Posted by BM on November 3, 2021

“The dividend is such an important factor in the success of many stocks, that you could hardly go wrong by making an entire portfolio of companies that have raised their dividends for 10 to 20 years in a row.” Peter Lynch, Beating the Street p. 49

“The best way to handle a situation in which you love a company but not the current price is to make a small commitment and then increase it in the next sell-off.” Peter Lynch, Beating the Street p. 158

Some good advice from Peter Lynch in his book Beating the Street.

Speaking of Peter Lynch, we were recently made aware of an article (Fear of Crashing) in Worth Magazine written by Mr. Lynch and financial writer John Rothchild in 1995 where Lynch advises how to prepare for, react to and recover from a market correction. We found it relevant not only because it is timely with the stock markets at an all-time high but because many of our subscribers are looking for a different withdrawal strategy other than the ‘4% Rule’.

“The strategy I’m proposing can offer the best of both worlds: money to live on that normally comes from bonds and growth that comes from stocks. Here’s how it works. You sink 100 percent of your investment capital into a portfolio of companies that pay regular dividends. You could do this the easy way and invest in an S&P 500 index fund, currently yielding about 3 percent. Or you could select a few “dividend achievers,” as identified by Moody’s. These are the companies that have a habit of raising their dividends year after year no matter what.

Since dividends are paid out of earnings, these dividend achievers couldn’t have compiled such a record without having enjoyed consistent success in their core business, whatever it is. So you’re looking at a group of profitable enterprises with staying power.”

-Peter Lynch

Interesting to note that even in 1995, one of the greatest growth investors of all-time is recommending dividend growth stocks as the core of his ‘Stay-in-Stocks Strategy’.

In a nutshell here is Lynch’s strategy:

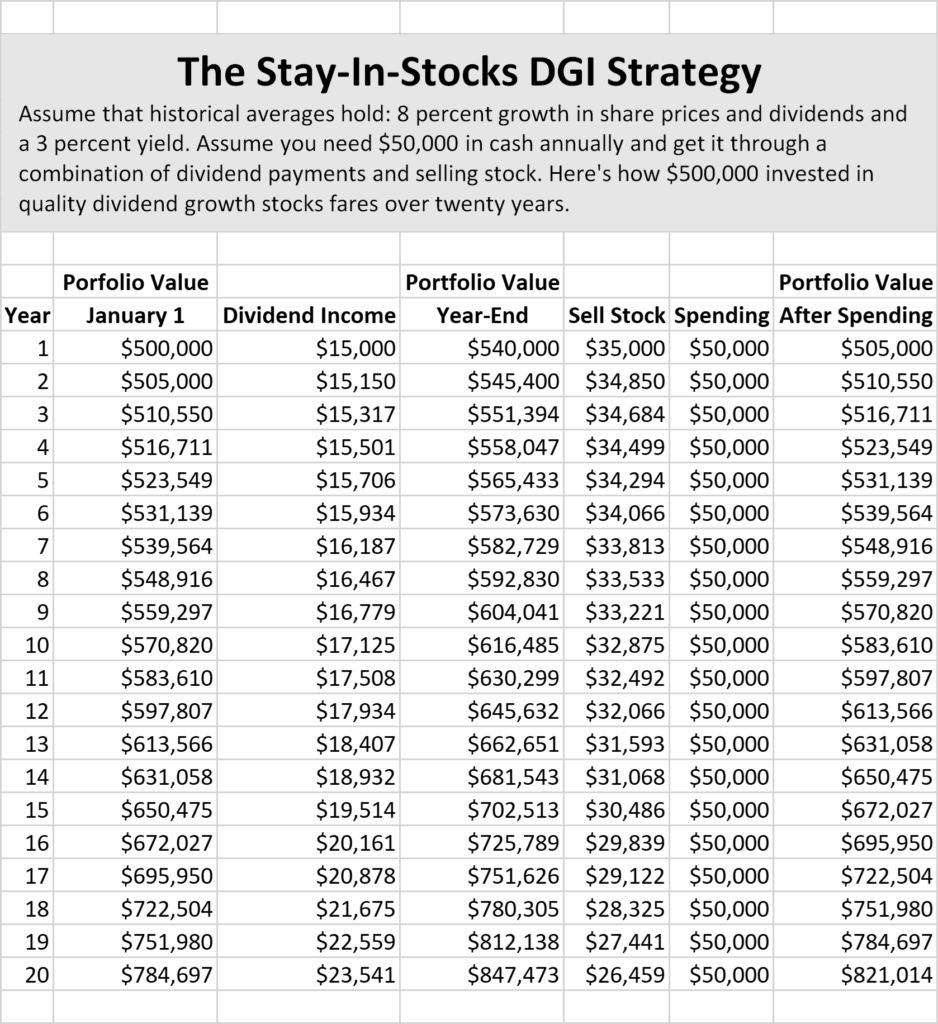

Let’s assume you have $500,000 to invest and you need a minimum of $50,000 each year to meet your spending obligations. First start by building a portfolio of quality dividend growth stocks from ‘The List’ with a starting dividend yield of 3%. Year one you will receive $15,000 in dividends ($500,000 x .03). You are still shy of your spending amount. You sell $35,000 in stock to make up the difference.

To some, selling stock that you have recently bought may sound a little scary but once you assume that the portfolio has risen by 8% (historical norm for stocks) during the year, the strategy begins to make a little more sense. Combine the dividends (3%) and capital growth (8%) of the DGI portfolio and you have an average total return of 11% for the year. This return back tests favorably with the stocks on ‘The List’ who achieved a higher total return CAGR of 13.3% for the last decade.

Here are the 10YR Compound Annual Returns of ‘The List’. 10YR_CAGR-The List-01-01-2021

Your portfolio would now be worth $555,000 had you left it alone ($500,000 x 1.11). The fact that you withdrew funds, $15,000 in dividends and sold $35,000 in stock means you begin the second year with a portfolio worth $505,000.

The good dividend growers raise their dividends again in year two and your portfolio value increases at the same rate (8%). At the end of year two, you sell a little bit less stock to reach your spending goal. Every year thereafter, as dividends are raised and stock prices go up, you’re selling less and less stock to cover your expenses. Selling less stock allows your portfolio to grow beyond its original value.

We have included a table below to show you what happens next as companies in your portfolio continue to raise their dividends and stock prices continue to go up at their historical rates.

Although these numbers are theoretical and no market goes up exactly 8% every year, a twenty-year time horizon is long enough to have a high probability that historical norms will be achieved.

This strategy will work for any investor but is particularly suited for those who require more than just dividend income to meet their financial obligations in retirement and are fine withdrawing some of their capital to enjoy a higher standard of living.

If we use the same strategy with a higher starting yield, higher growth rate or are fine with depleting our original portfolio value, we can increase our annual spending even more. Each investor must customize this strategy to suit their own circumstances and goals.

In summary, Lynch asks in his article that if this strategy is such a great idea, why aren’t more people taking advantage of it? His conclusion is that people are too worried about the next correction and are convinced it will happen the day after they invest in stocks. For fear of a market crash they don’t invest at all.

As dividend growth investors we protect ourselves from a market correction by only purchasing companies when they are sensibly priced, buying more when there is a sell-off, and holding for the long term as our growing income drives the prices of our quality stocks even higher.