Last updated by BM on February 28, 2022

“Most of the returns in stocks are concentrated in sharp bursts beginning in periods of great pessimism or fear, as we saw most recently in the 2020 pandemic decline. We believe time, not timing, is key to building wealth in the stock market.” – Bill Miller

After several years of market exuberance, we are finally seeing a correction in 2022. Outside of the ‘story stocks’, which never really had any solid fundamentals to begin with, many companies are simply coming back down to earth from their excessive valuations. JPMorgan stated last week that even with the correction so far in 2022, the markets still have another 11% to decline before they return to their historical fair value. Throw in the threat of rising interest rates and the geopolitical concerns with the Russian invasion of Ukraine and you have a market that has still not found its footing.

One of the reasons we were attracted to dividend growth investing initially was because we were tired of obsessing over every geopolitical event or what central bankers will do next. We were looking for a proven strategy that doesn’t care what happens with the economy over the long-term.

Right now, we think it is prudent to be patient when it comes to entering or adding to many of our positions until the markets do what they always do, revert to the mean. We will be ready when they do.

Performance of ‘The List’

‘The List’ was flat this week with a negative 0.6% YTD price return (capital) but another uptick in dividend growth with two new dividend announcements for an average increase of 8.2% in income so far in fiscal 2022.

The best performers last week on ‘The List’ were Alimentation Couche-Tard Inc. (ATD-T) up 3.1%; Enbridge Inc. (ENB-T) up 2.9%; Loblaws (L-T) up 2.8%.

CCL Industries (CCL-B-T) was the worst performer this week, down -5.7%.

Two companies on ‘The List’ announced a dividend increase and four companies announced their Q4 and Full Year 2021 earnings reports. In addition, Royal Bank reported on their Q1 2022 earnings.

Recent News

If you were like most people, you were glued to the television when Russia invaded Ukraine this past week. Equally disconcerting for investors was the significant volatility in the markets as a result. Although market corrections are unpleasant, they typically don’t last long, and they provide great opportunities to investors who don’t panic. Having a time-tested process, as we do, tells us not to panic and wait for our good dividend growers to reach a ‘sensible price’ or even better, go on sale.

I’ll go over all our earnings reports in a moment. I’ll also preview three more earnings reports for next week.

Here are a few of the companies on ‘The List’ due to report earnings this week:

TD Bank (TD-T) is scheduled to report earnings before the market opens Thursday, Mar. 03

Enghouse Systems Limited (ENGH-T) is scheduled to report earnings after hours Thursday, Mar. 03

Algonquin Power & Utilities (AQN-T) is scheduled to report earnings after hours Thursday, Mar. 03

Dividend Increases

There were two companies on ‘The List’ that announced a dividend increase this past week.

Stantec Inc. (STN-T) on Wednesday said it increased its 2022 quarterly dividend from $0.165 to $.18 per share, payable April 18, 2022, to shareholders of record on Mar. 31, 2022.

This represents a dividend increase of 9.1%, for this global leader in design and engineering.

CCL Industries (CCL-B-T) on Thursday said it increased its 2022 quarterly dividend from $0.21 to $.24 per share, payable March 31, 2022, to shareholders of record on Mar. 17, 2022.

This represents a dividend increase of 14.3%, for this world leader in specialty label, security, and packaging solutions.

Earnings Releases

We had five earnings reports from companies on ‘The List’ this past week. Let’s start with Canadian Utilities.

Canadian Utilities Limited (CU-T)

“Overall, Canadian Utilities had a great 2021 that saw us advance key growth initiatives while delivering strong year-over-year earnings growth for our shareholders. The groundwork that we’ve laid to establish ourselves as leaders in the energy transition space positions us well heading into 2022, and I am excited to continue pushing the business and these key initiatives forward.”

The company published these highlights:

Q4 2021 Financial Results

- Invested $334 million in capital projects in the fourth quarter of 2021, of which 75 per cent was invested in regulated utilities and 25 per cent mainly in Energy Infrastructure.

