Last updated by BM on January 22, 2024

Summary

This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was up with a YTD price return of +1.8% (capital). Dividends have increased by +2.7% YTD, highlighting the growth in the dividend (income).

- Last week, there were no dividend announcements from companies on ‘The List’.

- Last week, there were no earnings reports from companies on ‘The List’.

- One company on ‘The List’ is due to report earnings this week.

DGI Scoreboard

The List (2024)

The Magic Pants 2024 list includes 28 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on ‘The List’:

- Dividend growth streak: 10 years or more.

- Market cap: Minimum one billion dollars.

- Diversification: Limit of five companies per sector, preferably two per industry.

- Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies on ‘The List’ are added or removed annually on Jan. 1. Prices and dividends are updated weekly.

While ‘The List’ does not function as a portfolio on its own, it serves as an excellent initial reference for individuals looking to diversify their investments and achieve higher returns in the Canadian stock market. Through our newsletter, readers gain a deeper understanding of how to implement and benefit from our Canadian dividend growth investing strategy.

For those interested in something more, please upgrade to a paid subscriber; you get the enhanced weekly newsletter, access to premium content, full privileges on the new Substack website magicpants.substack.com and DGI alerts whenever we make stock transactions in our portfolio.

Performance of ‘The List’

Last week, ‘The List’ was up with a price return of +1.8% (capital). Dividend growth is looking as dependable as always. Some dividends show an increase already due to announcements during last year which carry over into this calendar year. Dividends have increased by +2.7% YTD, highlighting the growth in the dividend (income).

The best performers last week on ‘The List’ were Stella-Jones Inc. (SJ-T), up +5.7%; Alimentation Couche-Tard Inc. (ATD-T), up +4.7%; and Thomson Reuters (TRI-N), up +3.9%.

TFI International (TFII-N) was the worst performer last week, down -3.7%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $81.70 | 6.4% | $0.70 | 17.4% | 14 |

| BCE-T | Bell Canada | 6.9% | $55.99 | 3.3% | $3.87 | 0.0% | 15 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $30.97 | 0.9% | $1.53 | 0.0% | 15 |

| CCL-B-T | CCL Industries | 1.9% | $56.95 | -1.5% | $1.06 | 0.0% | 22 |

| CNR-T | Canadian National Railway | 1.9% | $169.44 | 1.5% | $3.16 | 0.0% | 28 |

| CTC-A-T | Canadian Tire | 4.8% | $146.24 | 5.5% | $7.00 | 1.4% | 13 |

| CU-T | Canadian Utilities Limited | 5.7% | $31.67 | -1.4% | $1.79 | 0.0% | 52 |

