Last updated by BM on December 26, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was down slightly with a minus -5.2% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.6% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, there were no earnings reports from a company on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“Compounding is mankind’s greatest invention because it allows the reliable, systematic accumulation of wealth.”

– Albert Einstein

DGI Truth #4: The power of compounding with dividend re-investment

Most people are aware of the ‘magic’ (there is that word again) of compound interest; returns balloon over time under the effects of compound interest accumulation. The same effects happen by re-investing your dividends in shares of your quality dividend growers. You not only add to your growing income, but you also add to your capital returns when the stock price goes up because you have more shares than you would have otherwise had.

For those who do not need dividend income to pay the bills or have fun with, dividend re-investment is important. Many of the companies we follow on ‘The List’ offer ‘Dividend Re-Investment Plans’ (DRIPs) that sell you additional shares in amounts equivalent to your dividend distribution at a discount to the current market price. You can automate this in your brokerage account, so there are no fees or trading required.

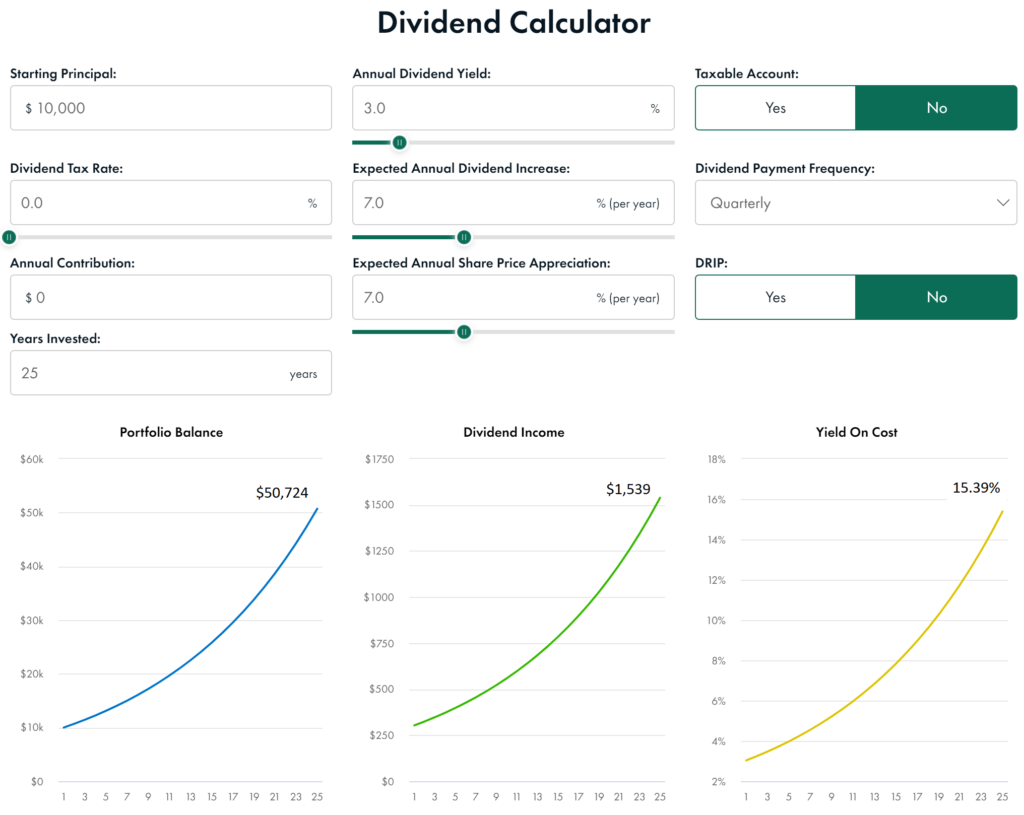

In the graphics below, let’s look at the same input values (starting principal, dividend yield, dividend/share growth rates, years invested, etc. ) and see the difference that dividend re-investment can mean to your income and portfolio values.

Now let’s change the last variable. Dividend reinvestment (DRIP) is now set to Yes.

By simply reinvesting dividends our portfolio balance, dividend income and yield on cost (growth yield) have all doubled over a twenty-five-year period and are accelerating. We have not made any new contributions except by re-investing the quarterly dividends.

In our Magic Pants portfolios, we believe in dividend re-investment, but we do it a bit differently. We never get caught automatically investing in our quality companies when they are overvalued. We accumulate dividends and re-invest in our quality dividend growers when they are sensibly priced. This approach allows us to supercharge the compounding effect of income and capital returns even more.

Adding dividend re-investment to your dividend growth strategy lets compounding do its magic, and the investor accumulates wealth at a much faster pace.

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

Last week, ‘The List’ was down slightly with a minus -5.2% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.6% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were Franco Nevada (FNV-N), up +2.53%; Enbridge Inc. (ENB-T), up +2.19%; and TD Bank (TD-T), up +1.96%.

TFI International (TFII-N) was the worst performer last week, down -3.88%.

Recent News

There are many ways to pick a bank stock. Here’s what worked (and what didn’t) (Globe & Mail)

https://www.theglobeandmail.com/investing/markets/inside-the-market/article-pick-bank-stocks/

Discussed in the article are four strategies.

- Ignore the stock, buy the dividend: the highest yielders are the best

- The worst stock is the best stock: buy the stock that had the worst record last year

- The lowest valuation shines brightest: cheap is good

- Just buy them all: invest in an ETF of all the bank stocks

Notice that most of the advice is about the short term and how to maximize returns next year. This is typical of the advice you find in the investment news today.

Having a longer-term investment horizon, investing in only the highest quality companies in a given sector/industry and then only purchasing them when they are sensibly priced continues to outperform any strategy we have found.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

No companies on ‘The List’ are due to report earnings this week.

Last week, there were no earnings reports from companies on ‘The List’.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not intended to be a portfolio others replicate. Rather, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor reflects the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolios. It is only a starting point for our analysis and discussion of dividend growth investing concepts.

The List (2022)

Last updated by BM on December 23, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 10.4% | $6.76 | -52.9% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $59.73 | 14.6% | $0.47 | 26.2% | 12 |

| BCE-T | Bell Canada | 6.1% | $60.02 | -8.9% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 4.6% | $31.33 | -23.1% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.6% | $58.36 | -13.9% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.8% | $163.69 | 5.7% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 4.1% | $142.19 | -22.4% | $5.85 | 21.1% | 11 |

| CU-T | Canadian Utilities Limited | 4.8% | $37.07 | 1.3% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $80.00 | 26.2% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 5.1% | $52.33 | -16.4% | $2.68 | 4.1% | 15 |

| ENB-T | Enbridge Inc. | 6.4% | $53.69 | 8.4% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.1% | $34.86 | -24.0% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 0.9% | $135.85 | -0.2% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.9% | $55.09 | -8.9% | $2.17 | 4.3% | 48 |

| IFC-T | Intact Financial | 2.0% | $198.38 | 21.2% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.2% | $123.66 | 20.4% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 3.2% | $55.45 | -32.0% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.4% | $76.50 | 14.1% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 3.9% | $128.28 | -6.3% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 1.7% | $47.87 | 17.7% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $64.04 | -8.8% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.0% | $88.33 | -11.1% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.1% | $101.44 | -8.4% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.6% | $97.45 | -14.3% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 6.4% | $55.35 | -7.3% | $3.57 | 4.4% | 21 |

| T-T | Telus | 5.0% | $26.74 | -10.1% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $133.37 | -0.5% | $0.95 | 11.8% | 12 |

| Averages | 3.2% | -5.2% | 10.6% | 18 |