Last updated by BM on June 19, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was up slightly with a YTD price return of +4.3% (capital). Dividend growth remained the same and is now at +8.4% YTD, highlighting growth in income over the past year.

- Last week, no dividend increases from companies on ‘The List’.

- Last week, one earnings report from companies on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

- If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service, which grants you access to the MP Wealth-Builder Model Portfolio (CDN) and exclusive subscriber-only content. Learn More

Introduction

“You have a pair of pants. In the left pocket, you have $100. You take $1 out of the left pocket and put it in the right pocket. You now have $101. There is no diminution of dollars in your left pocket. That is one magic pair of pants.”

This ‘magic pants’ analogy was from a Seeking Alpha article on dividend investing I read about a decade ago and was one of the catalysts for me to take a closer look at this type of investing and see if it truly was magical.

After conducting additional research, I have shifted towards utilizing a dividend growth investing (DGI) strategy as my primary investment approach. While I maintain portfolios consisting of high-quality dividend growers from both the United States and Canada, I have opted to concentrate on Canadian (CDN) dividend growth companies in this blog. This is due to several reasons, including a smaller pool of DGI companies to track, a lack of coverage for the DGI strategy by the North American investment media, and a tendency for those who do cover DGI to narrowly focus on only a handful of sectors (Energy and Financials).

While ‘The List’ is not a portfolio in itself, it serves as an excellent initial reference for individuals seeking to diversify their investments and attain higher returns in the Canadian stock market. Through our blog, we provide weekly updates on ‘The List’ and offer valuable perspectives and real-life examples of the dividend growth investing strategy in practice. This helps readers gain a deeper understanding of how to implement and benefit from this investment approach.

DGI Thoughts

“Since the S&P500 was created in 1957, there have been 10 recessions. Aside from the Covid-19 recession of 2020, which only lasted two months, the other nine recessions were preceded by high inflation and triggered by the Fed raising interest rates. Each recession ended as the Fed began lowering interest rates, loosening monetary policy, and often coincided with increased government spending, known as fiscal expansion…”

– Bryan M. Kuderna, author of Millennial Millionaire

Predicting the next recession is difficult but if you are honest with yourself the probability of one within the next twelve months is increasing. Recessions aren’t necessarily a bad thing for dividend growth investors as we do get to buy more income at attractive valuations.

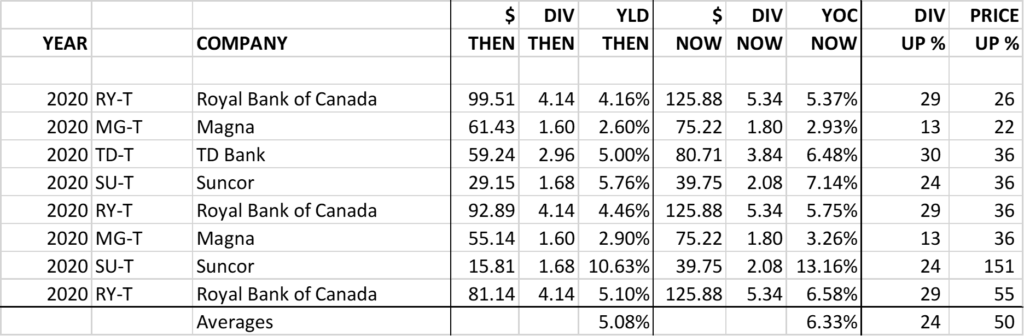

In March 2020 (the last recession) within our original Wealth-Builder Portfolio, we executed on our process and did very well.

Although a 50% capital return (on average) over three years is nothing to sneeze at, I am most proud of the current return we now get from dividends alone (6.33%).

You would get an average yield today of 4.4% for these four stocks. Still pretty good but I’ll take a 5% starting yield on quality dividend growers any day. Recessions give us the opportunity to buy more income at better prices, accelerating our total returns when the economy picks up.

As investors who focus on dividend growth, we distinguish ourselves through our patient approach toward buying opportunities, our readiness to hold cash for price pullbacks, and our unwavering confidence in the economy’s ability to recover.

