Last updated by BM on December 18, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was down with a YTD price return of +3.0% (capital). Dividends have increased by +9.1% YTD, highlighting the growth in the dividend (income).

- Last week, there were no dividend announcements from companies on ‘The List’.

- Last week, there were two earnings reports from companies on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

The List (2023)

The Magic Pants List includes 27 Canadian dividend growth stocks. Each has raised their dividend annually for the last ten years (or longer) and has a market cap of over a billion dollars. Based on these criteria, companies on ‘The List’ are added or removed annually, on January 1. Prices and dividends are updated weekly.

While ‘The List’ does not function as a portfolio on its own, it serves as an excellent initial reference for individuals looking to diversify their investments and achieve higher returns in the Canadian stock market. Through our newsletter, readers gain a deeper understanding of how to implement and benefit from our Canadian dividend growth investing strategy.

If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service. Subscribers gain access to buy/sell alerts and exclusive content available only to subscribers.

Performance of ‘The List’

Last week, ‘The List’ was down with a YTD price return of +3.0% (capital). Dividends have increased by +9.1% YTD, highlighting the growth in the dividend (income).

The best performers last week on ‘The List’ were Brookfield Infrastructure Partners (BIP-N), up +6.92%; Algonquin Power & Utilities (AQN-N), up +6.59%; and Waste Connections (WCN-N), up +5.12%.

Dollarama Inc. (DOL-T) was the worst performer last week, down -9.68%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 7.8% | $6.47 | -3.9% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $76.76 | 27.6% | $0.60 | 26.6% | 13 |

| BCE-T | Bell Canada | 7.5% | $51.78 | -14.0% | $3.87 | 5.2% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $30.11 | -3.9% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.8% | $58.73 | 1.2% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 2.0% | $161.01 | -1.1% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.9% | $141.56 | -3.4% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 5.7% | $31.70 | -14.2% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $90.00 | 12.7% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 5.7% | $49.56 | -5.8% | $2.82 | 5.0% | 16 |

| ENB-T | Enbridge Inc. | 7.5% | $47.36 | -11.2% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 2.4% | $34.68 | -2.9% | $0.85 | 18.2% | 16 |

| FNV-N | Franco Nevada | 1.2% | $111.11 | -19.6% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis Inc. | 4.2% | $54.89 | -0.8% | $2.29 | 5.3% | 49 |

| IFC-T | Intact Financial | 2.2% | $200.24 | 2.3% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.5% | $118.58 | -1.5% | $1.74 | 13.2% | 11 |

| MGA-N | Magna | 3.2% | $56.66 | -1.5% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.8% | $65.53 | -13.2% | $1.21 | 12.0% | 28 |

| RY-T | Royal Bank of Canada | 4.1% | $131.39 | 2.6% | $5.34 | 7.7% | 12 |

| SJ-T | Stella-Jones Inc. | 1.3% | $72.78 | 46.8% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 0.8% | $101.95 | 56.1% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.6% | $83.52 | -4.7% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.2% | $118.75 | 18.6% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.5% | $113.55 | 16.2% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 7.1% | $52.00 | -2.4% | $3.69 | 3.4% | 22 |

| T-T | Telus Corp. | 6.0% | $23.96 | -9.0% | $1.43 | 7.4% | 19 |

| WCN-N | Waste Connections | 0.7% | $145.41 | 10.4% | $1.05 | 10.5% | 13 |

| Averages | 3.4% | 3.0% | 9.1% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

DGI Clipboard

“The dividend is such an important factor in the success of many stocks, that you could hardly go wrong by making an entire portfolio of companies that have raised their dividends for 10 to 20 years in a row.”

