Last updated by BM on November 30, 2023

“I measure our progress primarily on the basis of the income we are collecting and the growth of that income through dividend increases.”

– Josh Peters, Former Editor of Morningstar DividendInvestor Newsletter and Author of ‘The Ultimate Dividend Playbook’.

Summary

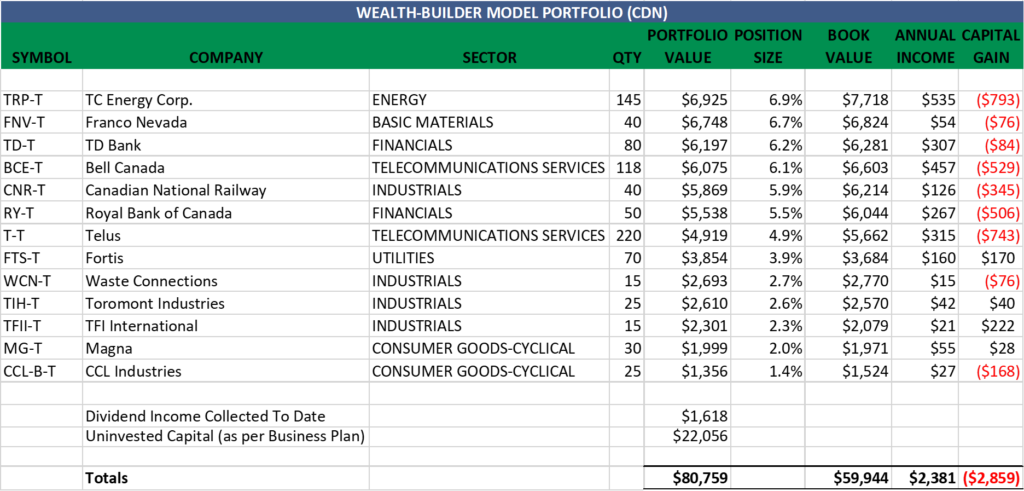

- During the last fiscal quarter, the Magic Pants Wealth-Builder Model Portfolio (CDN) made only one purchase to an existing position. The portfolio remains invested in thirteen dividend growth companies across seven sectors of the Canadian economy.

- With an initial capital investment of $59,944, the portfolio’s annualized income has grown to $2,381 at the end of this quarter. A 10.6% increase over the previous quarter.

- The main goal of the portfolio is to generate growing dividends from quality Canadian companies with a track record of dividend growth.

- The secondary goal is to build a portfolio that generates above-average total returns over the long term (5-10 years).

Background

“You have a pair of pants. In the left pocket, you have a $100. You take $1 out of the left pocket and put in the right pocket. You now have a $101. There is no diminution of dollars in your left pocket. That is one magic pair of pants.”

This ‘magic pants’ analogy was from an article on dividend investing I read about a decade ago on Seeking Alpha and was one of the catalysts for me to take a closer look at this type of investing and see if it truly was magical.

The Magic Pants Wealth-Builder Model Portfolio (CDN) is our attempt to prove that dividend growth investing is one of the simplest and safest ways to build wealth. We believe that by following our process, an everyday investor can learn to build powerful dividend growth portfolios and eventually find that elusive pair of magic pants.

Goals and Objectives

Dividend growth investing is a long-term investment strategy that involves selecting quality stocks with a history of consistently increasing dividends and holding them for the long term. The goal of this strategy is to generate a steadily increasing stream of income through the reinvestment of dividends, as well as potentially realizing capital gains as the stock price appreciates over time. This can be an appealing strategy for investors looking for a reliable source of income, as well as for those seeking to grow their wealth over time.

