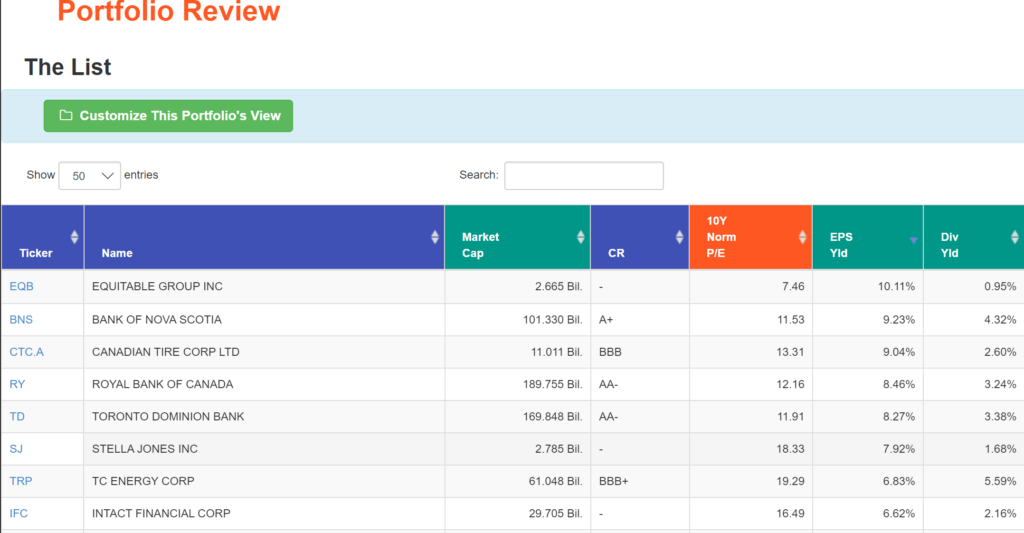

‘The List’ – Portfolio Review (March 2022)

