Last updated by BM on August 21, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was down with a YTD price return of +1.8% (capital). Dividend growth remained the same and is now at +8.4% YTD, highlighting growth in income over the past year.

- Last week, no dividend increases from companies on ‘The List’.

- Last week, no earnings reports from companies on ‘The List’.

- Two companies on ‘The List’ are due to report earnings this week.

- If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service, which grants you access to the MP Wealth-Builder Model Portfolio (CDN) and exclusive subscriber-only content. Learn More

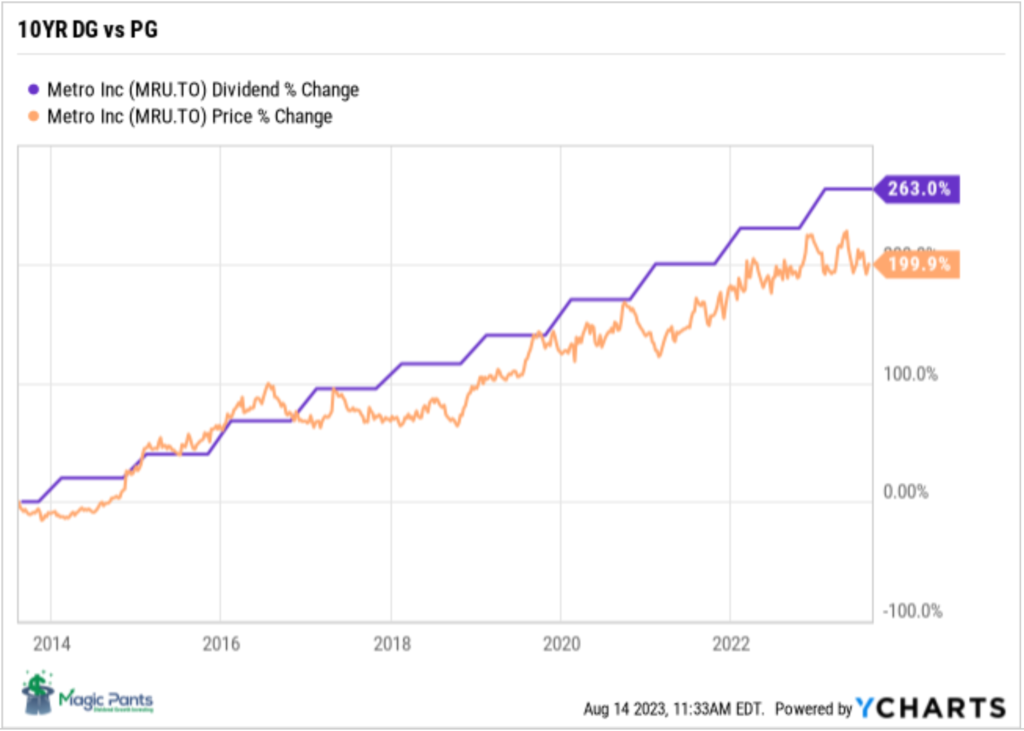

Identifying companies whose dividend growth aligns closely with price growth can considerably enhance the predictability of future returns. Dividend growth investors know that the dividend drives the price in a predictable way, not the other way around. Metro Inc. (MRU-T) is another company on ‘The List’ that follows this dividend growth principle.

Introduction

“You have a pair of pants. In the left pocket, you have $100. You take $1 out of the left pocket and put it in the right pocket. You now have $101. There is no diminution of dollars in your left pocket. That is one magic pair of pants.”

This ‘magic pants’ analogy was from a Seeking Alpha article on dividend investing I read about a decade ago and was one of the catalysts for me to take a closer look at this type of investing and see if it truly was magical.

After conducting additional research, I have shifted towards utilizing a dividend growth investing (DGI) strategy as my primary investment approach. While I maintain portfolios consisting of high-quality dividend growers from both the United States and Canada, I have opted to concentrate on Canadian (CDN) dividend growth companies in this blog. This is due to several reasons, including a smaller pool of DGI companies to track, a lack of coverage for the DGI strategy by the North American investment media, and a tendency for those who do cover DGI to narrowly focus on only a handful of sectors (Energy and Financials).

While ‘The List’ is not a portfolio in itself, it serves as an excellent initial reference for individuals seeking to diversify their investments and attain higher returns in the Canadian stock market. Through our blog, we provide weekly updates on ‘The List’ and offer valuable perspectives and real-life examples of the dividend growth investing strategy in practice. This helps readers gain a deeper understanding of how to implement and benefit from this investment approach.

DGI Thoughts

“Owning dividend growth stocks in retirement is like having an employer who offers generous wage increases every year.”

– Rob Carrick, Personal Finance Columnist

One of our mentors, Tom Connolly, had an article published in the Globe & Mail this week touting the advantages of dividend growth investing for retirees. His analysis showed how much a portfolio of dividend growth companies produced in income over a ten-year period.

Here is ‘The List’ from our blog, sorted by income generated, over a ten-year period for comparison:

Some takeaways from the data:

- The average income generated over the decade returns ~45% of your original investment back to you in the form of dividends alone.

- The dividend growth (10Y DG) average of ‘The List’ drives price growth (10Y PG) at about the same rate (10.0% vs 10.3%).

- The average annual total return (10Y TR) generated from ‘The List’ was 12.4%. This outperforms the TSX Composite index, and all other Canadian dividend growth mutual fund returns by almost 40% over the same time frame!

- High dividend growers, near bottom of the list also tend to be higher capital growers (CAGR 10Y PG).