| DOL-T | Dollarama Inc. | 0.3% | $99.21 | 4.4% | $0.28 | 5.8% | 13 |

| EMA-T | Emera | 5.8% | $49.38 | -2.8% | $2.87 | 3.0% | 17 |

| ENB-T | Enbridge Inc. | 7.6% | $48.34 | -0.1% | $3.66 | 3.1% | 28 |

| ENGH-T | Enghouse Systems Limited | 2.4% | $36.33 | 6.9% | $0.88 | 4.1% | 17 |

| FNV-N | Franco Nevada | 1.3% | $107.59 | -2.3% | $1.36 | 0.0% | 16 |

| FTS-T | Fortis Inc. | 4.3% | $54.38 | -0.9% | $2.36 | 3.3% | 50 |

| IFC-T | Intact Financial | 2.1% | $207.15 | 1.9% | $4.40 | 0.0% | 19 |

| L-T | Loblaw Companies Limited | 1.3% | $133.96 | 4.2% | $1.78 | 2.4% | 12 |

| MFC-T | Manulife Financial | 5.1% | $28.47 | -1.4% | $1.46 | 0.0% | 10 |

| MGA-N | Magna | 3.4% | $54.56 | -1.7% | $1.84 | 0.0% | 14 |

| MRU-T | Metro Inc. | 1.7% | $69.76 | 1.8% | $1.21 | 0.0% | 29 |

| RY-T | Royal Bank of Canada | 4.1% | $133.81 | 0.6% | $5.52 | 3.4% | 13 |

| SJ-T | Stella-Jones Inc. | 1.1% | $85.23 | 11.3% | $0.92 | 0.0% | 19 |

| STN-T | Stantec Inc. | 0.7% | $107.93 | 3.1% | $0.78 | 2.0% | 12 |

| T-T | Telus | 6.1% | $24.62 | 3.8% | $1.50 | 5.2% | 20 |

| TD-T | TD Bank | 5.0% | $81.17 | -4.2% | $4.08 | 6.3% | 13 |

| TFII-N | TFI International | 1.2% | $131.75 | 0.4% | $1.60 | 10.3% | 13 |

| TIH-T | Toromont Industries | 1.5% | $116.36 | 3.2% | $1.72 | 0.0% | 34 |

| TRI-N | Thomson Reuters | 1.3% | $151.17 | 5.5% | $1.96 | 0.0% | 30 |

| TRP-T | TC Energy Corp. | 7.1% | $52.08 | -0.4% | $3.72 | 0.0% | 23 |

| WCN-N | Waste Connections | 0.7% | $152.20 | 2.7% | $1.14 | 8.6% | 14 |

| Averages | 3.2% | 1.8% | 2.7% | 21 |

Note: Stocks ending in “-N” declare earnings and dividends in US dollars. To achieve currency consistency between dividends and share price for these stocks, we have shown dividends in US dollars and share price in US dollars (these stocks are listed on a US exchange). The dividends for their Canadian counterparts (-T) would be converted into CDN dollars and would fluctuate with the exchange rate.

DGI Clipboard

“Usually, a very long list of securities is not a sign of a brilliant investor but one who is not sure of himself.”

– Philip Fisher

The ‘No-Look’ Dividend Growth Investing (DGI) Portfolio

New retirees or novice investors often seek direct guidance regarding investment choices. To address this, we offer a model portfolio, complete with buy/sell alerts and valuation analysis supporting all transactions. Our process allows investors to get comfortable with our DGI strategy by building their portfolios passively over time alongside ours. For those who want to jump right in, we thought we would offer an alternative.

Today’s post applies to dividend growth investors with a lump sum to invest. Enter the ‘No-Look’ DGI Portfolio, inspired by the sports term, ‘no-look’ pass. Like athletes relying on instinct for the ‘no-look’ pass, success with this portfolio hinges only on picking the highest quality companies from the list of dividend growth companies we follow (The List). There is no overthinking, evaluating, or guessing which companies will outperform in today’s market.

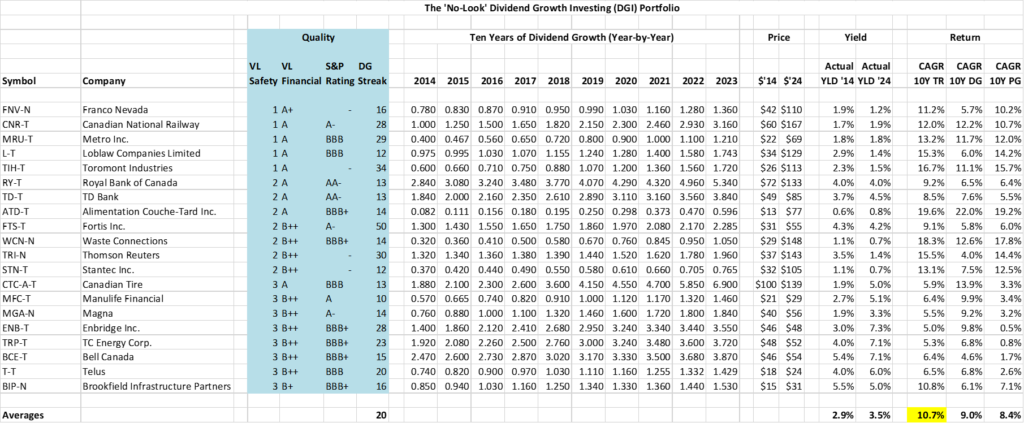

The ‘No-Look’ Portfolio skips the valuation step in our process, relying solely on the quality rankings of Value Line and S&P ratings agencies. The Value Line ratings are based on the rating services’ proprietary ranking system, which evaluates stocks on various factors, including financial strength, earnings potential, and risk. S&P ratings assess the creditworthiness of entities such as corporations, governments, and other issuers of debt. The better the ratings, the higher the quality of the company.

Using our ten-year compound annual growth rate (CAGR) spreadsheet, we sort all twenty-eight companies on ‘The List’ by quality. We then take the top twenty companies and create our ‘No-Look’ Portfolio.

We opted for a portfolio comprising only twenty companies because we believe that maintaining a concentrated portfolio of 15-20 stocks provides an optimal balance between diversification and performance without compromising the quality of the companies we invest in.

Note that the total return (CAGR 10YR TR) for the ‘No-Look’ Portfolio in the preceding 10-year period stands at 10.7%. To provide context, the ten-year returns for both the TSX Composite and Dividend Aristocrat indexes were 7.62% and 7.05%, respectively (as indicated below).

TSX Composite Index Total Returns as of December 31, 2023:

Source: S&P Global

TSX Dividend Aristocrat Index Total Returns as of December 31, 2023:

Source: S&P Global

The ease of crafting this portfolio, coupled with its track record of outperforming the indexes, positions the ‘No-Look’ DGI Portfolio as a compelling choice for investors seeking to deploy a lump sum in high-quality dividend growth companies.

Check us out on magicpants.substack.com for more info in this week’s issue….