Last updated by BM on October 8, 2024

Summary

This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- This week, we will examine the TC Energy and South Bow restructuring and what we are doing with our South Bow shares.

- Last week, dividend growth of ‘The List’ stayed the course and has increased by +8.8% YTD (income).

- Last week, the price of ‘The List’ was down with a return of +12.3% YTD (capital).

- Last week, there were no dividend announcements from companies on ‘The List’.

- Last week, there were no earnings reports from companies on ‘The List’.

- This week, no companies on ‘The List’ are due to report earnings.

DGI Clipboard

“You don’t have to buy at the bottom and sell at the top to be a great investor. Just buy quality companies at good valuations and hold long term.”

– Anonymous

New TC Energy and South Bow Valuations Expected to Surpass Pre-Spin-Off

Intro

This week, TC Energy (TRP-T), the largest holding in our model portfolio, completed its restructuring. Investors now own shares in South Bow Corporation (SOBO-T) in addition to (TRP-T) after the spinoff.

CALGARY, Alberta, Oct. 01, 2024 (GLOBE NEWSWIRE) — News Release – TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company) today announced that it has completed the spinoff of its Liquids Pipelines business into South Bow Corporation (South Bow).

The TC Energy common shares will resume “regular way” trading on the TSX and the NYSE on Oct. 2, 2024, under the designation TRP. The South Bow common shares will commence “regular way” trading under the designation SOBO on the TSX on Oct. 2, 2024, but will not trade “regular way” on the NYSE until one trading day after the U.S. Securities and Exchange Commission (SEC) declares South Bow’s registration statement on Form 40-F effective. TC Energy currently expects that the South Bow common shares will commence “regular way” trading on the NYSE on or about Oct. 8, 2024.

Estimated proportionate allocation of adjusted cost base between TC Energy common shares and South Bow common shares is expected to be posted on the TC Energy and South Bow websites when available during fourth quarter 2024.

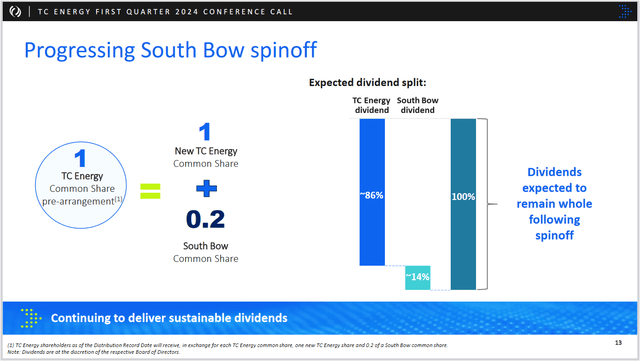

What did TC Energy shareholders receive in the spinoff?

TC Energy shareholders received:

1 new TC Energy Common Share for each TC Energy share they held on the Distribution Record Date of Sept. 25, 2024

0.2 of a South Bow Common Share for each TC Energy share they held on the Distribution Record Date of Sept. 25, 2024

What happens to my TC Energy dividend?

TC Energy and South Bow each intend to declare independent dividends for the quarter ended Dec. 31, 2024 on Nov. 7, 2024, reflecting their respective proportionate amounts of TC Energy’s dividend prior to the Arrangement. The dividends are expected to be paid on Jan. 31, 2025, to shareholders of record on Dec. 31, 2024. All dividends, including the expected dividends to be declared on Nov. 7, 2024, are subject to the discretion and approval of each company’s respective Board of Directors.

The Arrangement occurred on a “tax-free” basis. What does it mean to me as a shareholder?

The use of the phrase “tax-free” in the 2024 Management Information Circular is a reference to the tax-deferred nature of the Arrangement. The receipt of South Bow Common Shares pursuant to the Arrangement should not result in taxable income or gain to Holders, (as defined in the Management Information Circular) for Canadian federal income tax purposes or U.S. federal income tax purposes.

Estimated proportionate allocation of adjusted cost base between TC Energy Common Shares and South Bow Common Shares is expected to be posted on the TC Energy and South Bow websites when available during the fourth quarter in 2024.

Source: TC Energy website

Wrap Up

One of the main drivers of the spinoff was to unlock value in TC Energy’s shares. This seems to have worked. As of Friday’s closing, the combined value of both companies has already exceeded that of the previously integrated firm.

As a matter of process, we sell our spin-off shares soon after receiving them as the new entity does not meet our criterion as an investable dividend growth company.

DGI Scorecard

The List (2024)

The Magic Pants 2024 list includes 28 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on ‘The List’:

- Dividend growth streak: 10 years or more.

- Market cap: Minimum one billion dollars.

- Diversification: Limit of five companies per sector, preferably two per industry.

- Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies are added or removed from ‘The List’ annually on January 1. Prices and dividends are updated weekly.

‘The List’ is not a portfolio; it is a coaching tool that helps us think about ideas and risk manage our model portfolio. We own some but not all the companies on ‘The List’.