- Dividend growth of 10% (10Y DG) surpasses inflation by a considerable margin meaning your purchasing power is never impacted.

- Both income and capital are still growing (unlike bonds, GICs and other fixed income investments).

- Starting yield is much higher now than in 2013 (3.4% vs 2.7%).

If you have not yet joined as a paid subscriber of the blog to receive DGI Alerts on the activity and content related to our model portfolio, it’s not too late. Click Here.

Recent News

Want to grow your retirement income every year? Dividend growth stocks like these deliver. (Globe & Mail)

“A general rule from Mr. Connolly: share price growth tracks a company’s dividend growth rate. Not in lockstep, but there is a strong correlation.”

Good article on income generation from a list of dividend growth stocks, over a ten-year period, by one of my mentors, Tom Connolly.

“Whether it happens at some point in 2024 or beyond, interest rates will start to fall and dividend stocks will become more appealing to investors. Buying now puts you in a position to benefit from high yields in 2023, dividend growth in the future and the potential for capital gains.”

We agree with the author on this point. The recent yields of good dividend growers are now ~25% higher than in 2013.

Dividend stocks are a better investment than income properties: BMO economist. (Globe & Mail)

The author correctly points out many parallels between real estate investing and dividend growth investing. Both provide growing income and as the income goes up, so does the underlying asset’s price. A few of the differences are highlighted in this article which moves the needle towards dividend growth investing as our preferred choice.

As a real estate investor early in my career, I found out the hard way that the time I spent on real estate investing could have been better spent focusing on my career and building a dividend growth portfolio of quality companies in tandem.

The List (2023)

Last updated by BM on August 18, 2023

The Magic Pants List contains 27 Canadian dividend growth stocks. ‘The List’ contains Canadian companies that have raised their dividend yearly for at least the last ten years and have a market cap of over a billion dollars. Below is each stock’s symbol, name, current yield, current price, price return year-to-date, current dividend, dividend growth year-to-date and current dividend growth streak. Companies on ‘The List’ are added or subtracted once a year, on January 1. After that, ‘The List’ is set for the next twelve months. Prices and dividends are updated weekly.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 7.0% | $7.20 | 7.0% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $69.50 | 15.6% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 6.9% | $55.14 | -8.5% | $3.82 | 5.0% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $32.01 | 5.2% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.8% | $60.35 | 4.0% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 2.1% | $153.95 | -5.5% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.4% | $155.57 | 6.1% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 5.6% | $32.24 | -12.7% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $86.38 | 8.2% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 5.4% | $51.48 | -2.2% | $2.76 | 3.0% | 16 |

| ENB-T | Enbridge Inc. | 7.5% | $47.25 | -11.4% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 3.0% | $28.02 | -21.5% | $0.85 | 18.2% | 16 |

| FNV-N | Franco Nevada | 1.0% | $135.57 | -1.9% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis | 4.2% | $53.71 | -2.9% | $2.26 | 4.1% | 49 |

| IFC-T | Intact Financial | 2.3% | $195.50 | -0.1% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.5% | $115.72 | -3.8% | $1.74 | 10.3% | 11 |

| MGA-N | Magna | 3.3% | $55.64 | -3.3% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.7% | $70.20 | -7.0% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 4.4% | $121.47 | -5.1% | $5.34 | 7.7% | 12 |

| SJ-T | Stella-Jones Inc. | 1.4% | $64.80 | 30.7% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 0.9% | $89.19 | 36.5% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.6% | $83.93 | -4.3% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.1% | $130.03 | 29.9% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.5% | $110.17 | 12.8% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 7.6% | $48.44 | -9.1% | $3.69 | 3.4% | 22 |

| T-T | Telus Corp. | 6.3% | $22.83 | -13.3% | $1.43 | 7.4% | 19 |

| WCN-N | Waste Connections | 0.7% | $138.00 | 4.8% | $1.02 | 7.4% | 13 |

| Averages | 3.4% | 1.8% | 8.4% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

Note: When the dividend and share price currency match, the calculation is straightforward. But it’s not so simple when the dividend is declared in one currency, and the share price is quoted in another. Dividing the former by the latter would produce a meaningless result because it’s a case of apples and oranges. To calculate the yield properly, you must express the dividend and share price in the same currency.

Performance of ‘The List’

Feel free to click on this link, ‘The List’ for a sortable version from our website.

Last week, ‘The List’ was up with a YTD price return of +1.8% (capital). Dividend growth remained the same and is now at +8.4% YTD, highlighting growth in income over the past year.

The best performers last week on ‘The List’ were Dollarama Inc. (DOL-T), up +0.91%; Canadian Utilities Limited (CU-T), up +0.34%; and Emera (EMA-T), down -0.17%.

Franco Nevada (FNV-N) was the worst performer last week, down -5.09%.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

“As a dividend increase is a positive sign of a company’s financial strength, the safest purchase, after research, is a stock with a recent dividend increase.”

– Tom Connolly (the founder of dividendgrowth.ca)

Last week, no dividend increases from companies on ‘The List’.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

Earnings growth and dividend growth tend to go hand in hand, so this information can tell us a lot about the future dividend growth of our quality companies. Monitoring our dividend growers periodically is part of the process, and reading the quarterly earnings releases is a good place to start.

Two earnings reports from companies on ‘The List’ this week

Royal Bank of Canada (RY-T) will release its third-quarter fiscal 2023 results on Thursday, August 24, 2023, before markets open.

TD Bank (TD-T) will release its third-quarter fiscal 2023 results on Thursday, August 24, 2023, before markets open.

Last week, no companies on ‘The List’ reported earnings.