earned capital to work. We never know the individual goals of each investor who follow the blog, so we usually hold back on our thoughts about what they choose to invest in. However, we feel that his thoughts can be a coaching moment for others.

The reader is a fan of dividend growth investing but is still learning our process. He wanted to invest in a US company simply because it is undervalued and in a sector he liked. In addition, he wanted to invest in some of the companies on ‘The List’ in the same industry solely because they are quality companies (ignoring valuation). Although valuation and quality are cornerstone principles in what we do, we must be careful in applying these concepts.

Valuation is essential, but it should only be applied to quality companies. Check out our ‘quality indicators’ for a good playbook for determining a quality dividend growth company.

Overvaluing quality companies is not good either, as it will impact your future returns. A large component of the pullback in prices so far this year was due to overvaluation last year. You don’t want to be caught with a quality company whose P/E is well above its average (when you buy) and wondering why the stock price (capital return) remains below the purchase price well into the future, even though the earnings and dividends are growing.

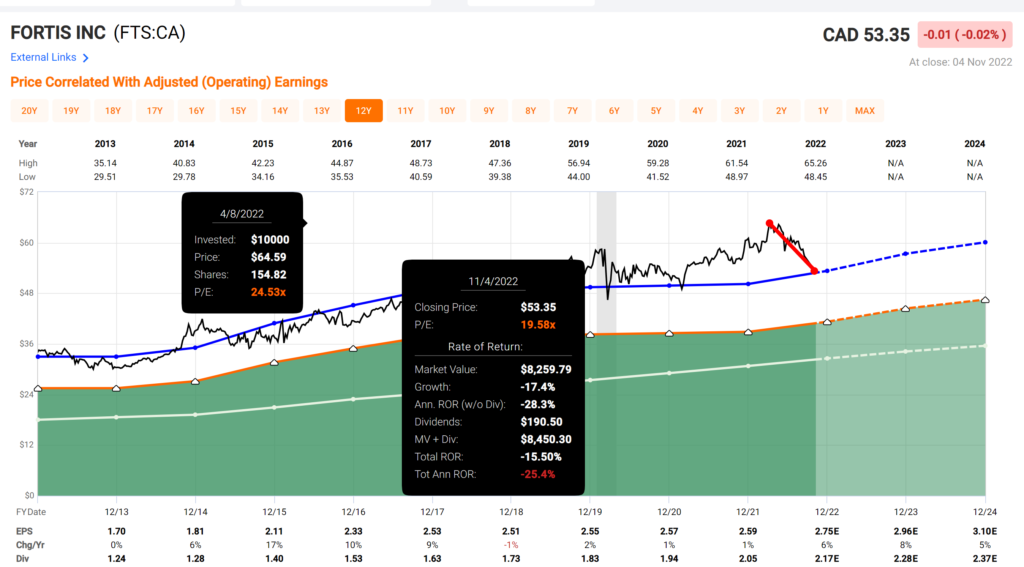

Fortis was a great example of overvaluation back in April of this year. Fortis is one of the highest-quality dividend growth companies in Canada, with a record of 49 straight years of dividend growth, but it was trading far above its sensible price range. An investor in Fortis back in April is now down -17.4%, and it could be a while before they get back to the price they paid earlier this year. The price has retreated closer to its average P/E (blue line).

Remember that return is yield plus dividend growth when purchased at a sensible price. You will need all three to win. Be patient in these ‘uncertain times’.

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

Last week, ‘The List’ was essentially flat with a minus -4.6% YTD price return (capital). Dividend growth of ‘The List’ increased to +10.4% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were TFI International (TFII-N), up +3.70%; Waste Connections (WCN-N), up +2.73%; and Enbridge Inc. (ENB-T), up +1.96%.

CCL Industries (CCL-B-T) was the worst performer last week, down -6.35%.

Recent News

We’re heading into a much different world. Investors in stocks, bonds and real estate aren’t going to like it (Globe & Mail)

“In my opinion, financial markets are too optimistic about inflation and interest rates in the long run and the effect they will have on economic growth.”

The author mentions that world events have led to companies bringing production back to North America, where output costs are higher and ill-planned attempts by governments and Central Banks to spend their way out of market downturns only ‘kicks the can down the road’, which will result in higher taxes eventually.

Add the underinvestment in the oil and gas industry in the name of climate change and you have all commodities becoming more expensive at a time when you need them the most (to fund renewable energy and electric vehicle production).

