Last updated by BM on May 08, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was down slightly with a YTD price return of +7.3% (capital). Dividend growth increased and is now at +8.4% YTD, highlighting growth in income over the past year.

- Last week, two dividend increases from companies on ‘The List’.

- Last week, eight earnings reports from companies on ‘The List’.

- Seven companies on ‘The List’ are due to report earnings this week.

- If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service, which grants you access to the MP Wealth-Builder Model Portfolio (CDN) and exclusive subscriber-only content. Learn More

Introduction

“You have a pair of pants. In the left pocket, you have $100. You take $1 out of the left pocket and put it in the right pocket. You now have $101. There is no diminution of dollars in your left pocket. That is one magic pair of pants.”

This ‘magic pants’ analogy was from a Seeking Alpha article on dividend investing I read about a decade ago and was one of the catalysts for me to take a closer look at this type of investing and see if it truly was magical.

After conducting additional research, I have shifted towards utilizing a dividend growth investing (DGI) strategy as my primary investment approach. While I maintain portfolios consisting of high-quality dividend growers from both the United States and Canada, I have opted to concentrate on Canadian (CDN) dividend growth companies in this blog. This is due to several reasons, including a smaller pool of DGI companies to track, a lack of coverage for the DGI strategy by the North American investment media, and a tendency for those who do cover DGI to narrowly focus on only a handful of sectors (Energy and Financials).

While ‘The List’ is not a portfolio in itself, it serves as an excellent initial reference for individuals seeking to diversify their investments and attain higher returns in the Canadian stock market. Through our blog, we provide weekly updates on ‘The List’ and offer valuable perspectives and real-life examples of the dividend growth investing strategy in practice. This helps readers gain a deeper understanding of how to implement and benefit from this investment approach.

DGI Thoughts

“I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.”

– Warren Buffett

After reading the article in the ‘News’ section centered around the 2023 Projection Assumption Guidelines published by the Financial Planning Canada Standards Council, I couldn’t help but take a look at the ten-year historical returns of the individual companies that make up ‘The List’.

Not only did almost all of the companies on ‘The List’ outperform the total return ‘standards’ (4.7% annually over the long term) communicated to their customers by financial planners but many of the companies on ‘The List’ outperformed these standard returns from dividends alone (Growth Yield).

One of the ‘quality’ indicators we use when evaluating which companies on ‘The List’ to build our portfolios with is ‘Growth Yield’. Growth Yield helps us determine our return from dividends alone at some point in the future on an investment made today.

Growth yield refers to the yield on cost of a stock, which takes into account the current annualized dividend payments in relation to the original cost basis of the investment. We like the term growth yield better as it proves that growth (a key part of our strategy) has indeed happened and highlights the yield you are now making on dividends alone. The magic of growth yield is typically lost in all statements and conversations about investing. Knowing the subtle difference between a good yield and a growing yield is fundamental in what we do.

According to our experience, creating a stock portfolio with an average estimated growth yield and historical growth yield of greater than 7% after ten years has proven to be a reliable indicator of quality.

If you have not yet joined as a subscriber of the blog to receive DGI Alerts on the activity in our model portfolio, it’s not too late. Click Here.

Recent News

TD, First Horizon terminate US$13.4-billion takeover deal (Globe & Mail)

https://www.theglobeandmail.com/business/article-td-first-horizon-terminate-merger/

In our post ‘Toronto-Dominion Bank: Time To Supercharge Your Dividend Growth Investing (DGI) Returns’, a few weeks back, we mentioned this was one of the possible outcomes in our investment thesis section of the article. The share price has responded favorably to the news.

If this doesn’t get you to pay attention to your investing fees, nothing will (Globe & Mail)

“The brain trust for financial planning standards in Canada thinks a 50-50 balanced portfolio of stocks and bonds will make an average 4.7 per cent annually over the long term.”

Aren’t you glad we do things differently as dividend growth investors. Our dividend income return (Growth Yield) alone easily outperforms the ‘brain trust’ after only a few short years.

To receive breaking news about companies on ‘The List’ follow us on Twitter @MagicPants_DGI.