- Announced the acquisition of the Alberta Hub natural gas storage facility near Edson, Alberta. The Alberta Hub underground natural gas storage facility has a capacity of approximately 49 petajoules and is connected to the NOVA Gas Transmission (NGTL) system.

- On January 18, 2022, Canadian Utilities’ parent company, ATCO, announced a comprehensive set of 2030 environmental, social and governance targets, and a commitment to achieve net zero greenhouse gas (GHG) emissions by 2050.

- On January 13, 2022, Canadian Utilities declared a first quarter dividend of 44.42 cents per share or $1.78 per Class A non-voting and Class B common share on an annualized basis, a 1 per cent increase over the 43.98 cents paid in each of the four previous quarters. Canadian Utilities has increased its dividend per share for 50 consecutive years, the longest track record of annual dividend increases of any publicly traded Canadian company.

Annual 2021 Financial Results (Comments from Brian Shkrobot, EVP and CFO)

- 2021 was another great year for Canadian Utilities Limited. We achieved adjusted earnings growth of $586 million or $2.17 per share for 2021. This is $51 million and $0.21 per share higher than 2020. While our businesses overall performed very well in 2021, this growth in year-over-year earnings was primarily driven by the performance of our LUMA Energy business and continued strong performance from ATCO Gas Australia throughout the full 2021 year.

- As we’ve messaged in our last few conference calls, we’ve been awaiting the final approvals from both the AUC and the Canadian Energy Regulator on our acquisition of the Pioneer Pipeline and the subsequent transfer of a 30-kilometre segment to Nova Gas Transmission Limited (NGTL). I am happy to report that as of January 2022 we have now received all outstanding approvals related to this transaction

- Switching to our Alberta distribution utilities, we continue to gain additional clarity on the 2023 cost of service rebasing year that will follow the second performance-based regulation term that concludes in 2022. While there’s still additional work to be done and filings to be processed by the regulator, early decisions support the expectation of a fair and prospective regulatory framework for our distribution utilities in 2023. Notably, the AUC has agreed to a hybrid approach to the forecasting of 2023 costs which will see applied for costs compared to an average of 2018 to 2020 actual costs. We expect to have these decisions on these application for both our Alberta distribution utilities in the third quarter of 2022.

- In 2021, we invested $1.3 billion in our business with $1.1 billion of this being invested in our core utilities. This ongoing utility investment ensures a continued generation of stable earnings and reliable cash flows from our utility businesses and drives rate base growth. When compared to 2020 capital investment, this represents an increase of $221 million. The largest share of this increase is associated with our Pioneer Pipeline acquisition.

- Collectively, projects initiated in 2021 represent a significant step forward for our energy transition strategy. As our solar and renewable natural gas developments are completed in late 2022, we will start to see the earnings and cash flows benefited by the bite-sized and rapidly executable nature of these initiatives.

If you like a safe 5% yield, then companies don’t get much better than CU-T. Their most recent dividend increase put them in an elite class of dividend growers (50-year streak). They are the only Canadian company to achieve such a milestone. The problem with CU-T is that there is very little growth to their dividend so companies with an average starting yield (2.5-3.5%) and high single digit growth, easily catch up within a decade. Be careful when you chase high yielding stocks thinking they will provide you with a growing income in retirement. Of the twenty-seven companies on ‘The List’ only six have a lower yield now, after a decade, than CU-T and all of them had much higher total returns.

Stantec (STN-T)

“In addition to achieving record earnings this year, several important strategic milestones attained in 2021 position us for accelerated value creation in 2022 and beyond,” said Gord Johnston, President and CEO. “The acquisition of Cardno, along with the five other acquisitions we made in 2021, expand our presence in key business lines such as environmental services and the energy transition, and key geographies like the United States and Australia that are poised for strong growth. Looking forward, we see a strong multi-year cycle ahead for the industry which will support expansion of our record 2021 Adjusted EBITDA margin and earnings.”

