Last updated by BM on August 29, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was down slightly with a minus -0.2% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, there were two earnings reports from companies on ‘The List’.

- One company on ‘The List’ is due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“The evidence is clear. If you like the idea of lower volatility, shallow losses in bear markets and higher long-term returns, then it would be prudent to increase your allocation to high-quality dividend-paying stocks.”

– Noah Solomon, Financial Post article

Stocks the undisputed champion for scoring long-term returns (Financial Post)

The author compares a wide range of historical returns on several types of investments. He cautions investors not to invest in a stock-only portfolio unless they meet three criteria.

“The 100-per-cent stock portfolio is a double-edged sword. If you can 1) stick with it through stomach-churning bear market losses, 2) have a (very) long-term horizon, and 3) don’t need to sell assets for any reason, then strapping yourself into the roller coaster of a 100-per-cent stock portfolio may indeed be the optimal solution. Conversely, it would be difficult to identify a worse alternative for those who do not meet these criteria.”

Our dividend growth strategy seems well aligned with his criteria.

- We only buy quality, so bear markets don’t bother us as we know our companies will still be there and be profitable coming out of downturns.

- Our time horizon is very long (ten years and more).

- We don’t need to sell to generate income and pay bills. We have growing dividends.

My favourite part of the article, though, is this graphic.

Another quote we like from the article is this one:

“With respect to the emotional fortitude required to stand pat through bear markets, there is considerable evidence that many investors are simply incapable of doing this.”

A time-tested dividend growth strategy focused on income and predictable capital returns over the long term certainly helps us with our ‘emotional fortitude’.

If a DGI strategy interests you, please subscribe to our Magic Pants DGI Premium Membership, and you can learn how to build a robust dividend growth portfolio of your own.

Performance of ‘The List’

Last week, ‘The List’ was down slightly with a minus -0.2% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were TFI International (TFII-N), up +5.19%; TC Energy Corp. (TRP-T), up +2.32%; and Brookfield Infrastructure Partners (BIP-N), up +1.32%.

Magna (MGA-N) was the worst performer last week, down -5.12%.

Recent News

Rule of 20 says market bottom much lower (Globe & Mail)

“The investing rule of 20 states that when a new U.S. bull market starts, the trailing price to earnings (PE) ratio of the S&P 500 added to the inflation rate will result in a number less than 20. Unfortunately, right now the trailing PE ratio is 20.2 and the inflation rate is 8.5.”

Following this rule, inflation would need to go to zero, the S&P 500 would have to fall 40 percent more, or earnings would have to be reported 50 percent above expectations. All three scenarios look improbable in the short term.

There is also mention of CAPE being abnormally high, one of the valuation metrics we use to arrive at a sensible price for our quality dividend growers.

The bear market rally is unravelling. Here’s why it may be two years until stocks truly bottom. (Globe & Mail)

A few months ago, since the markets in the United States entered a bear market, we have been commenting on ‘bear market bounces,’ and the data from past bear markets have backed us up. This article looks at the data and arrives at a similar conclusion. The bear market is likely to continue for at least a year. Based on the behaviour of the market last Friday and particularly the comments from Federal Reserve Chair Jerome Powell, we are in for some more pain in the short term.

There was some excellent advice later on in the article.

“Play the long game by being patient and nimble – since intermittent rallies will come and go – and focus mostly on capital preservation.”

Purchasing individual, quality, dividend growers at sensible prices helps us preserve our capital.

One company on ‘The List’ is due to report earnings this week. ATD-T is another of the handful of companies on ‘The List’ that follows an off-cycle reporting schedule.

Alimentation Couche-Tard Inc. (ATD-T) will release its first-quarter 2023 results on Wednesday, August 31, 2022, before markets open.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