Posted by BM on March 23, 2022

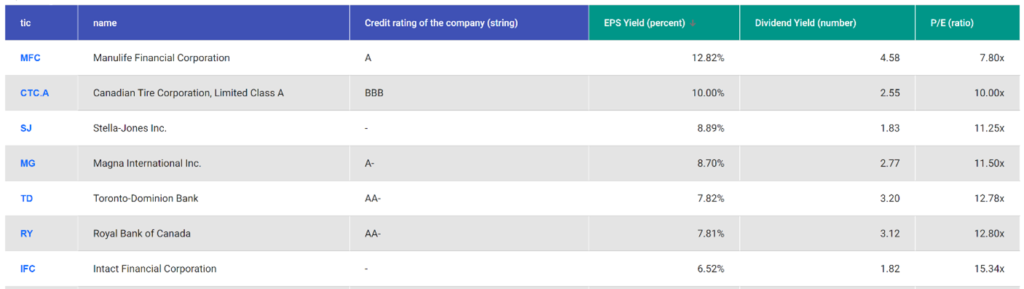

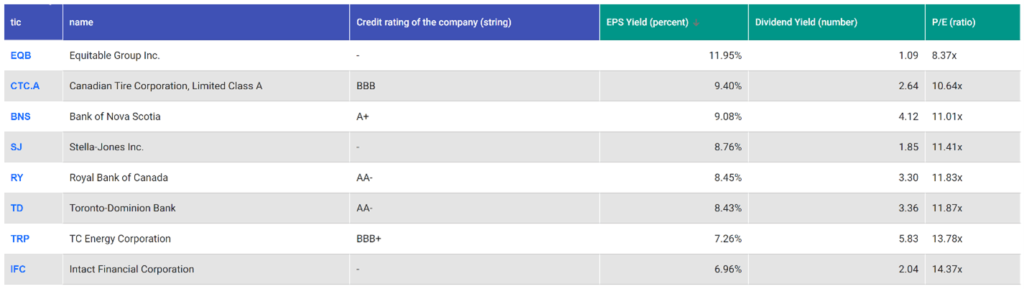

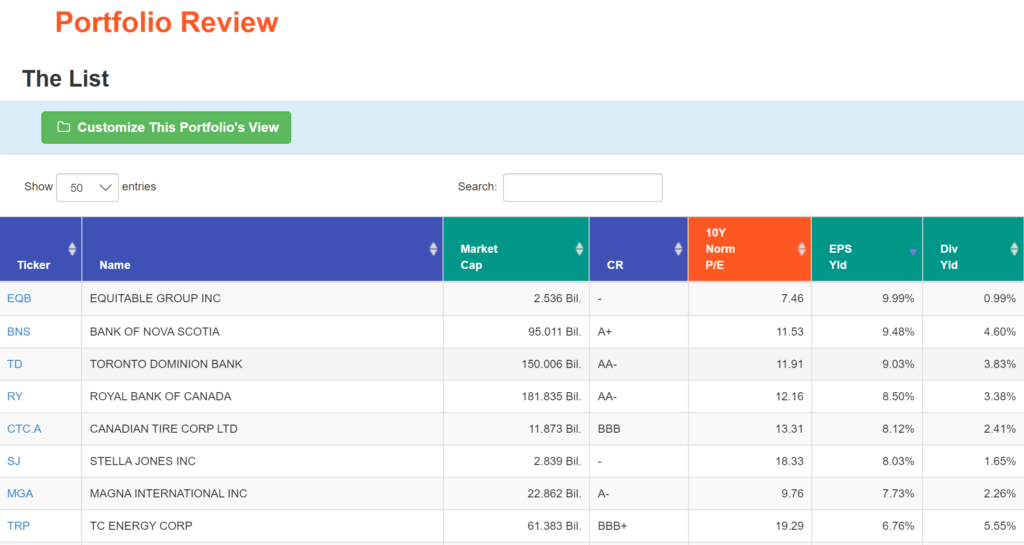

Each month we walk through our valuation process using a stock on ‘The List’ that meets our minimum screen of 6.5% EPS Yield. With many of our good dividend growers still not in our ‘sensible price’ range, we sometimes go looking outside of ‘The List’ for candidates. The company we will review today is Manulife Financial (MFC-T).

Valuation is the second step in our three-step process. Buying when our quality stocks are sensibly priced will help ensure our future investment returns meet our expectations. We rely heavily on the fundamental analyzer software tool (FASTgraphs) to help us understand the fundamentals of the stocks we invest in and then read the company’s website for investor presentations and recent earnings reports to learn more.

MFC-T has a dividend streak of eight years. We have added MFC-T to our screen to demonstrate where it sits from a valuation perspective. As you can see, it would be at the top of our list if it was on the 2022 List.

Intro:

Manulife was founded in 1887 in Toronto, Canada (“The Manufacturers Life Insurance Company” by Act of Parliament on 23 June 1887). Manulife provides life insurance and wealth management products and services to individuals and group customers in Canada, the United States, and Asia. Manulife is one of Canada’s Big Three Life Insurance companies (the other two are Sun Life and Great-West Life).

It’s the third-largest insurance company in Canada and the seventh-largest publicly-traded insurance company on earth. But it’s also highly diversified globally.

