Last updated by BM on November 12, 2024

Summary

This is a weekly installment of our MP Market Review series, which provides insights and updates on Canadian dividend growth companies we monitor on ‘The List’. To read all our newsletters and premium content be sure to check us out on magicpants.substack.com.

- This week, we reveal the performance of our MP Wealth Builder Model Portfolio (USA).

- Last week, dividend growth of ‘The List’ stayed the same and has increased by +9.0% YTD (income).

- Last week, the price of ‘The List’ was up with a return of +13.0% YTD (capital).

- Last week, there were two dividend announcements from companies on ‘The List’.

- Last week, there were fourteen earnings reports from companies on ‘The List’.

- This week, three companies on ‘The List’ are due to report earnings.

DGI Clipboard

”Missing the train” vs. ”losing your money”. There are a lot of trains, but if your money is gone, it’s over.

– Paul Tudor Jones

Growing Dividends, Growing Wealth: The Strong Returns of Our U.S. Portfolio

Intro

Major indices, including the S&P 500 and Dow Jones, have surged to new highs, reflecting investor optimism around the incoming Trump administration’s economic policies. Here in Canada, our markets experienced a similar boost following Donald Trump’s election victory, but our markets never seem to quite keep up.

This week, I’m excited to welcome our new subscribers from south of the border! Our reach is growing, and while much of our analysis focuses on Canadian dividend growth companies, the principles of dividend growth investing are just as relevant in the U.S. as they are in Canada. The key difference? The U.S. market offers roughly ten times the number of quality dividend growth companies to invest in.

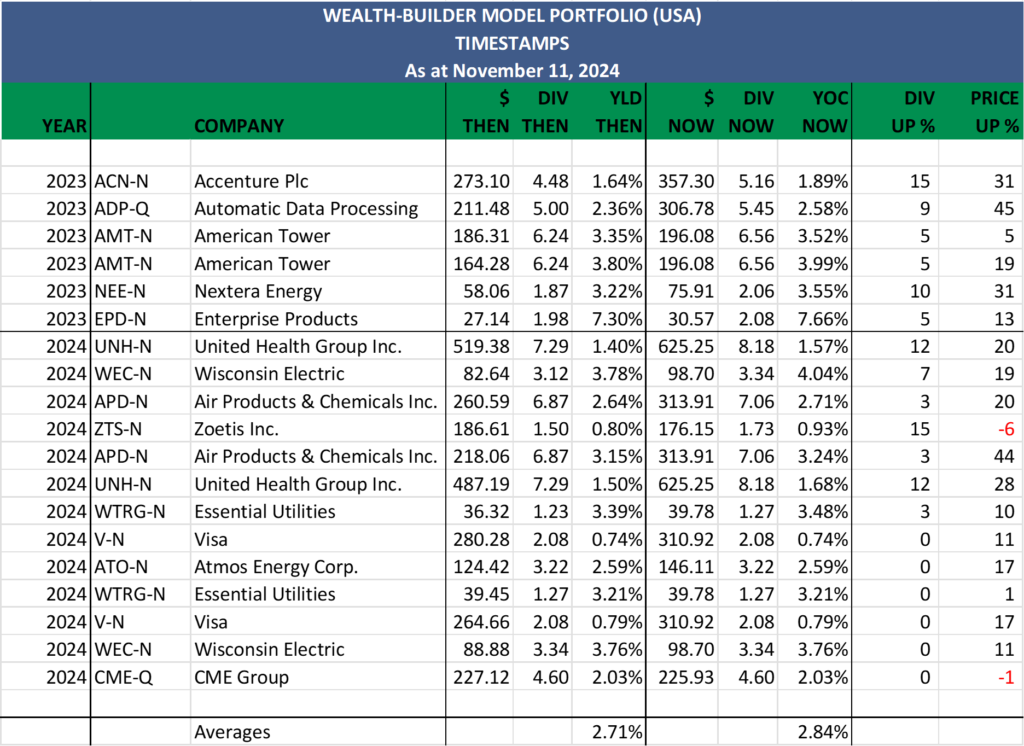

In this edition of the MP Market Review, readers will get a sneak peek at our soon-to-be-public MP Wealth-Builder Model Portfolio (USA). I launched this portfolio for family and friends in May 2023, following a business plan similar to the one in our ‘Premium Content’ section. The main difference lies in the position sizing strategy. When I post the portfolio performance to the blog, I will include the U.S. business plan as well.

To provide accountability, transparency, and trust in our process, we ‘timestamp’ all our trades. Each quarter, we show each purchase transaction to date to see how we are doing and the effects a growing dividend has on price. We don’t hide our history. When we’re wrong, it’s right there for all to see – every win, loss, and tie.

Portfolio To Date (USA)

To date, we’ve invested in thirteen high-quality dividend growth companies spanning seven U.S. sectors. Our strategy prioritizes top-tier companies within each sector, ensuring focused yet ample diversification.

Wrap Up

Since inception, our USA portfolio has achieved an impressive 25% annualized return (including dividends) without the volatility of FANG or AI stocks. This highlights the strength of our strategy to grow income and capital steadily while delivering above-average total returns.

For American investors, our approach mirrors the favourable tax treatment of eligible Canadian dividends that Canadians enjoy, making it an attractive option to explore. While I’ll begin posting performance updates for the USA portfolio on the blog, I won’t have time to write detailed articles about every trade. However, I’m happy to send timely trade alerts to those interested. Let me know in the comments section if this is something of interest to you.