If you have not yet joined as a subscriber of the blog to receive DGI Alerts on the activity and content related to our model portfolio, it’s not too late. Click Here.

Recent News

Stress Test transcript: ‘Punched in the face by my investments’: How to endure stock market swings (Globe & Mail)

Found this conversation between two financial writers from the Globe & Mail and an Investment Advisor interesting and typical of the advice being given to new investors. Not much different from the past except they recommend ETFs now.

Good advice from the article:

- Resist the urge to act on headlines

- Volatility is part of investing; use it to invest in your portfolio

- Delete trading apps on your phone

- Invest for the long term

- Market timing doesn’t work

Not so good advice:

- Learn to accept that it could be 5-10 years before you see a positive return on your investment

- Invest in ETFs as they give you lots of diversification

- Invest 80% in stocks and 20% in bonds

Do we have to wait 5-10 years for a return on our investments? Our dividends show up early and often and dividend increases are announced like clock work every year and sometimes twice a year. Capital returns magically follow the increase in the dividend.

Bell says it will eliminate 1,300 positions, close or sell nine radio stations amid declining revenues (Globe & Mail)

https://www.theglobeandmail.com/business/article-bce-layoffs-radio-stations/

Headlines like this are starting to appear more often as recession fears and increased competition begin to take hold.

“In a separate memo, Bell Media president Wade Oosterman blamed the cuts on “major disruption” to the industry due to a combination of customer cord cutting and the shift of advertising revenue to foreign digital platforms.”

Bell Canada is one of the ‘Core’ stocks in our model portfolio so we will be paying attention to the next earnings release to learn more.

To receive breaking news about companies on ‘The List’ follow us on Twitter @MagicPants_DGI.

The List (2023)

Last updated by BM on June 16, 2023

The Magic Pants List contains 27 Canadian dividend growth stocks. ‘The List’ contains Canadian companies that have raised their dividend yearly for at least the last ten years and have a market cap of over a billion dollars. Below is each stock’s symbol, name, current yield, current price, price return year-to-date, current dividend, dividend growth year-to-date and current dividend growth streak. Companies on ‘The List’ are added or subtracted once a year, on January 1. After that, ‘The List’ is set for the next twelve months. Prices and dividends are updated weekly.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 6.0% | $8.41 | 25.0% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $64.73 | 7.6% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 6.3% | $60.28 | 0.1% | $3.82 | 5.0% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $35.41 | 5.2% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.7% | $61.80 | 6.5% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 2.0% | $156.99 | -3.6% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.0% | $173.00 | 18.0% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 5.1% | $35.02 | -5.2% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $87.15 | 9.1% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 5.1% | $54.34 | 3.3% | $2.76 | 3.0% | 16 |

| ENB-T | Enbridge Inc. | 7.2% | $49.47 | -7.2% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 2.6% | $32.50 | -9.0% | $0.85 | 18.2% | 16 |

| FNV-N | Franco Nevada | 0.9% | $145.74 | 5.5% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis | 4.0% | $56.55 | 2.2% | $2.26 | 4.1% | 49 |

| IFC-T | Intact Financial | 2.2% | $198.54 | 1.4% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.5% | $115.22 | -4.2% | $1.74 | 10.3% | 11 |

| MGA-N | Magna | 3.2% | $56.99 | -0.9% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.7% | $71.14 | -5.7% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 4.2% | $125.88 | -1.7% | $5.34 | 7.7% | 12 |

| SJ-T | Stella-Jones Inc. | 1.4% | $64.54 | 30.2% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 0.9% | $84.21 | 28.9% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.8% | $80.71 | -7.9% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.3% | $106.25 | 6.1% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.6% | $107.00 | 9.5% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 6.9% | $53.57 | 0.5% | $3.69 | 3.4% | 22 |

| T-T | Telus | 5.6% | $25.73 | -2.2% | $1.43 | 7.3% | 19 |

| WCN-N | Waste Connections | 0.7% | $137.54 | 4.4% | $1.02 | 7.4% | 13 |

| Averages | 3.2% | 4.3% | 8.4% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

Note: When the dividend and share price currency match, the calculation is straightforward. But it’s not so simple when the dividend is declared in one currency, and the share price is quoted in another. Dividing the former by the latter would produce a meaningless result because it’s a case of apples and oranges. To calculate the yield properly, you must express the dividend and share price in the same currency.

