Posted by BM on November 15, 2021

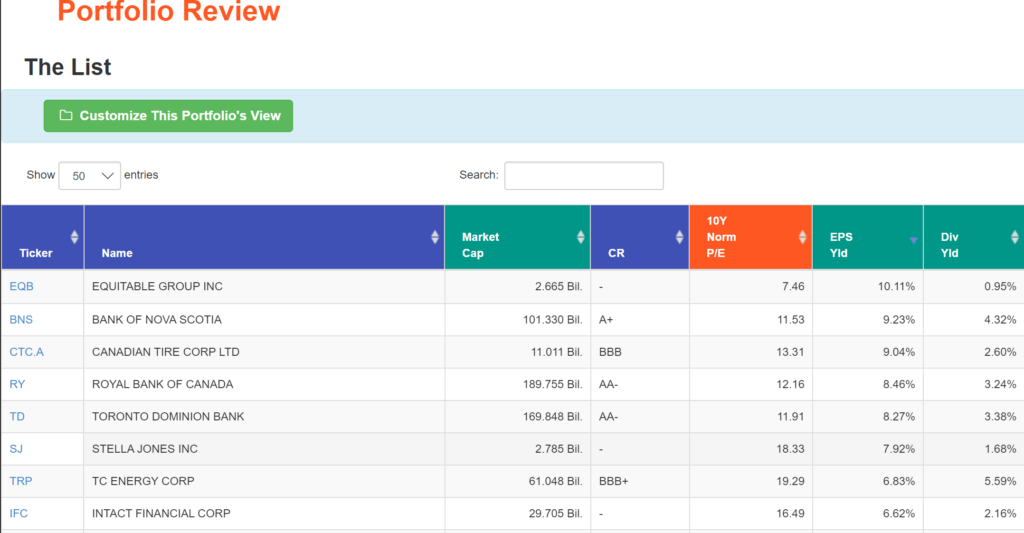

Each month I will walk through our valuation process using a stock on ‘The List’ that meets our minimum screen of 6.5% EPS Yld. This month it is TC Energy Corp. (TRP-T).

Valuation is the second step in our three-step process. Buying when our quality stocks are sensibly priced will help ensure our future investment returns meet our expectations. We rely heavily on the fundamental analyzer software tool (FASTgraphs) to help us understand the fundamentals of the stocks we invest in and then read the company’s website for investor presentations and recent earnings reports to learn more.

Intro:

TC Energy Corp. is a vital part of everyday life – delivering the energy millions of people rely on to power their lives in a sustainable way. Thanks to a safe, reliable network of natural gas and crude oil pipelines, along with power generation and storage facilities, wherever life happens. Guided by the core values of safety, innovation, responsibility, collaboration and integrity, 7,500 people make a positive difference in the communities where they operate across Canada, the U.S. and Mexico.

TC Energy Corp., formerly TransCanada Corp, is an energy infrastructure company. The Company is engaged in the development and operation of North American energy infrastructure, including natural gas and liquids pipelines, power generation and natural gas storage facilities. Its segments include Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines, Liquids Pipelines and Energy. The Company operates in three businesses: Natural Gas Pipelines, Liquids Pipelines and Energy. The Natural Gas Pipelines and Liquids Pipelines segments principally consist of its respective natural gas and liquids pipelines in Canada, the United States and Mexico, as well as its regulated natural gas storage operations in the United States. The Energy segment includes its power operations and the non-regulated natural gas storage business in Canada.