Slower growth and higher inflation from what we have been used to seem almost inevitable.

An industry leader that’s consistently delivered annual double-digit price returns and dividend growth (Globe & Mail)

Nice analysis of Waste Connections Inc. (WCN-N). They are one of the companies on ‘The List’. Although Waste Connections Inc. ticks off a lot of boxes for us as an investment, we are not comfortable with the valuation of the stock. For high-growth, low-yield companies like (WCN-N) it may take time to generate the income you are looking for, but the capital returns can ease the pain. Coming into this year, Waste Connections Inc. delivered a +19.8% compound annual growth rate (CAGR) over the last ten years!

Nine companies on ‘The List’ are due to report earnings this week.

Franco Nevada (FNV-N) will release its third-quarter 2022 results on Monday, November 7, 2022, before markets open.

Intact Financial (IFC-T) will release its third-quarter 2022 results on Tuesday, November 8, 2022, after markets close.

TC Energy (TRP-T) will release its third-quarter 2022 results on Wednesday, November 9, 2022, before markets open.

Stella-Jones Inc. (SJ-T) will release its third-quarter 2022 results on Wednesday, November 9, 2022, before markets open.

CCL Industries (CCL-B-T) will release its third-quarter 2022 results on Wednesday, November 9, 2022, after markets close.

Canadian Tire (CTC-A-T) will release its third-quarter 2022 results on Thursday, November 10, 2022, before markets open.

Stantec (STN-T) will release its third-quarter 2022 results on Thursday, November 10, 2022, after markets close.

Algonquin Power & Utilities (AQN-N) will release its third-quarter 2022 results on Friday, November 11, 2022, before markets open.

Emera Inc. (EMA-T) will release its third-quarter 2022 results on Friday, November 11, 2022, before markets open.

Dividend Increases

Two companies on ‘The List’ announced a dividend increase last week.

Waste Connections (WCN-N) on Thursday said it increased its 2022 quarterly dividend from $0.23 to $0.255 per share, payable December 1, 2022, to shareholders of record on November 16, 2022.

This represents a dividend increase of +11%, marking the 13th straight year of dividend growth for this quality waste management company.

Telus (T-T) on Friday said it increased its 2023 quarterly dividend from $0.339 to $0.3511 per share, payable January 3, 2023, to shareholders of record on December 9, 2022.

This represents a dividend increase of +3.5%, marking the 19th straight year of dividend growth for this quality telco.

Earnings Releases

Last week, there were seven earnings reports from companies on ‘The List’. Let’s get started with Canadian industrial company Toromont Industries.

Toromont Industries (TIH-T) released its third-quarter 2022 results on Tuesday, November 1, 2022, after markets closed.

“The team delivered solid operating and financial performance in the third quarter. The persistent supply constraint pressures, market and economic variables continue to contribute to a fluid and complex operating environment,” stated Scott J. Medhurst, President and Chief Executive Officer of Toromont Industries Ltd. “The Equipment Group reported good utilization activity in rental and positive product support demand, while uncertainties persist in timing of equipment and parts deliveries. CIMCO revenues improved in the quarter on project construction and higher product support activity. Across the organization, we remain committed to our operating disciplines, after-market strategies and customer solutions, as we manage through these uncertain conditions.”

– Chief Executive Officer, Scott Medhurst

Highlights:

- Revenues increased $142.4 million or 14% in the third quarter. Equipment sales were up 11% compared to prior year, with the Equipment Group up 10% and CIMCO package revenues up 19%, however both groups continue to experience delays in project construction and deliveries due to supply chain constraints in the current year. Product support revenues were 19% higher on increased demand, while rental revenues grew 13% on a larger fleet and higher utilization.

- Revenues increased $150.1 million (5%) to $3.1 billion for the year-to-date period, as the improved activity in rentals (up 19%) and product support (up 14%) offset reductions in equipment and package revenues (down 5%) against a tough comparable last year, coupled with continuing supply chain issues.

- Operating income increased 26% in the quarter on higher revenues, a favourable sales mix (higher percentage of rentals and product support revenues to total revenues) and improved gross margins. Expense levels were up 13% reflecting planned increases and higher activity levels, as well as certain inflationary impacts.

- Operating income increased 26% in the year-to-date period, and was 13.4% of revenues compared to 11.2% in the similar period last year, reflecting the continued favourable sales mix and improved gross margins, offset by a higher expense ratio.