The company published these highlights:

Q4 2021 Financial Results

- Net revenue, on a constant currency basis, increased 8.7% or $75.0 million, driven by acquisition growth of 6.7% and organic growth of 2.0%; including the effects of foreign exchange, net revenue increased $54.5 million. Without the impact of TMEP, organic growth would have been 4.2%, reflecting strong growth achieved in Canada and Global, and organic growth across most business lines with the exception of Infrastructure which stayed consistent with the prior period.

- Project margin increased 11.3%, or $51.6 million, and increased as a percentage of net revenue from 52.8% to 55.3%, primarily from higher net revenue, a shift in project mix, and strong project execution.

- Adjusted EBITDA from continuing operations increased 2.6% or $3.6 million to $142.1 million, representing 15.5% of net revenue compared with $138.5 million or 16.1% of net revenue in the prior period. The increase in project margin was partly offset by higher administrative and marketing expenses, most notably a $13.4 million increase in share-based compensation expense (146 basis points as a percentage of net revenue) reflecting the revaluation of incentive plans due to an increase in Stantec’s share price. As well, 2020 included the recovery of certain claim costs.

- Net income from continuing operations increased 11.4%, or $1.7 million, to $16.6 million, net income from continuing operations as a percentage of net revenue increased from 1.7% to 1.8%, and diluted EPS increased by 15.4%, or $0.02, to $0.15. Strong project margin, lower non-cash net lease asset and related property and equipment impairments and adjustments for onerous contract costs from the continued execution of the 2023 Real Estate Strategy, and non-cash fair value gains on equity investments contributed to a higher net income, partly offset by lower utilization in the US and higher amortization of intangible assets and acquisition and integration costs related to recent acquisitions.

- Adjusted net income decreased 4.8%, or $3.2 million, to $63.8 million, representing 7.0% of net revenue, and adjusted diluted EPS decreased 5.0%, or $0.03, to $0.57. Q4 2020 adjusted net income benefited from the favorable recovery of claim costs and resolution of certain tax matters.

Full-Year 2021 Financial Highlights

- Full-year net revenue was $3.6 billion, a 2.6% increase on a constant currency basis compared with the prior year, driven by acquisition growth of 3.9%, partly offset by a slight organic retraction. Excluding the impact of the descoped Trans Mountain Expansion Project (“TMEP”), organic growth was 0.3% driven by strong performances in Canada and Global and offset by a slower US recovery. Fluctuations in foreign currencies resulted in negative foreign exchange impacts of 3.9%.

- The Canadian dollar strengthened considerably relative to the US dollar during the year, with the average exchange rate shifting to $1.25 in 2021 from $1.34 in 2020. This reduced 2021 net revenues by $130.7 million. Stantec further estimates that the impact to adjusted EBITDA, adjusted net income, and adjusted diluted EPS was approximately $16.6 million, $6.5 million, and $0.06 per share, respectively.

- Project margin increased $32.8 million or 1.7% to $2.0 billion and increased as a percentage of net revenue from 52.4% to 54.0%, as a result of strong project execution in all geographies and businesses and shifts in project mix.

- Adjusted EBITDA from continuing operations was $573.8 million, approximating amounts generated in 2020 and increasing as a percentage of net revenue by 10 basis points to a record 15.8% from 15.7%. The increase in project margin was partly offset by higher administrative and marketing expenses, most notably a $30.3 million increase in share-based compensation expense (83 basis points as a percentage of net revenue) reflecting the revaluation of incentive plans due to an increase in Stantec’s share price.

- The 2023 Real Estate Strategy contributed more than $0.18 per share in cost savings to net income ($0.15 per share savings to adjusted net income). On a pre-IFRS 16 basis, the cumulative impact from this initiative is estimated to have increased 2021 adjusted EBITDA margin by more than 100 basis points. As further progress was made on the Real Estate Strategy in 2021, additional leased spaces were identified to vacate and sub-let, and expectations for sub-let opportunities were adjusted to reflect current market conditions and outlook. This led to a $24.8 million non-cash net impairment of lease assets and related property and equipment and $12.5 million in onerous contract costs being recorded. Stantec is on track to achieve a 30% reduction in its real estate footprint relative to its 2019 baseline and expects to deliver a further $0.20 to $0.25 contribution to earnings per share by the end of 2023.