- Asia 48% of operating income

- US 21%

- Canada 20%

- Other 11%

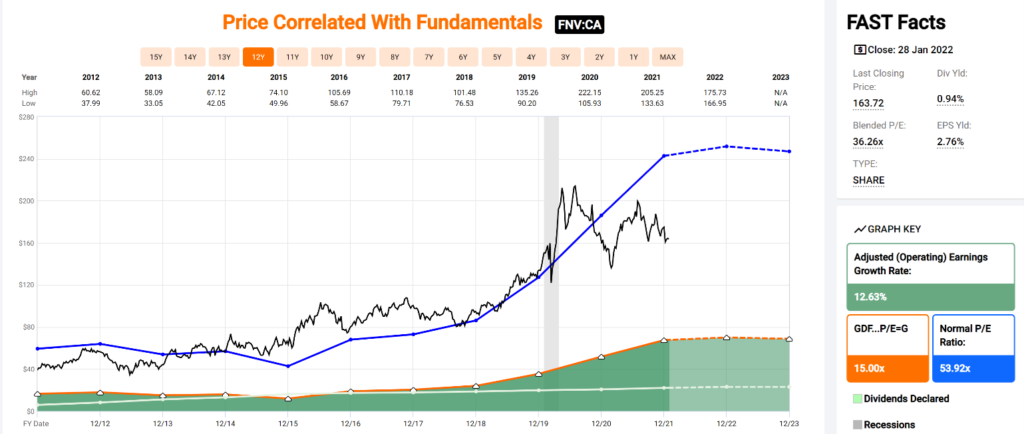

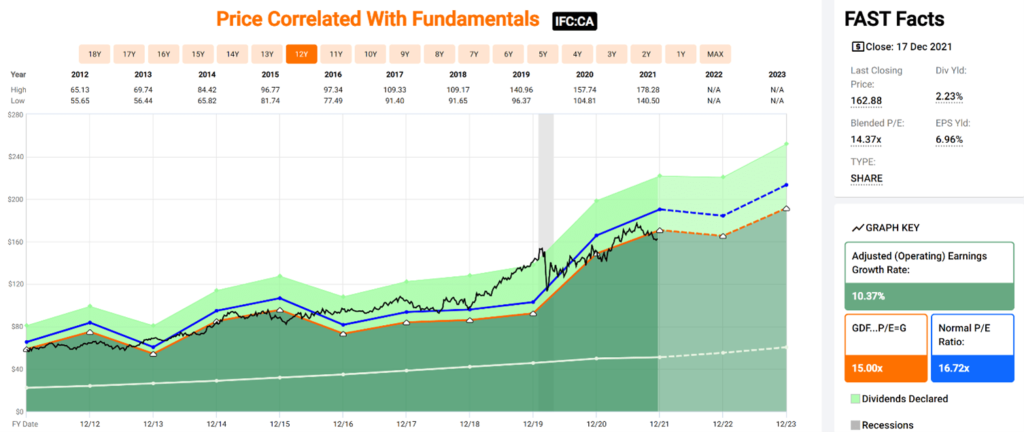

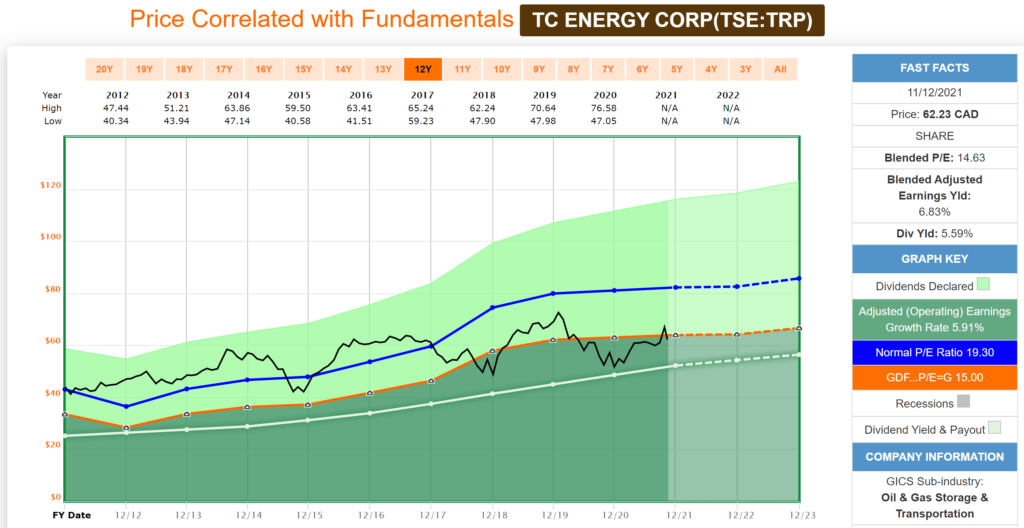

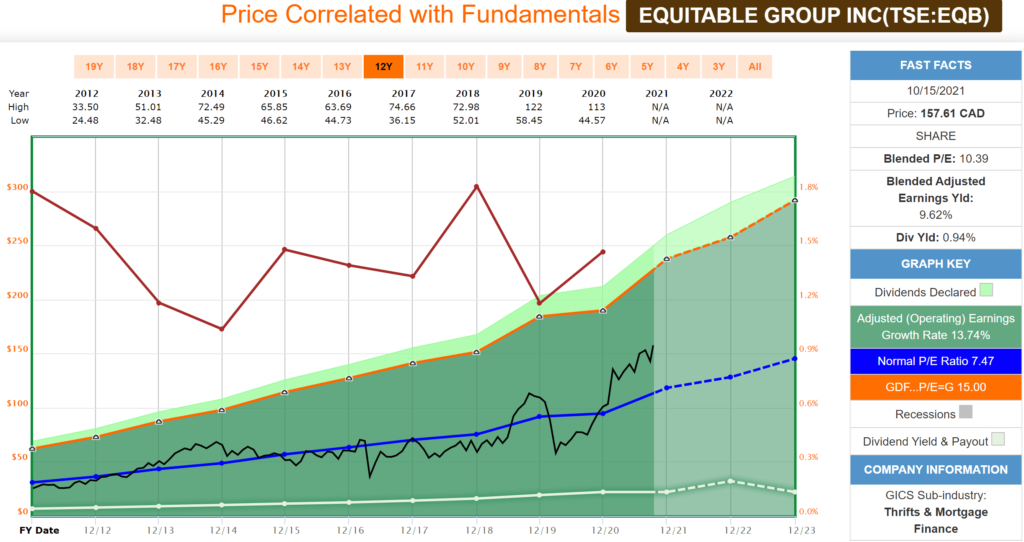

Historical Graph:

Comments:

Manulife Financial has a narrow valuation corridor. As you can see from the Blue Line on the graph (Normal P/E) and the Black Line (Price), there seems to be a correlation between Price and P/E. You would be wise to invest in MFC-T when it is below its average P/E of 10.99.

The fundamentals show a company whose earnings have grown steadily over the last ten years at an annualized rate of ~11.70%. This is rare for a company to have double digit earnings growth and such a high starting yield (5.1%).