- Net earnings increased $29.4 million or 31% in the quarter versus a year ago to $123.1 million or $1.50 EPS (basic).

- For the year-to-date period, net earnings increased $67.2 million or 30% to $294.3 million, or $3.57 EPS (basic).

- Bookings for the third quarter decreased 23% compared to last year and decreased 24% on a year‑to‑date basis. Both the Equipment Group and CIMCO reported strong bookings in 2021, after a period of lower activity stemming from pandemic restrictions.

- Backlogs were $1.4 billion at September 30, 2022, compared to $1.1 billion at September 30, 2021, reflecting strong order activity over the past year coupled with ongoing supply constraints.

Outlook:

“Activity remained sound with favourable backlog levels, but supply chains continue to be challenged. Pandemic challenges remain and we continue to measure inflationary pressures and supply-demand dynamics as the economic environment continues to evolve and change.”

– Chief Executive Officer, Scott Medhurst

See the full Earnings Release here

Brookfield Infrastructure Partners (BIP-N) released its third-quarter 2022 results on Wednesday, November 2, 2022, before markets opened.

“Brookfield Infrastructure had record quarterly results as a function of our high quality asset base, proven risk management approach and execution of our asset rotation strategy. Our strategic and financial principles provide a basis to capitalize on deep value investments when these opportunities arise.”

– Chief Executive Officer, Sam Pollock

Highlights:

- Brookfield Infrastructure reported net income of $113 million for the three-month period ended September 30, 2022 compared to $413 million in the prior year. Current year results benefited from recent acquisitions and organic growth across our base business, as well as mark-to-market gains on our foreign currency hedging program. Prior year results included a gain of approximately $425 million recognized on the sale of our U.S. district energy business. After removing the impact of disposition gains, net income increased by $125 million relative to the prior year.

- Funds from operations (FFO) for the third quarter was $525 million, increasing 24% relative to the comparable period. Organic growth for the quarter was robust at 10%, reflecting the benefits of elevated inflation levels impacting tariffs and the commissioning of approximately $1.2 billion of capital projects in the last 12 months. Additionally, approximately $2 billion of capital was deployed in acquisitions over the same period that contributed to results.

Outlook:

“In August, we announced a partnership with Intel Corporation to invest in a $30 billion semiconductor foundry in Arizona. Brookfield will be providing approximately $15 billion over the construction period for a 49% interest in the facility. The majority of our capital commitment has been sourced from non-recourse debt, with base interest rate exposure fully hedged concurrent with signing. Moreover, the majority of the Brookfield’s approximately $2 billion equity investment ($500 million net to BIP) is back-end weighted closer to the operational phase of the project.

This investment is structured to achieve an attractive risk-adjusted return. We draw parallels to other data investments such as hyperscale data centers that are generally contracted on a long-term basis, with highly creditworthy counterparties, where we do not assume technological risk. In this instance, we view Intel to be a creditworthy and market-leading partner. The transaction is expected to close by the end of 2022 and is thematically an example of the large-scale capital required to support the onshoring of critical supply chains.

For the balance of the year, our focus will be on closing the remaining two announced transactions, HomeServe and DFMG, in Q4 2022 and Q1 2023, respectively. Once closed, we will transition our focus to the execution of our growth plans in both businesses.

- At HomeServe, we are splitting the company’s U.S. and European operations to integrate them with existing portfolio businesses in each geography. We plan to accelerate growth by expanding our residential infrastructure product and service offering to a wider customer base.

- At DFMG, we are acquiring a marquee portfolio of 36,000 towers in Germany and Austria that also includes a greenfield development portfolio of an additional 5,200 build-to-suit towers. These additional towers are to be constructed over the next five-years and underpinned by the credit quality of Deutsche Telekom. In addition to the built-in organic growth, we plan to use this business as a platform for follow-on opportunities in the fragmented European telecom tower market.

On the capital recycling front, earlier this year, we signed agreements to sell three mature businesses for approximately $600 million of proceeds. These sales were in addition to the sale of our U.S. container terminal that closed earlier this year for approximately $350 million. Of the three secured sales, our New Zealand telecom tower portfolio sale closed November 1st, our Brazilian electricity transmission lines are expected to close in November and the Indian toll roads are on track to close by year end. In addition, several sales processes are underway that, combined, are expected to generate approximately $1.5 billion of proceeds.”

See the full Earnings Release here

Waste Connections (WCN-N) released its third-quarter 2022 results on Wednesday, November 2, 2022, after markets closed.