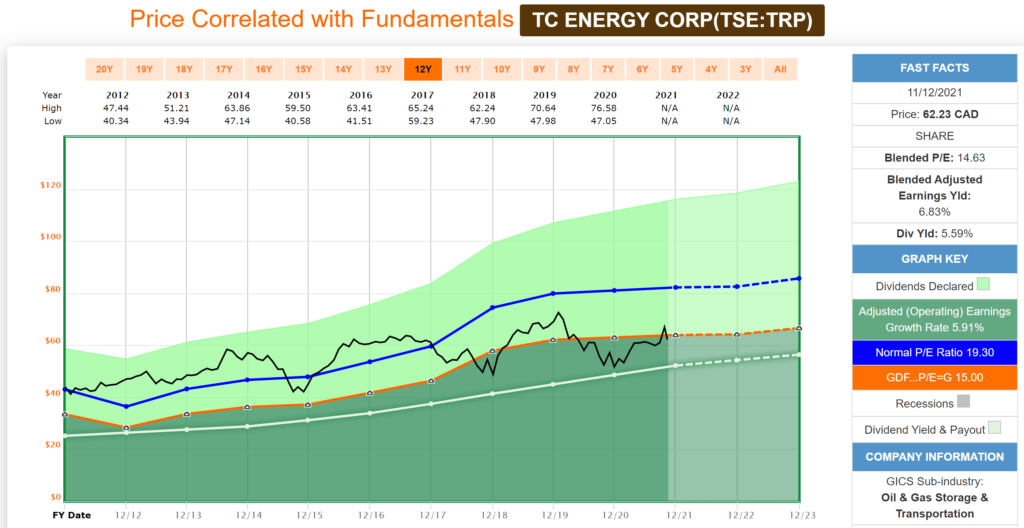

Historical Graph:

Comments:

TC Energy Corp. is another of our good dividend growers that trades within a narrow valuation corridor. As you can see from the Blue Line on the graph (Normal P/E) and the Black Line (Price), there is typically very little variance (except for the large dips in 2018 and 2020). Investment opportunities occur when the Black Line falls below the Blue Line or below the Orange Line (15 PE) in a sell-off with this quality dividend grower. The fundamentals show a company whose earnings have grown steadily over the last ten years at an annualized rate of ~6%.

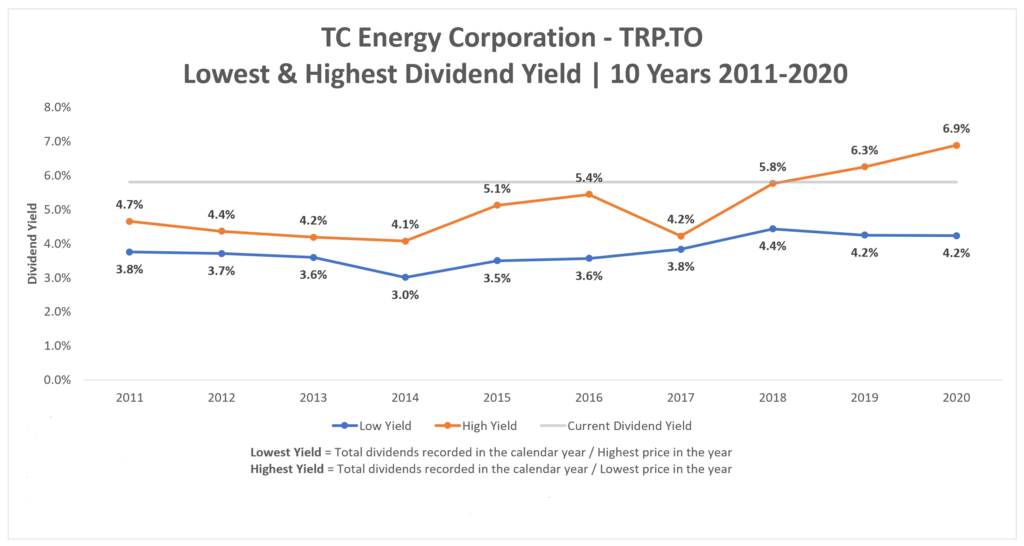

In the yield chart below, you will see a spike in the dividend yield above 6% last year when the price came under pressure. If you believed in ‘Dividend Yield Theory’ you would have been aggressively adding to your position last fall. The yield has come down a bit off its highs but is still trading well above its ten-year average of 4.3%.

