Last updated by BM on September 19, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was down slightly with a minus -2.6% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, there were no earnings reports from companies on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“Dividend growth investing (DGI) is not a way to “get rich quickly”, but it is a way to produce a safe, reliable, dependable, rising stream of cash to help pay for your retirement, without ever selling a single share.”

– Robert Allan Schwartz, Seeking Alpha Contributor

The markets continue to be volatile and trend downwards. Try not to focus on the narratives in the news and follow the process. This DGI anecdote should help.

When reading the article in the Globe & Mail on three dividend growth stocks to hold forever, I couldn’t help but comment on our own experience with dividend growth investing over the last ten years.

As dividend growth investors, we like to invest in high-quality companies with enduring competitive advantages, long operating histories, shareholder-aligned management, and large markets that provide opportunities for long-term growth. These businesses maintain reasonable payout ratios, generate consistent free cash flow, and have healthy balance sheets, providing a sturdy foundation for consistent dividend increases.

Like the article, we agree that Fortis is one of the highest quality dividend growth stocks in Canada with a dividend growth streak of 48 years, Fortis (FTS) has increased its dividend every year now for almost five decades.

To demonstrate how dividend growth investing works for a portfolio of dividend growth stocks, let’s look at some data from our Magic Pants Wealth-Builder Portfolio (CDN) portfolio back in 2012 and compare it to today.

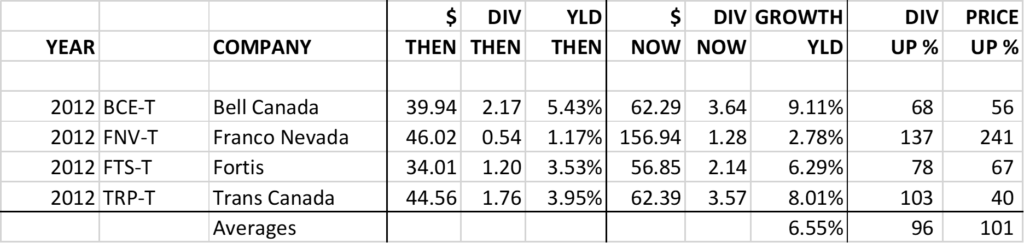

Our initial four stock portfolio in 2012:

There is a lot of significant data to grasp from a small chart like this. Our portfolio yield now (Growth YLD) is 6.55%. That is how much we earn today from dividends alone on the money we invested in 2012. Our dividend growth and price growth are aligned at 96% and 101%. This means that both our income and capital have doubled in the last decade. It doesn’t stop there either as dividend growth will more than likely continue and drive our capital growth even higher.

As our timeline progresses, our holdings get safer and safer and throw off even more cash. Our risk becomes negligible as our margin of safety grows with our yield. My mentor, Tom Connolly, has a word for stocks that perform like these; ‘bondified’. After a decade or two, maybe sooner, these stocks offer an attractive alternative to fixed income instruments such as government bonds and can be counted as the fixed income portion of your portfolio.

With decade-long returns like this and some of our quality dividend growers now paying higher yields (due to recent price declines) than they did in 2012, we will soon be buying more of these wealth-building machines and not fretting so much about what is in the news.

If a DGI strategy interests you, please subscribe to our Magic Pants DGI Premium Membership, and you can learn how to build a robust dividend growth portfolio of your own.

We provide real-time trade alerts. So, you won’t miss any of the action!

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

Last week, ‘The List’ was down slightly with a minus -2.6% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were Enghouse Systems Limited (ENGH-T), up +0.91%; Intact Financial (IFC-T), up +0.72%; and Enbridge Inc. (ENB-T), down -0.09%.

TFI International (TFII-N) was the worst performer last week, down -9.26%.

Recent News

Surprise jump in U.S. inflation sends stock markets tumbling (Globe & Mail)

More bad news on the inflation front this past week. We would hardly call the data a ‘surprise’ though. Have you filled up your car with gasoline, bought groceries, went out for dinner or paid rent lately? It seems everything continues to become more expensive.

“This means the Fed and other central banks will likely turn even more aggressive in their determination to wrestle inflation back to about 2 per cent, even if they hurt economic activity.”

When economic activity is hurt, economies go into recession. The Canadian economy is not immune to central bank actions. We still have a long way to go in our own ‘quantitative tightening’ (QT) process.

Three dividend growth stocks to hold forever (Globe & Mail)

The three stocks mentioned in the article are worthy candidates (FTS-T, BIP-N and TD-T). They are however just a small subset of the companies on ‘the List’ we publish and follow each week.

There are some terrific quotes in the article we believe are important to remember.

“One of the biggest investing myths is that you have to put in a lot of work to achieve great results. Without exhaustive research and a knack for savvy trading, you’ll never build lasting wealth and achieve financial independence, or so many investors believe. Nonsense.”

“Many investors know that the buy-and-hold approach makes sense, in theory. Yet they can’t resist the urge to make changes to their portfolios. When a stock rises, they sell to lock in their profit. When a stock tanks, they take their lumps and move on to the next shiny object. The underlying assumption is that they must trade to win at investing. This notion is reinforced by financial websites and ads for discount brokers that feature the latest whiz-bang trading tools.”

“But if you own great companies, the best approach is to do nothing. Stock prices always bounce around in the short run, but over the long run excellent businesses will reward you with capital appreciation and rising dividends.”

As dividend growth investors we believe in purchasing only the highest quality companies and rarely sell. Our strategy is not about trading. We focus on the rising cash flow and the capital appreciation that will follow.

No companies on ‘The List’ are due to report earnings this week.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

Last week, there were no earnings reports from companies on ‘The List’.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on September 16, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 5.3% | $13.20 | -8.0% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.7% | $59.08 | 13.4% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.8% | $62.29 | -5.5% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.6% | $40.55 | -0.4% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.5% | $65.80 | -2.9% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.9% | $154.61 | -0.2% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.7% | $157.76 | -13.9% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.4% | $40.43 | 10.4% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $76.75 | 21.0% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.3% | $61.04 | -2.5% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.3% | $54.42 | 9.9% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.4% | $29.88 | -34.8% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 1.1% | $118.21 | -13.1% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.8% | $56.85 | -6.0% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.0% | $202.66 | 23.8% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.4% | $113.80 | 10.8% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 3.3% | $54.87 | -32.7% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.5% | $71.28 | 6.3% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 3.9% | $126.45 | -7.6% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 2.0% | $40.97 | 0.7% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $62.42 | -11.1% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.0% | $87.93 | -11.5% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.1% | $94.91 | -14.3% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.5% | $101.02 | -11.1% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.7% | $62.39 | 4.5% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.6% | $28.77 | -3.3% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.6% | $144.81 | 8.0% | $0.92 | 8.9% | 12 |

| Averages | 2.9% | -2.6% | 10.2% | 18 |