Last updated by BM on June 3, 2024

Summary

This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- MP Wealth Builder Model Portfolio (CDN) Delivers Strong Results. Highlights in this week’s newsletter.

- Last week, dividend growth of ‘The List’ was up and has increased by +8.8% YTD (income).

- Last week, price return of ‘The List’ was down with a return of +4.3% YTD (capital).

- Last week, there was one dividend announcement from a company on ‘The List’.

- Last week, there was one earnings report from a company on ‘The List’.

- This week, no companies on ‘The List’ are due to report earnings.

DGI Clipboard

“A true investor buys for the dividend return.”

– Steve Hanke

MP Wealth Builder Model Portfolio (CDN) Delivers Strong Results

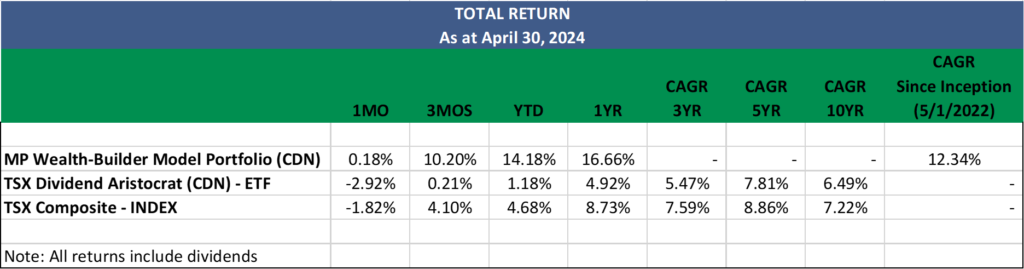

Last week, we shared our latest quarterly and second-year financial results for the MP Wealth Builder Model Portfolio (CDN). PAID Subscribers can access the full document in our ‘Premium Content’ section and receive DGI alerts whenever we buy or sell within the portfolio. Here are some highlights:

In the quarterly review, I reiterated our approach as DIY dividend growth investors:

This is about buying businesses, not just stocks.

Trusting Canada’s top companies, led by exceptional management teams and supported by thousands of dedicated employees, is key to achieving financial freedom.

We consider our portfolio an asset management business, with our assets being the many dividend growth companies we own. Our plan is to shift from working for our investments to managing our assets and growing our ownership in the investments that work for us.

We continue to outperform our benchmarks with respect to total return and exceed our income and dividend return projections. The MP Wealth-Builder Model Portfolio (CDN) now has a dividend return of 3.69% and continued to grow due to thirteen dividend increase announcements in the last quarter alone. It won’t be long before our return from dividends alone surpasses the total return of the benchmarks.

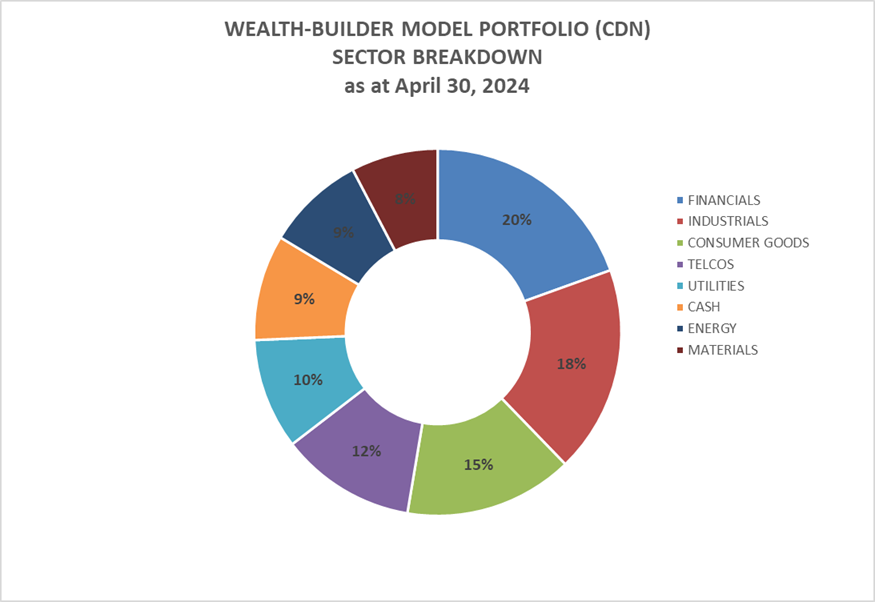

Our model portfolio now includes seventeen companies spanning seven economic sectors. Despite its concentration, we have achieved significant diversification across several industries.

Our approach is to own the best in each sector, not the most. Think quality, not quantity.

Wrap Up:

For those new to the blog, our model portfolio is being built and managed based on an initial $100,000 investment over the first four years of our business plan, with monthly contributions of $1,000 beginning in year two.

Investors can easily observe the effects of our strategy with more significant amounts of invested capital if they wish. For instance, using the same position sizes as our $100,000 plan, a million-dollar business plan would have generated ten times the annual income and capital gains. The principles of our strategy remain consistent, whether you are investing $1,000 per month, $100,000, or any amount in between.

Our evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

Sign up as a paid subscriber today and start generating real wealth. We do the work, and you stay in control.

DGI Scorecard

The List (2024)

The Magic Pants 2024 list includes 28 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on ‘The List’:

- Dividend growth streak: 10 years or more.