DGI Scorecard

The List (2024)

The Magic Pants 2024 list includes 28 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on ‘The List’:

- Dividend growth streak: 10 years or more.

- Market cap: Minimum one billion dollars.

- Diversification: Limit of five companies per sector, preferably two per industry.

- Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies are added or removed from ‘The List’ annually on January 1. Prices and dividends are updated weekly.

‘The List’ is not a portfolio; it is a coaching tool that helps us think about ideas and risk manage our model portfolio. We own some but not all the companies on ‘The List’.

Our newsletter provides readers with a comprehensive insight into the implementation and advantages of our Canadian dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

For those interested in something more, please upgrade to a paid subscriber; you get the enhanced weekly newsletter, access to premium content, full privileges on the new Substack website magicpants.substack.com and DGI alerts whenever we make stock transactions in our model portfolio.

Performance of ‘The List’

Last week, dividend growth of ‘The List’ stayed the same and has increased by +9.0% YTD (income). How much did your salary go up this year?

Last week, the average price return of ‘The List’ was up with a return of +13.0% YTD (capital).

Even though prices may fluctuate, the dependable growth in our income does not. Stay the course. You will be happy you did.

Last week’s best performers on ‘The List’ were TFI International (TFII-N), up +10.21%; Manulife Financial (MFC-T), up +7.56%; and Alimentation Couche-Tard Inc. (ATD-T), up +5.46%.

Stella-Jones Inc. (SJ-T) was the worst performer last week, down -16.81%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $77.03 | 0.4% | $0.70 | 17.4% | 14 |

| BCE-T | Bell Canada | 10.1% | $39.49 | -27.1% | $3.99 | 3.1% | 15 |

| BIP-N | Brookfield Infrastructure Partners | 4.7% | $34.29 | 11.7% | $1.62 | 5.9% | 16 |

| CCL-B-T | CCL Industries Inc. | 1.4% | $81.19 | 40.4% | $1.16 | 9.4% | 22 |

| CNR-T | Canadian National Railway | 2.2% | $154.15 | -7.6% | $3.38 | 7.0% | 28 |

| CTC-A-T | Canadian Tire | 4.5% | $154.00 | 11.1% | $7.00 | 1.4% | 13 |

| CU-T | Canadian Utilities Limited | 5.2% | $34.64 | 7.8% | $1.81 | 0.9% | 52 |

| DOL-T | Dollarama Inc. | 0.2% | $151.00 | 58.9% | $0.35 | 29.5% | 13 |

| EMA-T | Emera | 5.7% | $50.19 | -1.2% | $2.88 | 3.2% | 17 |

| ENB-T | Enbridge Inc. | 6.2% | $58.93 | 21.8% | $3.66 | 3.1% | 28 |

| ENGH-T | Enghouse Systems Limited | 3.3% | $30.09 | -11.4% | $1.00 | 18.3% | 17 |

| FNV-N | Franco Nevada | 1.2% | $122.44 | 11.2% | $1.44 | 5.9% | 16 |

| FTS-T | Fortis Inc. | 3.9% | $61.47 | 12.1% | $2.39 | 4.4% | 50 |

| IFC-T | Intact Financial | 1.8% | $266.23 | 30.9% | $4.84 | 10.0% | 19 |

| L-T | Loblaw Companies Limited | 1.0% | $185.51 | 44.3% | $1.92 | 10.0% | 12 |

| MFC-T | Manulife Financial | 3.6% | $44.24 | 53.2% | $1.60 | 9.6% | 10 |

| MGA-N | Magna | 4.4% | $43.40 | -21.8% | $1.90 | 3.3% | 14 |

| MRU-T | Metro Inc. | 1.6% | $85.74 | 25.1% | $1.34 | 10.7% | 29 |

| RY-T | Royal Bank of Canada | 3.3% | $172.04 | 29.3% | $5.72 | 7.1% | 13 |

| SJ-T | Stella-Jones Inc. | 1.5% | $72.37 | -5.5% | $1.12 | 21.7% | 19 |

| STN-T | Stantec Inc. | 0.7% | $112.16 | 7.2% | $0.83 | 7.8% | 12 |

| T-T | Telus | 7.0% | $21.81 | -8.1% | $1.53 | 7.1% | 20 |

| TD-T | TD Bank | 5.2% | $78.91 | -6.8% | $4.08 | 6.3% | 13 |

| TFII-N | TFI International | 1.1% | $145.55 | 10.9% | $1.60 | 10.3% | 13 |

| TIH-T | Toromont Industries | 1.6% | $118.65 | 5.2% | $1.92 | 11.6% | 34 |

| TRI-N | Thomson Reuters | 1.3% | $168.23 | 17.4% | $2.16 | 12.5% | 30 |

| TRP-T | TC Energy Corp. | 5.7% | $67.82 | 29.7% | $3.84 | 3.2% | 23 |

| WCN-N | Waste Connections | 0.6% | $184.04 | 24.2% | $1.17 | 11.4% | 14 |

| Averages | 3.2% | 13.0% | 9.0% | 21 |

Note: Stocks ending in “-N” declare earnings and dividends in US dollars. To achieve currency consistency between dividends and share price for these stocks, we have shown dividends in US dollars and share price in US dollars (these stocks are listed on a US exchange). The dividends for their Canadian counterparts (-T) would be converted into CDN dollars and would fluctuate with the exchange rate.

For more articles and the full newsletter, check us out on magicpants.substack.com. Don’t miss this opportunity to stay informed and make the most of your investments!