The List (2023)

Last updated by BM on May 05, 2023

The Magic Pants List contains 27 Canadian dividend growth stocks. ‘The List’ contains Canadian companies that have raised their dividend yearly for at least the last ten years and have a market cap of over a billion dollars. Below is each stock’s symbol, name, current yield, current price, price return year-to-date, current dividend, dividend growth year-to-date and current dividend growth streak. Companies on ‘The List’ are added or subtracted once a year, on January 1. After that, ‘The List’ is set for the next twelve months. Prices and dividends are updated weekly.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 5.7% | $8.83 | 31.2% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $67.21 | 11.8% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 5.9% | $64.44 | 7.0% | $3.82 | 5.0% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $35.54 | 5.2% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.7% | $64.05 | 10.3% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 1.9% | $163.07 | 0.1% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.0% | $174.65 | 19.1% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 4.6% | $39.32 | 6.4% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $82.96 | 3.9% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 4.7% | $58.76 | 11.7% | $2.76 | 3.0% | 16 |

| ENB-T | Enbridge Inc. | 6.6% | $53.43 | 0.2% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 2.3% | $36.18 | 1.3% | $0.85 | 18.2% | 16 |

| FNV-N | Franco Nevada | 0.9% | $159.01 | 15.1% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis | 3.7% | $60.84 | 9.9% | $2.26 | 4.1% | 49 |

| IFC-T | Intact Financial | 2.2% | $199.87 | 2.1% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.4% | $122.34 | 1.7% | $1.74 | 10.3% | 11 |

| MGA-N | Magna | 3.4% | $53.98 | -6.2% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.6% | $77.00 | 2.0% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 4.0% | $131.08 | 2.4% | $5.28 | 6.5% | 12 |

| SJ-T | Stella-Jones Inc. | 1.7% | $54.37 | 9.7% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 0.9% | $81.60 | 24.9% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.6% | $83.30 | -5.0% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.3% | $106.20 | 6.1% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.6% | $104.83 | 7.3% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 6.6% | $55.94 | 5.0% | $3.69 | 3.4% | 22 |

| T-T | Telus | 5.1% | $28.13 | 6.9% | $1.43 | 7.3% | 19 |

| WCN-N | Waste Connections | 0.7% | $140.82 | 6.9% | $1.02 | 7.4% | 13 |

| Averages | 3.1% | 7.3% | 8.4% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

Note: When the dividend and share price currency match, the calculation is straightforward. But it’s not so simple when the dividend is declared in one currency, and the share price is quoted in another. Dividing the former by the latter would produce a meaningless result because it’s a case of apples and oranges. To calculate the yield properly, you must express the dividend and share price in the same currency.

Performance of ‘The List’

Feel free to click on this link, ‘The List’ for a sortable version from our website.

Last week, ‘The List’ was down slightly with a YTD price return of +7.3% (capital). Dividend growth increased and is now at +8.4% YTD, highlighting growth in income over the past year.

The best performers last week on ‘The List’ were Franco Nevada (FNV-N), up +4.76%; Algonquin Power & Utilities (AQN-N), up +3.64%; and Magna (MGA-N), up +3.49%.

Toromont Industries (TIH-T) was the worst performer last week, down -4.25%.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

“As a dividend increase is a positive sign of a company’s financial strength, the safest purchase, after research, is a stock with a recent dividend increase.”

– Tom Connolly (the founder of dividendgrowth.ca)

Last week, two dividend increases from companies on ‘The List’.

Loblaws (L-T) on Wednesday said it increased its 2023 quarterly dividend from $.405 to $.446 per share, payable July 1, 2023, to shareholders of record on June 14, 2023.

This represents a dividend increase of +10.0%, marking the 12th straight year of dividend growth for this quality grocer.

Telus (T-T) on Thursday said it increased its 2023 quarterly dividend from $.3511 to $.3636 per share, payable July 4, 2023, to shareholders of record on June 09, 2023.

This represents a dividend increase of +3.6%, marking the 20th straight year of dividend growth for this quality telco.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

Earnings growth and dividend growth tend to go hand in hand, so this information can tell us a lot about the future dividend growth of our quality companies. Monitoring our dividend growers periodically is part of the process, and reading the quarterly earnings releases is a good place to start.

Seven companies on ‘The List’ ares due to report earnings this week.

Q1 earnings season wraps up this week with seven companies on ‘The List’ due to report earnings.

Stella-Jones Inc. (SJ-T) will release its first-quarter fiscal 2023 results on Wednesday, May 10, 2023, before markets open.

CCL Industries (CCL-B-T) will release its first-quarter fiscal 2023 results on Wednesday, May 10, 2023, after markets close.

Intact Financial (IFC-T) will release its first-quarter fiscal 2023 results on Wednesday, May 10, 2023, after markets close.

Stantec (STN-T) will release its first-quarter fiscal 2023 results on Wednesday, May 10, 2023, after markets close.