- Net income from continuing operations increased 26.1%, or $41.6 million, to $200.7 million; net income margin from continuing operations increased 1.2% from 4.3% to 5.5%, and diluted EPS increased 26.8%, or $0.38, to $1.80. Factors contributing to higher net income include project margin growth, lower interest and depreciation, unrealized fair value gains from equity investments, the combined effects of the 2023 Real Estate Strategy, and a lower effective tax rate partially offset by increased acquisition and integration costs.

- Adjusted net income from continuing operations increased 8.4%, or $21.0 million, to $269.9 million, representing 7.4% of net revenue, an improvement of 60 basis points, and adjusted diluted EPS increased 9.0%, or $0.20, to $2.42.

- Contract backlog stands at a record $5.1 billion—a 17.3% increase from December 31, 2020—representing approximately 13 months of work (11 months of work in 2020). Year over year, backlog grew 11.9% through acquisitions and 6.7% organically, with organic growth in all geographies. Of particular note, US backlog achieved 10.2% organic growth, with US Environmental Services recording over 50% organic growth. Further, Environmental Services backlog across all Stantec stands at over $1 billion, a new high-water mark for this business operating unit.

- Net debt to adjusted EBITDA was 1.8x at December 31, 2021 —within the guideline range of 1.0x to 2.0x. The ratio increased as a result of additions to net debt from acquisitions made in the fourth quarter.

- Operating cash flows from continuing operations decreased 34.1% from $602.6 million to $397.0 million; this was mainly due to decreased cash receipts from clients, negative foreign exchange impacts, and increased payments paid to suppliers.

- Days sales outstanding (“DSO”) was 75 days at December 31, 2021 and 2020, well below the expectation of 80 days.

- In 2021, 939,482 common shares were repurchased for an aggregated price of $50.7 million under the normal course issuer bid which was renewed on November 9, 2021, to allow for the repurchase of up to an additional 5,559,312 common shares.

- On February 23, 2022, Stantec’s Board of Directors declared a dividend of $0.18 per share, payable on April 18, 2022, to shareholders of record on March 31, 2022, representing an 9.1% increase on an annual basis.