- Market cap: Minimum one billion dollars.

- Diversification: Limit of five companies per sector, preferably two per industry.

- Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies are added or removed from ‘The List’ annually on January 1. Prices and dividends are updated weekly.

While ‘The List’ is not a standalone portfolio, it functions admirably as an initial guide for those seeking to broaden their investment portfolio and attain superior returns in the Canadian stock market. Our newsletter provides readers with a comprehensive insight into the implementation and advantages of our Canadian dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

For those interested in something more, please upgrade to a paid subscriber; you get the enhanced weekly newsletter, access to premium content, full privileges on the new Substack website magicpants.substack.com and DGI alerts whenever we make stock transactions in our model portfolio.

Performance of ‘The List’

Last week, dividend growth of ‘The List’ went up on the announcement from Royal Bank of Canada and has now increased by +8.8% YTD (income).

Last week, ‘The List’ ‘s price return was down, with a +4.3% YTD (capital).

Even though prices may fluctuate, the dependable growth in our income does not. Stay the course. You will be happy you did.

Last week’s best performers on ‘The List’ were Dollarama Inc. (DOL-T), up +3.84%; Royal Bank of Canada (RY-T), up +3.52%; and Bell Canada (BCE-T), up +1.59%.

Enghouse Systems Limited (ENGH-T) was the worst performer last week, down -5.07%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $79.55 | 3.6% | $0.70 | 17.4% | 14 |

| BCE-T | Bell Canada | 8.6% | $46.62 | -14.0% | $3.99 | 3.1% | 15 |

| BIP-N | Brookfield Infrastructure Partners | 5.6% | $28.89 | -5.9% | $1.62 | 5.9% | 16 |

| CCL-B-T | CCL Industries Inc. | 1.7% | $70.25 | 21.5% | $1.16 | 9.4% | 22 |

| CNR-T | Canadian National Railway | 1.9% | $173.50 | 4.0% | $3.38 | 7.0% | 28 |

| CTC-A-T | Canadian Tire | 5.1% | $136.04 | -1.8% | $7.00 | 1.4% | 13 |

| CU-T | Canadian Utilities Limited | 5.8% | $31.08 | -3.2% | $1.81 | 0.9% | 52 |

| DOL-T | Dollarama Inc. | 0.3% | $129.00 | 35.8% | $0.35 | 29.5% | 13 |

| EMA-T | Emera | 6.0% | $47.46 | -6.6% | $2.87 | 3.0% | 17 |

| ENB-T | Enbridge Inc. | 7.3% | $49.83 | 3.0% | $3.66 | 3.1% | 28 |

| ENGH-T | Enghouse Systems Limited | 3.7% | $27.34 | -19.5% | $1.00 | 18.3% | 17 |

| FNV-N | Franco Nevada | 1.2% | $123.80 | 12.4% | $1.44 | 5.9% | 16 |

| FTS-T | Fortis Inc. | 4.3% | $54.51 | -0.6% | $2.36 | 3.3% | 50 |

| IFC-T | Intact Financial | 2.1% | $228.04 | 12.2% | $4.84 | 10.0% | 19 |

| L-T | Loblaw Companies Limited | 1.2% | $158.30 | 23.1% | $1.92 | 10.0% | 12 |

| MFC-T | Manulife Financial | 4.5% | $35.40 | 22.6% | $1.60 | 9.6% | 10 |

| MGA-N | Magna | 4.2% | $45.21 | -18.5% | $1.90 | 3.3% | 14 |

| MRU-T | Metro Inc. | 1.8% | $72.63 | 6.0% | $1.34 | 10.7% | 29 |

| RY-T | Royal Bank of Canada | 3.8% | $148.98 | 12.0% | $5.72 | 7.1% | 13 |

| SJ-T | Stella-Jones Inc. | 1.4% | $81.36 | 6.2% | $1.12 | 21.7% | 19 |

| STN-T | Stantec Inc. | 0.8% | $110.00 | 5.1% | $0.83 | 7.8% | 12 |

| T-T | Telus | 6.8% | $22.41 | -5.5% | $1.53 | 7.1% | 20 |

| TD-T | TD Bank | 5.4% | $76.20 | -10.0% | $4.08 | 6.3% | 13 |

| TFII-N | TFI International | 1.2% | $132.28 | 0.8% | $1.60 | 10.3% | 13 |

| TIH-T | Toromont Industries | 1.6% | $119.04 | 5.5% | $1.92 | 11.6% | 34 |

| TRI-N | Thomson Reuters | 1.3% | $172.11 | 20.1% | $2.16 | 10.2% | 30 |

| TRP-T | TC Energy Corp. | 7.3% | $52.56 | 0.5% | $3.84 | 3.2% | 23 |

| WCN-N | Waste Connections | 0.7% | $164.32 | 10.9% | $1.14 | 8.6% | 14 |

| Averages | 3.4% | 4.3% | 8.8% | 21 |

Note: Stocks ending in “-N” declare earnings and dividends in US dollars. To achieve currency consistency between dividends and share price for these stocks, we have shown dividends in US dollars and share price in US dollars (these stocks are listed on a US exchange). The dividends for their Canadian counterparts (-T) would be converted into CDN dollars and would fluctuate with the exchange rate.

Check us out on magicpants.substack.com for more info in this week’s issue….