Last updated by BM on October 03, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was down with a minus -8.0% YTD price return (capital). Dividend growth of ‘The List’ went up on Fortis’ dividend increase announcement. The YTD dividend growth percentage of ‘The List’ is now at +10.3% YTD, demonstrating our rise in income over the last fiscal year.

- One company on ‘The List’ announced a dividend increase last week. Fortis (FTS-T) announced a 5.6% dividend increase. It’s 49th consecutive yearly dividend increase!

- Last week, there were no earnings reports from companies on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“As a dividend increase is a positive sign of a company’s financial strength, the safest purchase, after research, is a stock with a recent dividend increase.”

– Tom Connolly

Fortis Inc. announced last week that it is raising its dividend for the 49th consecutive year.

A growing dividend is the single most crucial factor in our strategy, so naturally, we pay close attention to dividend increases. Another factor that makes Fortis Inc. such a quality dividend growth stock is its dividend growth/price growth alignment over long periods. The two rarely get far apart, and the valuation corridor that Fortis trades in is one of the narrowest you will find. All these things make Fortis Inc. one of the safest dividend growth stocks to hold in your portfolio.

If a good starting yield of ~4% plus a reasonable dividend growth rate of ~6% doesn’t catch your eye, how about Fortis’ historical total returns?

Fortis’ future returns have also tended to follow our Yield + Growth formula with a ~10% annualized return over the last ten years. Check out those 20-year returns too! Not too shabby for a boring utility stock that very few people have even heard of let alone invested in.

One of the things we like most about our income investing strategy is the predictability of dividends from our quality dividend growers. We have a much higher probability of success forecasting Fortis’ dividend next year than we do its price. Knowing we have dividend growth in our portfolios helps us weather any kind of storm the markets send our way as we know that price growth will eventually follow.

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

Last week, ‘The List’ was down a bit more with a minus -8.0% YTD price return (capital). Dividend growth of ‘The List’ went up on Fortis’ dividend increase announcement. The YTD dividend growth % of ‘The List’ is now at +10.3% YTD, demonstrating the rise in income over the last fiscal year.

The best performers last week on ‘The List’ were Franco Nevada (FNV-N), up +4.69%; Dollarama Inc. (DOL-T), up +3.63%; and Stella-Jones Inc. (SJ-T), up +2.46%.

Alimentation Couche-Tard Inc. (ATD-T) was the worst performer last week, down -9.88%.

Recent News

My dividend portfolio’s five-year returns are in and they validate the dividend-growth investing strategy (Globe & Mail)

It is always nice to see the mainstream media cover similar strategies to ours, and John Heinzls Yield Hog Dividend Growth Portfolio is one that we glance at from time to time. Mr. Heinzl is a believer in the dividend growth strategy, but in our opinion, his application is a little off.

In his previous version of implementing a dividend growth model portfolio (Strategy Lab; 2012-17), Mr. Heinzl did much better than his current version (Yield Hog Dividend Growth Portfolio; 2017-2022). Annualized returns for the Strategy Lab portfolio were 11.6% and the Yield Hog Dividend Growth Portfolio was 7.4%.

Perhaps the inclusion of a couple of US-based companies helped (JNJ and PG) with his initial portfolio or maybe he was lucky with his timing on purchases. In both versions, however, his REIT investments held both his income and capital growth back. Most REITs do not grow their distributions as much or as consistently as quality dividend growth stocks and often freeze or cut them when the real estate cycle turns.

Mr. Heinzl would do better to focus on better selection criteria for the companies he invests in and adhere to sound valuation measures when purchasing if he is to have better success at dividend growth investing. We wonder if he will continue adding REITs to his model dividend growth portfolios going forward after two bad experiences.

