Posted by BM on March 7, 2021

The year 2020 was certainly one for the history books. On the investing side of things there was lots to remember and learn from as well. The stock market crash of 2020 began on Monday, March 9, with history’s largest point plunge on the US stock market up to that date. It was followed by two more record-setting point drops on March 12 and March 16. The stock market crash included the three worst point drops in U.S. history. If you had retirement savings or other funds invested in the stock market, the crash lowered the value of your holdings. When something like this happens, many people panic and sell their stocks to avoid losing more. But the risk with that strategy is that it is difficult to know when to re-enter the market and buy again. I was incredibly happy to have a solid investing strategy in place that continued to pay dividend income throughout the market turbulence and gave me the confidence to make the right investing decisions. By the end of the year the USA S&P 500 was up 18.4% and the CDN TSX was up 5.6% which on average, allowed patient investors to ride out 2020 virtually unscathed with a good return on their invested capital.

I am a firm believer in having a rules-based process for everything you do in life, but March 2020 was the first time my dividend growth process was truly tested. On top of that, I joined the category of ‘retiree’ about midway through the year which meant that all my investment decisions going forward would directly affect the capital I had set aside for retirement. I felt a heightened sense of pressure to make the right choices. Thankfully, I had a process I have been fine tuning for the last eight years.

Dividend growth investing is simple to understand with only three basic rules:

- Quality; only buy companies that have a long dividend growth streak and good financial safety metrics in an industry that is stable and growing.

- Valuation; look to buy a company that is fairly or undervalued.

- Monitor; keep an eye on your dividend growers; especially the current yield; fluctuations in yields send signals. The consistency of a firm’s dividend growth is the best measure of management’s confidence in the long-term growth outlook for a company.

I already knew which companies were ‘Quality’ businesses with good financial metrics and stability. I have been researching dividend growth companies for years and my ‘List’ is always ready to go. Rather than initiating new positions at the low point in the market I chose to stay with companies I already held and knew well.

Valuation was next. I looked at how the companies on my list had historically been valued using three valuation metrics. Historical dividend yields (Dividend Yield Theory), Graham Value and Cyclically Adjusted Price to Earnings ratios (CAPE) made famous by Robert Shiller.

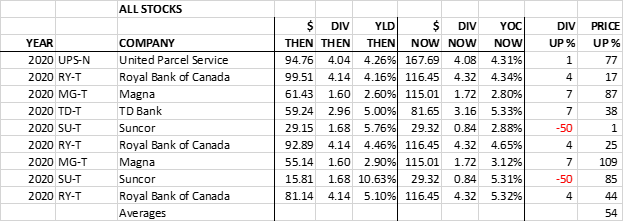

As the market spiralled downward in March, I topped up positions in a couple of Canadian Banks (RY, TD), a Consumer Goods stock, Magna (MG) and an out of favour Energy company (SU). In my USD portfolio I bought an Industrial stock (UPS). I really did not pay much attention to the industry or sector these stocks were in, I simply followed my process.

The most difficult thing to do was to buy more when my original purchase dropped 10% or more shortly thereafter. As you will see from the chart below, buying quality companies that are undervalued is a terrific way to super charge your long-term investment returns.

Here are the results as of March 12, 2021 on those March 2020 COVID purchases:

A one-year price/capital return, on average, of 54%!

Buying opportunities like March 2020 do not happen every year but you should be prepared and confident to pull the trigger when they do. Having a good process does that for you.

My process also tells me not to SELL my good dividend growers unless:

- The company’s long-term earnings power appears to have become impaired.

- The stocks valuation reaches seemingly excessive levels.

- Or, I find a more attractive idea.

I did SELL some of my dividend growers in 2020 for one or more of the reasons listed above but not because I panicked when their price came under pressure due to the pandemic. As a new investor to DGI I have made a few mistakes and most of my SELLs are due to mistakes I made early on.

Finally, I will continue to monitor all positions as part of my process. Case in point is the 2020 dividend reduction of my Suncor (SU) position. I like its recent Q4 earnings and price growth but am still debating if I want a cyclical stock like Suncor in my retirement portfolio. With the recent uptick in oil prices, my guess is that the dividend will be raised back up to pre-pandemic levels in 2021/22 and my decision will be even more difficult. A nice decision to have.