Yield Chart:

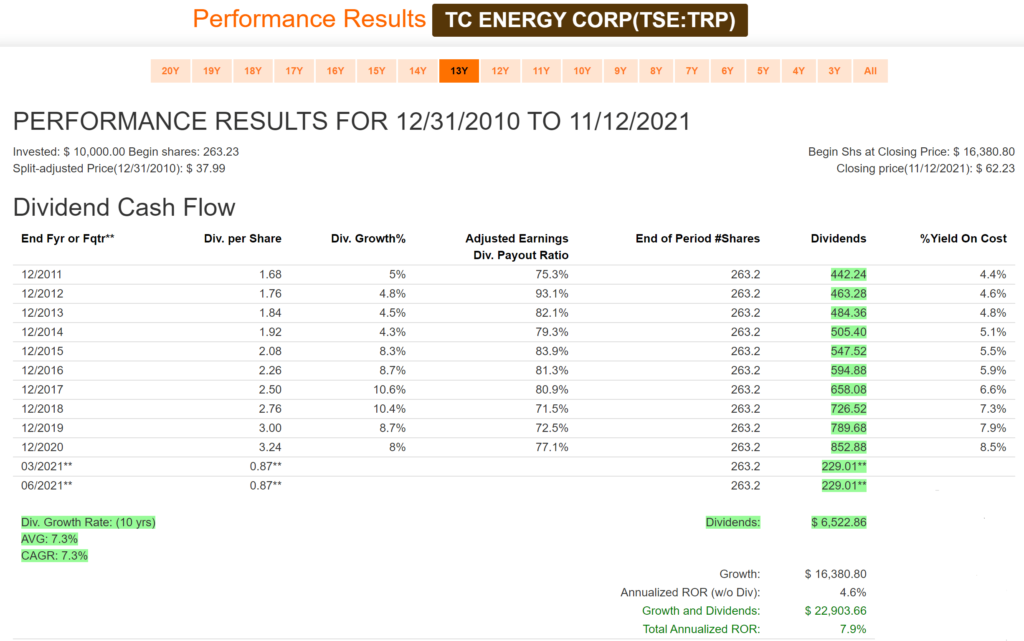

Performance Graph:

Comments:

TC Energy Corp. has an annualized dividend growth rate of 7.3% over the last decade. With a yield on cost of 8.5% from an initial purchase a decade ago, investors now enjoy a healthy return from the dividend alone. Up until their Q3 Earnings announcement last week, investors of this quality company were expecting the trend of 7% dividend growth to continue. Management has now modified their dividend growth outlook to between 3-5% to help strengthen their Balance Sheet and have ‘dry powder’ to take advantage of opportunities when they arise.

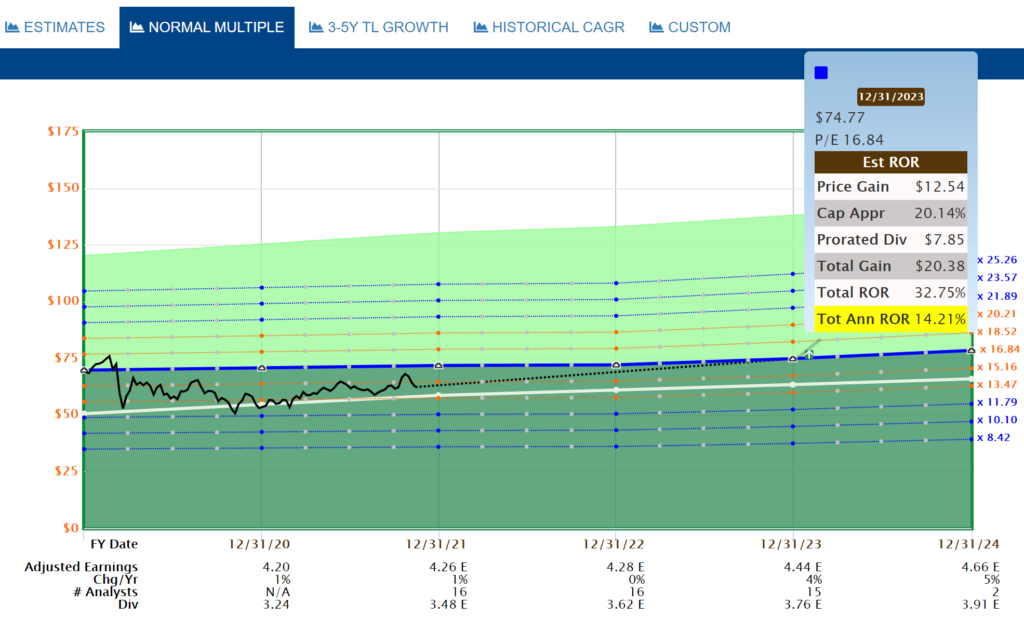

Estimated Earnings:

Comments:

Using the “Normal Multiple’ estimating tool from FASTgraphs, we see a blended P/E average over the last five years of 16.84. Based on fifteen analysts’ forecasts two years out, you can expect an annualized return based on today’s price of 14.21% should TRP.TO trade at its blended P/E.