Outlook

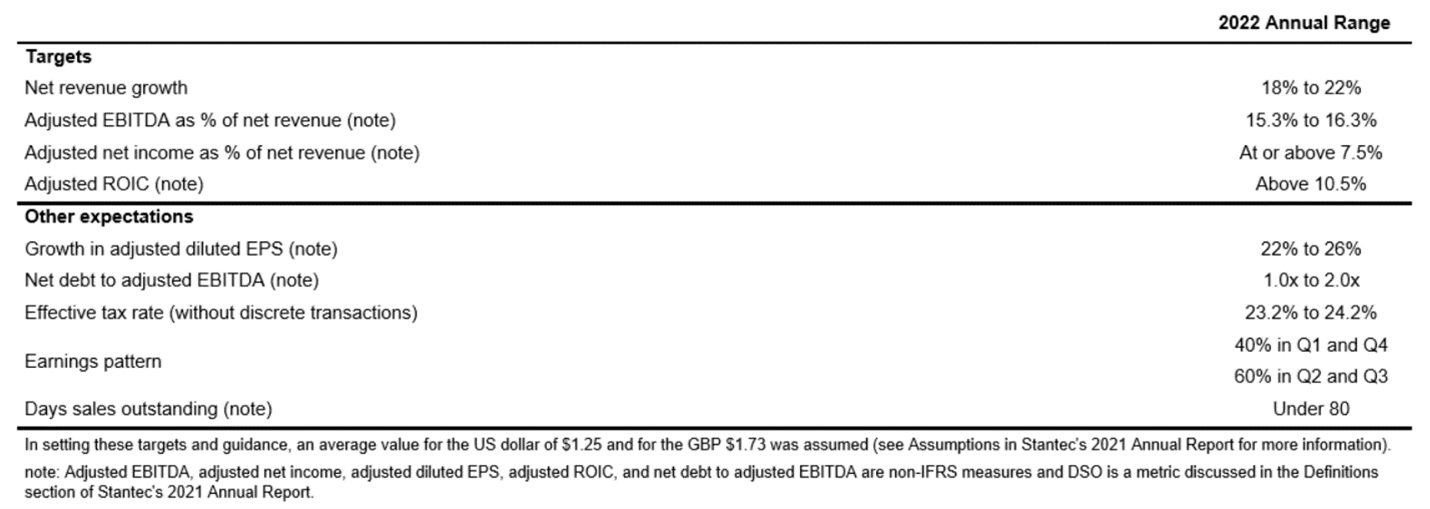

Targets for 2022 are based on the assumption of a continued gradual global recovery but may not be valid should any of our key geographies experience a severe worsening of the pandemic.

Net revenue is expected to increase 18% to 22% in 2022, and organic net revenue growth is expected to be in the mid to high single digits, weighted to the second half of the year. Organic growth in the US is expected to be in the high single digits, driven by growing momentum as evidenced by Stantec’s record-high US backlog and project opportunities arising from the $1.2 trillion infrastructure stimulus bill. After a year of robust organic growth in Canada in 2021, high levels of activity are expected to be maintained, driving 2022 organic growth in the low single digits. Organic growth in Global is expected to achieve high single to low double-digit growth propelled by strong economic growth, continued demand, and stimulus in infrastructure sectors.

Project margin as a percent of net revenues is expected to be relatively consistent in 2022 compared to 2021. Adjusted EBITDA margin is anticipated to be in the range of 15.3% to 16.3%, reflecting investments in internal resources to support growth and the commercialization of new innovations and technologies, and increased discretionary spending (albeit not to pre-pandemic levels). Adjusted EBITDA margin in Q1 2022 will likely be at or below the low end of this range because of the additional effects of regular seasonal factors in the northern hemisphere and the protracted ramp-up of US activities and major projects awarded in Q4 2021. The higher end of the range is expected to be reached by the second half of 2022 driven by high organic net revenue growth and increased utilization in the US operations.

Adjusted net income is expected to continue to benefit from the 2023 Real Estate Strategy, which remains on track to achieve a 30% reduction in real-estate footprint compared with a 2019 baseline and a cumulative $0.35 to $0.40 per share by the end of 2023. With $0.15 recognized in 2021, the remaining $0.20 to $0.25 per share is expected to be generated approximately evenly between 2022 and 2023. For 2022, this, in conjunction with continued benefits from tax planning strategies, is expected to drive an adjusted net income margin of 7.5% or greater as a percent of net revenue. As a result, adjusted diluted EPS is expected to grow 22% to 26% in comparison to 2021.

Stantec is a new addition to ‘The List’ in 2022 as they just recently met our criteria of ten consecutive years of dividend growth. Stantec had a great year in 2021 and it looks like 2022 is shaping up to be another one. Stantec’s fundamentals are in line with what we look for in our quality dividend growers. Their dividend growth and price growth are above average, and they tend to align over time. Purchasing STN-T at a sensible price however has been the challenge recently. The YTD pull back in the price of STN-T seems more to do with last years over valuation than a reflection of the operations of the business going forward.

Loblaws (L-T)

The company published these highlights:

Q4 2021 Financial Results

- Revenue was $12,757 million. This represented an increase of $349 million, or 2.8% when compared to the fourth quarter of 2020.

- Retail segment sales were $12,486 million. This represented an increase of $321 million, or 2.6% when compared to the fourth quarter of 2020.

- Food Retail (Loblaw) same-stores sales increased by 1.1%.

- Drug Retail (Shoppers Drug Mart) same-store sales increased by 7.9%, with pharmacy same-store sales growth of 10.2% and front store same-store sales growth of 6.1%.

- The two year sales Compound Average Growth Rate (“CAGR”) was 4.8% and 5.5% for Food Retail and Drug Retail, respectively.

