MP Market Review – November 21, 2025

Last updated by BM on November 25, 2025

Summary

Welcome to this week’s MP Market Review – your go-to source for insights and updates on the Canadian dividend growth companies we track on The List! While we’ve expanded our watchlists to include U.S. companies The List-USA, our Canadian lineup remains the cornerstone of our coaching approach.

Don’t miss out on exclusive newsletters and premium content that will help you sharpen your investing strategy. Explore it all at magicpants.substack.com.

Your journey to dividend growth mastery starts here – let’s dive in!

- Last week, dividend growth of The List stayed the same with an average return of +7.1% YTD (income).

- Last week, the price of The List was down from the previous week with an average return of +10.9% YTD (capital).

- Last week, no companies on The List made a dividend announcement.

- Last week, one company on The List released an earnings report.

- This week, one company from The List will report their off-cycle earnings.

DGI Clipboard

“If you are just starting to invest in dividend growth stocks and you also hold bonds, I’d keep them for a while…until the dividend income starts to grow…until you realize what’s going on. Once your ‘yield on cost’ gets close to the yield on your bonds, you’ll know what to do.”

— Tom Connolly

Homes Didn’t Get Pricier. Your Dollar Got Weaker. The Investing Lesson No One Talks About.

Intro

I came across a chart in the article referenced in our “DGI News” section below that illustrates something we can all relate to: the erosion of purchasing power as seen through Canadian home prices. While home prices have surged dramatically in dollar terms, their value in forms of money with longer histories, like gold and silver, has barely changed in more than four decades.

In 1981, the average Canadian home cost about 4.5 kilograms of gold. Today, it costs almost exactly the same. Measured in silver, the average home is worth roughly 375 kilograms, virtually identical to its value back in 1986. This raises an obvious question: If homes do not cost more in real terms, why do they feel so much less affordable?

The answer lies in the nature of fiat currency. Modern money is not anchored to anything tangible. As governments expand the money supply, each dollar buys less over time. Homes have not become dramatically more valuable. Our money has simply become weaker.

Federal governments, particularly those with significant debt, increase the money supply to bring on inflation which will reduce the real value of their debt and boost tax revenue. Given the current state of government balance sheets, it’s reasonable to expect higher inflation will become more common in the future.

So, why discuss inflation in the context of dividend growth investing? Because it can have a profound impact on your retirement planning.

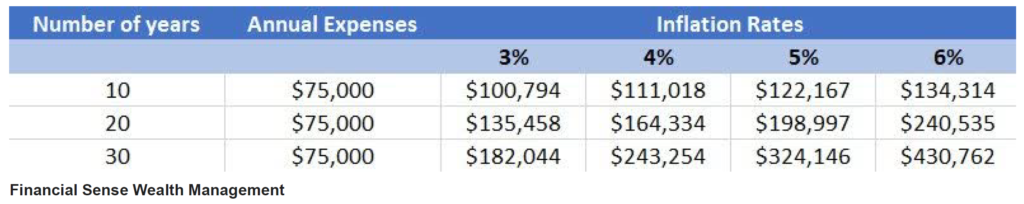

The chart below illustrates how much more you’ll need in 10, 20, or 30 years to cover $75,000 in expenses today at various inflation rates.

Now let’s apply the same concept to fixed income investing (Bonds) versus dividend growth investing.

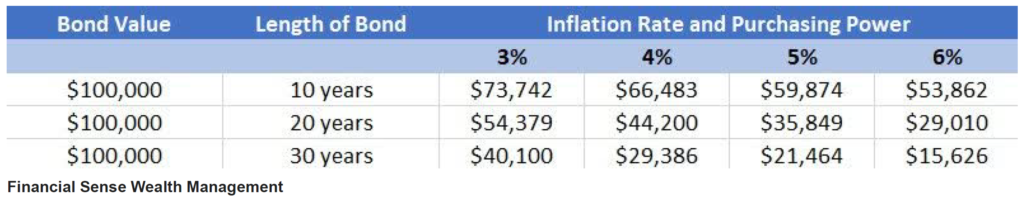

In this example we look at a $100,000 Bond over 10, 20, or 30 years, as inflation steadily erodes its purchasing power.

Over time, a fixed coupon loses purchasing power, just like wages that do not keep up with inflation. Investors may think they are buying stability, but in real terms they may be locking in a long-term loss.

Dividend growth companies are different. They adjust. As earnings rise, so do dividends. Quality businesses with pricing power can pass inflation on to customers and grow their income streams in real terms. Dividend growth investors are not simply collecting a fixed payment. They own businesses that increase their distributions year after year, helping protect and expand purchasing power over time.

Takeaway

In an environment where money steadily loses value, fixed income stands still. Dividend growth compounds.

Become a paid partner, and I’ll show you exactly how I do it. With real money. In real stocks. In addition, gain full access to this post and exclusive, subscriber-only content. We do the work; you stay in control. Subscribe today and take your dividend growth investing to the next level!

DGI Scorecard

The List (2025)

The Magic Pants 2025 list includes 29 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on ‘The List’:

- Dividend growth streak: 10 years or more.

- Market cap: Minimum one billion dollars.

- Diversification: Limit of five companies per sector, preferably two per industry.

- Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies are added or removed from ‘The List’ annually on January 1. Prices and dividends are updated weekly.

