Last updated by BM on June 27, 2022

“When an investor focuses on short-term investments, he or she is observing the variability of the portfolio, not the returns – in short, being fooled by randomness.”

– Nicholas Nassim Taleb

Price declines don’t impact our reason for investing; income. For us, it is about the income stream down the road. We know that our growing yields will eventually drive price gains. We are not distracted by short-term price movements.

One of the reasons we publish ‘The List’ of Canadian dividend growth stocks is to demonstrate how our process works. Each week, we post the income and capital returns of ‘The List’ year-to-date. The main reason for doing this is to show those new to dividend growth investing that there are times when prices decline and short-term capital returns suffer, but we always have growing returns from our dividends. This growing income, combined with an initial starting yield, gets our money working for us until our capital catches up. The dividends on ‘The List’ are doing fine in 2022, up 10.2%, on average, year-to-date.

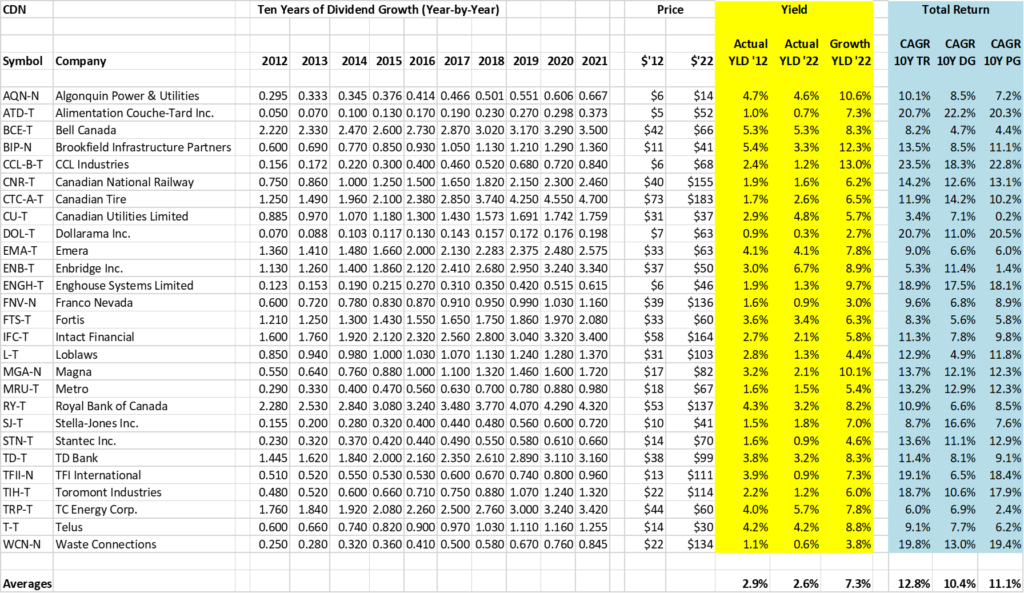

Compare ‘The List’ 2022 to the decade-long chart below, and you will see the compound annual growth rate of dividends (CAGR 10Y DG) track this year’s dividend growth year-to-date very closely (10.2% vs 10.4%). The price growth (CAGR 10Y PG), however, can vary as we are seeing in 2022 but aligns closely with dividend growth (10.4% vs 11.1%) over time. The starting yield in 2012 plus annual dividend growth was very close to the total return achieved annually of 12.8% (CAGR 10Y TR) of ‘The List’. For those new to dividend growth investing, this is the magic of our strategy!

In summary, price declines don’t matter for dividend growth investors when our portfolios produce the income we need. We know that price growth will eventually catch up.

Performance of ‘The List’

Last week, ‘The List’ was up from the previous week by 2.8% but down YTD with a minus -5.9% price return (capital). Dividend growth of ‘The List’ remains at 10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were Enghouse Systems Limited (ENGH-T), up 10.2%; TFI International (TFII-N), up 7.67%; and Waste Connections (WCN-N), up 6.91%.

Stella Jones (SJ-T) was the worst performer last week, down -3.31%.

Recent News

Enghouse Systems Limited Acquires Competella AB (Source: MT Newswires)

“Competella offers an easy to deploy cloud-based contact center solution that works effectively in the Microsoft Teams,” said Steve Sadler, Chairman & CEO of Enghouse. “Competella is a great fit for us as we have both operated in Sweden for a long time. We are very pleased to welcome Competella’s customers, employees and partners to Enghouse.”

In our MP Market Review-June 10, 2022, we mentioned that Enghouse Systems (ENGH-T) was looking for new acquisitions in the cloud computing space. It appears they found one in Competella AB. One of the takeaways from this news for dividend growth investors is that Enghouse Systems is doing what they said they would do. This creates trust with investors, and one of the reasons (ENGH-T) has been the top performer on ‘The List’ over the last two weeks even though their earnings have suffered YTD.

Canada’s inflation rate spikes to 7.7 per cent in May, highest since 1983 (Source: Globe & Mail)

“We know inflation is keeping Canadians up at night; it’s keeping us up at night,” Carolyn Rogers, senior deputy governor at the Bank of Canada, said on Wednesday at a Globe and Mail event. “And we will not rest easy until we get it back down to target,” which is 2 per cent.

Inflation is still a big issue here in Canada. Governments will do everything they can to get it under control, even if it means taking the economy into a recession. The Bank of Canada makes its next rate decision on July 13. Many expect a 75 basis point hike similar to the one announced by the U.S. Federal Reserve two weeks ago. Remember what happened to stock markets shortly after?

There is one company on ‘The List’ due to report earnings this week.

Alimentation Couche-Tard (ATD-T) will release its fourth-quarter 2022 results on Tuesday, June 28, 2022, after markets close.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List.’

Earnings Releases

Last week, there were no earnings releases from companies on ‘The List.’

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on June 24, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 5.1% | $13.86 | -3.4% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $55.17 | 5.9% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.8% | $63.28 | -4.0% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.9% | $37.09 | -8.9% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.6% | $60.48 | -10.8% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 2.0% | $146.75 | -5.3% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.5% | $166.29 | -9.2% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.7% | $37.70 | 3.0% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $74.95 | 18.2% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.4% | $59.80 | -4.5% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.4% | $53.85 | 8.7% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.5% | $29.06 | -36.6% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 0.9% | $138.47 | 1.7% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.6% | $59.77 | -1.2% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.2% | $180.42 | 10.2% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.3% | $114.71 | 11.7% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 3.1% | $57.87 | -29.1% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.6% | $68.88 | 2.7% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 4.0% | $124.34 | -9.1% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 2.6% | $31.28 | -23.1% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.3% | $56.06 | -20.1% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.3% | $83.74 | -15.7% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.4% | $78.59 | -29.0% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.5% | $100.95 | -11.2% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.3% | $66.81 | 11.9% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.6% | $28.89 | -2.9% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $122.73 | -8.5% | $0.92 | 8.9% | 12 |

| Averages | 2.9% | -5.9% | 10.2% | 18 |