Our newsletter provides readers with a comprehensive insight into the implementation and advantages of our Canadian dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

For those interested in something more, please upgrade to a paid subscriber; you get the enhanced weekly newsletter, access to premium content, full privileges on the new Substack website magicpants.substack.com and DGI alerts whenever we make stock transactions in our model portfolio.

Performance of ‘The List’

Last week, dividend growth of ‘The List’ stayed the course and has now increased by +8.8% YTD (income).

Last week, the price return of ‘The List’ was down with a return of +12.3% YTD (capital).

Even though prices may fluctuate, the dependable growth in our income does not. Stay the course. You will be happy you did.

Last week’s best performers on ‘The List’ were Stella-Jones Inc. (SJ-T), up +4.57%; Stantec Inc. (STN-T), up +3.47%; and Manulife Financial (MFC-T), up +2.75%.

Magna (MGA-N) was the worst performer last week, down -3.86%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $73.96 | -3.6% | $0.70 | 17.4% | 14 |

| BCE-T | Bell Canada | 8.7% | $45.76 | -15.5% | $3.99 | 3.1% | 15 |

| BIP-N | Brookfield Infrastructure Partners | 4.7% | $34.67 | 13.0% | $1.62 | 5.9% | 16 |

| CCL-B-T | CCL Industries Inc. | 1.5% | $79.75 | 37.9% | $1.16 | 9.4% | 22 |

| CNR-T | Canadian National Railway | 2.2% | $154.03 | -7.7% | $3.38 | 7.0% | 28 |

| CTC-A-T | Canadian Tire | 4.4% | $158.13 | 14.1% | $7.00 | 1.4% | 13 |

| CU-T | Canadian Utilities Limited | 5.1% | $35.58 | 10.8% | $1.81 | 0.9% | 52 |

| DOL-T | Dollarama Inc. | 0.3% | $137.98 | 45.2% | $0.35 | 29.5% | 13 |

| EMA-T | Emera | 5.5% | $52.14 | 2.7% | $2.88 | 3.2% | 17 |

| ENB-T | Enbridge Inc. | 6.6% | $55.76 | 15.2% | $3.66 | 3.1% | 28 |

| ENGH-T | Enghouse Systems Limited | 3.1% | $32.60 | -4.0% | $1.00 | 18.3% | 17 |

| FNV-N | Franco Nevada | 1.2% | $120.86 | 9.7% | $1.44 | 5.9% | 16 |

| FTS-T | Fortis Inc. | 4.0% | $60.33 | 10.0% | $2.39 | 4.4% | 50 |

| IFC-T | Intact Financial | 1.9% | $258.45 | 27.1% | $4.84 | 10.0% | 19 |

| L-T | Loblaw Companies Limited | 1.1% | $172.91 | 34.5% | $1.92 | 10.0% | 12 |

| MFC-T | Manulife Financial | 3.9% | $41.03 | 42.1% | $1.60 | 9.6% | 10 |

| MGA-N | Magna | 4.6% | $41.08 | -26.0% | $1.90 | 3.3% | 14 |

| MRU-T | Metro Inc. | 1.6% | $83.30 | 21.6% | $1.34 | 10.7% | 29 |

| RY-T | Royal Bank of Canada | 3.4% | $166.20 | 24.9% | $5.72 | 7.1% | 13 |

| SJ-T | Stella-Jones Inc. | 1.2% | $91.33 | 19.2% | $1.12 | 21.7% | 19 |

| STN-T | Stantec Inc. | 0.7% | $112.32 | 7.3% | $0.83 | 7.8% | 12 |

| T-T | Telus | 6.9% | $22.11 | -6.8% | $1.53 | 7.1% | 20 |

| TD-T | TD Bank | 4.7% | $86.51 | 2.1% | $4.08 | 6.3% | 13 |

| TFII-N | TFI International | 1.2% | $135.83 | 3.5% | $1.60 | 10.3% | 13 |

| TIH-T | Toromont Industries | 1.5% | $130.00 | 15.2% | $1.92 | 11.6% | 34 |

| TRI-N | Thomson Reuters | 1.3% | $165.92 | 15.8% | $2.16 | 10.2% | 30 |

| TRP-T | TC Energy Corp. | 6.3% | $61.22 | 17.0% | $3.84 | 3.2% | 23 |

| WCN-N | Waste Connections | 0.6% | $176.41 | 19.1% | $1.14 | 8.6% | 14 |

| Averages | 3.2% | 12.3% | 8.8% | 21 |

Note: Stocks ending in “-N” declare earnings and dividends in US dollars. To achieve currency consistency between dividends and share price for these stocks, we have shown dividends in US dollars and share price in US dollars (these stocks are listed on a US exchange). The dividends for their Canadian counterparts (-T) would be converted into CDN dollars and would fluctuate with the exchange rate.

Check us out on magicpants.substack.com for more info in this week’s issue….