Posted by BM on December 22, 2021

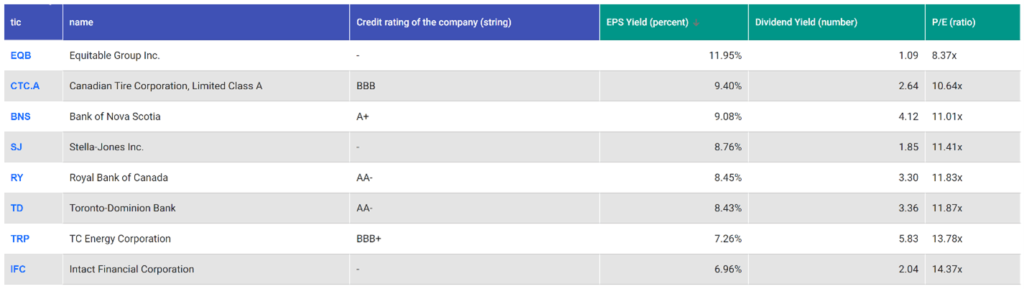

Each month I will walk through our valuation process using a stock on ‘The List’ that meets our minimum screen of 6.5% EPS Yld. This month it is Intact Financial Corp. (IFC-T).

Valuation is the second step in our three-step process. Buying when our quality stocks are sensibly priced will help ensure our future investment returns meet our expectations. We rely heavily on the fundamental analyzer software tool (FASTgraphs) to help us understand the fundamentals of the stocks we invest in and then read the company’s website for investor presentations and recent earnings reports to learn more.

Intro:

Intact Financial Corporation (IFC-T) is the largest provider of property and casualty (P&C) insurance in Canada, a leading provider of global specialty insurance, and, with RSA, a leader in the U.K. and Ireland. The business has grown organically and through acquisitions to over $20 billion of total annual premiums.

In Canada, Intact distributes insurance under the Intact Insurance brand through a wide network of brokers, including its wholly-owned subsidiary BrokerLink, and directly to consumers through Belairdirect. Intact also provides affinity insurance solutions through the Johnson Affinity Groups.

In the U.S., Intact Insurance Specialty Solutions provides a range of specialty insurance products and services through independent agencies, regional and national brokers, and wholesalers and managing general agencies.

Outside of North America, the Company provides personal, commercial and specialty insurance solutions acro ss the U.K., Ireland, Europe and the Middle East through the RSA brands.

Intact directly manages its investments through subsidiary Intact Investment Management. Most of these invested assets are fixed-income securities. Its asset mix is designed to generate interest and dividend income.

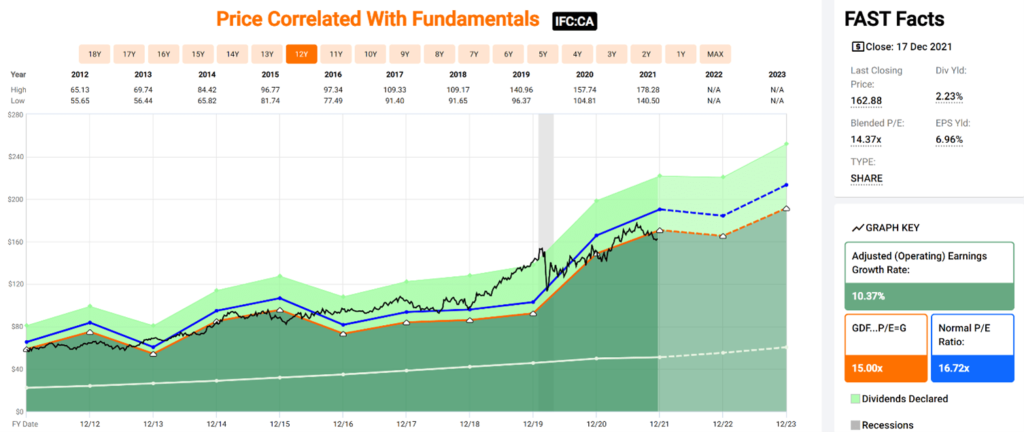

Historical Graph:

Comments:

Intact Financial Corp. is another of our good dividend growers that trades within a narrow valuation corridor. As you can see from the Blue Line on the graph (Normal P/E) and the Black Line (Price), there is typically very little variance. Investment opportunities occur when the Black Line falls below the Orange Line (15 PE) with this quality dividend grower. The fundamentals show a company whose earnings have grown steadily over the last ten years at an annualized rate of ~10%.