- The Company’s e-commerce sales decreased by 8.4% (2020 – increased 158%) due to the lapping of high e-commerce sales in the fourth quarter of 2020.

- COVID-19 related costs were approximately $8 million (2020 – approximately $42 million).

- Retail segment adjusted gross profit percentage was 30.9%. This represented an increase of 150 basis points compared to the fourth quarter of 2020.

- Operating income was $705 million. This represented an increase of $70 million, or 11.0% when compared to the fourth quarter of 2020.

- Adjusted EBITDA was $1,324 million. This represented an increase of $78 million, or 6.3% when compared to the fourth quarter of 2020.

- Net earnings available to common shareholders of the Company were $744 million. This represented an increase of $434 million, or 140.0% when compared to the fourth quarter of 2020. Diluted net earnings per common share were $2.20. This represented an increase of $1.32, or 150.0% when compared to the fourth quarter of 2020.

- Net loss attributable to non-controlling interests was $28 million in the fourth quarter of 2021 and represents the share of earnings that relates to the Company’s Food Retail franchisees. Franchisee earnings are impacted by the timing of when profit sharing with franchisees is agreed and finalized under the terms of the agreements. On a full year basis, net earnings attributable to non-controlling interests of $101 million increased by $26 million when compared to 2020, reflecting an improvement in franchisee earnings.

- During the quarter, the Company recorded a recovery of $301 million related to the Supreme Court of Canada’s decision on the Glenhuron Bank Limited (“Glenhuron”) tax matter, of which $173 million is recorded as interest income and $128 million is recorded as income tax recovery. In addition, net interest of $16 million, before tax, was recorded in respect of interest income earned on expected cash tax refunds. This recovery is expected to be received in 2022 and will increase the Company’s cash and cash equivalents balance.

- Adjusted net earnings available to common shareholders of the Company were $515 million. This represented an increase of $119 million, or 30.1% when compared to the fourth quarter of 2020.

- Adjusted diluted net earnings per common share were $1.52. This represented an increase of $0.40, or 35.7% when compared to the fourth quarter of 2020. The two year adjusted diluted net earnings per common share CAGR was 30.0%.

- The two year adjusted diluted net earnings per common share CAGR was positively impacted by lower fixed asset impairment in 2021 when compared to 2019. The impact on the CAGR was 7.3%.

- The Company repurchased, for cancellation, 2.0 million common shares at a cost of $200 million and 15.6 million common shares at a cost of $1,200 million on a year-to-date basis.

- The Company invested $381 million in capital expenditures and generated $460 million of Retail Segment free cash flow.

2021 SELECT ANNUAL HIGHLIGHTS

On a comparable 52-week basis, the Company:

- Delivered Food Retail same-store sales growth of 0.3% and Drug Retail same-store sales growth of 5.0%.

- Delivered adjusted net earnings available to common shareholders of the Company of $1,911 million. When compared to 2020, this represented an increase of 30.5%.

- Delivered adjusted diluted net earnings per common share of $5.59. When compared to 2020, this represented an increase of 36.7%.

In 2021, the Company:

- Invested approximately $1,103 million in capital expenditures, net of proceeds from property disposals.

- Returned capital to shareholders by allocating a significant portion of the Company’s Retail segment free cash flow of approximately $2,004 million to share repurchases. In 2021, the Company repurchased, for cancellation, 15.6 million common shares at a cost of $1,200 million.

- The Company’s e-commerce sales were $3.1 billion and grew by 13.9% when compared to the prior year.

Outlook

Loblaws will continue to execute on retail excellence in its core grocery, pharmacy and apparel businesses while advancing its growth initiatives in 2022. In the third year of the pandemic, the Company’s businesses remain well placed to service the everyday needs of Canadians. However, the Company cannot predict the precise impacts of COVID-19 and the current industry volatility on its 2022 financial results. Loblaw anticipates that in the first half of 2022 sales will benefit from the continued impact of the pandemic and elevated industry-wide inflation. As economies reopen and the Company starts to lap elevated 2021 inflationary prices and COVID-related pharmacy services, year on year revenue growth will be more challenged.