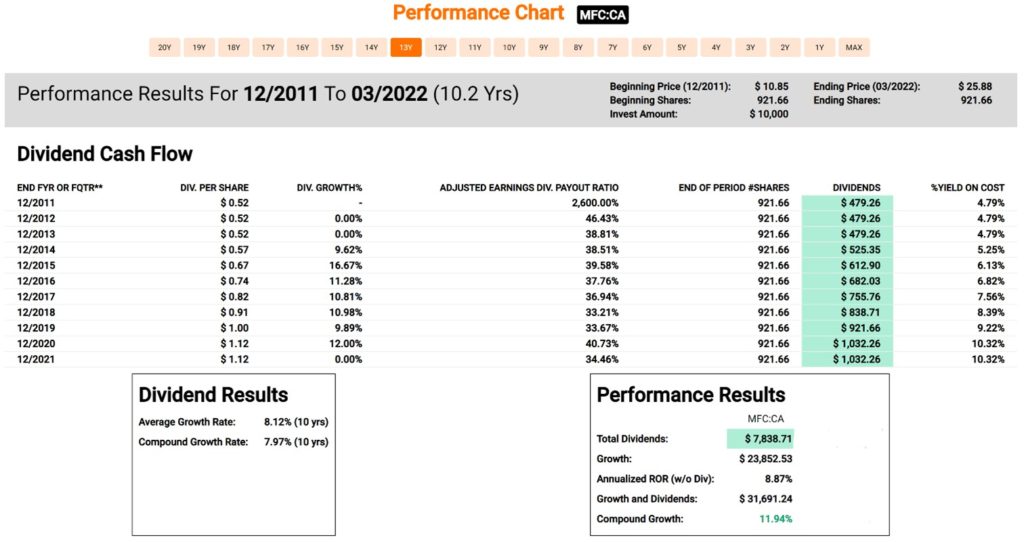

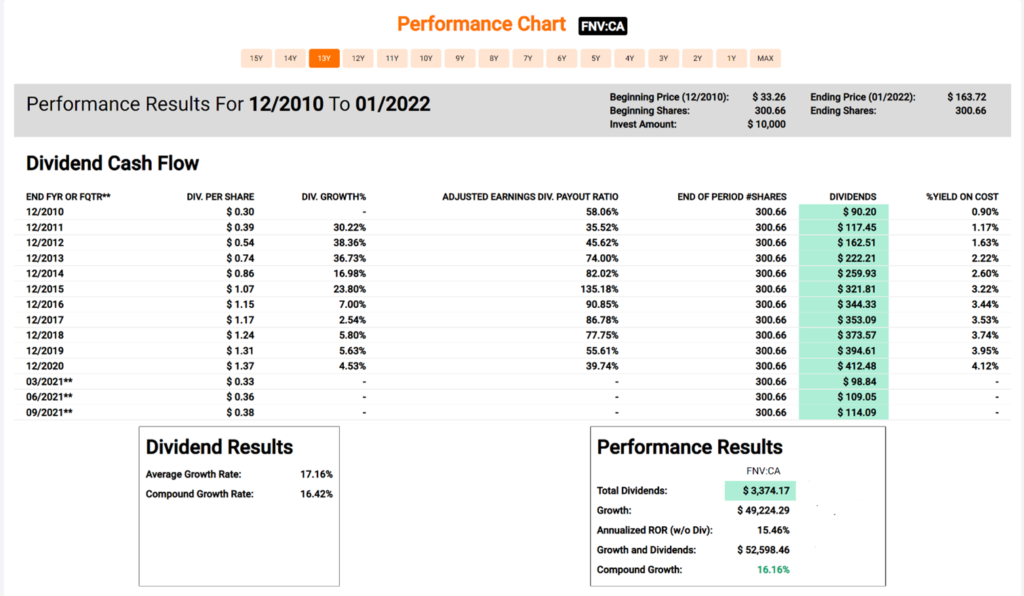

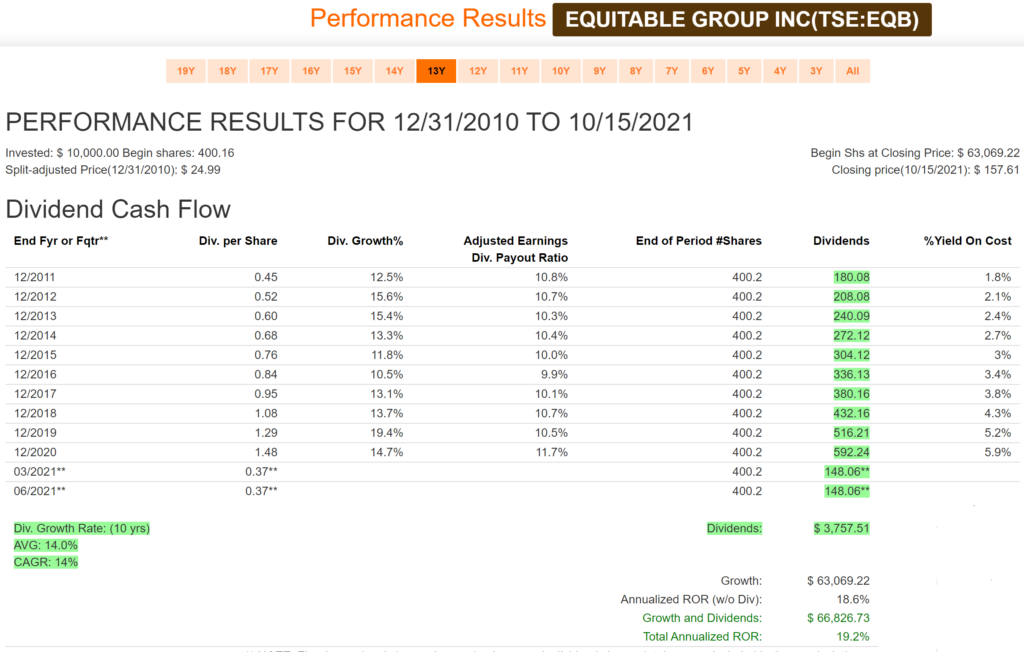

Performance Graph:

Comments:

Manulife Financial has an annualized dividend growth rate of 7.97% over the last ten years. The company also has an annualized Total Return of 11.94% over that period. MFC-T recently announced a dividend increase of ~18.0% for 2022 which is more than double their ten-year growth rate. Manulife has been a terrific investment over the last decade, especially as an income holding, with investors in 2012 now generating a 10.32% return on their initial investment from dividends alone.