Peter Lynch, Beating the Street p. 49

Spend income not capital

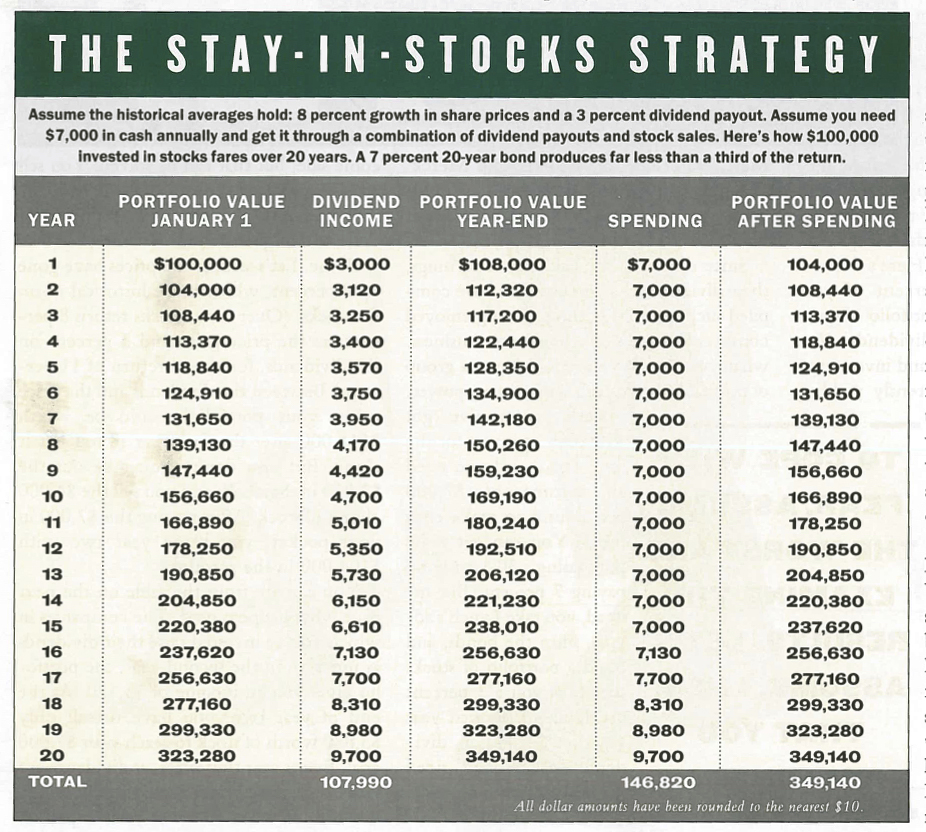

Renowned investor and author Peter Lynch advocated for dividend growth companies, demonstrating in a chart how an investor could annually withdraw 7% in an all-stock portfolio without depleting their funds. The chart highlights the flexibility in retirement funding choices.

For years, financial planners have promoted the ‘4% Rule’ in retirement planning. Switching to a 60/40 mix of bonds and stocks and withdrawing 4% of your hard-earned capital increases the likelihood of outliving your money. For many, this necessitates significant savings during their working years and some sleepless nights in retirement as their income stops growing and they rely more and more on capital performance.

Lynch grasped how dividends drive portfolio performance, and his ‘Stay in Stocks’ strategy emphasizes this belief. Many financial planners overlook that dividend companies are safer and continue to grow their dividends in retirement, making them more attractive than other stocks or fixed income as a source of growing income.

Nevertheless, a study on withdrawal strategies, that encapsulated seventy-one “rolling” twenty-year periods, concluded that there is still a chance of your portfolio balance falling to zero along the way. Lynch’s returns and strategy were based on averages, and as we know, that can sometimes backfire, as evidenced in this study, occurring 15% of the time.

By incorporating one change, the study’s author found that he could increase the success of Lynch’s ‘Stay in Stocks’ strategy to 100%. This change, termed the ‘90% Balance Rule,’ stipulates that if, after the income withdrawal is taken at the end of each year, the portfolio balance falls below 90% of the original starting amount, the annual withdrawal is reduced by 50%. In subsequent years, the portfolio balance is monitored for a rise back above 90% of the original starting amount, at which point a 7% income withdrawal can be reinstated.

Applying the ‘90% Balance Rule’ over all 20-year periods of the test sample resulted in 96% of finishing portfolio balances ending above the initial starting level with no portfolio failures. Another notable observation was that a high majority (82%) of the twenty-year periods required none or only one reduction in the withdrawal rate.

The author recommends that investors may want to take additional steps to compensate for a period of lower income derived from reduced withdrawal rates, such as building a ‘safe money’ bucket or having access to other sources of backup income.