Canadian Tire (CTC-A-T) will release its first-quarter fiscal 2023 results on Thursday, May 11, 2023, before markets open.

Algonquin Power & Utilities (AQN-N) will release its first-quarter fiscal 2023 results on Thursday, May 11, 2023, before markets open.

Emera Inc. (EMA-T) will release its first-quarter fiscal 2023 results on Friday, May 12, 2023, before markets open.

Last week, eight earnings reports from companies on ‘The List’.

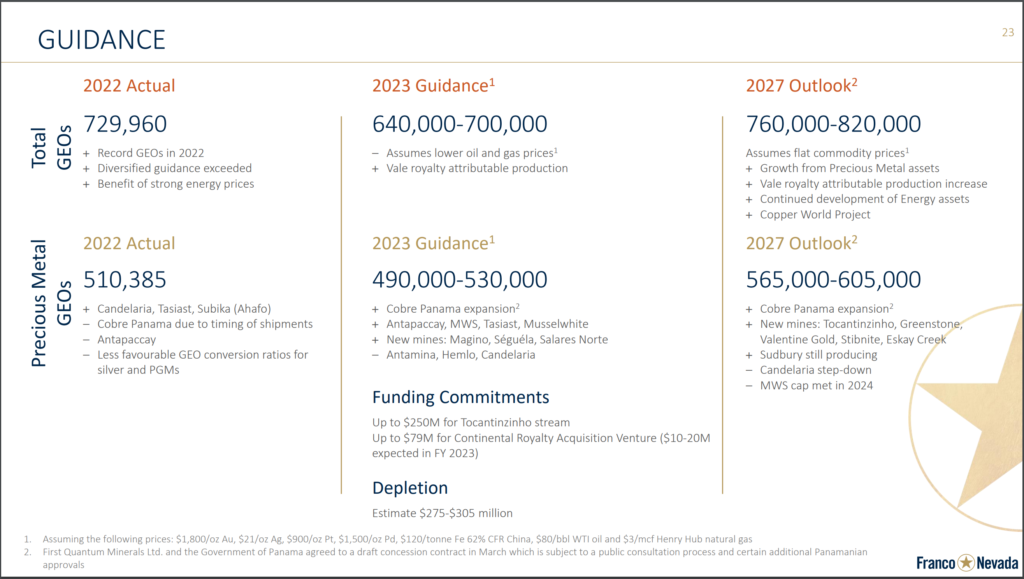

Franco Nevada (FNV-N) released its first-quarter fiscal 2023 results on Tuesday, May 2, 2023, after markets closed.

“Our diversified portfolio continues to generate strong cash flows and high margins. The first quarter was impacted by production disruptions at Cobre Panama and Antapaccay as well as lower energy prices. Stronger precious metal deliveries are anticipated in Q2 with both assets having returned to normal operations. “Cobre Panama’s CP 100 Expansion is on-track for year-end and we look forward to initial contributions from Magino, Séguéla and Salares Norte during the year”, commented Paul Brink, CEO. Franco-Nevada is debt-free, is growing its cash balances and has a strong pipeline of growth opportunities.

– Chief Executive Officer, Paul Brink

Highlights:

- No debt and $2.2 billion in available capital as at March 31, 2023

- Generated $209.8 million in operating cash flow during the quarter

- 16 consecutive dividend increases. Quarterly dividend of $0.34/share

Source: (FNV-N) Q1-2023 News Release

Loblaws (L-T) released its first-quarter fiscal 2023 results on Wednesday, May 3, 2023, before markets opened.

“In the face of ongoing inflation, we are working hard to deliver the value and choice Canadians are looking for. I’m pleased that customers are responding positively to the breadth of our offerings including our diverse store formats, market leading prices, private label brands, and loyalty offers.”

– Chairman and Chief Executive Officer, Galen Weston

Highlights:

- Revenue was $12,995 million, an increase of $733 million, or 6.0%.

- Retail segment sales were $12,735 million, an increase of $690 million, or 5.7%.

- Food Retail (Loblaw) same-stores sales increased by 3.1%, including the negative impact of 1.1% related to the timing of New Year’s Day.

- Drug Retail (Shoppers Drug Mart) same-store sales increased by 7.4%, with front store same-store sales growth of 10.3% and pharmacy same-store sales growth of 4.7%.

- E-commerce sales decreased by 1.1%, lapping elevated online sales due to lockdowns last year.