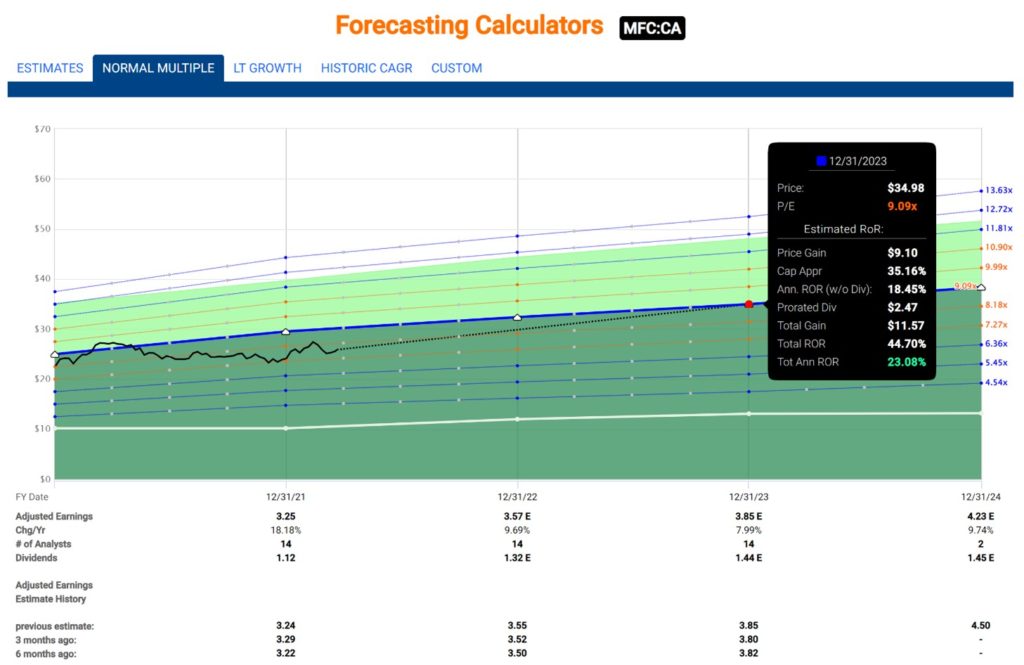

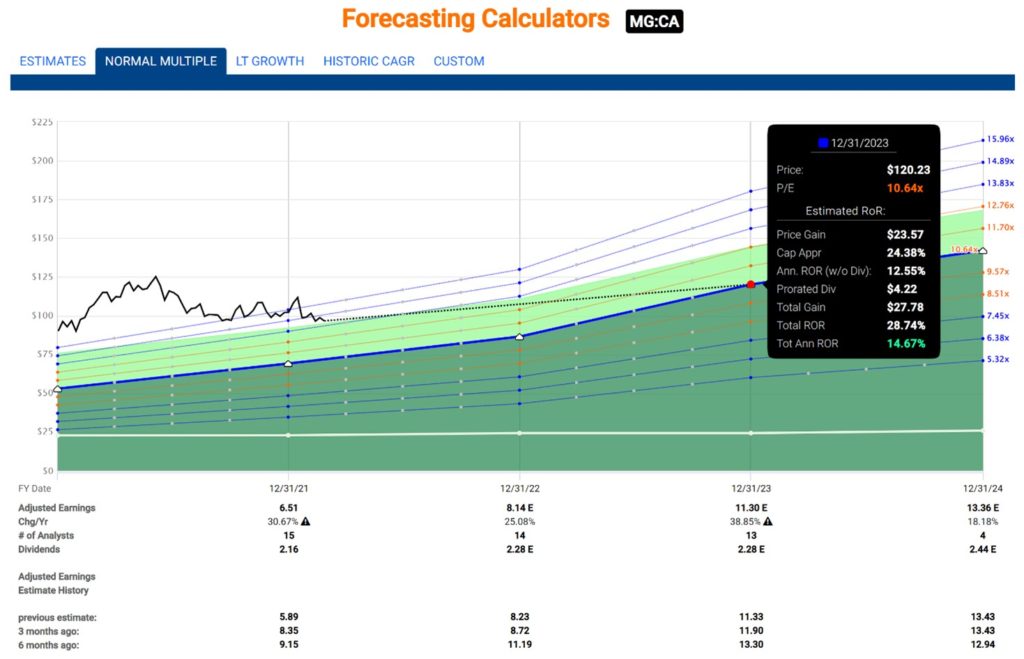

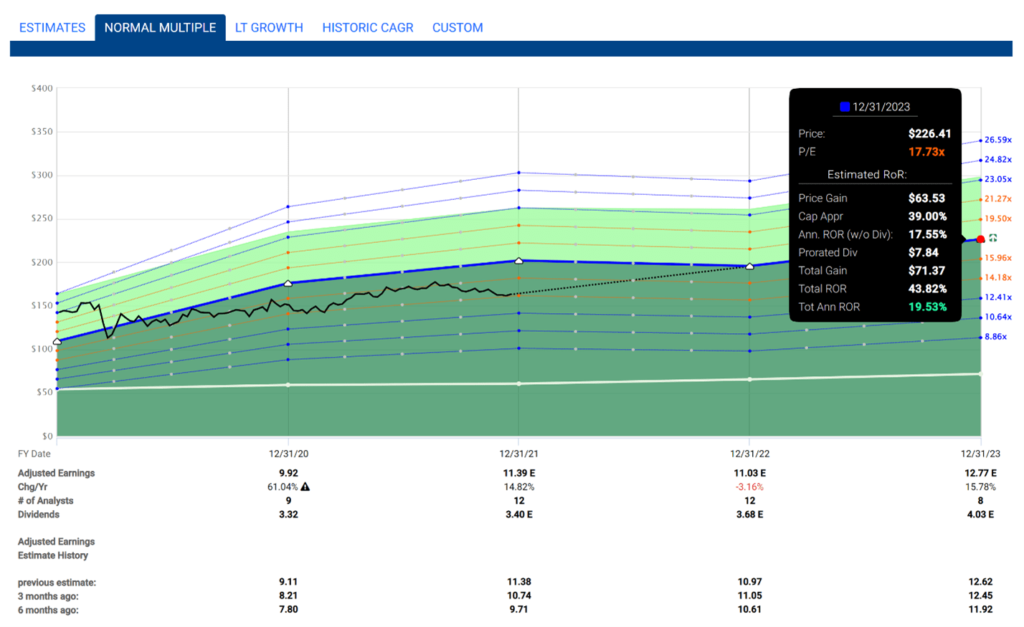

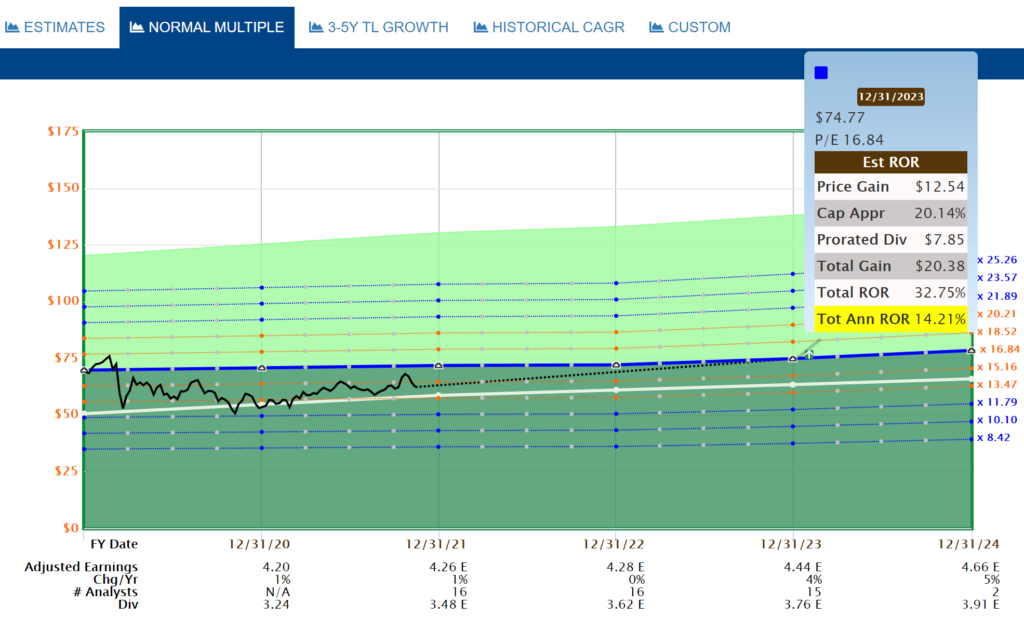

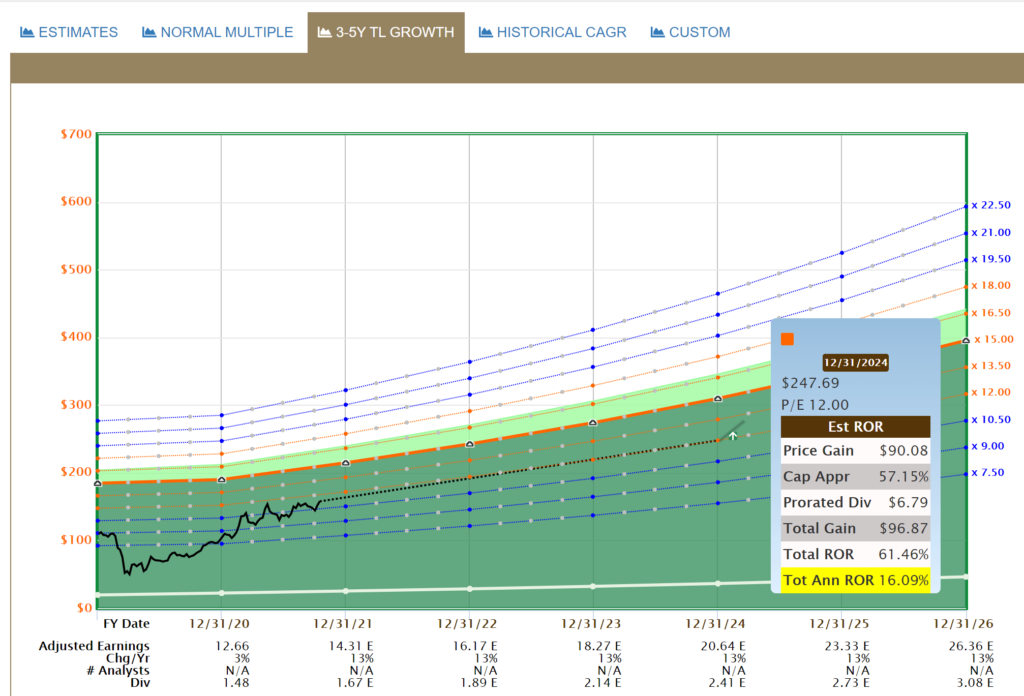

Estimated Earnings:

Comments:

Using the “Normal Multiple’ estimating tool from FASTgraphs, we see a blended P/E average over the last five years of 9.09. Based on Analysts’ forecasts two years out, you can expect an annualized return based on today’s price of 23.08% should MFC-T trade at its five-year average blended P/E.