Performance Graph:

Comments:

Intact Financial Corp. has an annualized dividend growth rate of 9.34% over the last decade. The company also has an annualized Total Return of 12.70% over that time. IFC-T recently announced another dividend increase of 9.64% for 2022.

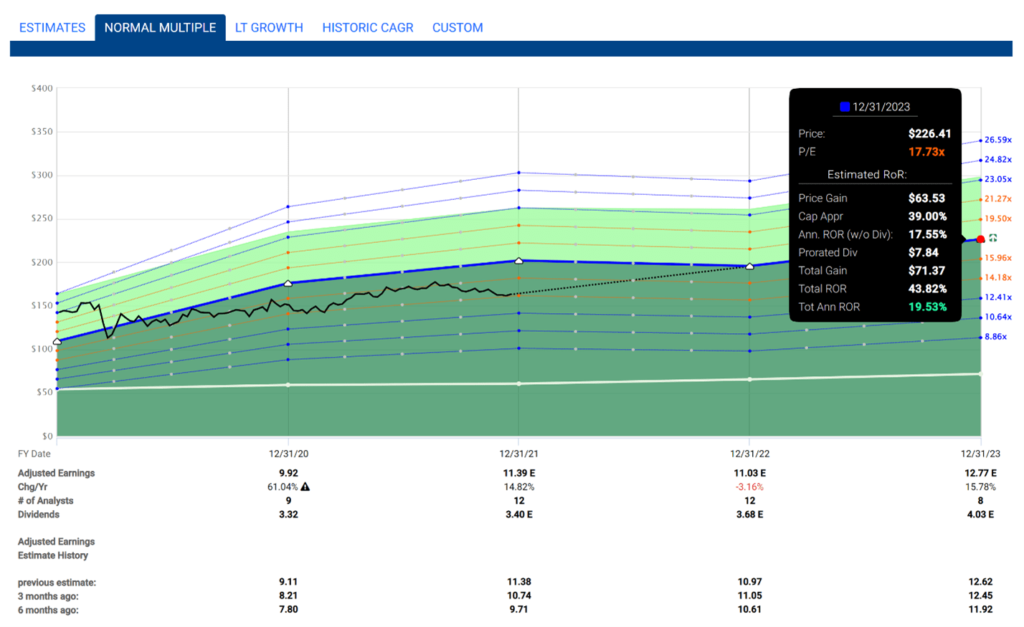

Estimated Earnings:

Comments:

Using the “Normal Multiple’ estimating tool from FASTgraphs, we see a blended P/E average over the last five years of 17.73. Based on Analysts’ forecasts two years out, you can expect an annualized return based on today’s price of 19.53% should IFC-T trade at its blended P/E.

Blended P/E is based upon a weighted average of the most recent actual value and the closest forecast value.

Another thing I like about Intact Financial Corp.’s earnings is that they are being revised upwards from both six months and three months ago for both 2022 and 2023. Analysts seem bullish on IFC-T in the short term.