- Operating income was $769 million, an increase of $31 million, or 4.2%.

- Adjusted EBITDA(2) was $1,448 million, an increase of $105 million, or 7.8%.

- Retail segment adjusted gross profit percentage(2) was 31.3%, an increase of 20 basis points.

- Net earnings available to common shareholders of the Company were $418 million, a decrease of $19 million or 4.3%. Diluted net earnings per common share were $1.29, a decrease of $0.01, or 0.8%. The decrease was primarily driven by a prior year gain related to a favourable Court ruling.

- Adjusted net earnings available to common shareholders of the Company (2) were $505 million, an increase of $46 million, or 10.0%.

- Adjusted diluted net earnings per common share(2) were $1.55, an increase of $0.19 or 14.0%.

- Repurchased for cancellation 3.3 million common shares at a cost of $383 million and invested $208 million in capital expenditures, net of proceeds from property disposals. Free cash flow(2) used in the Retail segment was $81 million.

- Twelfth consecutive annual increase to the quarterly common share dividend from $0.405 per common share to $0.446 per common share, an increase of 10%.

- The Company just announced the release of its 2022 Environmental, Social and Governance (“ESG”) Report.

Outlook:

Loblaw will continue to execute on retail excellence while advancing its growth initiatives in 2023. The Company’s businesses remain well placed to service the everyday needs of Canadians. However, the Company cannot predict the precise impacts of global economic uncertainties, including the inflationary environment, on its 2023 financial results.

For the full-year 2023, the Company continues to expect:

- its Retail business to grow earnings faster than sales;

- adjusted net earnings per common share growth in the low double digits;

- to increase investments in our store network and distribution centres by investing a net amount of $1.6 billion in capital expenditures, which reflects gross capital investments of approximately $2.1 billion offset by approximately $500 million of proceeds from real estate dispositions; and

- to return capital to shareholders by allocating a significant portion of free cash flow to share repurchases.

Source: (L-T) Q1-2023 Quarterly Review

Fortis (FTS-T) released its first-quarter fiscal 2023 results on Wednesday, May 3, 2023, before markets opened.

“Our strong first quarter results reflect the diversified nature of our business and the continued delivery of our low-risk capital plan. With capital expenditures of $1.0 billion in the quarter, we are on track to invest $4.3 billion in our systems this year.

Our funding plan remains intact, and the sale of the Aitken Creek Natural Gas Storage Facility further strengthens our balance sheet and supports financing of our regulated utility investments. We remain confident in our growth strategy as we continue to provide value to shareholders while executing on the transition to a cleaner energy future and delivering safe, reliable and affordable service to our customers.”

– President and Chief Executive Officer, David Hutchens

Highlights:

- First quarter net earnings of $437 million, or $0.90 per common share, up from $350 million, or $0.74 per common share in 2022

- Adjusted net earnings per common share of $0.91, up from $0.78 in the first quarter of 2022

- Capital expenditures of $1.0 billion in the first quarter; $4.3 billion annual capital plan on track

- Significant regulatory applications at Tucson Electric Power and FortisBC continue to progress

- Announced the sale of the Corporation’s ownership interest in the Aitken Creek Natural Gas Storage Facility in British Columbia

Outlook:

Fortis continues to enhance shareholder value through the execution of its capital plan, the balance and strength of its diversified portfolio of regulated utility businesses, and growth opportunities within and proximate to its service territories. While energy price volatility, global supply chain constraints and persistent inflation are issues of potential concern that continue to evolve, the Corporation does not currently expect there to be a material impact on its operations or financial results in 2023.

Fortis is executing on the transition to a cleaner energy future and is on track to achieve its corporate-wide targets to reduce greenhouse gas emissions (“GHG”) by 50% by 2030 and 75% by 2035. Upon achieving these targets, 99% of the Corporation’s assets will support energy delivery and renewable, carbon-free generation. The Corporation’s additional 2050 net-zero direct GHG emissions target reinforces Fortis’ commitment to further decarbonize over the long-term, while preserving customer reliability and affordability.

The Corporation’s $22.3 billion five-year capital plan is expected to increase midyear rate base from $34.1 billion in 2022 to $46.1 billion by 2027, translating into a five-year compound annual growth rate of 6.2%.

Beyond the five-year capital plan, additional opportunities to expand and extend growth include: further expansion of the electric transmission grid in the U.S. to facilitate the interconnection of cleaner energy, including infrastructure investments associated with the Inflation Reduction Act of 2022 and the MISO LRTP; climate adaptation and grid resiliency investments; renewable gas solutions and liquefied natural gas infrastructure in British Columbia; and the acceleration of cleaner energy infrastructure investments across our jurisdictions.