The Magic Pants Wealth-Builder Model Portfolio (CDN) is a public, real-money, real-time portfolio demonstrating the principles and practices of dividend growth investing. The portfolio was launched on May 1, 2022, and has been managed in real-time since. Its primary goal is to generate a steadily increasing stream of dividends paid by quality Canadian companies. All the decisions to buy, hold, and sell securities are real decisions about handling money. The portfolio is intended to serve as a blueprint for constructing a dividend growth portfolio, and as a living example of how dividend growth investing works. It can be useful for illustrating goal setting, planning, stock selection, portfolio management, and other aspects of investing for those with similar goals.

With an initial capital injection of $100,000, dividend reinvestment and annual contributions of $12,000, the 10-year target is to achieve ~ $11,400 annual income by the tenth-anniversary date. The MP Wealth-Builder Model Portfolio (CDN) – Business Plan can be found here.

Quarterly Portfolio Review

One of our practices is to give the Magic Pants Wealth-Builder Model Portfolio (CDN) a checkup four times yearly, at the end of July, October, January and April. The basic questions are: How is the portfolio doing? Is it tracking towards its goal? How is each position doing? Should changes be made to keep the enterprise on track? We follow a formal process for portfolio reviews plus additional discussion.

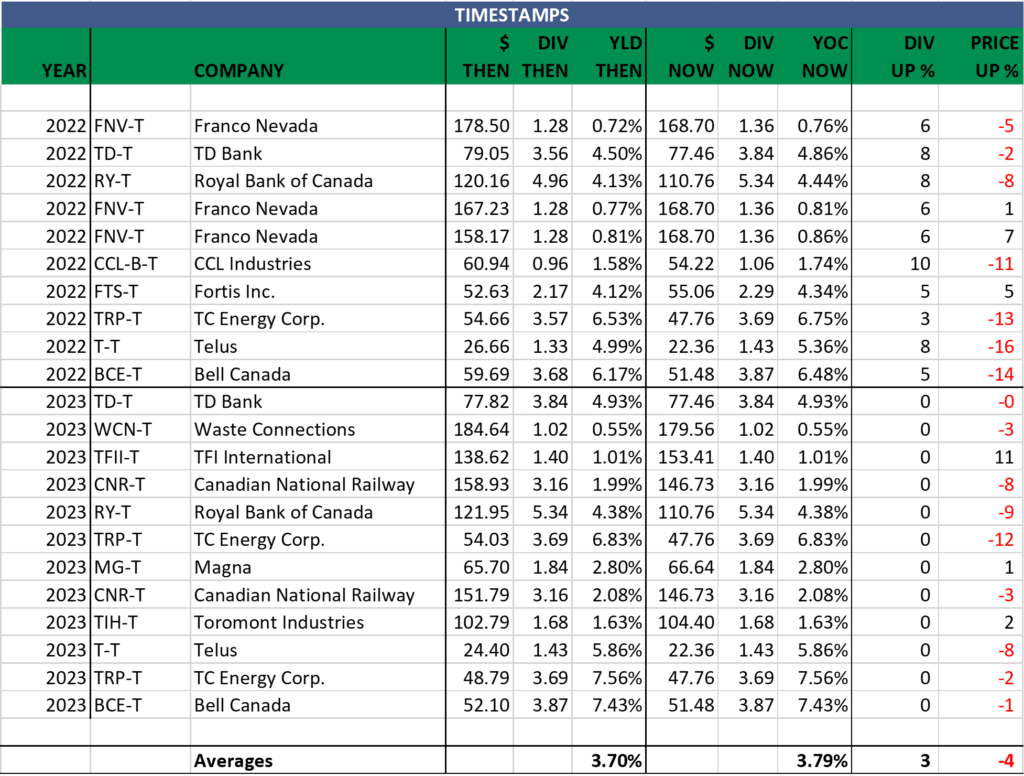

To provide accountability, transparency and trust in our process, we ‘timestamp’ all our trades. We also like viewing our trades in this manner because it is easy to quickly see how we are doing and the effects a growing dividend has on price.

Every DGI Alert we’ve issued since we started our portfolio has been timestamped. We don’t hide our history. When we’re wrong, it’s right there for all to see – every win, loss, and tie.