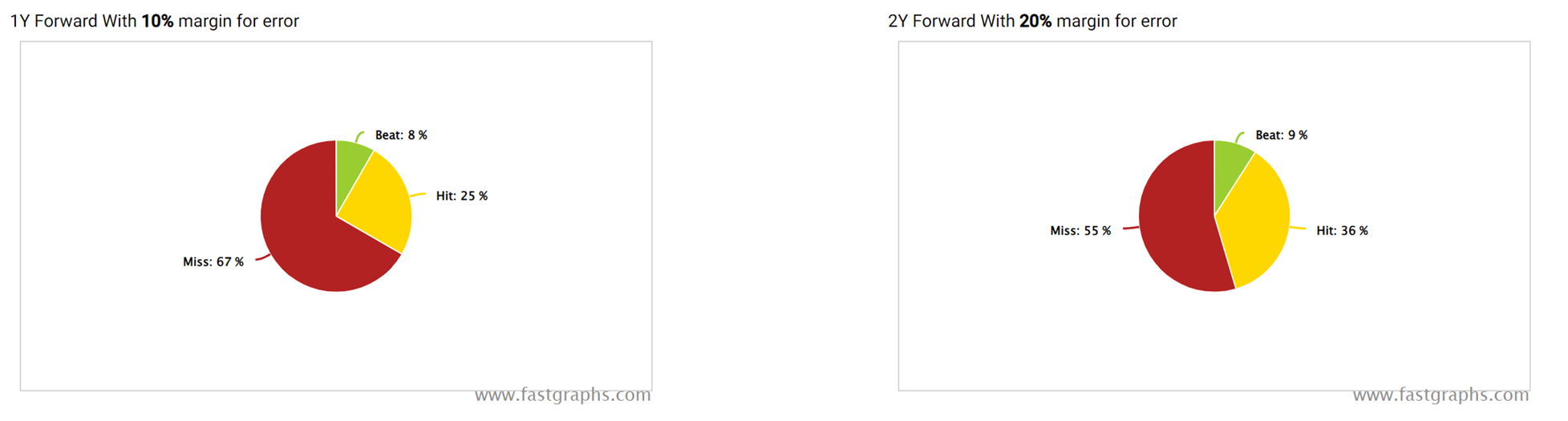

Analyst Scorecard:

Comments:

Analyst estimates over the years are not very accurate based on one and two-year earnings projections. Analysts’ projections have hit or beat 33% of the time on one-year estimates and 45% on two-year estimates. This does not give us a lot of confidence on estimating the future with Intact Financial Corp.’s earnings. Monitoring quarterly earnings reports will give us a better idea on where things are headed.

Recent Earnings Report-Q3 2021:

Highlights

- Net operating income per share of $2.87 driven by strong underwriting performance and an accretive contribution from RSA

- Premiums grew 68%, reflecting the first full quarter of RSA in our results and continued strength in commercial lines

- Combined ratio of 91.3%, driven by strength in all business segments despite an elevated 7.5 pts of catastrophe losses

- OROE of 18.3% with a total capital margin of $2.7 billion

- EPS of $1.60 reflects strong operating results tempered by an investment loss and integration costs

- Quarterly dividend increased by 10% to $0.91 per common share

Charles Brindamour, Chief Executive Officer, said:

“The strength of our business was again evident this quarter, with robust operating performance across the platform, despite an elevated level of catastrophes. Our people have worked hard to get customers back on track following many severe weather events. We are making great progress on the integration of RSA, with synergies being realized as expected. The acquisition is already delivering high single-digit accretion to NOIPS since closing on June 1, and we remain on track to generate upper teens accretion within 36 months. With a strong and resilient balance sheet and momentum in all segments, we are increasing dividends to our common shareholders for the sixteenth consecutive year.”

UBS Keeps Buy Rating, $187 Target Price on Intact Financial, Ups EPS Estimates

01:22 PM EST, 11/30/2021 (MT Newswires) — UBS has kept its 12-month Buy rating and $187 TP on Intact Financial Corporation. 2021 EPS estimate goes to $11.42 from $10.11 to reflect stronger underlying results and distribution income, stronger RSA results, and a lower personal auto underlying loss ratio, partially offset by lower growth in personal auto. 2022 EPS estimate goes to $11.30 from $10.90 on stronger RSA results, partially offset by lower personal auto growth. 2023 estimate is also increasing to $12.91 from $12.44.

Summary:

Intact Financial Corp. appears to be sensibly priced based on historical metrics. Both its forecasted earnings growth and dividend growth appear to be trending along historical norms as well (~10%). Throw in a recent dividend increase (16 years and counting) and there is a lot to like about IFC-T. The company seems to be integrating its newest acquisition, RSA, quite well which will help improve the bottom line. Incrementally buying when the price gets below a 15 P/E has worked well over the last decade with this dividend grower.