Fortis expects its long-term growth in rate base will drive earnings that support dividend growth guidance of 4-6% annually through 2027.

Source: (FTS-T) Q1-2023 Quarterly Review

Brookfield Infrastructure Partners (BIP-N) released its first-quarter fiscal 2023 results on Wednesday, May 3, 2023, before markets opened.

“We are pleased to report a strong start to 2023 for Brookfield Infrastructure, with future growth secured from several successful capital deployment initiatives. Our diversified portfolio of high-quality infrastructure assets are well positioned to deliver resilient results during all market conditions.”

– Chief Executive Officer, Sam Pollock

Highlights:

- FFO of $554 million or $0.72 per unit in the first quarter represents an increase of 12% over the prior year – Organic growth of 9% captures elevated inflation, volume growth across our transport segment, and earnings associated with capital commissioned over the last 12 months – Incremental contribution from our asset rotation program including the privatization of HomeServe on January 4, 2023

- Distribution of $0.3825 per unit represents an increase of 6% compared to the prior year

- Payout ratio for the quarter of 68% falls within our long-term 60-70% target range

- Net income benefited from the contributions associated with recent acquisitions and organic growth across our base business, offset by mark-tomarket losses on commodity contracts and one-time transaction costs associated with the acquisition of HomeServe and the European telecom tower portfolio, which are expensed on acquisition

- Total assets increased compared to December 31, 2022 as a result of the acquisition of HomeServe and the European telecom tower portfolio, organic growth initiatives, and the impact of foreign exchange

Outlook:

We believe that the long-term positive outlook for the infrastructure sector, in conjunction with our full cycle investment strategy, will allow us to continue to create significant value for our investors. Our strategy is grounded in a deep understanding of the infrastructure sector and the various market forces that drive it. We have made significant progress during the quarter, adding valuable pieces to our long-term growth plans, with two important investments: the agreement to acquire Data4 and the planned Triton privatization. Both investments are expected to generate strong cash flow for our unitholders. We also believe that our ability to look through near-term headlines and overreactions to invest in high quality businesses that have long-term growth potential will differentiate us during this current market cycle.

Our priorities for the balance of the year will be the integration of our recently secured investments and the execution of our current capital recycling program. We are also focused on continuing to deliver excellent financial results, which are expected to benefit from the full run-rate contribution of our new Heartland Petrochemical Complex, commissioning of new projects from our capital backlog and the closing of the Data4 and Triton acquisitions.

Source: (BIP-N) Q1-2023 Quarterly Review

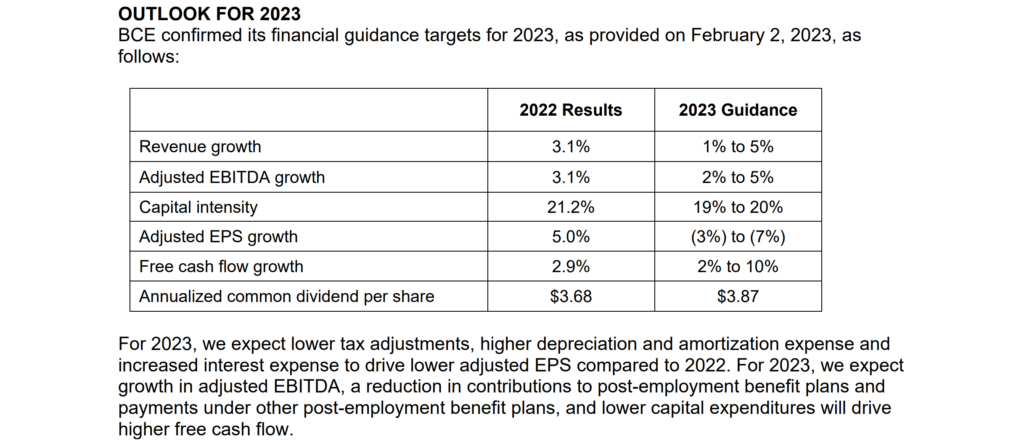

Bell Canada (BCE-T) released its first-quarter fiscal 2023 results on Thursday, May 4, 2023, before markets opened.

“Bell has delivered a solid start to the year with results that were on plan and that reflect our consistently strong execution.

