Last updated by BM on December 04, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was up with a YTD price return of +3.4% (capital). Dividends have increased by +9.0% YTD, highlighting the growth in the dividend (income).

- Last week, four dividend announcements from companies on ‘The List’.

- Last week, three earnings reports from companies on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

The List (2023)

The Magic Pants List includes 27 Canadian dividend growth stocks. Each have raised their dividend annually for the last ten years (or longer) and have a market cap of over a billion dollars. Based on these criteria, companies on ‘The List’ are added or removed annually, on January 1. Prices and dividends are updated weekly.

While ‘The List’ does not function as a portfolio on its own, it serves as an excellent initial reference for individuals looking to diversify their investments and achieve higher returns in the Canadian stock market. Through our newsletter, readers gain a deeper understanding of how to implement and benefit from our Canadian dividend growth investing strategy.

If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service. Subscribers gain access to buy/sell alerts and exclusive content available only to subscribers.

Performance of ‘The List’

Last week, ‘The List’ was up with a YTD price return of +3.4% (capital). Dividends have increased by +9.0% YTD, highlighting the growth in the dividend (income).

The best performers last week on ‘The List’ were Stantec Inc. (STN-T), up +6.64%; Algonquin Power & Utilities (AQN-N), up +4.81%; and Waste Connections (WCN-N), up +4.74%.

Franco Nevada (FNV-N) was the worst performer last week, down -3.74%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 8.0% | $6.32 | -6.1% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $76.93 | 27.9% | $0.60 | 26.6% | 13 |

| BCE-T | Bell Canada | 7.1% | $54.39 | -9.7% | $3.87 | 5.2% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $27.75 | -11.4% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.8% | $57.56 | -0.8% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 2.0% | $160.23 | -1.6% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.8% | $142.86 | -2.5% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 5.8% | $30.82 | -16.6% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $99.42 | 24.5% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 5.8% | $48.37 | -8.1% | $2.82 | 5.0% | 16 |

| ENB-T | Enbridge Inc. | 7.5% | $47.47 | -11.0% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 2.5% | $34.33 | -3.9% | $0.85 | 18.2% | 16 |

| FNV-N | Franco Nevada | 1.2% | $113.16 | -18.1% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis Inc. | 4.2% | $54.84 | -0.9% | $2.29 | 5.3% | 49 |

| IFC-T | Intact Financial | 2.1% | $210.80 | 7.7% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.5% | $118.19 | -1.8% | $1.74 | 13.2% | 11 |

| MGA-N | Magna | 3.3% | $55.68 | -3.2% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.8% | $68.32 | -9.5% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 4.3% | $122.94 | -4.0% | $5.34 | 7.7% | 12 |

| SJ-T | Stella-Jones Inc. | 1.2% | $78.30 | 57.9% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 0.8% | $101.89 | 56.0% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.7% | $81.91 | -6.6% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.2% | $121.72 | 21.6% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.5% | $113.05 | 15.7% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 7.2% | $51.06 | -4.2% | $3.69 | 3.4% | 22 |

| T-T | Telus Corp. | 5.7% | $24.98 | -5.1% | $1.43 | 7.4% | 19 |

| WCN-N | Waste Connections | 0.8% | $139.63 | 6.0% | $1.05 | 10.5% | 13 |

| Averages | 3.4% | 3.4% | 9.0% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

DGI Clipboard

“It is far better to buy a great business at a fair price than a fair business at a great price”

– Warren Buffett

Less is better: quality not quantity for safely building wealth.