Blended P/E is based upon a weighted average of the most recent actual value and the closest forecast value.

Of importance is that Analysts have been revising their estimates upwards recently. Both the six and three months ago projections for 2022 and 2023 have been increasing. It means that Analysts are more bullish on Manulife Financial in the short term.

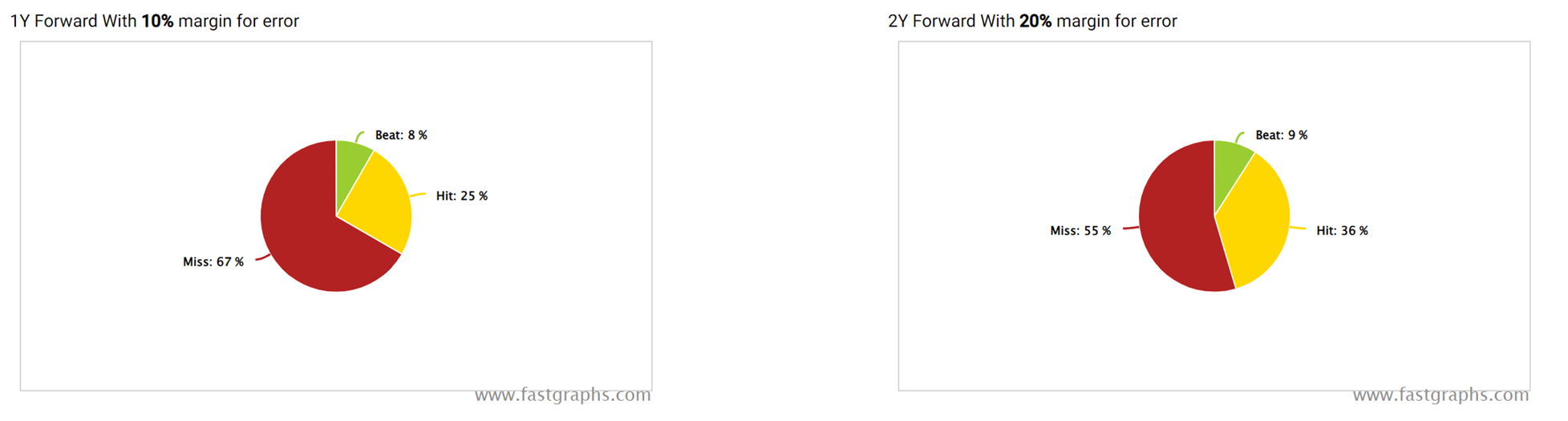

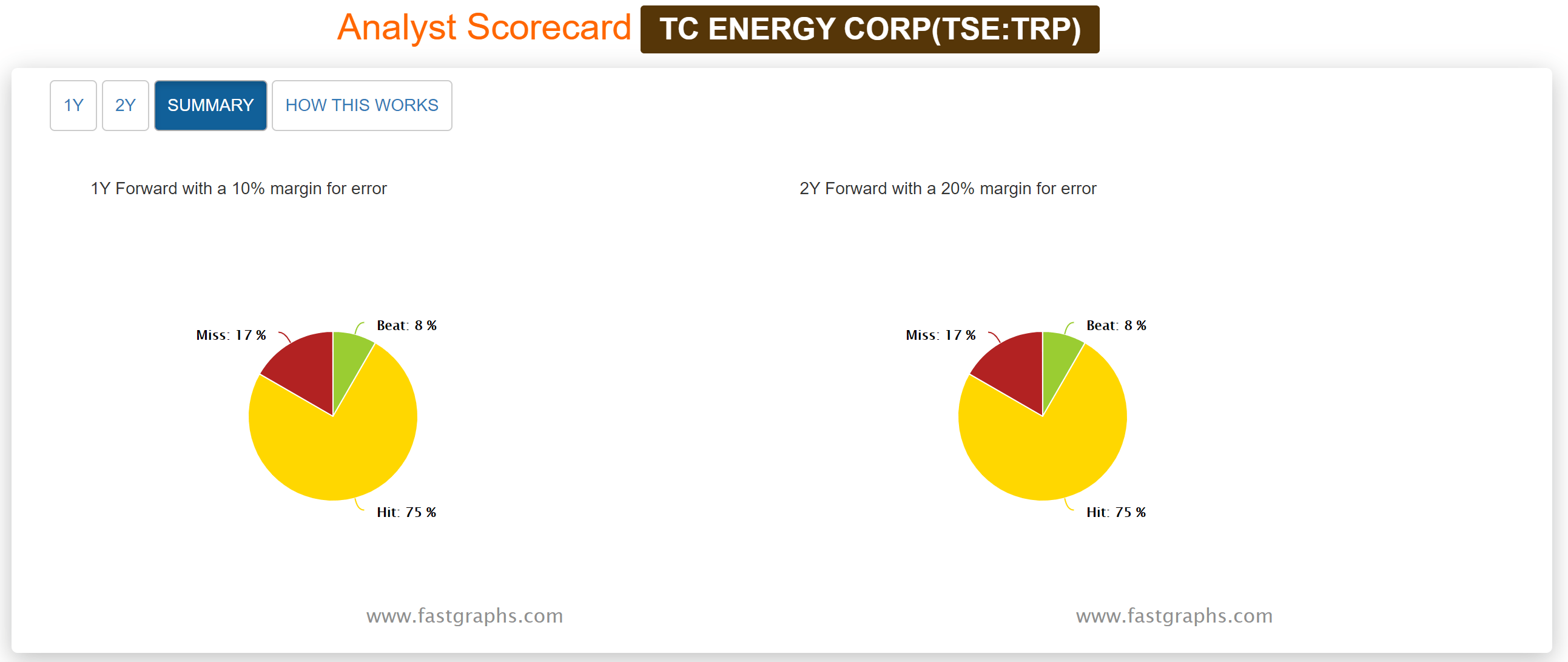

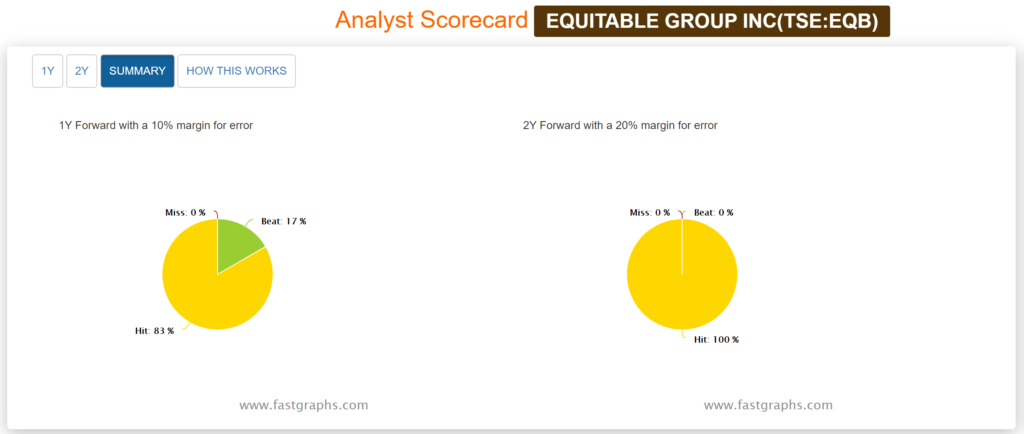

Analyst Scorecard:

Comments:

Analyst estimates over the years are slightly above average on one and two-year earnings projections. Analysts’ projections have hit or beat ~62% of the time on one-year estimates and ~69% on two-year estimates.

Recent Earnings Report-Q4 2021:

“Our ability to adapt and serve clients across the globe who are navigating a very uncertain environment continues to drive our operating results with record net income of $7.1 billion and core earnings of $6.5 billion in 2021 driven by our insurance businesses delivering double-digit growth in APE sales and NBV and Global WAM delivering strong net inflows of $27.9 billion,” said Manulife President & Chief Executive Officer Roy Gori.

Highlights:

- Net income attributed to shareholders of $7.1 billion in 2021, up $1.2 billion from 2020, and $2.1 billion in 4Q21, up $304 million from the fourth quarter of 2020 (“4Q20”)

- Core earnings of $6.5 billion in 2021, up 26% on a constant exchange rate basis from 2020, and $1.7 billion in 4Q21, up 20% on a constant exchange rate basis from 4Q202

- Strong LICAT ratio of 142%

- Core ROE of 13.0% in 2021 and 12.7% in 4Q21, and ROE of 14.2% in 2021 and 15.6% in 4Q21