Overall, our performance in wireless and Internet helped to drive strong 3.5% consolidated revenue growth, offsetting the impacts of an advertising slowdown within our Bell Media segment. Our mobile phone postpaid net subscriber activations were up 26.5%, with 5.4% higher wireless service revenue. We also added nearly 48,000 new FTTH customers in Q1, up 24% over last year, with consumer Internet revenue up 10%.

In line with our broadband network buildout plan, we invested close to $1.1 billion in capital expenditures in Q1 and remain on pace to expand our fibre footprint by 650,000 locations and cover 85% of the population with our 5G service by the end of 2023. While we’re currently experiencing an uncertain economic environment amid headwinds, inflationary cost pressures and regulatory uncertainty, we remain committed to our corporate purpose to advance how 2/17 Canadians connect with each other and the world. As we look ahead to the remainder of 2023, we are confident in our ability to continue delivering results with consistent, strong execution.”

– President and Chief Executive Officer, Mirko Bibic

Highlights:

- BCE operating revenue increased 3.5% over Q1 2022 to $6,054 million. This was the result of 0.9% higher service revenue of $5,222 million and a 23.6% increase in product revenue to $832 million, driven by growth at Bell Communication and Technology Services (Bell CTS), partly offset by a year-over-year decline at Bell Media.

- Net earnings decreased 15.6% to $788 million and net earnings attributable to common shareholders totalled $725 million, or $0.79 per share, down 17.3% and 17.7% respectively. The year-over-year declines were due to increased interest expense, higher depreciation and amortization expense, lower adjusted EBITDA, higher severance, acquisition and other costs and higher asset impairment charges related to office spaces we ceased using as part of our real estate optimization strategy due to Bell’s hybrid work policy. These factors were partly offset by lower income taxes and higher other income which included gains from the sale of land related to our real estate optimization strategy. Adjusted net earnings were down 4.8% to $772 million, resulting in a 4.5% decrease in adjusted EPS to $0.85.

- Adjusted EBITDA was down 1.8% to $2,538 million, reflecting a 36.5% decrease at Bell Media, partly offset by a 1.3% increase at Bell CTS. BCE’s consolidated adjusted EBITDA margin13 declined 2.3 percentage points to 41.9% from 44.2% in Q1 2022, due to lower year-over-year media revenue attributable mainly to a favourable one-time retroactive adjustment to subscriber revenue in Q1 2022 related to a contract with a Canadian TV distributor, higher low-margin product sales, as well as operating cost pressures related to inflation, strategic initiatives, higher TV content costs and the normalization of our cost structure to pre-COVID levels.

- BCE capital expenditures were $1,086 million, up 13.2% from $959 million last year, corresponding to a capital intensity 14 of 17.9%, compared to 16.4% in Q1 2022. The year over-year increase in capital spending was due mainly to significant ongoing investment in expanding Bell’s pure fibre network, including connecting more homes and businesses to Bell Internet services.

- BCE cash flows from operating activities were $1,247 million, down 27.3% from Q1 2022, reflecting lower cash from working capital attributable to the timing of supplier payments, higher interest paid, increased cash taxes due mainly to the timing of instalment payments and lower adjusted EBITDA, partly offset by lower contributions to post-employment benefit plans.

- Free cash flow decreased 88.1% to $85 million from $716 million in Q1 2022, due to lower cash flows from operating activities excluding acquisition and other costs paid, and higher capital expenditures.

Outlook:

Source: (BCE-T) Q1-2023 Quarterly Review

Telus (T-T) released its first-quarter fiscal 2023 results on Thursday, May 4, 2023, before markets opened.

“In the first quarter, our TELUS team once again demonstrated our hallmark execution excellence, characterized by the potent combination of leading customer growth and strong financial results. Our robust performance is underpinned by our globally leading broadband networks and customer-centric culture, which enabled our strongest first quarter on record, with total customer net additions of 163,000, up 10 per cent, year-over-year. This included strong mobile phone net additions of 47,000, our best first quarter result since 2010; healthy connected device net additions of 58,000; and record first quarter total fixed net additions of 58,000, inclusive of reaching our one millionth security subscriber. Our leading customer growth is reflective of our consistent, industry-best client loyalty across our mobile and fixed product lines.”