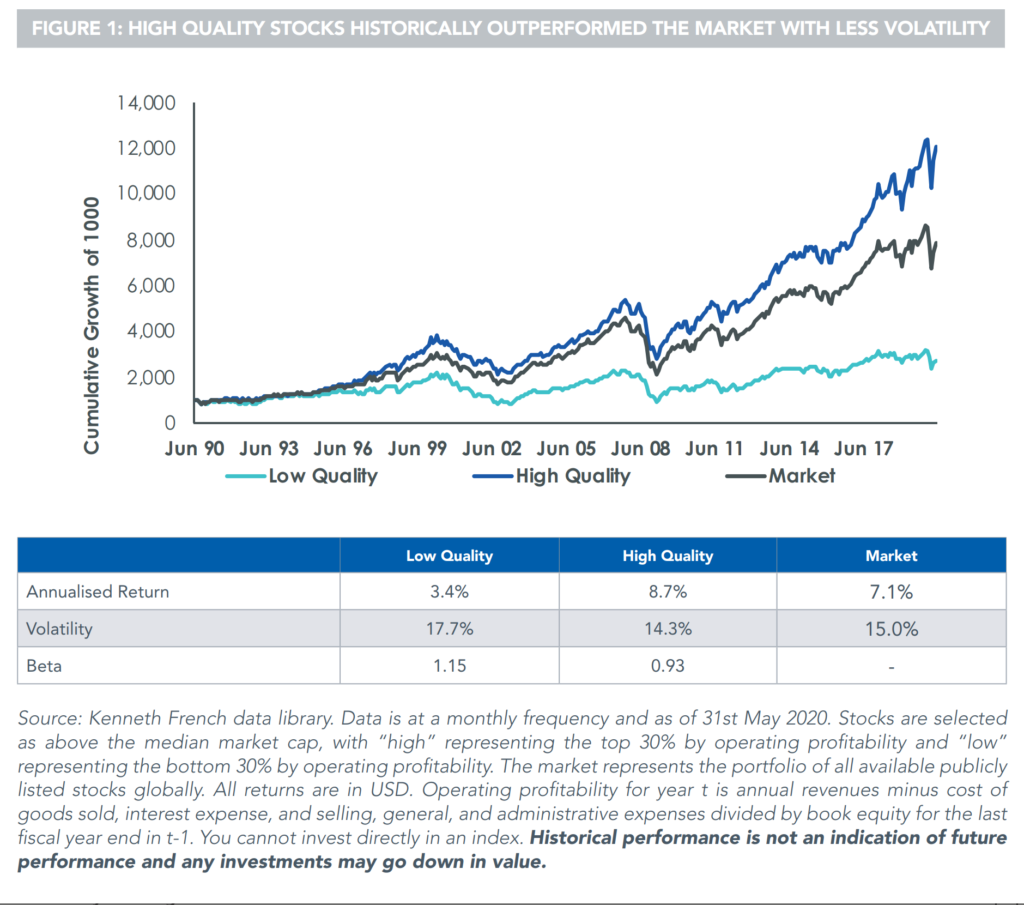

It is no coincidence that our dividend growth investing strategy incorporates identifying individual ‘quality’ companies as the first step in our process. Study after study backs our strategy that the best way to have long-term investment success is to select a few individual quality stocks and hold for the growing income. Buying quantity (think ETF) does not reduce risk, it only lowers your returns. Risk is in the price we pay not in how many stocks we own.

Understanding this key difference in what we do and what others don’t, is the key to our long-term success.

Although we don’t have a formal quality rating system, we identify quality individual companies by looking for indicators that have shown themselves to be highly predictive of long-term success. Stocks with strong business models and steady financial results over time are the ones we eventually invest in. We also value the independent research from services that sell information for a living (Value Line, S&P Credit Ratings). For more information on all our quality indicators read our post ‘Finding Quality Dividend Growth Stocks’ which was recently updated.

Because of our focus on quality, you will see us sometimes open a position in a company when it reaches a sensible price as opposed to one that has a great price.

There were a few significant events this past week which we will touch on in this issue. First the passing of Charlie Munger, Buffets right hand man. Secondly, bank earnings were released. Finally, an update on the Cobre Panama mine where the Panamanian court ruled that Law 406 was unconstitutional. Franco Nevada (FNV-T), a core stock on ‘The List’ and in our model portfolio, has a significant royalty stream coming from this mine.

If you have not yet joined as a paid subscriber of the blog to receive DGI Alerts on the activity and content related to our model portfolio, it’s not too late. Click Here.