Transactions This Quarter

“Your money is like a bar of soap – the more you handle it, the less you’ll have.”

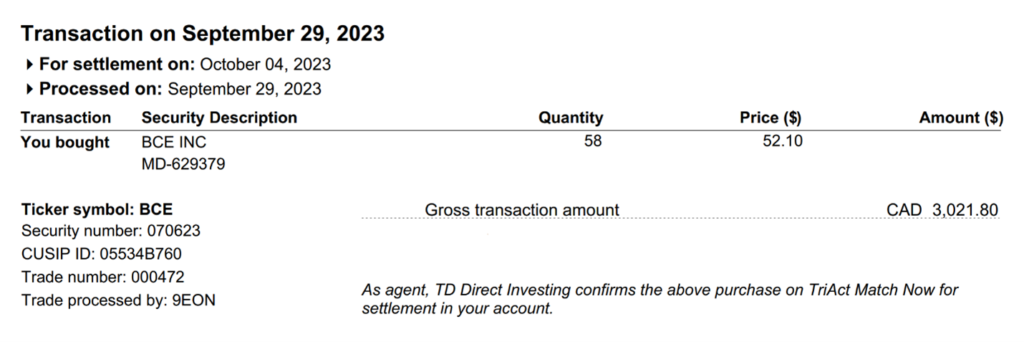

There was one purchase this quarter.

We will provide DGI alerts (timestamped) each time we buy/sell stock in our portfolio and then write an article on why.

Articles detailing the investment thesis behind our purchases can be found in the ‘Subscriber Only’ category section of our site on the right side of our home page. Here are the links:

We Just Bought More Bell Canada (BCE-T) for our MP Wealth-Builder Model Portfolio (CDN)

Dividend Increases Announced This Quarter

Three companies in the portfolio announced dividend increases this quarter:

Waste Connections (WCN-N) .255 to .285 up 11.8% payable on November 28, 2023

Fortis Inc. (FTS-T) .565 to .59 up 4.42% payable on December 01, 2023

TFI International (TFII-N) .35 to .40 up 14.28% payable on January 13, 2024

Income Paid This Quarter

“The market may move irrationally while dividends remain much more stable, reliable and predictable.”

We earned $554.52 in dividend income last quarter, up 11.5% from the previous quarter. This amount gets deposited directly into our brokerage account, where we can reinvest it in quality individual dividend growth companies that are sensibly priced.

Note: When the currency of the dividend and share price match, the calculation is straightforward. But it’s not so simple when the dividend is declared in one currency, and the share price is quoted in another. Dividing the former by the latter would produce a meaningless result because it’s a case of apples and oranges. To calculate the yield properly, you must express the dividend and share price in the same currency. Franco Nevada is one such company. We bought it in CDN dollars, and it pays a USD dividend. The dividend amount above has been converted to CDN dollars.

Returns

Return Calculation:

We reviewed several different calculations to come up with a fair representation of total return. The ‘gold standard’ in the investment industry is time-weighted results which we calculate monthly. We use the ‘Modified Dietz Return’ formula to calculate our portfolio returns.

The ‘Modified Dietz Return’ calculates the monthly rate of return of an investment portfolio which includes the cashflows in and out of the portfolio. The method accounts for the timing of when the cash flows come in and out of the portfolio to properly weigh the impact of these cash flows on the portfolio’s return.

At present we do not incorporate the returns of our uninvested cash positions as part of our portfolio returns only contributions and withdrawals to the portfolio and of course our dividends.

