Posted by BM on July 19, 2021

“Investor success is driven not so much by picking winning firms, but rather the entry point at which fine companies are purchased.”

-Tom Connolly

Crestmont Research is a site we visit quite often to help better understand investing. The post we share today will help summarize what Ed Easterling calls ‘The Reconciliation Principle’.

Here is the link to the full article by Crestmont Research:

https://www.crestmontresearch.com/docs/Stock-Reconciliation-Principle.pdf

As dividend growth investors we tend to buy and hold our investments if they continue to increase their earnings and pay a growing dividend. Sometimes this can last for decades. Although holding a good company for the long term is viewed as unconventional by today’s standards, it turns out that looking at things in an unconventional manner can increase your Total Returns, especially when you purchase your quality companies when they are sensibly priced (below average P/E).

“Conventional wisdom holds that stock market returns are random. That is true over days, weeks, months, and even a few years. But contrary to conventional wisdom, stock market returns are highly predictable over periods that reflect investors’ horizons–periods either side of a decade. This predictability occurs because stock market returns are driven by component parts.”

– Ed Easterling

In an earlier post we talked about Jack Bogle’s expected return formula when it comes to estimating future returns:

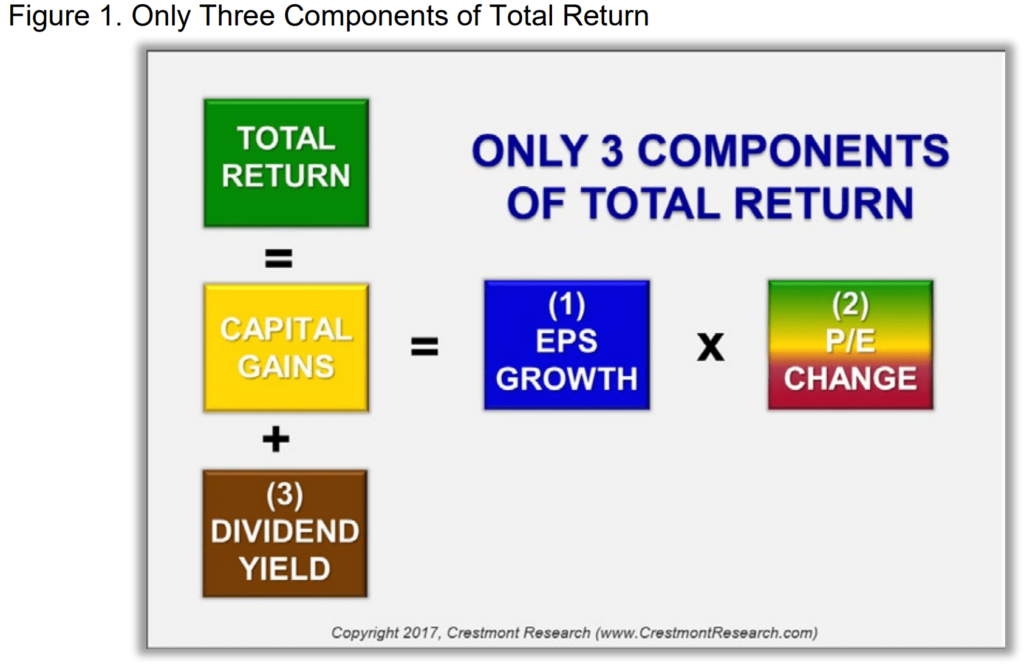

Future Market Returns = Dividend Yield + Earnings Growth +/- Change in P/E Ratio

Ed Easterling essentially agrees with Bogle and then expands on Bogles formula by breaking down the drivers behind the three components.

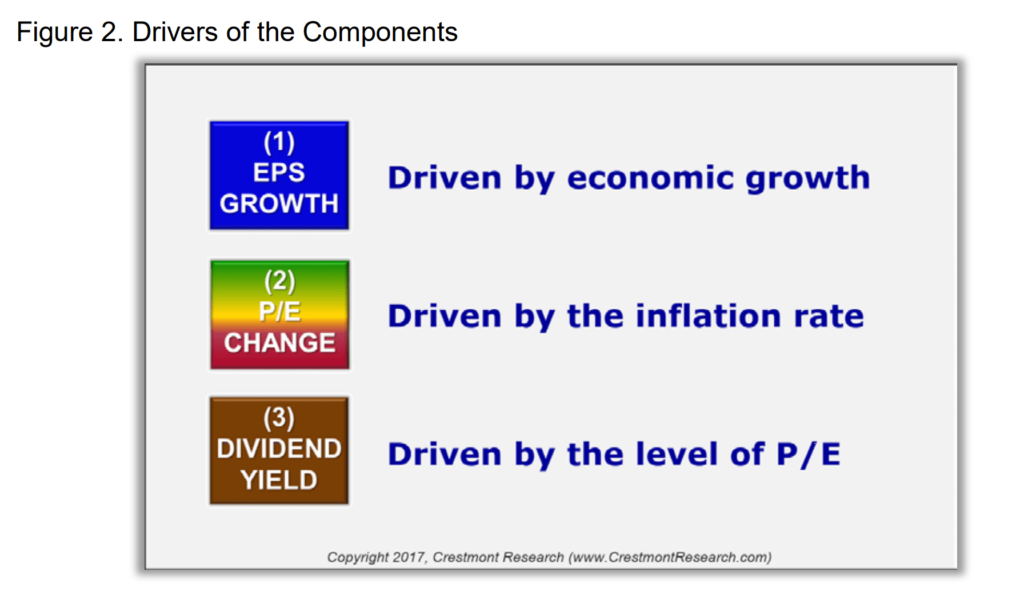

According to Easterling, …”not only is total return from the stock market driven by the fundamental principle of three components, but also each of the three components is driven by fundamental principles. Not one of the three components is a random element. Each of them has a tangible and definitive driver. This set of relationships further reinforces that stock market returns are not random.

In summary, earnings per share (EPS) growth is driven by economic growth. P/E expansion and contraction are driven by the inflation rate. Dividend yield is driven by the starting level of the P/E ratio.”

If we agree with Easterling, we know that long term returns are not random but short term returns can be because there are so many noneconomic and nonfinancial factors that can affect the markets. Understanding the drivers of long-term returns helps us as dividend growth investors ‘peel back the cloak’ and see the fundamental principles that drive the market so that we can make informed investing decisions.

Let us apply these principles in today’s market. Which of the three drivers do you hear the most talk about?

With the other components (Dividend Yield and EPS Growth) being in the range of their historical averages, I think we can all agree that P/E levels today are the outlier, being substantially higher than average for many stocks. With inflation being the principle that drives the P/E component of Total Return, we need to pay attention to inflation. The market is high right now. It would not be a good time to buy an index fund. Companies whose returns have benefitted from rising P/E’s over the last few years will certainly come under pressure if inflation continues to rise.

One of my DGI mentors, Chuck Carnevale, likes to say that it is a ‘market of stocks not a stock market’, I agree. Not all stocks have higher than average P/E’s. Knowing the components of long term returns and their drivers is empowering to say the least. Be selective when you invest in today’s market and only invest in quality companies that are sensibly priced.