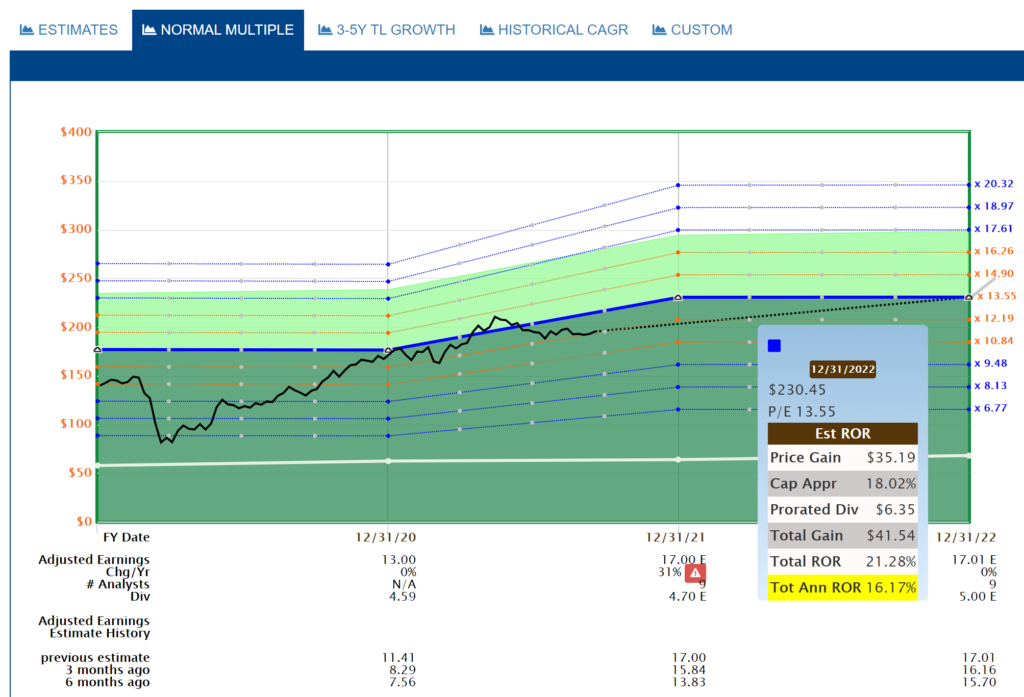

Comments:

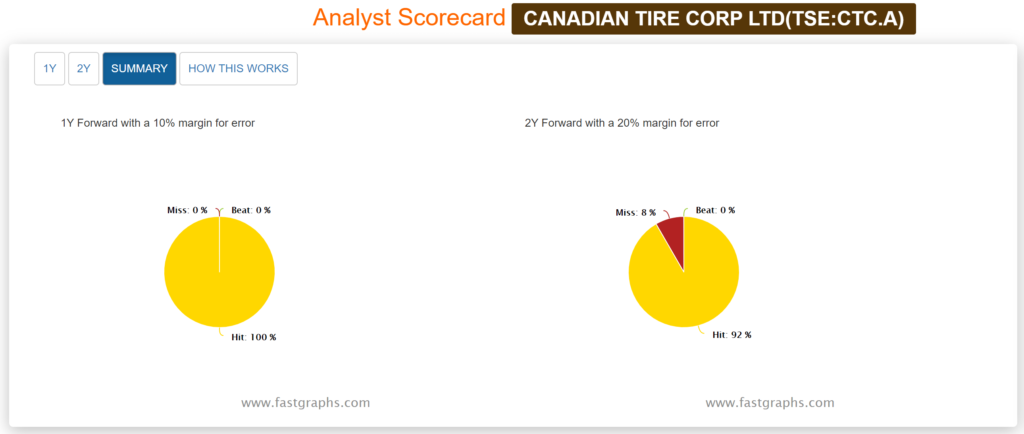

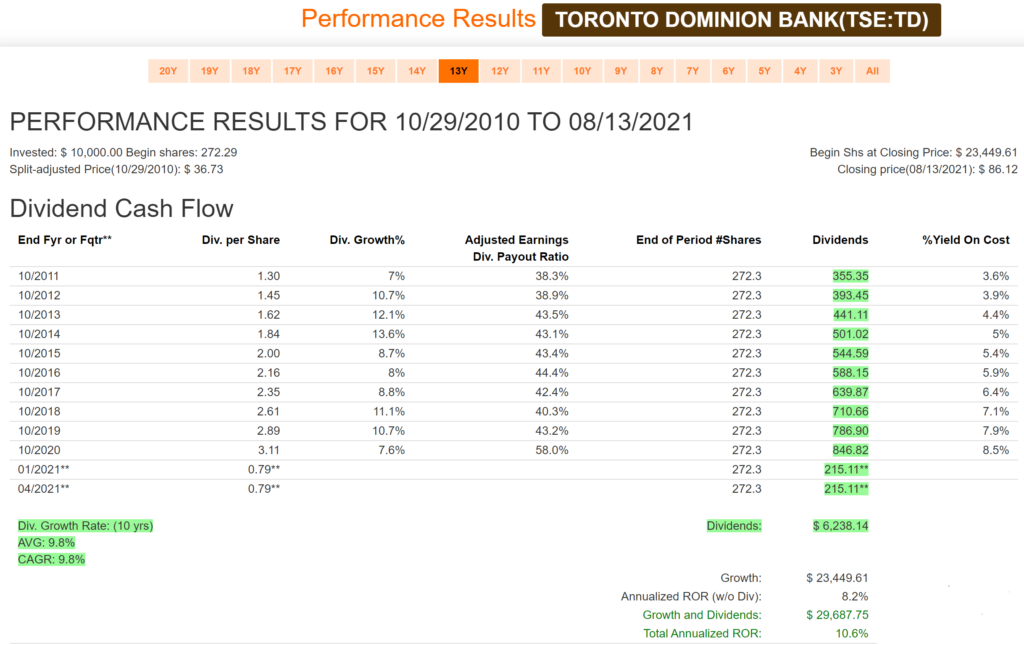

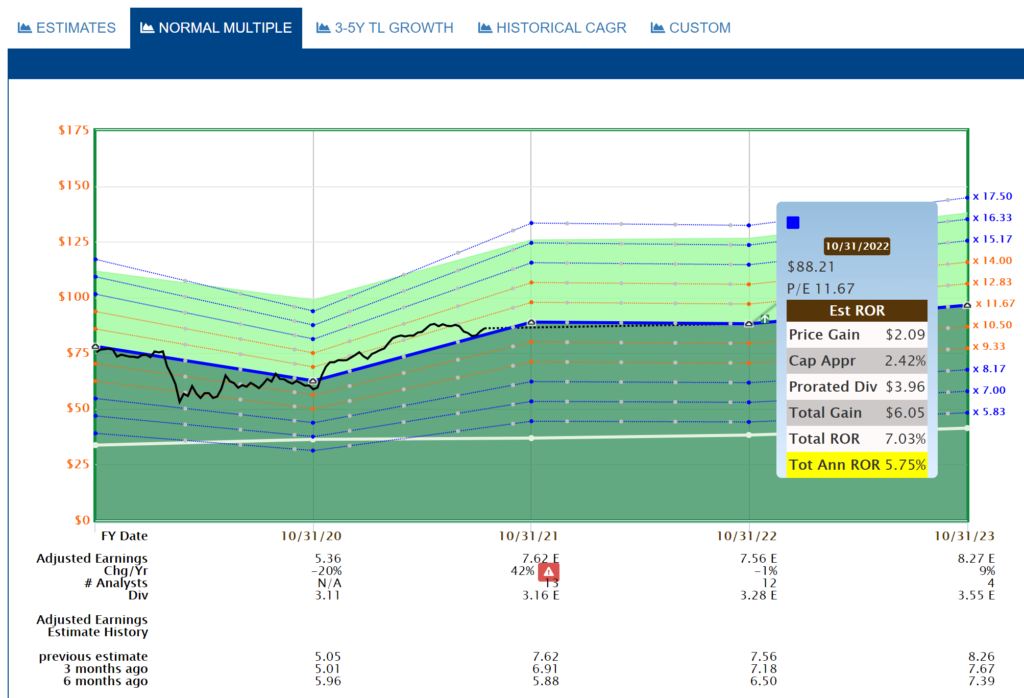

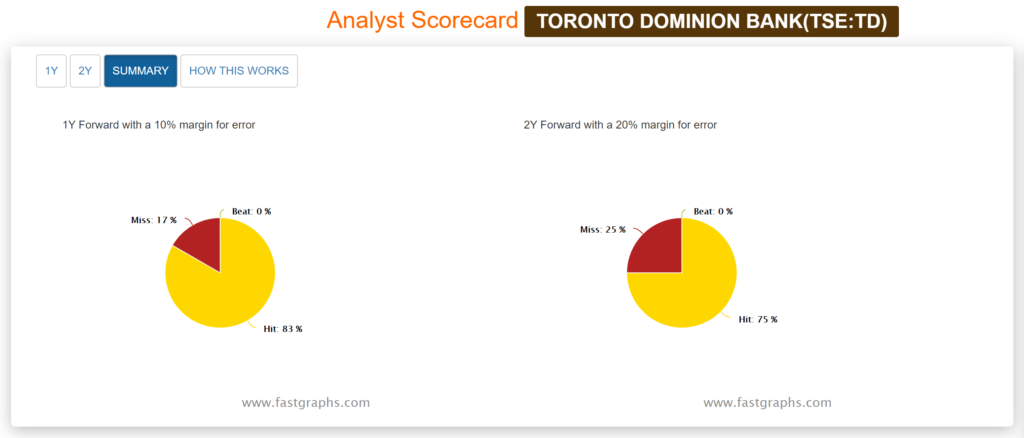

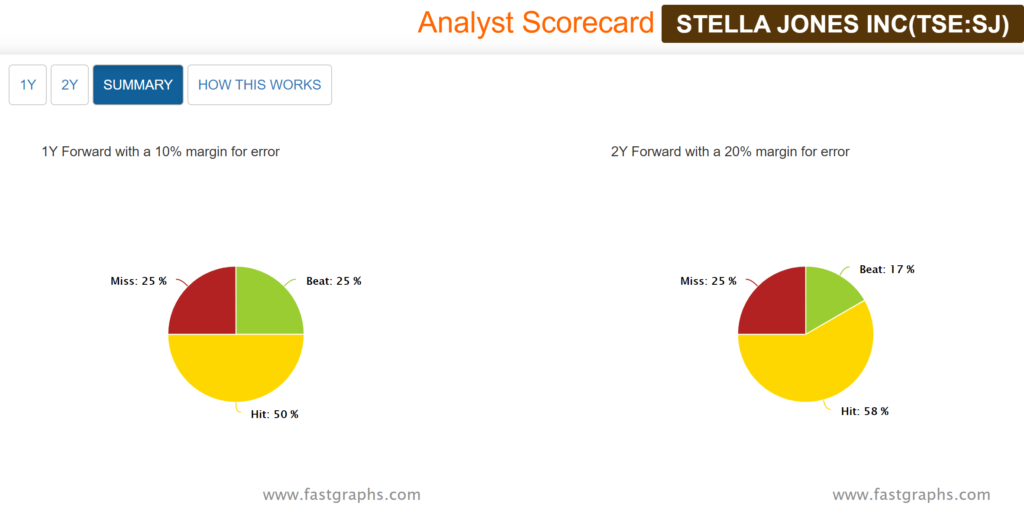

Analyst estimates over the years are quite accurate based on one and two-year earnings projections. Analysts projections have hit 83% of the time on one year estimates and 75% accuracy on two-year estimates.

Recent Earnings Report-Q2 2021:

Second Quarter Financial Highlights, compared with the second quarter last year:

Reported diluted earnings per share were $1.99, compared with $0.80.

Adjusted diluted earnings per share were $2.04, compared with $0.85.

Reported net income was $3,695 million, compared with $1,515 million.

Adjusted net income was $3,775 million, compared with $1,599 million.

Year-To-Date Financial Highlights, six months ended April 30, 2021, compared with the corresponding period last year:

Reported diluted earnings per share were $3.76, compared with $2.42.

Adjusted diluted earnings per share were $3.86, compared with $2.51.

Reported net income was $6,972 million, compared with $4,504 million.

Adjusted net income was $7,155 million, compared with $4,671 million.

“TD reported strong results in the second quarter, reflecting the underlying strength of our diversified businesses, improving economic conditions and our prudent approach to managing risk,” said Bharat Masrani, Group President and CEO, TD Bank Group. “We continued to invest in our people, capabilities and technology to position our business for growth as economies re-open and consumer and business activity recovers.”