- NBV of $2.2 billion in 2021, up 31% from 2020, and $555 million in 4Q21, up 17% from 4Q20

- APE sales of $6.1 billion in 2021, up 13% from 2020, and $1.4 billion in 4Q21, up 5% from 4Q20

- Global Wealth and Asset Management (“Global WAM”) net inflows of $27.9 billion in 2021 compared with net inflows of $8.9 billion in 2020 and net inflows of $8.1 billion in 4Q21 compared with net inflows of $2.8 billion in 4Q20. A record year for our retail wealth business with net inflows of $29.2 billion

- Global WAM average AUMA increased by 20% in 2021

- Remittances were $4.4 billion in 2021 compared with $1.6 billion in 2020, an increase of $2.8 billion

- Quarterly common share dividend increased by 18% in 4Q21

- Launched a Normal Course Issuer Bid (“NCIB”) that permits repurchase of up to 5% of outstanding common

Summary:

When I first started dividend growth investing, my mentor Tom Connolly made a point of staying away from life insurance companies due to their sub-par dividend growth. I agreed and have not looked at life insurance companies until now. Manulife Financials’ (MFC-T) balance sheet and risk-management look nothing like the company that had to cut its dividend twice during the Great Recession.

MFC-T’s fundamentals look good, and it has been growing earnings since 2016. Throw in a recent 18% dividend increase, an S&P Quality Financial ‘A’ rating, and we like what we see from this up and coming dividend grower. On the macro side, high inflation tends to cause rising interest rates and that’s a boon to financial blue chips like Manulife Financial.

Based on the fundamentals alone, the company seems ‘sensibly priced’ today.