Last updated by BM on April 22, 2025

Summary

Welcome to this week’s MP Market Review – your go-to source for insights and updates on the Canadian dividend growth companies we track on ‘The List’! While we’ve expanded our watchlists to include U.S. companies (The List-USA), our Canadian lineup remains the cornerstone of our coaching approach.

Don’t miss out on exclusive newsletters and premium content that will help you sharpen your investing strategy. Explore it all at magicpants.substack.com.

Your journey to dividend growth mastery starts here – let’s dive in!

- Last week, dividend growth was up, with an average return of +7.5% YTD (income).

- Last week, the price of ‘The List’ was up from the previous week with an average return of +1.06% YTD (capital).

- Last week, there were no dividend announcements from companies on ‘The List’.

- Last week, there was one earnings report from a company on ‘The List’.

- This week, two companies on ‘The List’ will report on earnings.

DGI Clipboard

“Basically, price fluctuations have only one significant meaning for the true investor. They provide an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies.”

– Ben Graham

Want Financial Peace? Embrace the Dividend Growth Mindset

Intro

It’s the dividend growth mindset that helps you successfully navigate challenging markets like today’s. A simple shift in how you approach investing can truly make all the difference. Imagine your retirement portfolio as a business—a business designed to generate steady profits, consistent revenue, and regular payments to you, the owner, every single quarter and year.

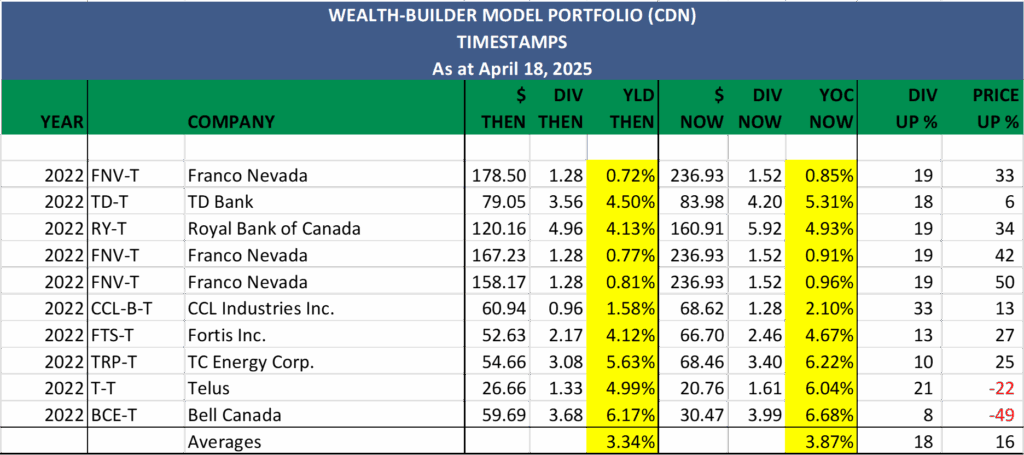

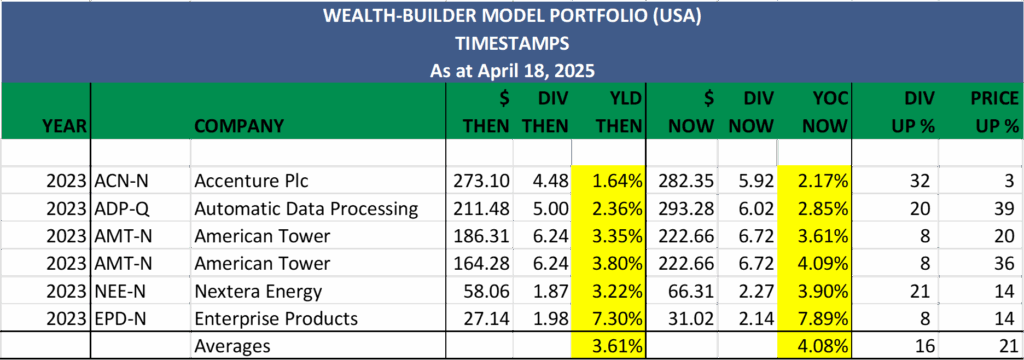

Although our model portfolios are still relatively young, our yield-on-cost (dividend return) is already beginning to take shape. Regularly reviewing this data provides reassuring confirmation that our retirement strategy remains on the right track.

One of my investing mentors, Tom Connolly, offers valuable advice: “If market gyrations bother you, study the yield on the original price of stocks you purchased years ago. Such data is relaxing.”

Below you’ll find ‘timestamps’ marking the first year of investing in both our Canadian and American model portfolios. The columns ‘YLD THEN’ (Starting Yield) and ‘YOC NOW’ (Yield on Cost) clearly illustrate the growth in our yields. After just a few short years, our dividend returns alone (currently 3.87% and 4.08%) already surpass those of most fixed-income investments, and these yields will likely continue to increase.

Our capital appreciation has also been solid, with eleven of the thirteen companies now valued higher than our original purchase price, even following recent market sell-offs!

Wrap Up

As a dividend growth investor, I stopped worrying about market fluctuations long ago. Treat your portfolio like a business, and you’ll sleep much better at night.

Join as a paying subscriber to gain full access to this post and exclusive, subscriber-only content. Plus, get real-time DGI alerts from our model signaling service whenever we make trades in our portfolios. We do the work; you stay in control. Subscribe today and take your dividend growth investing to the next level.

DGI Scorecard

The List (2025)

The Magic Pants 2025 list includes 29 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on ‘The List’:

- Dividend growth streak: 10 years or more.