– President and Chief Executive Officer, Darren Entwistle

Highlights:

- Total Mobile and Fixed customer growth of 163,000, up 15,000 over last year, and our strongest first quarter on record, driven by strong demand for our leading portfolio across Mobility and Fixed services

- Strong Mobile Phone net additions of 47,000, our best first quarter since 2010, and robust Connected Device net additions of 58,000; industry-leading postpaid churn of 0.70 per cent and Mobile Phone ARPU growth of 3.8 per cent

- Record first quarter Fixed customer net additions of 58,000, including 35,000 internet customer additions, powered by industry-leading customer loyalty, with blended PureFibre churn below 1 per cent, in combination with TELUS’ PureFibre network; achieved one million security customer milestone

- Strong quarterly financial results including Consolidated Operating Revenue and Adjusted EBITDA growth of 16 per cent and 11 per cent, respectively, and double digit Free Cash Flow growth of 29 per cent; Net Income lower by 45 per cent on higher interest, depreciation and amortization, and restructuring and other costs

- Quarterly dividend raised to $0.3636, an increase of 7.4 per cent over the same period last year and our twenty-fourth increase since May 2011, representing a yield of approximately 5 per cent, supported by leading Adjusted EBITDA growth and strong cash flow expansion

Outlook:

Reiterating our 2023 Consolidated Financial Targets including Operating Revenue and Adjusted EBITDA growth of 11 to 14 per cent and 9.5 to 11 per cent, respectively, Capital Expenditures of approximately $2.6 billion and Free Cash Flow of approximately $2.0 billion.

Source: (T-T) Q1-2023 Quarterly Review

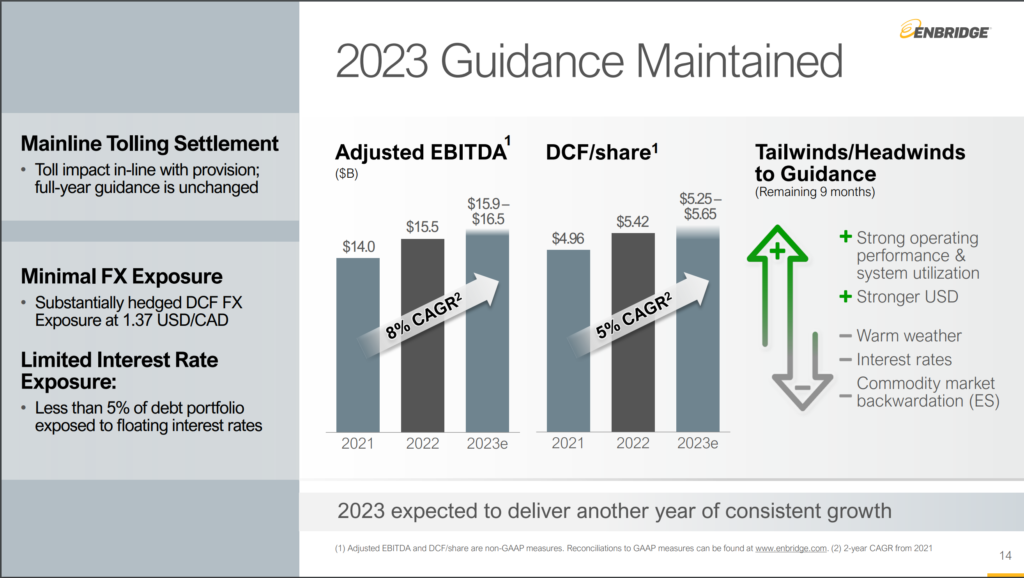

Enbridge Inc. (ENB-T) released its first-quarter fiscal 2023 results on Friday, May 5, 2023, before markets opened.

“We are very pleased with a strong start to 2023 and how our low-risk business model continues to deliver in all market cycles. Our first quarter results were right in line with our expectations despite extreme volatility in both financial and commodity markets. Operationally, we continue to be a first-choice service provider to our customers and during the quarter, this resulted in high utilization across our systems and record volumes on the Mainline. Enbridge is very proud of its long history of predictable financial and operational performance. For 17 consecutive years, shareholders have benefited from our ability to consistently meet financial guidance and we have delivered 28 consecutive annual dividend increases.”