Recent News

What Charlie Munger taught Warren Buffett about investing, and life

Charlie Munger is often credited with advising Warren Buffet on the value of investing in quality companies at reasonable prices. Buffett had previously made a reputation of investing in companies that were severely undervalued (great price).

Good advice by Mr. Munger on the importance of knowing who you are.

“And the most important person you must understand is: you. Because if you don’t see the world as it really is, and yourself as you really are, then barring the happenstance of good luck, your life is likely to be marked by disappointment and failure.”

Article takeaway: Lifelong learning and lifelong companionship, to the degree we can attain them, pay dividends — tangibly and intangibly.

Banks brace for tough economic times in 2024 (Globe & Mail)

https://www.theglobeandmail.com/business/article-banks-brace-for-tough-economic-times-in-2024/

“The country’s largest lenders posted mixed fourth-quarter financial results this week. As uncertainty looms over just how far the economy could tumble next year, bank earnings point to lower profits and an uptick in sour loans.”

Depending on which earnings report you read, Canada’s banks are either modestly optimistic or very cautious in their predictions. One thing for sure, the economy is slowing and per capital GDP is decreasing.

Franco-Nevada Maintained at Outperform at BMO as it Sees Lengthy Cobre Panama Shutdown; Price Target cut to C$200.00

11:23 AM EST, 12/04/2023 (MT Newswires) — BMO Capital Markets on Monday reiterated its Franco-Nevada (FNV.TO, FNV) while cutting its price target to C$200.00 from C$214.00 as it expects a lengthy shutdown for First Quantum Minerals (FM.TO) Cobre Panama project amid an uncertain political outlook for the project. Franco-Nevada has a significant royalty interest in the project.

“We have pushed our assumed restart for Cobre Panama to October 1, 2024 (from January 1, 2024 previously) based on our evolving understanding of the circumstances in country … Our Franco-Nevada estimates are also impacted by the mine closure due to its stream on Cobre Panama. With our updated closure assumption, our Franco-Nevada one-year target has fallen to C$200/share (from C$214); we maintain our Outperform rating,” analyst Jackie Przybylowski wrote.

Trying to speculate on when the mine will re-open is not what we do. The mine is too important to the country and its global reputation to stay shut down for long. Franco-Nevada is a quality company and will survive these short-term headwinds.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

Four companies on ‘The List’ had dividend announcements last week.

Alimentation Couche-Tard Inc. (ATD-T) on Tuesday said it increased its 2023 quarterly dividend from $0.14 to $0.175 per share, payable December 21, 2023, to shareholders of record on December 07, 2023.

This represents a dividend increase of +25.0%, marking the 14th straight year of dividend growth for this global leader in both convenience store and road transportation fuel retail.

Enbridge Inc. (ENB-T) on Wednesday said it increased its 2024 quarterly dividend from $0.8875 to $0.915 per share, payable March 1, 2024, to shareholders of record on February 15, 2024.

This represents a dividend increase of +3.1%, marking the 28th straight year of dividend growth for this pipeline company.

Royal Bank of Canada (RY-T) on Thursday said it increased its 2024 quarterly dividend from $1.35 to $1.38 per share, payable February 23, 2024, to shareholders of record on January 25, 2024.

This represents a dividend increase of +2.0%, marking the 13th straight year of dividend growth for this quality Canadian bank.

TD Bank (TD-T) on Thursday said it increased its 2024 quarterly dividend from $0.96 to $1.02 per share, payable January 31, 2024, to shareholders of record on January 10, 2024.

This represents a dividend increase of +6.3%, marking the 13th straight year of dividend growth for this quality Canadian bank.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter, we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

No earnings reports from companies on ‘The List’ this week

Last week, three earnings reports from companies on ‘The List’.

Alimentation Couche-Tard Inc. (ATD-T) released its second-quarter fiscal 2024 results on Tuesday, November 28, 2023, after markets closed.