While sustaining oneself solely on dividend income, without capital withdrawals, is achievable for some, for the majority, a DGI plan that combines both income and capital withdrawals while preserving the original capital, and incorporating the ‘90% Balance Rule,’ may be more realistic.

If you have not yet joined as a paid subscriber of the blog to receive DGI Alerts on the activity and content related to our model portfolio, it’s not too late. Click Here.

Recent News

U.S. Federal Reserve keeps key interest rate unchanged, foresees three cuts next year (Globe & Mail)

On Wednesday, the Federal Reserve maintained steady rates and hinted at potential interest rate cuts next year. However, on Friday, there was a market pullback. The stock market’s volatility is evident – investors oscillate between optimism and pessimism. It’s crucial to avoid being swayed by these fluctuations and instead concentrate on the fundamentals of quality companies. Focus on earnings, dividends, and outlooks for a more accurate signal of the market’s direction.

Everyone knows stock market predictions are awful. So why make them and should investors care? (Globe & Mail)

“I looked at 10 different firms’ one-year forecasts for the S&P 500 over the past 10 years and found that every single one of them missed the mark by more than 10 percentage points per year, on average.”

Expect many inaccurate short-term stock market prediction articles. Favor a long-term investment strategy aligned with historical success for goal achievement.

Dollarama profit jumps 31.4% as shoppers continue to look to discount retailers for inflation relief (Globe & Mail)

Dollarama’s recent earnings report had positive aspects, yet the stock declined nearly 10% last week. Analysts view the company as fully valued after a remarkable performance. If the pullback is excessive, investors could find an opportunity to purchase shares in this reputable retailer at a reasonable price.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

No companies on ‘The List’ had dividend announcements last week.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter, we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

No earnings reports from companies on ‘The List’ this week

Last week, there were two earnings reports from companies on ‘The List’.

Dollarama Inc. (DOL-T) released its third-quarter fiscal 2024 results before markets opened on Wednesday, December 13, 2023.

“Sustained consumer demand for our broad range of affordable everyday products and strong execution in the third quarter of Fiscal 2024 drove double-digit same store sales growth for a sixth consecutive quarter as well as over 31% earnings per share growth. Our financial and operational performance year-to-date reflects the strength and relevance of our value proposition and business model in a challenging macro-economic context.”

– Neil Rossy, President and Chief Executive Officer

Highlights:

- 1% increase in comparable store sales

- 0% growth in EBITDA to $478.8 million, or 32.4% of sales

- Diluted net earnings per common share up 31.4% to $0.92

- Fiscal 2024 guidance for comparable store sales growth increased to between 11.0% to 12.0%

Outlook:

Based on our performance fiscal year-to-date and assuming continued positive customer response to our product offering, value proposition and in-store merchandising in the fourth quarter of Fiscal 2024, the Corporation has increased its full-year comparable store sales guidance to a range of 11.0% to 12.0%. All other guidance ranges and underlying assumptions remain unchanged.

Source: (DOL-T) Q2-2024 Quarterly Report

Enghouse Systems Limited (ENGH-T) released its fourth-quarter and fiscal 2023 results after markets closed on Thursday, December 14, 2023.

“In fiscal 2023 we achieved a significant milestone by expanding our revenue, increasing our cash reserves and also deploying $55.2 million on acquisitions. We are pleased to announce record annual SaaS and Maintenance services revenue of $297.6 million, an increase of $39.4 million or 15.2% compared to the prior year. SaaS and maintenance services are an important strategic source of revenue characterized by their predictable and recurring nature. They now represent 65.6% of total revenues for the year compared to 60.4% in the prior year.”

– Stephen J. Sadler, Chairman and Chief Executive Officer

Highlights:

- Revenue increased 13.9% to $123.1 million.

- Recurring revenue, which includes SaaS and maintenance services, grew 35.0% to $87.2 million.

- Operating profits improved from $33.1 to $35.7 million, while achieving a 30.8% EBITDA margin.

Outlook:

With cash reserves of $240.4 million and no external debt, we continue to actively pursue opportunities to strategically deploy our cash reserves on acquisitions and return cash to our shareholders in the form of dividends.

Source: (ENGH-T) Q4-2023 Quarterly Report