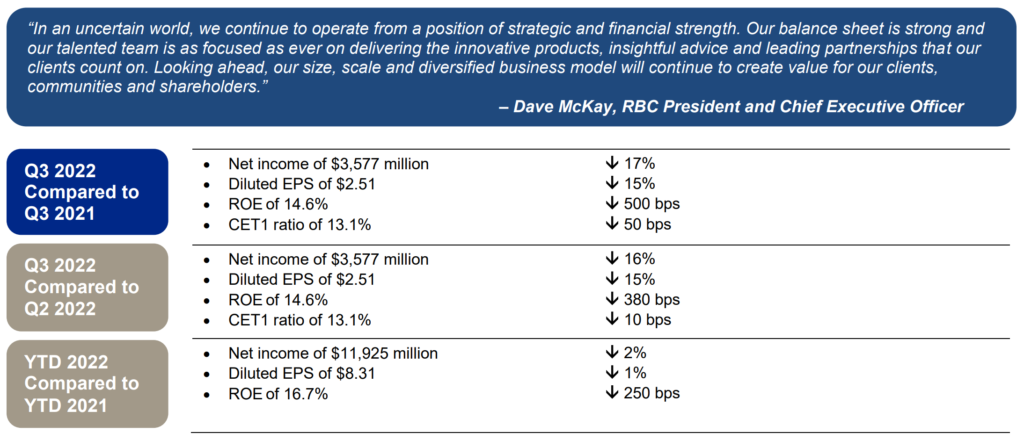

Royal Bank (RY-T) and TD Bank (TD-T) follow an off-cycle reporting schedule. Their year ends on October 31 each year. Last week, both companies reported their Q3 Fiscal 2022 earnings.

Royal Bank (RY-T)

Highlights:

Outlook:

“Despite the complicated macroeconomic backdrop, we are operating from a position of strength across our capital, liquidity and allowance coverage ratios. I am confident our competitive advantages will drive premium growth going forward. Our premium return on equity was a source of strong internal capital generation and double-digit growth in book value per share. Our priorities in deploying our capital have not changed. We remain focused on building on our momentum and driving accretive, organic growth. Which I will speak to a little later. As part of our commitment to delivering long-term value for our shareholders, we bought back over 10 million shares while paying $1.8 billion of dividends this quarter. We remain well-positioned to execute on key strategic priorities via acquisitions should they meet our strategic and financial requirements. And we are looking forward to working with our new colleagues following the anticipated close of Brewin Dolphin acquisition later this year. Finally, we are comfortable with operating at a higher capital ratio at this point in the cycle. We believe this is the prudent thing to do given the uncertain environment. Our liquidity coverage ratio provides a $66 billion buffer over the regulatory minimum. And we expect to continue to fund the majority of our organic loan growth in our personal and commercial banking businesses through our large client deposit base.”

See the full Earnings Release here

Toronto Dominion Bank (TD-T)

“Continued business momentum, increased customer activity and the benefits of our deposit rich franchise contributed to TD’s strong performance in the third quarter,” said Bharat Masrani, Group President and CEO, TD Bank Group. “Investments in talent and innovation, combined with our focus on prudent risk and financial management, strengthened our business and extended our competitive advantage.”

Highlights:

THIRD QUARTER HIGHLIGHTS

- Reported diluted earnings per share were $1.75, compared with $1.92.

- Adjusted diluted earnings per share were $2.09, compared with $1.96.

- Reported net income was $3,214 million, compared with $3,545 million.

- Adjusted net income was $3,813 million, compared with $3,628 million.

YEAR-TO-DATE FINANCIAL HIGHLIGHTS

- Reported diluted earnings per share were $5.85, compared with $5.68.

- Adjusted diluted earnings per share were $6.18, compared with $5.83.

- Reported net income was $10,758 million, compared with $10,517 million.

- Adjusted net income was $11,360 million, compared with $10,783 million.

Outlook:

“We enter the final quarter of fiscal 2022 with growing businesses, a powerful brand and a proven ability to drive consistent execution across the Bank,” added Masrani. “In a complex macroeconomic environment, we are well-positioned to continue investing in our business and create long-term value for our shareholders.”

See the full Earnings Release here

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on August 26, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 5.0% | $14.15 | -1.4% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $56.97 | 9.3% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.6% | $64.65 | -1.9% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.3% | $43.01 | 5.6% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.5% | $64.27 | -5.2% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.8% | $160.99 | 3.9% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.6% | $161.24 | -12.0% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.3% | $41.23 | 12.6% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $80.48 | 26.9% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.3% | $61.35 | -2.0% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.1% | $56.80 | 14.7% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.2% | $32.33 | -29.5% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 1.0% | $126.96 | -6.7% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.6% | $58.83 | -2.7% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.1% | $192.44 | 17.5% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.3% | $117.31 | 14.2% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 3.1% | $58.98 | -27.7% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.6% | $70.06 | 4.5% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 4.0% | $124.97 | -8.7% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 1.9% | $41.08 | 1.0% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $63.22 | -9.9% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.1% | $86.87 | -12.6% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.0% | $107.33 | -3.1% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.4% | $105.49 | -7.2% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.4% | $65.74 | 10.1% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.4% | $30.10 | 1.1% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $139.64 | 4.2% | $0.92 | 8.9% | 12 |

| Averages | 2.8% | -0.2% | 10.2% | 18 |