The Company expects:

- its Retail business to grow earnings faster than sales;

- Earnings per Common Share growth in the low double digits, with higher growth in the first half of the year;

- to invest approximately $1.4 billion in capital expenditures, net of proceeds from property disposals, reflecting incremental store and distribution network investments; and

- to return capital to shareholders by allocating a significant portion of free cash flow to share repurchases.

Loblaws did well during the pandemic and is projecting double-digit growth in the first half of 2022. L-T was one of the first dividend growth stocks we bought back in 2012 in our Magic Pants Wealth-Builder (CDN) Portfolio but it went through a period of low dividend growth, so we ended up selling it for better ideas. Low yield and low growth companies do not meet our standard even if they grow their dividend. Returning capital to shareholders, by growing dividends at a higher than average rate and buying back shares has this quality dividend grower back on our radar.

CCL Industries (CCL-B-T)

Geoffrey T. Martin, President and Chief Executive Officer, commented, “2021 marked our second consecutive year of delivering record results in the midst of a global pandemic as strong growth in sales and adjusted basic earnings per share generated solid free cash flow. This speaks to the resiliency and diversity of our end markets plus the focus and dedication of our amazing people. These results come as the Company faces supply chain disruptions and inflationary issues the likes of which we have rarely seen in our long history.”

The company published these highlights:

Q4 2021 Financial Results

- Per Class B share: $0.81 adjusted basic earnings down 3.6%; $0.80 basic earnings down 1.2%; currency translation negative $0.04

- Sales increased 10.2% on 12.8% organic growth, 1.8% acquisition growth partially offset by 4.4% negative currency translation

- 0% operating margin down 180 bps on inflation challenges

Full Year 2021

- Per Class B share: $3.37 adjusted basic earnings, up 9.4%; $3.33 basic earnings up 12.5%; currency translation negative $0.15

- Sales increased 9.4% on 11.8% organic growth, 2% acquisition growth partially offset by 4.4% negative currency translation

- Operating income increased 8.2%, with a 15.5% operating margin down 20 bps

- Consolidated leverage ratio improved to 1.06 for 2021; annual dividend increased 14.3% effective March 17, 2022

Outlook

- H122 will be a pass-through period of numerous inflation drivers, some supply availability issues, comps should ease as year unfolds

- Avery should continue to improve, augmented by acquisitions

- Checkpoint needs to execute price increases to recover inflation in MAS business, expect strength in ALS to continue on RFID growth

- CCL Design chip shortage issues to continue, especially in Automotive, acquisitions a significant offset

- CCL HPC, Food & Beverage and Healthcare & Specialty units all dealing with inflation

- Banknote demand difficult to predict at CCL Secure

- Resin markets declining in the U.S, Innovia must navigate energy & freight inflation plus the Eco Float start up in Europe

CCL Industries seems to have been impacted by the effects of inflation with their earnings up a bit but not at the rate as in prior years. The recent dividend increase of 14.3% is not something to ignore as it shows a lot of confidence by management in the operations outlook of the business (the safest dividend is the one just hiked). Share price weakness in 2022 has brought this 20-year dividend grower closer to the ‘sensible price’ range we look for.

Royal Bank (RY-T)

“RBC’s firstquarter performance reflects the significant momentum we continue to build while facing change and uncertainty in the current operating environment. This is a testament to our scale, diversified business model, and strategic investments in technology, talent and innovation to create differentiated value for our clients and shareholders. While the Omicron variant has created headwinds to the global economic recovery over the past quarter, RBC employees remained unwavering in their commitment to supporting our clients and communities. I’m proud of how they continue to make a difference in the lives of those we serve. Looking forward, we remain focused on our Purpose-led approach to delivering the advice, products and services our clients need in a changing world, while also accelerating our commitments to enable a sustainable and inclusive future.” Dave McKay, RBC President and CEO

The company published these highlights:

