Last updated by BM on July 18, 2022

Summary:

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List.’

- ‘The List’ was down slightly last week with a minus -5.7% YTD price return (capital). Dividend growth of ‘The List’ remains at 10.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List.’

- Last week, there were no earnings reports from companies on ‘The List.’

- No companies on ‘The List’ are due to report earnings this week.

- Are you looking for a portfolio of ideas like these? Magic Pants DGI Premium Membership Subscribers get exclusive access to the MP Wealth-Builder Model Portfolio (CDN). Learn More

“The desirability of a business with extraordinary economic characteristics can be ruined by the price you pay for it.”

– Charlie Munger

This year, we have been very patient in adding to our MP Wealth-Builder Portfolio (CDN). Rising interest rates slow the economy down and adversely impact a company’s earnings. When we execute a position in one of our quality dividend growers, it is with the knowledge that we have entered the position at a sensible price according to historical fundamentals.

The market is reacting strongly to interest rate hikes and revised earnings forecasts. We will continue to view this behaviour as an opportunity to add to our positions. Q2 earnings results are just around the corner, and we will be ready! A long-term mindset protects us from the emotional grind of a volatile market.

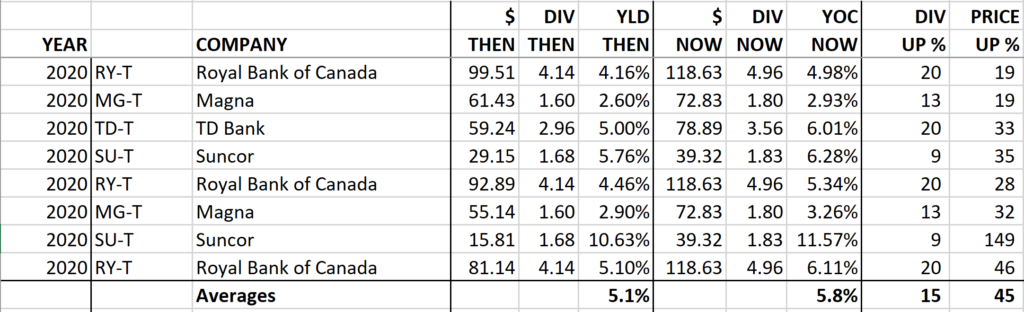

Here is a recent example from March 2020 (from our MP Wealth-Builder Portfolio (CDN)) of taking advantage of the market mispricing some of our quality dividend growers. The $ NOW column is pricing based on last Friday’s closing price.

An average 15% income growth and 45% capital return even after the market pullback of this year.

Performance of ‘The List’

Last week, ‘The List’ was down slightly with a minus -5.7% YTD price return (capital). Dividend growth of ‘The List’ remains at 10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were Canadian Utilities Limited (CU-T), up 4.62%; Fortis (FTS-T), up 2.66%; and Emera (EMA-T), up 1.35%.

Royal Bank of Canada (RY-T) was the worst performer last week, down -7.00%.

Recent News

More pain in store for Canadian consumers after central bank’s jumbo rate hike (Globe & Mail)

“The central bank raised its policy rate by 100 basis points to 2.5 per cent on Wednesday, its largest increase in nearly 24 years. Its aim is to crush hot inflation, which hit a four-decade high of 7.7 per cent in May, with the bank promising more hikes to come.”

“There’s going to be a lot of pain out there. And I think the bank is underestimating the risks to both housing and consumption,” said Stephen Brown, senior Canada economist at Capital Economics.

As expected, another down week for Canadian stocks immediately following another rate hike. The bet is that there will be three more rate hikes in 2022.

Why bear markets are gifts for smart investors (Globe & Mail)

“Every correction, crash and bear market in stocks is a gift in disguise.”

“Generally speaking, these are the kinds of moments that shape one’s performance over a lifetime of investing in the stock market.”

The article does caution the investor, though. As we mentioned in earlier articles, we have yet to see the impact of Q2 and Q3 earnings results on this market. Any revisions downwards will more than likely bring the market into bear market territory (down 20% from recent highs).

“At this point, it makes more sense for investors to pick away at positions in companies with decent earnings power in a recession, which is looking increasingly certain.”

No companies on ‘The List’ are due to report earnings this week.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

Last week, there were no earnings reports from companies on ‘The List’.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on July 15, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 5.3% | $13.30 | -7.3% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $52.43 | 0.6% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.7% | $63.50 | -3.7% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.8% | $37.74 | -7.3% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.6% | $60.55 | -10.7% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 2.0% | $145.38 | -6.1% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.5% | $164.86 | -10.0% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.4% | $40.32 | 10.1% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $76.20 | 20.2% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.3% | $60.97 | -2.6% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.4% | $54.13 | 9.3% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.4% | $29.37 | -36.0% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 1.0% | $127.28 | -6.5% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.5% | $61.28 | 1.3% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.2% | $182.51 | 11.5% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.3% | $119.40 | 16.2% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 3.2% | $55.92 | -31.5% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.6% | $70.18 | 4.7% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 4.2% | $118.63 | -13.3% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 2.4% | $32.82 | -19.3% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.2% | $56.87 | -19.0% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.5% | $78.89 | -20.6% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.3% | $85.67 | -22.6% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.5% | $99.44 | -12.5% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.4% | $66.37 | 11.1% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.7% | $28.61 | -3.9% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $124.44 | -7.2% | $0.92 | 8.9% | 12 |

| Averages | 2.9% | -5.7% | 10.2% | 18 |