Q2 2021 Earnings Calendar-Intro

Posted by JM on June 28, 2021

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

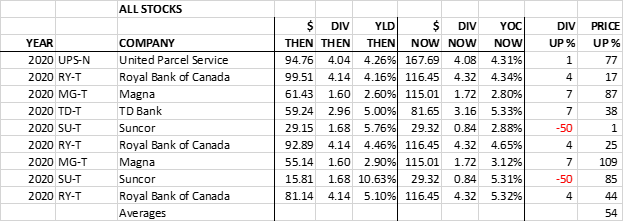

Each quarter we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season. Q2 has just ended, and companies are now beginning to report. The chart can be found below the updated List by selecting ‘The List’ menu item.

Earnings growth and dividend growth tend to go hand in hand so this information can tell us a lot about future dividend growth of our quality companies. Monitoring our dividend growers periodically is part of the process and reading the quarterly earnings releases is a good place to start.

Some of our dividend growers from ‘The List’ have reported quarterly earnings already, based on their fiscal year, with the majority of Q2 earnings scheduled to report in July. Here’s a list (sorted by date) of reporting dates, the market’s consensus estimates and actual reported results.

| SYMBOL | COMPANY | DATE | ESTIMATE | RESULT |

|---|---|---|---|---|

| RY-T | Royal Bank of Canada | 27-May | $2.49 | $2.79 |

| TD-T | TD Bank | 27-May | $1.76 | $2.04 |

| ENGH-T | Enghouse Systems Limited | 10-Jun | $0.45 | $0.37 |

| ATD-B-T | Alimentation Couche-Tard Inc. | 29-Jun | $0.42 |