“We are pleased to announce a solid second quarter with good progress across most of our key metrics, although we did see softening in same store sales in the U.S., driven by weakness in the cigarette category and cycled against a robust second quarter, up 5.6%, last year. In an environment with continued inflation and high interest rates, we remain committed to offering compelling value and ease. We have substantially expanded the rollout of our Inner Circle membership program, which is now in seven U.S. business units covering close to 3,000 locations with over 2.7 million fully enrolled, providing meaningful convenience and fuel rewards to our most valuable customers. As America’s Thirst Stop, we are focused on the growth of our beverage category by offering great assortment, innovation and value in both packaged and dispensed beverages at affordable price points. We also continue to be pleased with the performance of our fuel business, in terms of both volumes and margins, as we continue to bring traffic to our sites through reoccurring promotional Fuel Days.”

– Brian Hannasch, President and Chief Executive Officer

Highlights:

- Net earnings were $819.2 million, or $0.85 per diluted share for the second quarter of fiscal 2024 compared with $810.4 million, or $0.79 per diluted share for the second quarter of fiscal 2023. Adjusted net earnings were approximately $792.0 million compared with $838.0 million for the second quarter of fiscal 2023. Adjusted diluted net earnings per share were $0.82, unchanged compared with the corresponding quarter of last year.

- Total merchandise and service revenues of $4.1 billion, an increase of 1.0%. Same-store merchandise revenues decreased by 0.1% in the United States, by 0.2% in Europe and other regions, and increased by 1.6% in Canada.

- Same-store road transportation fuel volumes decreased by 1.5% in the United States, by 0.9% in Europe and other regions, and increased by 3.0% in Canada.

- Growth of expenses for the second quarter of fiscal 2024 was 2.5% while normalized growth of expenses was 1.5%, remaining below the average inflation observed throughout the Corporation’s network.

- Subsequent to the end of the quarter, the Corporation closed the acquisition of 112 company-owned and operated convenience retail and fuel sites in the United States.

- During its November 28, 2023 meeting, the Board of Directors approved an increase in the quarterly dividend of CA 3.5¢ per share, bringing it to CA 17.5¢ per share, an increase of 25.0%.

Outlook:

“Following the announcement of our 10 For The Win five-year strategy, we are excited by the recent developments in the growth of our network. In the beginning of November, we closed on the acquisition of 112 MAPCO sites, accelerating our development in key markets in Alabama, Georgia, Kentucky, Mississippi and Tennessee and adding approximately 1,300 team members to the Alimentation Couche-Tard Family. We also recently received an important decision by the European Commission allowing us to move closer to an end of calendar year completion of our game-changing acquisition of TotalEnergies in four new European countries. On the organic front, we are making progress on our stated goal of building 500 stores over the next five years, having already finished more than 40 new stores this fiscal year with considerably more in the pipeline that are either currently under or starting construction in the upcoming months,” concluded Brian Hannasch.

Source: (ATD-T) Q2-2024 Quarterly Review

Royal Bank of Canada (RY-T) released its fourth-quarter and fiscal 2023 results on Thursday, November 30, 2023, before markets opened.

“In a year defined by uncertainty, RBC served as a stabilizing force for our clients, communities, colleagues and shareholders. Our overall performance in 2023 exemplifies our standing as an all-weather bank. Our strong balance sheet, prudent risk management and diversified business model continue to underpin our ability to deliver differentiated client experiences and advice across all our businesses. As we enter 2024, RBC will work to provide the best client value as efficiently as possible, sharpening our focus to ensure our people and investments are aligned to build the bank of the future. Across RBC, our employees remain steadfast in their commitment to helping clients and communities adapt and thrive in a changing world.”

– Dave McKay, President and Chief Executive Officer

Highlights:

- Net income and diluted EPS of $4.1 billion and $2.90, respectively, were both up 6% from a year ago. Adjusted net income and adjusted diluted EPS of $4.0 billion and $2.78, respectively, were up 1% and flat compared to the prior year, respectively.

- Results this quarter reflected higher provisions for credit losses, with a PCL on loans ratio of 34 bps. Results benefitted from lower taxes reflecting a favourable shift in earnings mix and the impact of the specified item relating to certain deferred tax adjustments of $578 million.