“Strong execution once again provided for better than expected results, driven in the third quarter by continued acceleration of solid waste pricing to 10.1% and higher E&P waste activity, along with acquisitions closed during the period. Most notably, we overcame 50 basis points in incremental headwinds, primarily from the precipitous decline in recycled commodity values in September, to beat our outlook and expand adjusted EBITDA margin both sequentially and on a year-over-year basis, excluding the dilutive impact from acquisitions completed since the year ago period,” said Worthing F. Jackman, President and Chief Executive Officer.

– President and Chief Executive Officer, Worthing F. Jackman

Highlights:

- Increasing solid waste pricing growth, E&P waste activity and acquisition contribution once again drive better than expected quarterly results

- Revenue of $1.880 billion, up 17.7%

- Net income of $236.9 million, and adjusted EBITDA(b) of $588.1 million, up 16.3%

- Adjusted EBITDA margin of 31.3% of revenue, above outlook and up 20 basis points year over year, excluding acquisitions

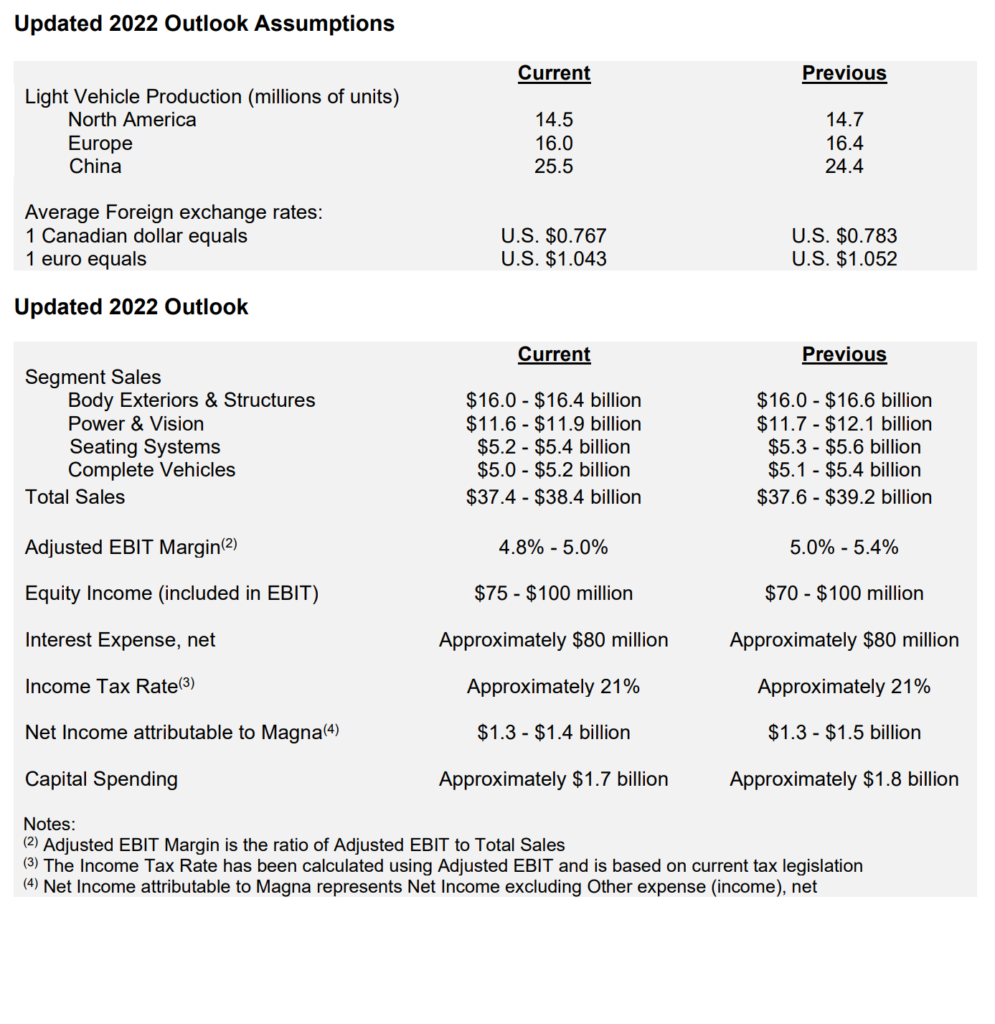

- Net income of $0.92 per share, and adjusted net income(b) of $1.10 per share