‘The List’ is not a portfolio but a coaching tool that helps us think about ideas and risk manage our model portfolio. We own some but not all the companies on ‘The List’. In other words, we might want to buy these companies when valuation looks attractive.

Our newsletter provides readers with a comprehensive insight into the implementation and advantages of our Canadian dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

Performance of ‘The List’

Last week, dividend growth stayed the same, with an average return of +7.1% YTD (income).

The price of ‘The List’ was down from the previous week, with an average YTD return of +10.9% (capital).

Last week’s best performers on ‘The List’ were Loblaw Companies Limited (L-T), up +4.16%.; Waste Connections (WCN-N), up +3.96%; and Royal Bank of Canada (RY-T) up +2.88%.

Stantec Inc. (STN-T) was the worst performer last week, down -10.75%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| ATD-T | Alimentation Couche-Tard Inc. | 1.1% | $72.02 | -8.89% | $0.78 | 8.3% | 15 |

| BCE-T | Bell Canada | 8.8% | $32.60 | -2.74% | $2.87 | -28.1% | 16 |

| BIP-N | Brookfield Infrastructure Partners | 4.9% | $35.21 | 10.51% | $1.72 | 6.2% | 17 |

| CCL-B-T | CCL Industries Inc. | 1.5% | $83.77 | 13.79% | $1.28 | 10.3% | 23 |

| CNR-T | Canadian National Railway | 2.7% | $131.11 | -10.68% | $3.55 | 5.0% | 29 |

| CTC-A-T | Canadian Tire | 4.3% | $166.65 | 8.42% | $7.10 | 1.4% | 14 |

| CU-T | Canadian Utilities Limited | 4.4% | $41.84 | 20.30% | $1.83 | 1.0% | 53 |

| DOL-T | Dollarama Inc. | 0.2% | $197.68 | 41.00% | $0.41 | 18.1% | 14 |

| EMA-T | Emera | 4.4% | $66.78 | 24.75% | $2.92 | 1.2% | 18 |

| ENB-T | Enbridge Inc. | 5.6% | $67.60 | 9.26% | $3.77 | 3.0% | 29 |

| ENGH-T | Enghouse Systems Limited | 5.8% | $20.13 | -25.61% | $1.16 | 16.0% | 18 |

| FNV-N | Franco Nevada | 0.8% | $191.30 | 57.93% | $1.52 | 5.6% | 17 |

| FTS-T | Fortis Inc. | 3.4% | $72.66 | 21.87% | $2.49 | 4.2% | 51 |

| GSY-T | goeasy Ltd. | 4.7% | $124.43 | -25.56% | $5.84 | 24.8% | 10 |

| IFC-T | Intact Financial | 1.9% | $284.19 | 8.07% | $5.32 | 9.9% | 20 |

| L-T | Loblaw Companies Limited | 0.9% | $63.03 | 32.53% | $0.55 | 15.2% | 13 |

| MFC-T | Manulife Financial | 3.6% | $48.66 | 10.74% | $1.76 | 10.0% | 11 |

| MGA-N | Magna | 4.0% | $48.26 | 15.62% | $1.94 | 2.1% | 15 |

| MRU-T | Metro Inc. | 1.5% | $100.19 | 11.11% | $1.48 | 10.4% | 30 |

| RY-T | Royal Bank of Canada | 2.9% | $211.38 | 22.70% | $6.04 | 7.9% | 14 |

| SJ-T | Stella-Jones Inc. | 1.5% | $84.26 | 15.44% | $1.24 | 10.7% | 20 |

| STN-T | Stantec Inc. | 0.7% | $132.65 | 17.28% | $0.89 | 7.3% | 13 |

| T-T | Telus | 8.8% | $18.71 | -4.69% | $1.64 | 7.0% | 21 |

| TD-T | TD Bank | 3.6% | $115.59 | 51.10% | $4.20 | 2.9% | 14 |

| TFII-N | TFI International | 2.1% | $85.95 | -35.19% | $1.80 | 12.5% | 14 |

| TIH-T | Toromont Industries | 1.3% | $158.98 | 40.57% | $2.08 | 8.3% | 35 |

| TRI-Q | Thomson Reuters | 1.8% | $135.00 | -16.86% | $2.38 | 10.2% | 31 |

| TRP-T | TC Energy Corp. | 4.5% | $75.98 | 11.37% | $3.40 | 3.3% | 24 |

| WCN-N | Waste Connections | 0.7% | $175.30 | 3.17% | $1.30 | 10.7% | 15 |

| Averages | 3.2% | 10.9% | 7.1% | 21 |

Note: Stocks ending in “-N or -Q” declare earnings and dividends in US dollars. To achieve currency consistency between dividends and share price for these stocks, we have shown dividends in US dollars and share price in US dollars (these stocks are listed on a US exchange). The dividends for their Canadian counterparts (-T) would be converted into CDN dollars and would fluctuate with the exchange rate.

PAID subscribers enjoy full access to our enhanced weekly newsletter, premium content, and easy-to-follow trade alerts so they can build DGI portfolios alongside ours. This service provides the resources to develop your DGI business plan confidently. We do the work; you stay in control!

It truly is the subscription that pays dividends!

The greatest investment you can make is in yourself. Are you ready to take that step?

For more articles and the full newsletter, check us out on magicpants.substack.com.