“TD is strong and well-capitalized, and we continue to adapt and grow through this time of disruption. Our performance demonstrates the strength of our proven business model, brought to life through the efforts and resilience of our 90,000 colleagues across the globe who live our purpose and demonstrate a deep commitment to the Bank, those we serve, and the communities where we live and work,” concluded Masrani.

Summary:

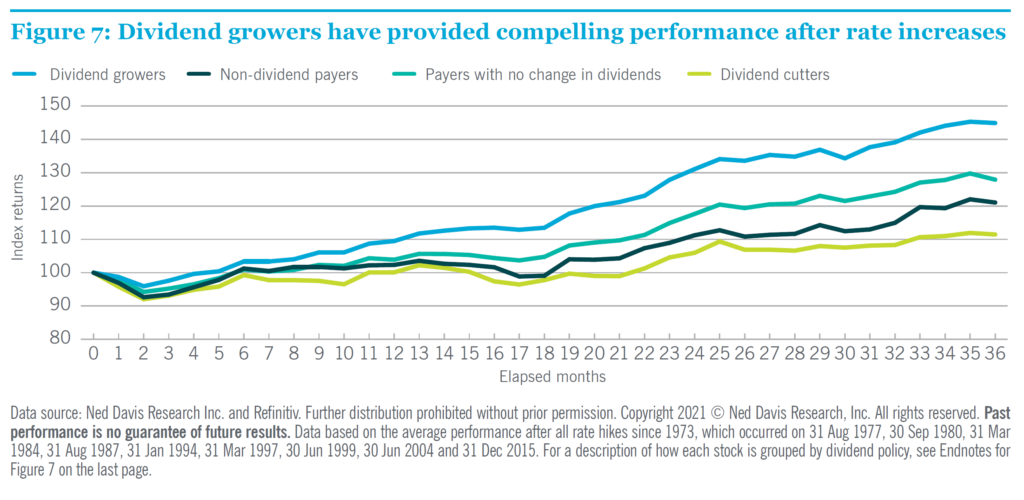

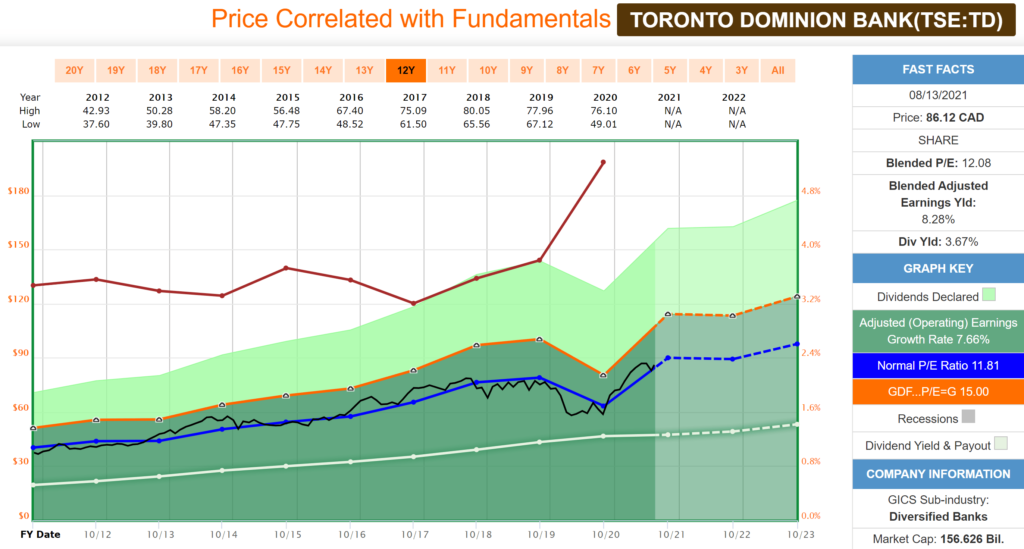

The banks have been on fire in the last year with the sector up over 50% from their 2020 lows. Valuation is a bit ‘frothy’ compared to historical norms which limits short term upside on price appreciation. With that said, TD is one of the highest quality (Value Line Financial Rating of ‘A’) dividend growers in Canada with a stellar record of consecutive dividend payments.

“Valuations control long-term returns. The higher the price you pay today for each dollar you expect to receive in the future, the lower the long-term return you should expect from your investment.”

-John Hussman

Toronto Dominion reports it’s Q3 results on August 26, 2021 which will give us a better idea of when dividend increases will resume.