Blended P/E is based upon a weighted average of the most recent actual value and the closest forecast value.

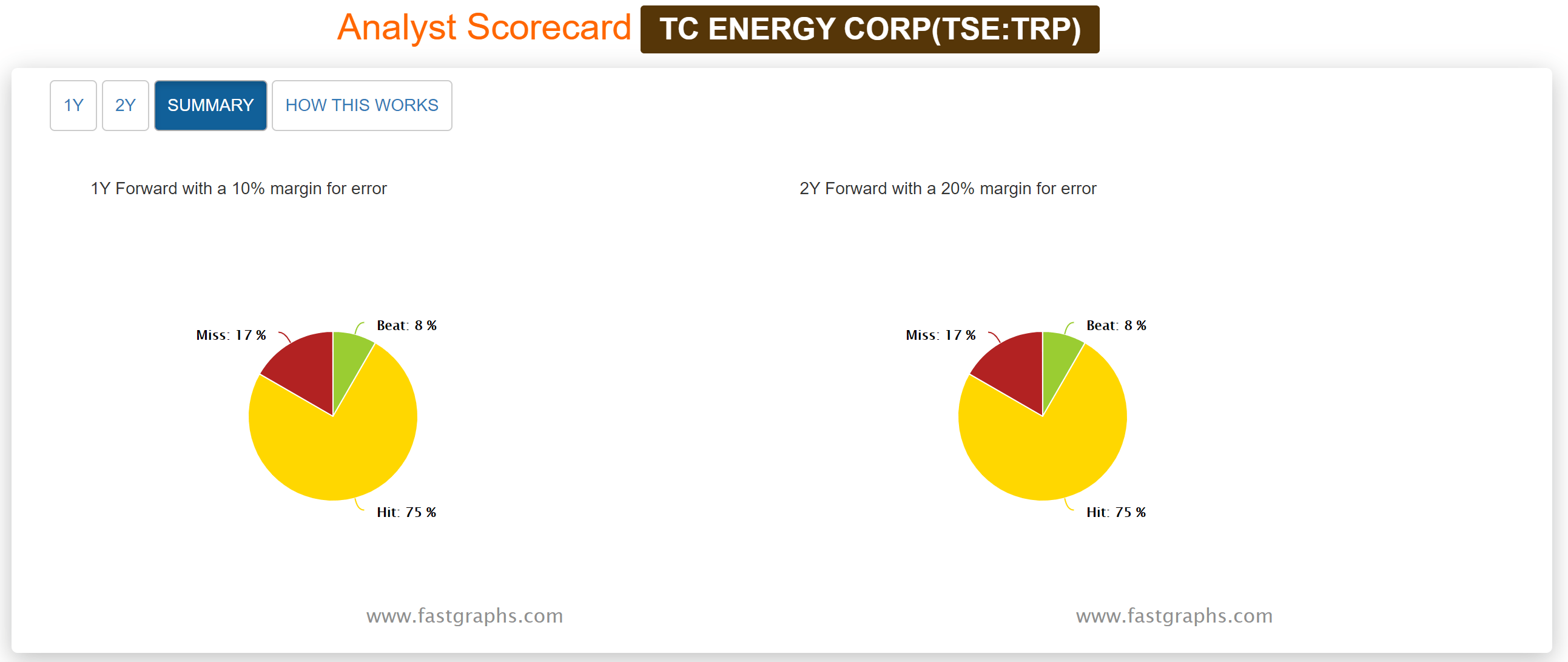

Analyst Scorecard:

Comments:

Analyst estimates over the years are quite accurate based on one and two-year earnings projections. Analysts’ projections have hit or beat 83% of the time on one and two year estimates.