– President and Chief Executive Officer, Greg Ebel

Highlights:

- Debt to EBITDA of 4.6×1, mid-point of the target range

- BBB+ credit ratings reaffirmed by all agencies

- Settlement in principle reached on Mainline

- Acquired Tres Palacios & Signed agreement to acquire Aitken Creek Gas Storage

- Signed LOI to advance Blue Ammonia export facility at EIEC

- Announced successful bid to design, build and operate Normandy OSW

- High utilization across our systems

- Strong operational performance in the quarter

- Continued strong reliability and personnel

- ESG update with audited 2022 statistics

- 27% reduction in emissions intensity since 2018

Outlook:

Strong Q1 performance – on track to meet full-year guidance

Source: (ENB-T) Q1-2023 Quarterly Review

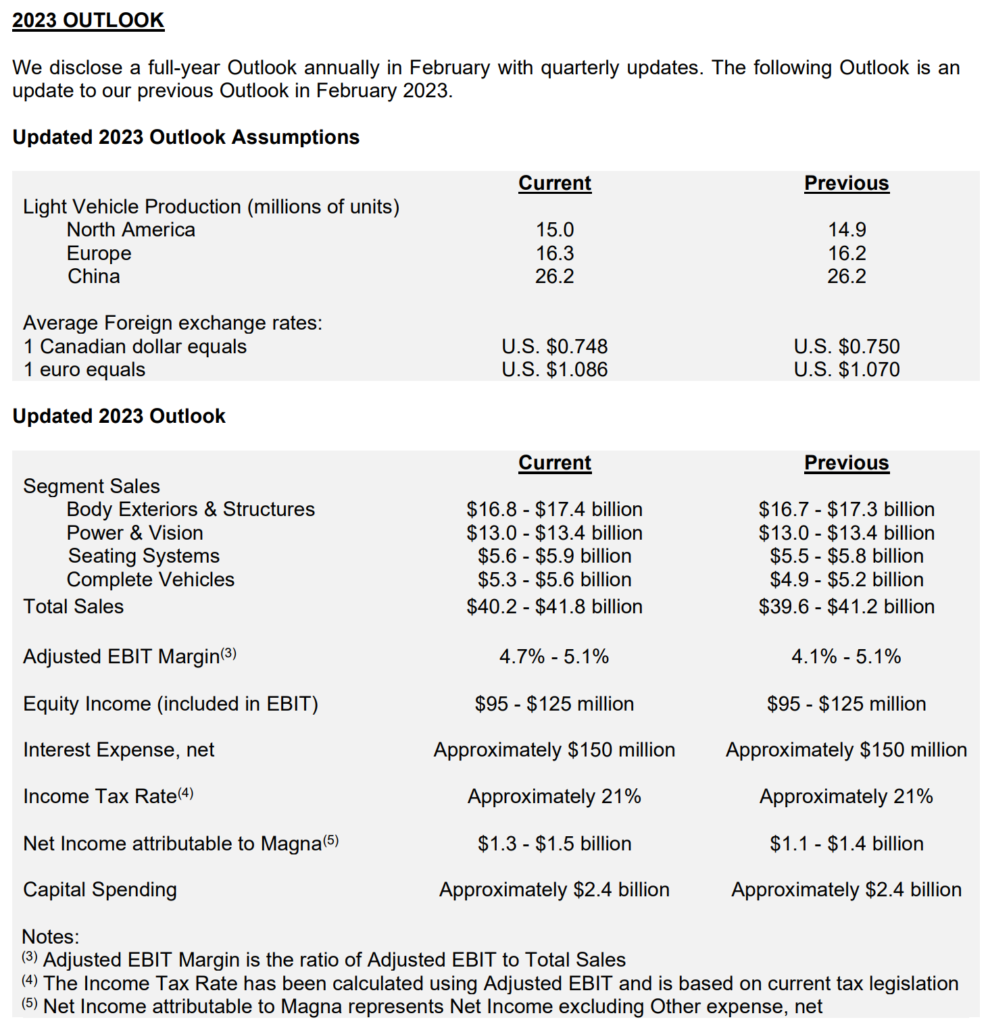

Magna (MGA-N) released its first-quarter fiscal 2023 results on Friday, May 5, 2023, before markets opened.

“Our strong first quarter operating performance reflects strong earnings on higher organic sales. More importantly, we are taking targeted actions to reduce expenses and optimize our cost structure. Our increased outlook is based on the strength of our first quarter results and the expected benefit of these targeted actions. We are highly focused on executing our strategy and remain confident in our ability to meet our long-term growth and margin outlook.”

– President and Chief Executive Officer, Swamy Kotagiri

Highlights:

- Sales increased 11% to $10.7 billion, compared to a global light vehicle production that rose 3%

- Diluted earnings per share and Adjusted diluted earnings per share were $0.73 and $1.11, respectively

- Paid dividends of $132 million

- Raised Adjusted EBIT Margin Outlook range to 4.7%-5.1% from 4.1%-5.1%

Source: (MGA-N) Q1-2023 Quarterly Review