- Pre-provision, pre-tax earnings of $4.8 billion were down 9% from a year ago, due to lower revenue in Wealth Management, largely reflecting the impact of impairment losses with respect to our interest in an associated company, as well as lower revenue in Global Markets. Results were also impacted by higher expenses, reflecting higher staff-related costs including severance, higher professional fees, ongoing technology investments and other items, such as legal provisions in U.S. Wealth Management. These factors were partially offset by higher net interest income driven by higher spreads and strong volume growth in Canadian Banking, higher revenue in Corporate & Investment Banking, and higher fee-based revenue in Wealth Management.

- Compared to last quarter, net income was up $259 million or 7% reflecting higher results in Corporate Support, Insurance and Capital Markets, partially offset by lower results in Wealth Management and Personal & Commercial Banking. Adjusted net income13 was down 1% over the same period.

Outlook:

Economic and market review and outlook GDP growth is slowing across most advanced economies as headwinds from higher interest rates continue to have a lagged impact. Unemployment rates remain low across most economies. However, they have begun to marginally increase in Canada and the United Kingdom (U.K.). The U.S. economy has remained resilient with strong GDP growth and a low unemployment rate. However, credit conditions continue to tighten, the number of job openings are signaling a decline in hiring demand and the excess of household savings accumulated during the pandemic has shrunk. U.S. GDP growth is expected to slow late in calendar 2023 with mild recessions expected in the first half of calendar 2024. Canadian GDP is expected to decline over the second half of calendar 2023 and grow slowly in early calendar 2024. Inflation is still high but has been slowing in most advanced economies. Interest rates have increased to levels that most central banks view as sufficient to slow economic growth and reduce inflationary pressures over time. We expect central banks will not increase policy interest rates further and expect a shift to reductions in interest rates from the Federal Reserve (Fed) and Bank of Canada (BoC) in the next calendar year. However, interest rates are expected to remain significantly higher than pre-pandemic levels.

Source: (RY-T) Q4-2023 Quarterly Review

TD Bank (TD-T) released its fourth-quarter and fiscal 2023 results on Thursday, November 30, 2023, before markets opened.

“TD delivered strong revenue growth this quarter, reflecting positive underlying business momentum and the benefits of our diversified business model. In a complex operating environment, we continued to adapt, invest in new capabilities and take important steps to deliver efficiencies and drive growth across the Bank.”

– Bharat Masrani, Group President and CEO

Highlights:

FOURTH QUARTER FINANCIAL HIGHLIGHTS, compared with the fourth quarter last year:

- Reported diluted earnings per share were $1.49, compared with $3.62.

- Adjusted diluted earnings per share were $1.83, compared with $2.18.

- Reported net income was $2,886 million, compared with $6,671 million.

- Adjusted net income was $3,505 million, compared with $4,065 million.

FULL YEAR FINANCIAL HIGHLIGHTS, compared with last year:

- Reported diluted earnings per share were $5.60, compared with $9.47.

- Adjusted diluted earnings per share were $7.99, compared with $8.36.

- Reported net income was $10,782 million, compared with $17,429 million.

- Adjusted net income was $15,143 million, compared with $15,425 million.

Outlook:

The global economy remains on track to slow in calendar 2023 and 2024, but to a lesser extent than anticipated in the previous quarter. Inflation has generally continued to cool across the G-7, and more central banks have taken a pause on interest rate hikes. Central bankers will remain vigilant on inflation and further rate hikes cannot be ruled out, but most are fine-tuning interest rate adjustments at this stage. The lagged impact of cumulative interest rate hikes is expected to be the primary influence dampening economic growth and returning inflation closer to the target ranges of the various regions by the end of calendar 2024.

TD Economics continues to believe there is a chance the federal funds rate may rise a further quarter point from its current range of 5.25-5.50% early in calendar 2024. The economic environment remains fluid. If the central bank sees evidence of further cooling in the labor market and is increasingly confident that inflation is headed towards its 2% target, it could opt to hold rates steady. Given the steep rise in interest rates over the past year, the trend towards tighter U.S. credit and financial conditions, and the likelihood of rolling periods of financial stress related to risk factors, the probability of a recession stateside remains elevated.

Source: (TD-T) Q4-2023 Quarterly Review