Recent Earnings Report-Q3 2021:

Third quarter 2021 financial results

- Net income attributable to common shares of $779 million or $0.80 per common share

- Comparable earnings of $1.0 billion or $0.99 per common share

- Comparable EBITDA of $2.2 billion

- Net cash provided by operations of $1.7 billion

- Comparable funds generated from operations of $1.6 billion

Declared a quarterly dividend of $0.87 per common share for the quarter ending December 31, 2021

Continued to advance our $22 billion secured capital program by investing $1.7 billion in various growth projects

Began construction on the 2022 NGTL System Expansion Program

Continued to actively develop projects on our U.S. Natural Gas Pipeline network that will replace and upgrade certain facilities while reducing emissions including the US$0.8 billion WR project on ANR

Uncontested GTN rate settlement filed with FERC which would set new recourse rates for GTN effective January 1, 2022

Filed Columbia Gas rate settlement with FERC in October which includes continuation of its modernization program with approval expected in early 2022

Executed a 15-year Power Purchase Agreement (PPA) in September for 100 per cent of the power produced and the rights to all environmental attributes from the 297 MW Sharp Hills Wind Farm

Advanced the Bruce Power Unit 6 MCR program on budget and on schedule

Project 2030 launched by Bruce Power with the goal of achieving a site peak output of 7,000 MW by 2030 in support of climate change targets and future clean energy needs

Continued to develop a 1,000 MW pumped hydro storage project in Meaford, Ontario which is designed to provide emission-free electricity to the province while reducing greenhouse gas emissions

Signed a memorandum of understanding in August with Irving Oil to explore the joint development of a series of proposed energy projects focused on reducing greenhouse gas emissions and creating new economic opportunities in New Brunswick and Atlantic Canada

Partnered with Nikola Corporation in October to collaborate on developing, constructing, operating and owning large-scale hydrogen production facilities in the United States and Canada

Issued US$1.25 billion of 3-year and US$1.0 billion of 10-year fixed rate Senior Unsecured Notes in October

Released our 2021 Report on Sustainability in October which includes targets for our sustainability commitments, including reducing the emissions intensity from our operations 30 per cent by 2030 and positioning to achieve net zero emissions from our operations by 2050.

“During the first nine months of 2021, our diversified portfolio of essential energy infrastructure assets continued to perform very well and reliably meet North America’s growing demand for energy,” said François Poirier, TC Energy’s President and Chief Executive Officer.

“We are in the midst of an unprecedented period that is providing a significant number of investment opportunities driven by both the growing demand for energy and the transition to a cleaner energy future, added Poirier. We expect to sanction approximately $7 billion of new projects in 2021 with a risk-adjusted return profile that is consistent with previous investments and anticipate annual amounts of more than $5 billion will be added to our secured projects portfolio in each of the next several years. In order to judiciously fund our attractive suite of growth opportunities, maintain a strong financial position and enhance our already conservative, utility-like dividend payout ratios, we have modified our near-term dividend growth outlook,” continued Poirier. “We now expect to increase our common share dividend at an average annual rate of three to five per cent. While our previous outlook remains affordable and supported by the strong underlying performance of our business, we believe a modest change is prudent given our vast opportunity set. It will allow us to fund a larger portion of our future capital programs through internally generated cash flow, moderate our leverage and continue to deliver superior long-term total shareholder returns.”

Summary:

The market seems to have shaken off the ‘modified near-term dividend growth outlook’ announced last week. Analysts are mostly in agreement with management’s decision to strengthen their Balance Sheet and increase cash flow as opposed to paying out more dividends. Earnings are still projected to be in the traditional 7% range.

In the Magic Pants Wealth Builder (CDN) portfolio we added to our position in TC Energy incrementally last fall when the dividend yield was well above 6%. Once again, our process signaled that this was the time to buy even though the short-term narrative was negative surrounding the cancellation of the Keystone XL pipeline under a Biden administration. The pipeline was indeed cancelled but the stock has rebounded nicely from its December lows and we were able to purchase more income at a discounted price.

Quality companies find a way to overcome short-term setbacks. With no new pipelines being built in the foreseeable future and energy demand increasing, management sees the value of ‘pipe in the ground’ and is optimistic this will help increase margins. Combine that with new projects underway, higher cash flow and a disciplined management team, there is optimism that TC Energy will be able to transition to a cleaner energy future successfully. We will be monitoring our position closely.

As an investor looking for income there is a lot to like about TC Energy Corporation. A twenty-year dividend growth streak, an above average starting yield and currently, modest dividend growth at a sensible price.