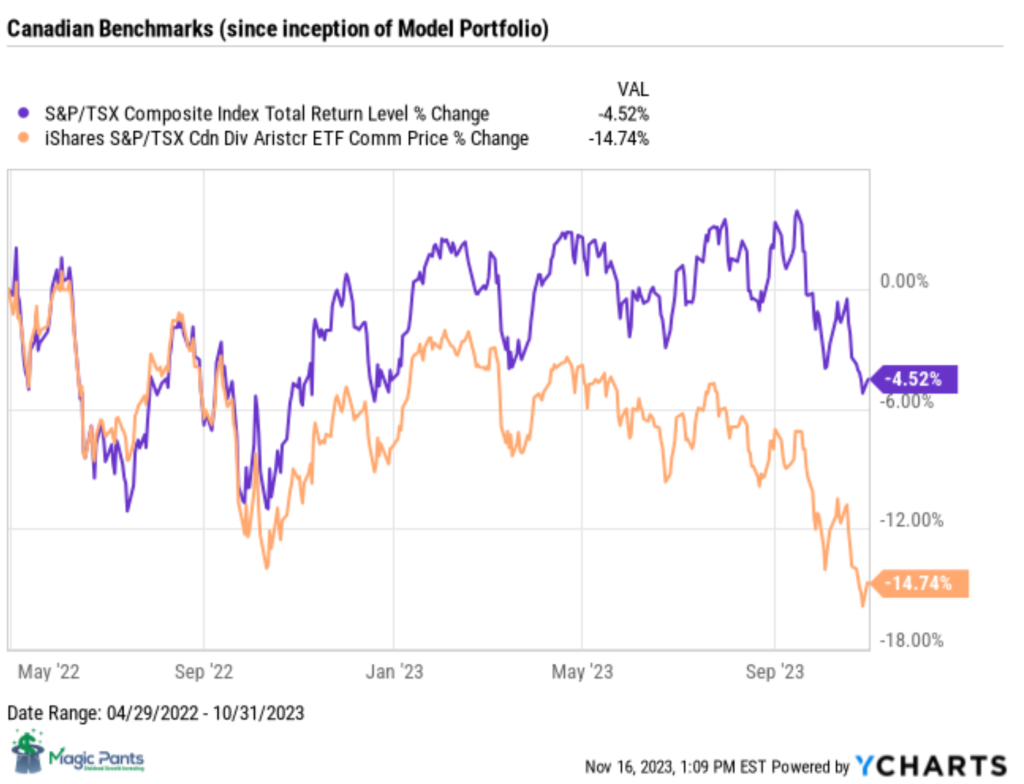

Here are the benchmarks we track our capital returns against.

Our Portfolio

To date, we have invested $59,944 of our initial capital as per our business plan. That leaves us with remaining uninvested capital for this fiscal year of $22,056 ($82,000-$59,944) plus dividends collected.

Since inception, our income has grown to an annualized amount of +$2,381 and our capital has an unrealized capital loss of -$2,859 as of October 31, 2023.

Wrap Up

When facing a tough quarter with negative short-term capital returns, it’s easy to lose sight of our goals. Luckily, our objectives are well-documented, and our proven process has stood the test of time for decades.

Goals:

- Our primary aim is to generate increasing dividends from top-notch Canadian companies known for their consistent dividend growth.

- Our secondary goal is to construct a portfolio that delivers higher-than-average total returns over the long term (5-10 years).

Regarding our first goal, we’re surpassing expectations. Our dividend income has risen by 11.5% compared to the previous quarter and 10.6% on an annualized basis.

Downward trending markets allowed us to invest at a higher starting yield than projected in our business plan. With six months to go until the end of our second fiscal year we have already reached 84% of our target income with only 72% of our capital invested as per the business plan. This allows us a lot of flexibility to balance out our portfolio with a few low-yield, high-growth stocks.

Achieving our secondary goal takes a bit more time. As long as our income keeps growing, our capital will soon follow suit. By maintaining patience and discipline in our approach, we’re confident that we’ll reap the rewards.

BM

P.S. Enjoy your growing income and don’t forget to ‘Front Load The Fun’!

Please don’t hesitate to reach out to me anytime with your comments or questions to info@magicpants.ca .