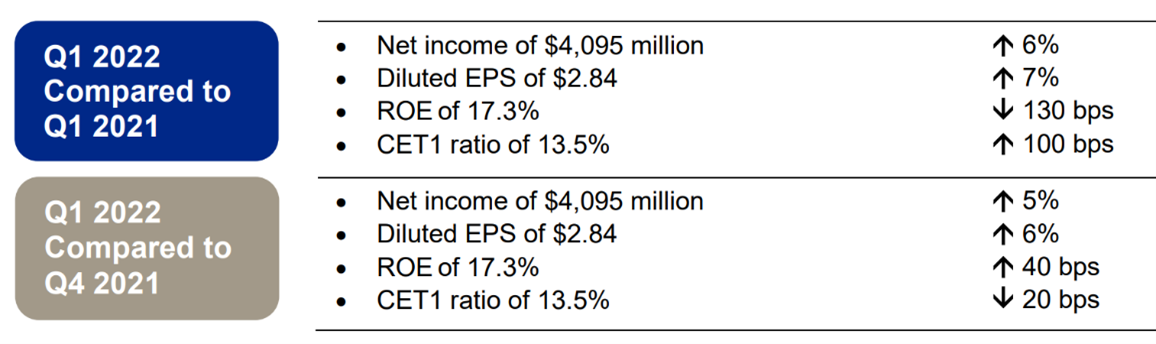

Q1 2022 Financial Results

Royal Bank was one the first of the big five banks to report their Q1 2022 earnings and they were good. RY-T continues to roll along as does their share price in 2022. Although RY-T has seen about a 40% increase in their share price during the pandemic, it still isn’t that far outside of its historical valuation corridor. With a starting yield of 3.5% and average dividend growth over the last decade in the 7.5% range. Buying this quality company at a ‘sensible price’ should yield you 11% plus returns (D + G +/- change in P/E).

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’ please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Rather, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder CDN Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on February 25, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 4.8% | $14.26 | -0.6% | $0.68 | 2.3% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $51.21 | -1.7% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.5% | $67.15 | 1.9% | $3.68 | 5.1% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.7% | $58.95 | -3.5% | $2.16 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.6% | $59.28 | -12.6% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.9% | $158.24 | 2.2% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 2.8% | $185.27 | 1.1% | $5.20 | 10.6% | 11 |

| CU-T | Canadian Utilities Limited | 5.0% | $35.24 | -3.7% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $65.28 | 2.9% | $0.20 | 1.7% | 11 |

| EMA-T | Emera | 4.5% | $59.26 | -5.3% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.4% | $54.08 | 9.2% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 1.5% | $41.37 | -9.8% | $0.64 | 4.1% | 15 |

| FNV-N | Franco Nevada | 0.9% | $147.13 | 8.1% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.7% | $58.15 | -3.9% | $2.14 | 4.4% | 48 |

| IFC-T | Intact Financial | 2.2% | $182.45 | 11.4% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.4% | $100.95 | -1.7% | $1.46 | 6.6% | 10 |

| MGA-N | Magna | 2.4% | $76.14 | -6.7% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.6% | $67.26 | 0.3% | $1.10 | 10.0% | 27 |

| RY-T | Royal Bank of Canada | 3.4% | $140.37 | 2.6% | $4.80 | 11.1% | 11 |

| SJ-T | Stella-Jones Inc. | 1.8% | $39.88 | -2.0% | $0.72 | 0.0% | 17 |

| STN-T | Stantec Inc. | 1.1% | $63.82 | -9.1% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 3.4% | $104.68 | 5.4% | $3.56 | 12.7% | 11 |

| TFII-T | TFI International | 1.0% | $131.32 | -6.3% | $1.36 | 17.4% | 11 |

| TIH-T | Toromont Industries | 1.4% | $106.82 | -6.0% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.4% | $66.68 | 11.6% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.0% | $32.34 | 8.7% | $1.31 | 4.4% | 18 |

| WCN-N | Waste Connections | 0.7% | $124.01 | -7.5% | $0.92 | 8.9% | 12 |

| Averages | 2.7% | -0.6% | 8.2% | 18 |