Dividend Yield Comes Back To Life; Rising Interest Rates And Poor Equity Returns Resurrect An “Old Timer” Strategy (CIBC Equity Research)

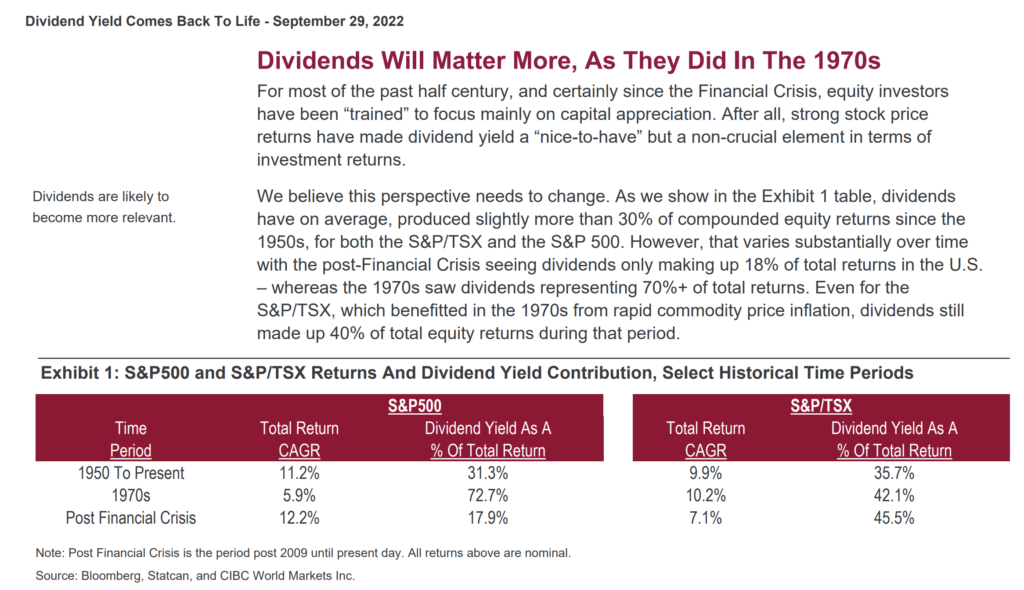

We were fortunate enough to review a research report put together by analysts at CIBC World Markets last week that stresses the importance that dividends will play in a rising rate environment, in the years ahead.

One of the authors, Ian de Verteuil, was kind enough to allow us to publish some of the report’s conclusions.

Here are some of his findings:

“Dividend yield has been one of the more powerful Quantitative Factors since the trough in U.S. 10-year rates in August 2020. This fits with our fundamental work which argues for stocks with high and stable dividends, despite rising interest rates. Outperformance by stocks is akin to the 1970s when dividends represented well over half (and as much as 70%) of annual equity returns.

In the current environment when fiscal and monetary policy seems at odds with one another, equity investors should insist on being compensated with higher running yields, underpinned by stable businesses.”

Mr. de Verteuil also believes that the recent lack of focus on dividends in the pursuit of solid price returns is a perspective that needs to change.

No companies on ‘The List’ are due to report earnings this week.

Dividend Increases

One company on ‘The List’ announced a dividend increase last week.

Fortis Inc. (FTS-T) on Thursday said it increased its 2022 quarterly dividend from $0.535 to $0.565 per share, payable December 1, 2022, to shareholders of record on November 17, 2022.

This represents a dividend increase of +5.6%, marking the 49th straight year of dividend growth for this quality utility holding company.

Earnings Releases

Last week, there were no earnings reports from companies on ‘The List’.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on September 30, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 6.4% | $10.91 | -24.0% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $55.61 | 6.7% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 6.3% | $57.92 | -12.1% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 4.0% | $35.90 | -11.9% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.4% | $66.96 | -1.2% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 2.0% | $149.18 | -3.7% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 4.0% | $147.05 | -19.7% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.9% | $35.93 | -1.9% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $79.30 | 25.1% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.7% | $55.89 | -10.7% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.7% | $51.22 | 3.4% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.5% | $29.00 | -36.8% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 1.1% | $119.48 | -12.2% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 4.1% | $52.48 | -13.2% | $2.17 | 4.3% | 48 |

| IFC-T | Intact Financial | 2.0% | $195.49 | 19.4% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.4% | $109.38 | 6.5% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 3.8% | $47.42 | -41.9% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.6% | $69.17 | 3.2% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 4.0% | $124.37 | -9.1% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 2.1% | $38.78 | -4.7% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.2% | $60.58 | -13.7% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.2% | $84.72 | -14.7% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.2% | $90.48 | -18.3% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.6% | $96.16 | -15.4% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 6.4% | $55.64 | -6.8% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.9% | $27.43 | -7.8% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $135.13 | 0.8% | $0.92 | 8.9% | 12 |

| Averages | 3.1% | -8.0% | 10.3% | 18 |