- Market cap: Minimum one billion dollars.

- Diversification: Limit of five companies per sector, preferably two per industry.

- Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies are added or removed from ‘The List’ annually on January 1. Prices and dividends are updated weekly.

‘The List’ is not a portfolio but a coaching tool that helps us think about ideas and risk manage our model portfolio. We own some but not all the companies on ‘The List’. In other words, we might want to buy these companies when valuation looks attractive.

Our newsletter provides readers with a comprehensive insight into the implementation and advantages of our Canadian dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

Performance of ‘The List’

Last week, dividend growth was up, with an average return of +7.5% YTD (income).

The price of ‘The List’ was up from the previous week, with an average YTD return of +1.06% (capital).

Even though prices may fluctuate, the dependable growth in our income does not. Stay the course. You will be happy you did.

Last week’s best performers on ‘The List’ were goeasy Ltd. (GSY-T), up +5.43%; Thomson Reuters (TRI-N), up +5.37%; and Enbridge Inc. (ENB-T), up +4.61%.

TFI International (TFII-N) was the worst performer last week, down -4.46%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| ATD-T | Alimentation Couche-Tard Inc. | 1.1% | $71.30 | -9.80% | $0.78 | 8.3% | 15 |

| BCE-T | Bell Canada | 13.1% | $30.47 | -9.10% | $3.99 | 0.0% | 16 |

| BIP-N | Brookfield Infrastructure Partners | 6.2% | $27.90 | -12.43% | $1.72 | 6.2% | 17 |

| CCL-B-T | CCL Industries Inc. | 1.9% | $68.62 | -6.79% | $1.28 | 10.3% | 23 |

| CNR-T | Canadian National Railway | 2.6% | $137.31 | -6.45% | $3.55 | 5.0% | 29 |

| CTC-A-T | Canadian Tire | 4.8% | $146.75 | -4.53% | $7.10 | 1.4% | 14 |

| CU-T | Canadian Utilities Limited | 4.9% | $37.60 | 8.11% | $1.83 | 1.0% | 53 |

| DOL-T | Dollarama Inc. | 0.2% | $167.80 | 19.69% | $0.41 | 18.1% | 14 |

| EMA-T | Emera | 4.8% | $61.03 | 14.01% | $2.90 | 0.7% | 18 |

| ENB-T | Enbridge Inc. | 6.0% | $62.82 | 1.54% | $3.77 | 3.0% | 29 |

| ENGH-T | Enghouse Systems Limited | 4.8% | $24.37 | -9.94% | $1.16 | 16.0% | 18 |

| FNV-N | Franco Nevada | 0.9% | $171.09 | 41.24% | $1.52 | 5.6% | 17 |

| FTS-T | Fortis Inc. | 3.7% | $66.70 | 11.88% | $2.46 | 3.1% | 51 |

| GSY-T | goeasy Ltd. | 3.7% | $157.92 | -5.53% | $5.84 | 24.8% | 10 |

| IFC-T | Intact Financial | 1.8% | $293.93 | 11.77% | $5.32 | 9.9% | 20 |

| L-T | Loblaw Companies Limited | 1.0% | $213.68 | 12.33% | $2.05 | 7.0% | 13 |

| MFC-T | Manulife Financial | 4.4% | $39.65 | -9.76% | $1.76 | 10.0% | 11 |

| MGA-N | Magna | 6.0% | $32.25 | -22.74% | $1.94 | 2.1% | 15 |

| MRU-T | Metro Inc. | 1.4% | $102.08 | 13.21% | $1.48 | 10.4% | 30 |

| RY-T | Royal Bank of Canada | 3.7% | $160.91 | -6.59% | $5.92 | 5.7% | 14 |

| SJ-T | Stella-Jones Inc. | 1.9% | $66.54 | -8.84% | $1.24 | 10.7% | 20 |

| STN-T | Stantec Inc. | 0.7% | $120.88 | 6.87% | $0.89 | 7.3% | 13 |

| T-T | Telus | 7.8% | $20.76 | 5.76% | $1.61 | 5.2% | 21 |

| TD-T | TD Bank | 5.0% | $83.98 | 9.78% | $4.20 | 2.9% | 14 |

| TFII-N | TFI International | 2.3% | $77.75 | -41.37% | $1.80 | 12.5% | 14 |

| TIH-T | Toromont Industries | 1.8% | $112.88 | -0.19% | $2.08 | 8.3% | 35 |

| TRI-Q | Thomson Reuters | 1.3% | $181.95 | 12.05% | $2.38 | 10.2% | 31 |

| TRP-T | TC Energy Corp. | 5.0% | $68.46 | 0.35% | $3.40 | 3.3% | 24 |

| WCN-N | Waste Connections | 0.6% | $197.37 | 16.16% | $1.26 | 7.7% | 15 |

| Averages | 3.6% | 1.06% | 7.5% | 21 |

Note: Stocks ending in “-N or -Q” declare earnings and dividends in US dollars. To achieve currency consistency between dividends and share price for these stocks, we have shown dividends in US dollars and share price in US dollars (these stocks are listed on a US exchange). The dividends for their Canadian counterparts (-T) would be converted into CDN dollars and would fluctuate with the exchange rate.

PAID subscribers enjoy full access to our enhanced weekly newsletter, premium content, and easy-to-follow trade alerts so they can build DGI portfolios alongside ours. This service provides the resources to develop your DGI business plan confidently. We do the work; you stay in control!

It truly is the subscription that pays dividends!

The greatest investment you can make is in yourself. Are you ready to take that step?

For more articles and the full newsletter, check us out on magicpants.substack.com.