Performance of ‘The List’

Feel free to click on this link, ‘The List’ for a sortable version from our website.

Last week, ‘The List’ was up slightly with a YTD price return of +4.3% (capital). Dividend growth remained the same and is now at +8.4% YTD, highlighting growth in income over the past year.

The best performers last week on ‘The List’ were Magna (MGA-N), up +7.04%; Dollarama Inc. (DOL-T), up +4.96%; and Stantec Inc. (STN-T), up +3.43%.

Enghouse Systems Limited (ENGH-T) was the worst performer last week, down -11.71%.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

“As a dividend increase is a positive sign of a company’s financial strength, the safest purchase, after research, is a stock with a recent dividend increase.”

– Tom Connolly (the founder of dividendgrowth.ca)

Last week, no dividend increases from companies on ‘The List’.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

Earnings growth and dividend growth tend to go hand in hand, so this information can tell us a lot about the future dividend growth of our quality companies. Monitoring our dividend growers periodically is part of the process, and reading the quarterly earnings releases is a good place to start.

No earnings reports from companies on ‘The List’ this week

Last week, one earnings report from companies on ‘The List’.

Enghouse Systems Limited (ENGH-T) released its second-quarter fiscal 2023 results on Monday, June 12, 2023, after markets closed.

“During the second quarter of 2023, we generated an increase in revenue, positive operating cash flows, operating income profits and completed two acquisitions. Consistent with our strategy, the increase in revenue is mainly a result of acquisitions that have expanded our recurring SaaS revenue base. We continue with our strategy of offering our customers choice around how they deploy our technology whether on-premise or in the cloud. Furthermore, our products are “cloud-vendor agnostic” offering options to our customers to use their preferred cloud providers. Offering choice has been an important factor in winning and retaining customers.”

– Stephen J. Sadler, President and Chief Executive Officer

Highlights:

- Revenue achieved was $113.5 and $219.9 million, respectively, compared to revenue of $106.3 and $217.4 million;

- Results from operating activities was $25.6 and $55.5 million, respectively, compared to $31.1 and $66.8 million;

- Net income was $12.5 and $29.6 million, respectively, compared to $17.9 and $39.5 million;

- Adjusted EBITDA was $30.2 and $62.5 million, respectively, compared to $33.8 and $72.3 million;

- Cash flow from operating activities excluding changes in working capital was $28.9 and $61.5 million, respectively, compared to $34.5 and $73.3 million.

Outlook:

We continue to achieve our objective of profitable growth with results from operating activities of $25.6 million and cash flows from operating activities, excluding changes in working capital, of $28.9 million, which was accomplished in a quarter where we closed two acquisitions that required significant operational improvements.

On February 9, 2023, the Company acquired 100% of the issued and outstanding common shares of Mobi All Tecnologia S.A. (“Navita”). Headquartered in Sao Paulo, Brazil, Navita provides SaaS based Enterprise Mobility Management solutions in managing and controlling critical mobile assets as well as telecom and IT expense management.

On February 8, 2023, the Company completed its acquisition of Qumu Corporation (“Qumu”) (Nasdaq: QUMU), a global provider of cloud-based enterprise video technology. Under a December 19, 2022 agreement, a wholly owned subsidiary of the Company completed the tender offer for all the outstanding shares of Qumu for USD $0.90 per share in cash. The two acquisitions were completed for an aggregate cash purchase price of $30.1 million with $2.4 million remaining in holdback, subject to potential adjustment. Results for both acquisitions are included in IMG from their respective dates of acquisition.

Subsequent Event

On May 17, 2023, Enghouse entered into an asset purchase agreement with Lifesize Inc (“Lifesize”), a global provider of video conferencing and omnichannel contact center solutions, based in Texas. Under the agreement, Enghouse will acquire substantially all of Lifesize’s assets and brands, including Lifesize, Kaptivo, ProScheduler, Serenova and Telstrat. The purchase remains subject to court approval.

Source: (ENGH-T) Q2-2023 Earnings Release